The State of Michigan offers a diverse range of health insurance options, catering to individuals, families, and employers. Understanding these options is crucial for securing affordable and comprehensive healthcare coverage. This guide delves into the intricacies of Michigan’s health insurance system, exploring various plan types, eligibility requirements, and the regulatory roles played by key state and federal agencies. From individual market plans and employer-sponsored insurance to Medicaid, CHIP, and Medicare, we’ll provide a comprehensive overview to empower you with the knowledge to make informed decisions about your health coverage.

This exploration will cover the different types of plans available, the regulatory oversight provided by the Michigan Department of Insurance and Financial Services (DIFS), and the significant impact of the Affordable Care Act (ACA) on Michigan residents. We will also analyze the options for obtaining coverage through the Michigan Health Insurance Marketplace, employer-sponsored plans, and government programs like Medicaid and Medicare.

Overview of Michigan’s Health Insurance Landscape

Navigating the world of health insurance in Michigan can seem complex, but understanding the different plan types, regulatory bodies, and the impact of federal legislation helps clarify the process. This overview provides a foundational understanding of Michigan’s health insurance system.

Michigan offers a variety of health insurance plans, each designed to meet different needs and budgets. These plans are generally categorized into several types, each with its own features and cost structure. The availability and specifics of each plan can vary depending on factors such as location, employer participation, and individual eligibility.

Types of Health Insurance Plans in Michigan

Michigan residents have access to several major types of health insurance plans. These plans differ in their coverage, cost-sharing, and the way they are accessed.

- Employer-Sponsored Insurance: Many Michigan residents obtain health insurance through their employers. These plans vary widely in their coverage and cost-sharing responsibilities, depending on the employer’s plan design.

- Individual Market Plans: Individuals who are not covered by employer-sponsored insurance can purchase plans directly through the Michigan Health Insurance Marketplace (Healthcare.gov) or from private insurers. These plans are often subject to regulations under the Affordable Care Act (ACA).

- Medicaid and Medicare: Medicaid is a government-funded program providing healthcare coverage to low-income individuals and families. Medicare is a federal health insurance program for individuals aged 65 and older and certain younger people with disabilities.

- Short-Term Limited Duration Insurance (STLDI): These plans offer limited coverage for a short period, typically less than a year. They are generally less comprehensive than ACA-compliant plans and may not cover pre-existing conditions.

The Role of the Michigan Department of Insurance and Financial Services (DIFS)

The Michigan Department of Insurance and Financial Services (DIFS) plays a crucial role in overseeing and regulating the health insurance market within the state. Their responsibilities are vital in ensuring fair practices and consumer protection.

- Licensing and Regulation of Insurers: DIFS licenses and regulates health insurance companies operating in Michigan, ensuring they comply with state and federal laws.

- Consumer Protection: DIFS investigates complaints from consumers regarding health insurance practices and works to resolve disputes.

- Market Oversight: DIFS monitors the health insurance market to ensure stability and affordability, including reviewing rate increases proposed by insurers.

The Affordable Care Act (ACA) and its Impact on Michigan Residents

The Affordable Care Act (ACA), also known as Obamacare, significantly impacted the health insurance landscape in Michigan and across the nation. Its provisions have expanded access to health coverage and introduced consumer protections.

- Expanded Medicaid Eligibility: The ACA expanded Medicaid eligibility in many states, including Michigan, leading to increased coverage for low-income individuals and families.

- Health Insurance Marketplaces: The ACA established state-based health insurance marketplaces (or exchanges) like Healthcare.gov, allowing individuals to compare and purchase health insurance plans.

- Essential Health Benefits: The ACA mandates that all individual and small group market plans cover a set of essential health benefits, including hospitalization, maternity care, and prescription drugs.

- Pre-existing Conditions: The ACA prohibits insurers from denying coverage or charging higher premiums based on pre-existing health conditions.

Key Features of the Michigan Health Insurance Marketplace (Healthcare.gov)

The Michigan Health Insurance Marketplace, accessed through Healthcare.gov, serves as a central platform for individuals to explore and purchase health insurance plans. Its key features aim to simplify the process and ensure consumers make informed decisions.

- Plan Comparison Tool: The marketplace provides a tool allowing users to compare plans based on cost, coverage, and provider networks.

- Eligibility Determination: The marketplace determines eligibility for subsidies and tax credits to help individuals afford coverage.

