Surety insurance, often overlooked, plays a vital role in securing numerous financial transactions. It acts as a crucial bridge, fostering trust between parties involved in contracts and other agreements. This guide delves into the intricacies of surety bonds, exploring their various types, applications across diverse industries, and the legal framework that governs them. We’ll unpack the processes involved, from application to claim settlement, and highlight the risk management aspects that are central to this unique form of insurance.

From construction projects to financial dealings, surety bonds provide a safety net, mitigating risks and ensuring accountability. This exploration will illuminate the complexities of surety insurance, empowering readers with a comprehensive understanding of its significance in the modern business landscape.

Definition and Types of Surety Insurance

Surety insurance is a unique form of insurance that protects a third party (the obligee) against the failure of a principal to fulfill their contractual obligations. Unlike other insurance types that cover losses due to unforeseen events, surety insurance focuses on guaranteeing the performance of a specific duty or contract. The core purpose is to provide financial security and mitigate risk for those who rely on others to complete contractual agreements.

Surety Bond Classification

Surety bonds are categorized into several types, each designed to address specific contractual or legal requirements. A clear understanding of these categories is crucial for both principals seeking bonds and obligees needing protection. The primary classifications include contract bonds, commercial bonds, and judicial bonds.

Contract Bonds

Contract bonds guarantee the performance of a contract, ensuring the principal completes the work as agreed. These are commonly used in construction projects, where the obligee (often the project owner) needs assurance that the contractor (principal) will finish the job according to specifications and on time. Failure to perform results in the surety company stepping in to complete the work or compensate the obligee for losses incurred. Examples include bid bonds (guaranteeing a bid submission), performance bonds (guaranteeing project completion), and payment bonds (guaranteeing payment to subcontractors and suppliers). A large-scale highway construction project, for instance, would likely require all three types of contract bonds.

Commercial Bonds

Commercial bonds cover a broader range of business activities outside of construction, guaranteeing various types of performance and financial responsibility. These bonds are used to ensure businesses meet their obligations to customers, employees, or government agencies. Examples include license and permit bonds (ensuring compliance with regulations), fidelity bonds (protecting against employee dishonesty), and public official bonds (guaranteeing the ethical conduct of public officials). A small business owner applying for a liquor license, for example, would need a license and permit bond to demonstrate financial responsibility and adherence to regulations.

Judicial Bonds

Judicial bonds are required in legal proceedings to guarantee the fulfillment of court orders or other legal obligations. These bonds are used to protect against financial losses resulting from legal actions. Examples include probate bonds (protecting beneficiaries of an estate), appeal bonds (guaranteeing payment of court costs if an appeal is unsuccessful), and replevin bonds (guaranteeing the return of seized property). An individual appealing a court decision, for instance, might need to post an appeal bond to ensure the court receives any outstanding fees if the appeal is unsuccessful.

Comparison of Surety Bond Types

| Type | Purpose | Typical Applicant | Key Features |

|---|---|---|---|

| Performance Bond | Guarantees completion of a contract | Contractor | Covers project completion, protects owner from contractor default |

| Fidelity Bond | Protects against employee dishonesty | Employer | Covers losses due to employee theft, fraud, or embezzlement |

| License and Permit Bond | Guarantees compliance with regulations | Business Owner | Ensures adherence to laws and regulations, protects the public |