- Enrollment Assistance: Navigators and certified application counselors are available to assist individuals with the enrollment process.

- Secure Online Platform: The marketplace offers a secure online platform for managing accounts and accessing plan information.

Individual Health Insurance in Michigan

Choosing the right individual health insurance plan in Michigan can feel overwhelming, given the variety of options and factors to consider. Understanding the differences in coverage, cost, and provider networks is crucial for making an informed decision that best suits your individual needs and budget. This section will guide you through the process of selecting a plan, navigating the Marketplace, and understanding available financial assistance.

Comparison of Individual Health Insurance Plans

Individual health insurance plans in Michigan vary significantly in their coverage, cost, and the doctors and hospitals included in their provider networks. Factors like your age, health status, and location influence the premium you’ll pay. Generally, plans with lower premiums often have higher out-of-pocket costs, such as deductibles and co-pays. Conversely, plans with higher premiums may offer lower out-of-pocket costs. Provider networks determine which doctors, specialists, and hospitals are covered under your plan. A narrow network might offer lower premiums but limit your choices, while a broader network provides more flexibility but usually comes with a higher premium.

Enrolling in an Individual Health Insurance Plan Through the Marketplace

The HealthCare.gov Marketplace is the primary platform for enrolling in individual health insurance plans in Michigan. The enrollment process typically involves creating an account, providing personal information, and comparing available plans based on your needs and budget. You’ll need to provide information about your income, household size, and any qualifying life events that might affect your eligibility for subsidies. The Marketplace will then show you a range of plans that meet your eligibility criteria, allowing you to compare costs and benefits before selecting a plan. It is advisable to thoroughly review the details of each plan before making your final decision. The enrollment period usually occurs annually, but there may be special enrollment periods available for qualifying life events, such as losing other coverage or moving to a new state.

Available Subsidies and Tax Credits

The Affordable Care Act (ACA) offers subsidies and tax credits to help individuals afford health insurance. The amount of financial assistance you receive depends on your income and household size. These subsidies directly reduce your monthly premium, making coverage more affordable. Tax credits are also available, further reducing the overall cost of health insurance. Eligibility for subsidies and tax credits is determined by your income relative to the federal poverty level (FPL). The Marketplace will automatically calculate your eligibility and apply the appropriate financial assistance if you qualify. It’s crucial to accurately report your income to ensure you receive the correct amount of assistance.

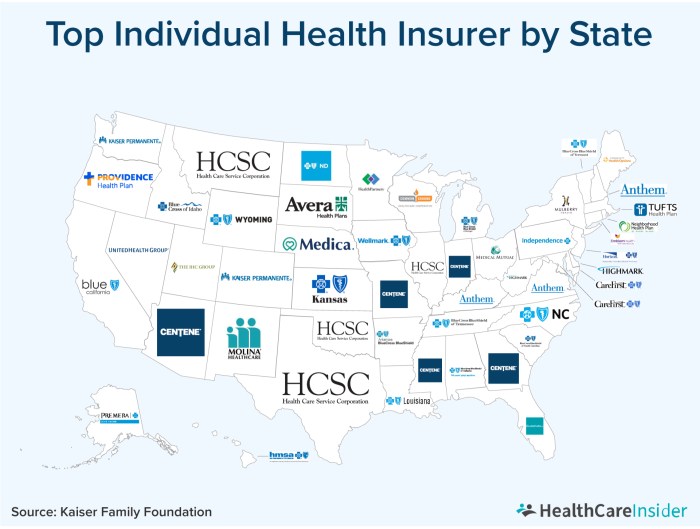

Comparison of Major Health Insurance Providers in Michigan

The following table compares the premium costs and benefits of three major health insurance providers in Michigan. Please note that these are sample costs and benefits, and actual premiums and plan details may vary depending on your location, age, and chosen plan. Always consult the insurance provider directly for the most up-to-date information.

| Provider | Average Monthly Premium (Example) | Deductible (Example) | Network Size |

|---|---|---|---|

| Blue Cross Blue Shield of Michigan | $400 | $5,000 | Extensive |

| Health Alliance Plan (HAP) | $350 | $4,000 | Broad |

| Molina Healthcare | $300 | $6,000 | Moderate |

Employer-Sponsored Health Insurance in Michigan

Employer-sponsored health insurance is a significant source of health coverage for many Michiganders. This system, where employers provide health insurance as a benefit to their employees, offers a range of plan options and contributes significantly to the overall health insurance landscape of the state. Understanding the types of plans available, the employee’s role in selection, and the factors employers consider is crucial for both employees and employers navigating this system.