How Surety Insurance Works

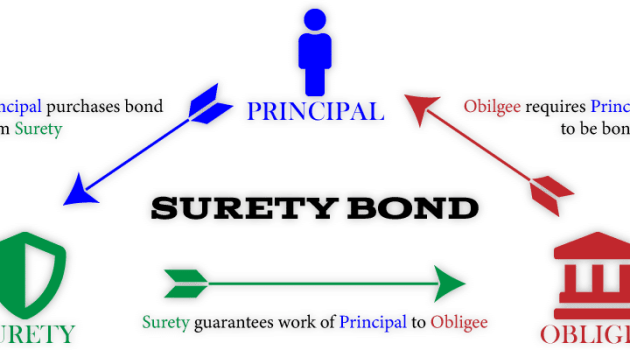

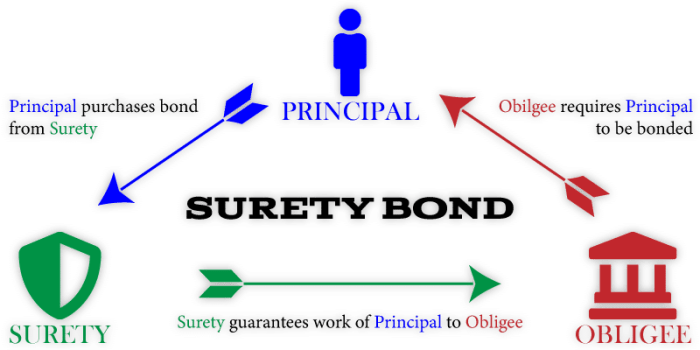

Surety insurance, unlike other types of insurance, doesn’t protect against personal loss. Instead, it guarantees the performance of a contractual obligation by one party (the principal) to another (the obligee). This guarantee is backed by a third party, the surety, who assumes financial responsibility if the principal fails to fulfill their commitment. Understanding this three-way relationship is crucial to grasping how surety insurance operates.

The process of obtaining a surety bond involves several key steps, beginning with a comprehensive application process and culminating in the issuance of the bond. This process ensures the surety company adequately assesses the risk involved before extending its guarantee.

Obtaining a Surety Bond

The process of securing a surety bond typically begins with the principal submitting an application to a surety company. This application requires detailed financial information, including credit history, business records, and personal references. The surety company then performs a thorough underwriting process to evaluate the principal’s creditworthiness and the risk associated with the underlying contract. This assessment involves reviewing the principal’s financial statements, conducting background checks, and assessing the nature and complexity of the project or contract. If the surety company approves the application, they will issue a surety bond, which legally binds them to fulfill the principal’s obligations if they default. The amount of the bond, known as the penal sum, is determined based on the potential financial exposure associated with the contract. The process concludes with the surety issuing the bond, a legally binding document, and the principal paying a premium.

Roles and Responsibilities

In a surety bond arrangement, three distinct parties play crucial roles: the principal, the surety, and the obligee. The principal is the individual or entity undertaking the obligation. Their responsibility is to fulfill the terms of the contract as agreed. The surety acts as a guarantor, assuming financial responsibility if the principal defaults. Their role is to indemnify the obligee for losses incurred due to the principal’s failure to perform. Finally, the obligee is the party who benefits from the surety bond. They are protected against financial losses if the principal fails to meet their contractual obligations. The obligee’s responsibility is to monitor the principal’s performance and promptly notify the surety of any default.

Claim Filing and Settlement

If the principal fails to meet their contractual obligations, the obligee can file a claim with the surety company. This claim must be supported by documentation demonstrating the principal’s default. The surety company then investigates the claim to verify the validity of the obligee’s assertion. If the claim is validated, the surety company will either fulfill the principal’s obligations directly or compensate the obligee for the losses incurred. The settlement process can involve negotiation between the surety, the obligee, and potentially the principal, aiming to resolve the matter fairly and efficiently. The surety may then pursue recovery from the principal to recoup their losses.

Surety Bond Transaction Flowchart

A flowchart illustrating the process would visually depict the following stages:

1. Principal applies for a surety bond: This involves submitting an application with necessary documentation.

2. Surety company underwrites the application: This involves assessing the principal’s risk profile.

3. Surety bond issued (or denied): The surety approves or rejects the application based on the risk assessment.

4. Principal pays premium: The principal pays the surety for the bond.

5. Principal performs contractual obligations: The principal fulfills the terms of the contract.

6. Principal defaults (or not): If the principal fails to fulfill their obligations, the obligee files a claim.

7. Obligee files claim (if applicable): The obligee submits documentation to support the claim.

8. Surety investigates the claim: The surety verifies the validity of the claim.

9. Surety settles the claim (if valid): The surety fulfills the principal’s obligations or compensates the obligee.

10. Surety seeks recovery from the principal (if applicable): The surety attempts to recover losses from the principal.

Surety Insurance and Risk Management

Surety insurance, while seemingly straightforward, involves a complex interplay of risk assessment and mitigation. Surety companies, before extending coverage, meticulously evaluate the financial stability and operational capacity of the principal (the party seeking the bond), ensuring a responsible allocation of resources and minimizing potential losses. This process is crucial for maintaining the financial health of the surety industry and fostering trust in the surety bond market.