Common Types of Employer-Sponsored Health Insurance Plans in Michigan

Michigan employers offer a variety of health insurance plans, mirroring national trends. These plans generally fall under a few key categories, each with varying levels of cost-sharing and coverage. The specific plans available will depend on the employer’s size and the negotiated agreements with insurance providers.

- Health Maintenance Organizations (HMOs): HMO plans typically require employees to choose a primary care physician (PCP) within the plan’s network. Referrals are usually needed to see specialists. HMOs often have lower premiums but may restrict access to out-of-network providers.

- Preferred Provider Organizations (PPOs): PPO plans offer more flexibility. Employees can generally see any doctor, but using in-network providers results in lower costs. PPOs usually have higher premiums than HMOs but offer greater choice.

- Point of Service (POS) Plans: POS plans combine elements of HMOs and PPOs. They typically require a PCP, but allow out-of-network access at a higher cost. This provides a balance between cost-containment and choice.

- High Deductible Health Plans (HDHPs): These plans have higher deductibles (the amount you pay out-of-pocket before insurance coverage kicks in) but lower premiums. They are often paired with a Health Savings Account (HSA), allowing pre-tax contributions to pay for medical expenses.

Employee’s Role in Choosing a Health Plan

Employees typically have a defined period during the year (often open enrollment) to choose their health insurance plan from the options offered by their employer. This selection process requires careful consideration of individual needs and financial situations. Many employers provide resources like online tools and informational sessions to assist employees in making informed decisions.

The employee’s role includes reviewing plan details, comparing premiums, deductibles, co-pays, and out-of-pocket maximums. Understanding the network of doctors and hospitals included in each plan is also crucial. Employees should also consider their current health status, anticipated healthcare needs, and their budget when making their selection.

Factors Employers Consider When Selecting Health Insurance Plans

Employers in Michigan, like those across the nation, carefully weigh several factors when choosing health insurance plans for their workforce. These decisions impact employee satisfaction, recruitment and retention efforts, and the company’s overall budget.

- Cost: Premiums, administrative costs, and employee contributions are major considerations. Employers seek plans that offer a balance between affordability and comprehensive coverage.

- Employee Satisfaction: Employers often survey employees or use other methods to gauge preferences and satisfaction with existing plans. High employee satisfaction translates to improved productivity and retention.

- Network Adequacy: The geographic reach and breadth of the provider network are critical. Employers aim for plans that offer convenient access to quality healthcare for their employees.

- Plan Features: Employers consider features such as wellness programs, telehealth options, and prescription drug formularies. These features can impact employee health and well-being.

Flowchart: Obtaining Health Insurance Through an Employer

The process of obtaining employer-sponsored health insurance can be visualized as a flowchart:

[Imagine a flowchart here. The flowchart would begin with “Employer Offers Enrollment Period,” branching to “Employee Reviews Plan Options,” then to “Employee Selects Plan and Completes Enrollment,” followed by “Employer Submits Enrollment to Insurer,” and finally, “Employee Receives Insurance Card and Benefits Information.”] The flowchart visually depicts the sequential steps involved, from the employer’s announcement of open enrollment to the employee receiving their insurance card and benefits information. Each step represents a crucial stage in the process, highlighting the collaborative nature of obtaining employer-sponsored health insurance.

Medicaid and CHIP in Michigan

Michigan’s Medicaid and Children’s Health Insurance Program (CHIP) provide crucial healthcare coverage to low-income individuals and families. These programs offer vital medical benefits, helping to ensure access to necessary care and improving overall health outcomes for eligible residents. Understanding eligibility criteria, benefits, and the application process is essential for those seeking coverage.

Eligibility Requirements for Medicaid and CHIP in Michigan

Eligibility for Medicaid and CHIP in Michigan is determined by several factors, including income, household size, and citizenship status. For Medicaid, income limits are based on the federal poverty level (FPL), and individuals must fall below a certain percentage of the FPL to qualify. Additional factors such as age, disability, and pregnancy may also influence eligibility. CHIP, designed for children and pregnant women, has its own income guidelines, generally covering families earning above the Medicaid income threshold but still below a higher limit. Specific income limits and eligibility requirements are subject to change and should be verified through the official Michigan Department of Health and Human Services website or by contacting the department directly. It is important to note that immigration status also plays a role in eligibility for both programs.

Benefits and Services Covered under Michigan’s Medicaid and CHIP Programs

Michigan’s Medicaid and CHIP programs offer a comprehensive range of healthcare benefits and services. These typically include doctor visits, hospital care, prescription drugs, dental care, vision care, and mental health services. Specific services covered may vary slightly between Medicaid and CHIP, and some services might require pre-authorization. Both programs aim to provide preventative care as well as treatment for illnesses and injuries. The goal is to ensure that enrolled individuals receive the healthcare they need to maintain their health and well-being. For example, preventative services like vaccinations and regular check-ups are generally covered under both programs.

Application Process for Medicaid and CHIP in Michigan

Applying for Medicaid or CHIP in Michigan can be done through the state’s online application portal or by contacting the Michigan Department of Health and Human Services directly. Applicants will need to provide information about their income, household size, and other relevant personal details. The application process involves reviewing the provided information and determining eligibility based on the established guidelines. Once approved, individuals will receive a Medicaid or CHIP card that can be used to access healthcare services from participating providers. The processing time for applications can vary, and applicants may be required to provide additional documentation during the review process. The state’s website provides detailed instructions and resources to guide applicants through the process.

Key Differences Between Medicaid and CHIP in Michigan

The following points highlight the key differences between Medicaid and CHIP in Michigan:

- Target Population: Medicaid covers low-income individuals of all ages, while CHIP primarily focuses on children and pregnant women.

- Income Limits: Medicaid generally has lower income limits than CHIP. CHIP covers families earning above the Medicaid income threshold but still within a specific higher limit.

- Eligibility Criteria: While both programs consider income and household size, additional factors like disability or pregnancy may affect Medicaid eligibility more significantly.

- Funding Sources: Both programs receive funding from both the state and federal governments, but the funding proportions may differ slightly.

Medicare in Michigan

Medicare is the federal health insurance program for people age 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD). Understanding how Medicare works in Michigan is crucial for accessing the benefits available to eligible residents. This section details the different parts of Medicare, enrollment, supplemental plans, and available savings programs.

Parts of Medicare and Their Coverage

Medicare consists of four parts, each with its own coverage:

Part A (Hospital Insurance): Covers inpatient hospital care, skilled nursing facility care, hospice, and some home healthcare. Most people don’t pay a premium for Part A because they or their spouse paid Medicare taxes while working.

Part B (Medical Insurance): Covers doctor visits, outpatient care, medical supplies, and preventive services. Most people pay a monthly premium for Part B, the amount varying based on income.

Part C (Medicare Advantage): Offered by private companies that contract with Medicare, these plans provide all the benefits of Part A and Part B, and often include Part D prescription drug coverage. They may also offer extra benefits like vision, hearing, and dental coverage. Premiums and cost-sharing vary by plan.

Part D (Prescription Drug Insurance): Helps cover the cost of prescription medications. This coverage is usually purchased through a stand-alone plan or is included in a Medicare Advantage plan. Premiums and cost-sharing vary by plan.

Medicare Enrollment in Michigan

The initial enrollment period for Medicare generally begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65. Individuals can enroll online through the Social Security Administration website (ssa.gov), by phone, or by mail. There are penalties for delaying enrollment in Part B and Part D, resulting in higher premiums. People with disabilities or ESRD have different enrollment periods.

Medicare Advantage and Medicare Supplement Plans in Michigan

Many private insurance companies offer Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans in Michigan. Medicare Advantage plans vary in their benefits, premiums, and networks of doctors and hospitals. Medicare Supplement plans help pay some of the costs that Medicare doesn’t cover, such as deductibles and copayments. It’s crucial to compare plans to find one that best suits individual needs and budget. The Medicare Plan Finder website (medicare.gov) is a valuable resource for comparing plans.

Medicare Savings Programs in Michigan

Several Medicare Savings Programs (MSPs) help eligible low-income seniors and people with disabilities pay their Medicare premiums, deductibles, and coinsurance. These programs are administered by the State of Michigan and include the Qualified Medicare Beneficiary (QMB), Specified Low-Income Medicare Beneficiary (SLMB), and Qualified Individual (QI) programs. Eligibility is based on income and resource limits. Applying for these programs can significantly reduce out-of-pocket costs associated with Medicare. Applications can be submitted through the Michigan Department of Health and Human Services (MDHHS).