Surety Company Risk Assessment

The risk assessment process employed by surety companies is multifaceted. It begins with a thorough review of the principal’s financial statements, including balance sheets, income statements, and cash flow statements. This analysis helps determine the principal’s solvency and ability to meet its contractual obligations. Beyond financial health, the surety company will investigate the principal’s operational history, considering factors such as experience in the relevant industry, project management capabilities, and past performance on similar projects. Credit reports and background checks are also common components of the due diligence process. The surety underwriter assesses the overall risk profile of the principal and the specific project, weighing potential challenges and unforeseen circumstances. A high-risk profile might lead to a higher premium or even a rejection of the bond application. This rigorous evaluation is crucial to safeguarding the surety company’s financial interests.

Factors Influencing Surety Bond Pricing

Several key factors influence the pricing of surety bonds. The most significant is the perceived risk associated with the principal and the project. A principal with a strong financial history and a well-defined project plan will likely receive a lower premium than a high-risk principal undertaking a complex or uncertain project. The size and complexity of the project also play a crucial role. Larger, more complex projects naturally carry a higher degree of risk, leading to higher premiums. The type of bond also influences pricing; some bonds, such as bid bonds, carry lower premiums than others, such as performance bonds, due to the differing levels of risk exposure. Market conditions and the surety company’s own risk appetite further influence pricing. Competition within the surety industry can also affect the final premium quoted to the principal.

Comparison of Surety Insurance and Liability Insurance

Surety insurance and liability insurance, while both forms of insurance, differ significantly in their purpose and coverage. Surety bonds guarantee the performance of a contractual obligation, protecting the obligee (the party receiving the bond) against the principal’s failure to fulfill its contractual commitments. Liability insurance, on the other hand, protects the insured against financial losses arising from claims of third-party injury or damage. In essence, surety insurance focuses on contractual performance, while liability insurance focuses on protecting against liability for negligence or wrongdoing. A key difference lies in the legal recourse available; surety bonds allow for direct action against the surety by the obligee, while liability insurance typically requires a claim to be made against the insured first. The focus of risk is also different; surety bonds focus on the risk of non-performance, whereas liability insurance focuses on the risk of causing harm to others.

Risk Mitigation Strategies for Principals

Principals can significantly improve their chances of bond approval by implementing effective risk mitigation strategies. Maintaining strong financial health is paramount. This includes having sufficient working capital, a positive cash flow, and a healthy debt-to-equity ratio. Demonstrating a proven track record of successful project completion and strong project management skills also enhances the surety company’s confidence. A well-defined project plan, including detailed budgets, schedules, and risk assessments, showcases preparedness and reduces the perceived risk. Securing letters of credit or other forms of collateral can strengthen the bond application, offering additional security to the surety company. Finally, maintaining open communication with the surety company throughout the process can foster trust and transparency, leading to a more positive outcome.

Legal and Regulatory Aspects of Surety Insurance

Surety insurance, while seemingly straightforward, operates within a complex legal and regulatory framework. Understanding this framework is crucial for both surety companies and those seeking surety bonds, as it dictates the rights, responsibilities, and potential liabilities of all involved parties. This section will explore the legal landscape of surety insurance in the United States, focusing on the regulatory bodies, legal implications of defaults, and the language commonly found in surety bond agreements.

The Legal Framework Governing Surety Insurance in the United States

The regulation of surety insurance in the United States is primarily handled at the state level, meaning that specific rules and requirements can vary from state to state. However, some common themes emerge. State insurance departments oversee the licensing and solvency of surety companies, ensuring they maintain adequate reserves to meet their obligations. These departments also regulate the forms and content of surety bonds, aiming to protect the interests of both principals and obligees. Federal laws, while less directly involved in day-to-day operations, play a role in areas such as anti-trust and consumer protection, indirectly influencing surety insurance practices. The National Association of Surety Bond Producers (NASBP) also plays a significant role in shaping industry best practices and advocating for consistent regulations across states.

Implications of Surety Bond Defaults and Legal Consequences

When a surety bond defaults, a complex legal process unfolds. The obligee, typically the party protected by the bond, has the right to make a claim against the surety. The surety, in turn, may attempt to recover its losses from the principal, the party who originally obtained the bond. Legal action may be necessary to resolve disputes over the validity of the claim, the amount of damages, or the surety’s liability. The legal consequences can be significant, potentially leading to financial losses for the principal, the surety, or both. For example, a contractor’s failure to complete a project as agreed could result in a default on the payment bond, leading to legal action by subcontractors who haven’t been paid. The surety would then be responsible for covering these payments, potentially pursuing legal recourse against the contractor to recoup its losses.