Affordable Care Act (ACA) in Michigan

The Affordable Care Act (ACA), also known as Obamacare, significantly reshaped the healthcare landscape in Michigan, impacting access to insurance and the cost of care for many residents. Its key provisions have led to both successes and challenges in the state.

Key ACA Provisions Relevant to Michigan Residents

The ACA’s core provisions relevant to Michigan residents include the establishment of health insurance marketplaces (exchanges) where individuals and small businesses can compare and purchase health plans. These marketplaces offer subsidies to help individuals and families afford coverage, based on income. The ACA also expanded Medicaid eligibility in many states, including Michigan, allowing more low-income individuals to access healthcare coverage. Pre-existing conditions are no longer grounds for denial of coverage under ACA-compliant plans, a critical provision for many Michiganders. Finally, young adults can remain on their parents’ insurance plans until age 26.

Impact of the ACA on Michigan’s Uninsured Rate

The ACA significantly reduced Michigan’s uninsured rate. Prior to the ACA’s implementation, a substantial portion of the population lacked health insurance, resulting in delayed or forgone care and financial hardship for many families. The expansion of Medicaid and the availability of subsidized health plans through the marketplace dramatically decreased the number of uninsured Michiganders. While precise figures fluctuate yearly, data consistently shows a marked decline in the uninsured population since the ACA’s enactment.

Challenges and Successes of Implementing the ACA in Michigan

Implementing the ACA in Michigan presented both challenges and successes. A major success was the significant reduction in the uninsured rate. However, challenges included navigating the complexities of the marketplace, ensuring adequate provider participation in the plans offered, and addressing the ongoing issue of affordability for some individuals and families, even with subsidies. Furthermore, some rural areas faced difficulties accessing sufficient healthcare providers participating in the ACA marketplace. Despite these challenges, the overall impact on access to care has been largely positive.

Changes in Health Insurance Coverage in Michigan Since ACA Implementation

A line graph illustrating changes in health insurance coverage in Michigan since the ACA’s implementation would show a clear downward trend in the uninsured rate. The graph’s x-axis would represent years since the ACA’s implementation (e.g., 2010, 2014, 2018, 2022), and the y-axis would represent the percentage of the Michigan population without health insurance. The line would show a steep initial decline following the ACA’s full implementation in 2014, followed by a more gradual decrease in subsequent years. The graph would likely also include separate lines representing the percentage of the population covered by employer-sponsored insurance, Medicaid, and individual market plans, showcasing shifts in coverage sources over time. This would demonstrate the ACA’s impact on shifting the composition of Michigan’s insured population. For example, the line representing Medicaid coverage would likely show a significant increase, reflecting the expansion of eligibility under the ACA.

Concluding Remarks

Securing adequate health insurance is a critical aspect of financial and personal well-being in Michigan. This guide has provided a foundational understanding of the state’s diverse health insurance landscape, from individual plans and employer-sponsored options to government programs like Medicaid and Medicare. By understanding the nuances of each program and the role of regulatory bodies like the DIFS, Michigan residents can navigate the complexities of health insurance and make informed choices to protect their health and financial security. Remember to explore the resources available to you and seek professional guidance when needed to ensure you find the best coverage for your specific circumstances.

FAQ Section

What is the deadline for open enrollment in the Michigan Health Insurance Marketplace?

The open enrollment period for the Marketplace typically runs for a few months each year, usually in the fall. Specific dates vary; it’s best to check Healthcare.gov for the most up-to-date information.

Can I lose my health insurance if I change jobs?

It depends on your employer’s policy and the type of plan you have. COBRA allows you to continue coverage for a limited time, but at your own expense. You may also be eligible for coverage through the Marketplace.

What documents do I need to apply for Medicaid or CHIP?

Required documents typically include proof of income, residency, identity, and age. Specific requirements may vary, so check the Michigan Department of Health and Human Services website for detailed information.

How do I appeal a decision regarding my health insurance coverage?

The process for appealing a decision varies depending on the insurer and the reason for the appeal. Contact your insurance provider or the DIFS for information on the appeal process.