Key Regulatory Bodies Overseeing the Surety Insurance Industry

State insurance departments are the primary regulatory bodies overseeing surety insurance. Each state has its own department, responsible for licensing surety companies, monitoring their financial stability, and ensuring compliance with state regulations. The National Association of Insurance Commissioners (NAIC) works to harmonize regulations across states, fostering consistency and cooperation among different state insurance departments. While not a direct regulator, the NAIC plays a vital role in developing model regulations and promoting best practices within the surety insurance industry.

Legal Language in Surety Bond Agreements

Surety bond agreements are legally binding contracts characterized by precise and often complex language. Key terms such as “principal,” “obligee,” “surety,” “penalty,” and “conditions precedent” are frequently used. The agreement will clearly Artikel the obligations of each party, the conditions under which the surety is liable, and the procedures for making a claim. Understanding the specific wording of the bond agreement is crucial for all involved parties to avoid misunderstandings and potential disputes. A thorough review by legal counsel is often advisable, particularly for larger or more complex projects. For example, a bond might specify that the principal must meet certain performance milestones by a specific date; failure to do so triggers the surety’s obligation to step in. The agreement would detail the process for the obligee to submit a claim and the surety’s responsibilities in resolving the issue.

Illustrative Examples of Surety Bonds in Action

Surety bonds are vital instruments in various sectors, offering crucial financial protection to obligees against potential defaults by principals. The following examples demonstrate how surety bonds mitigate risk and ensure contractual obligations are met.

Construction Project Default

This scenario involves a construction company (the principal), a property developer (the obligee), and a surety company (the surety). The property developer commissions the construction company to build a new apartment complex for $10 million. A surety bond, valued at, say, 10% of the contract price ($1 million), is procured to guarantee the construction company’s performance. The construction company encounters unforeseen financial difficulties, resulting in a failure to complete the project according to the contract specifications. The property developer, faced with significant losses due to project delays and potential legal action from buyers, files a claim with the surety company. After verifying the construction company’s default, the surety company steps in, either completing the project by hiring another contractor or compensating the property developer directly for the financial losses incurred due to the principal’s default. This avoids significant financial losses for the property developer and safeguards their investment. The surety company then pursues recovery from the defaulting construction company.

Fiduciary Fund Mismanagement

Consider a scenario involving a charitable organization (the principal), its board of directors (the obligee), and a surety company. The charitable organization manages significant funds donated by various benefactors. To ensure the proper handling of these funds, the organization obtains a fiduciary bond. This bond protects the board of directors and the donors from potential embezzlement or misappropriation of funds by the organization’s treasurer. If an audit reveals that the treasurer has misappropriated funds, the board of directors can file a claim with the surety company. The surety company investigates the claim and, upon verification of the misappropriation, compensates the charitable organization for the missing funds. The surety company then seeks to recover the misappropriated funds from the treasurer. This process protects the organization’s assets and maintains public trust in the organization’s financial integrity. The specific amount of the bond would depend on the volume of funds managed by the organization. For example, a bond might be 5% or 10% of the total assets under management. The higher the amount of funds managed, the higher the potential risk and thus, the bond amount.

Ultimate Conclusion

Surety insurance, in its multifaceted nature, emerges as a cornerstone of trust and financial security across a wide range of industries. By understanding the mechanics of surety bonds, the roles of involved parties, and the legal implications, businesses and individuals can leverage this powerful tool to mitigate risk and ensure the successful completion of projects and agreements. This guide has provided a foundational understanding; further research tailored to specific circumstances is always recommended for informed decision-making.

General Inquiries

What happens if the surety company goes bankrupt?

While unlikely, bankruptcy of a surety company can trigger complex legal proceedings. The obligee may need to pursue legal action against the principal or seek recovery from a state guaranty association, depending on the jurisdiction and specific circumstances.

How is the premium for a surety bond determined?

Surety bond premiums are calculated based on several factors, including the principal’s creditworthiness, the project’s complexity and risk, and the bond amount. Surety underwriters conduct a thorough risk assessment before setting the premium.

Can I get a surety bond with bad credit?

Obtaining a surety bond with bad credit is challenging but not impossible. Surety companies consider various factors beyond credit score, such as the project’s financial strength and the principal’s experience. A co-signer or collateral may be required.

What is the difference between a surety bond and a performance bond?

A performance bond is a specific type of surety bond guaranteeing the completion of a contract. While all performance bonds are surety bonds, not all surety bonds are performance bonds. Surety bonds encompass a broader range of financial guarantees.