Securing affordable healthcare in North Carolina can feel like navigating a complex maze. This guide aims to illuminate the path, offering a clear understanding of the various options available to residents, from the Affordable Care Act (ACA) plans and Medicaid to employer-sponsored insurance. We’ll delve into the nuances of each, helping you determine the best fit for your individual needs and budget.

Understanding the intricacies of health insurance is crucial for financial well-being and peace of mind. This comprehensive resource breaks down the complexities, offering practical advice and actionable steps to help North Carolinians access the coverage they deserve without breaking the bank. We’ll explore eligibility criteria, cost comparisons, and strategies for minimizing expenses, ensuring you’re well-equipped to make informed decisions about your healthcare.

Understanding Affordable Care Act (ACA) in NC

The Affordable Care Act (ACA), also known as Obamacare, significantly impacted health insurance affordability and access in North Carolina. Its provisions aimed to expand coverage, regulate insurance markets, and provide subsidies to help individuals and families afford coverage. Understanding these changes is crucial for navigating the North Carolina health insurance landscape.

ACA’s Impact on Health Insurance Affordability in North Carolina

The ACA has broadened access to affordable health insurance in North Carolina through several key mechanisms. The expansion of Medicaid eligibility under the ACA, while not fully implemented in NC, still increased coverage for some low-income residents. Furthermore, the establishment of health insurance marketplaces (exchanges) facilitated comparison shopping and the availability of tax credits (subsidies) to lower the cost of premiums for eligible individuals and families. These subsidies are particularly beneficial for those with lower incomes. While the impact on affordability varies based on individual circumstances and plan choices, the ACA generally aimed to reduce the financial burden of healthcare.

ACA Plans Available in NC and Their Coverage Levels

The ACA marketplaces in North Carolina offer a range of plans categorized by metal tiers: Bronze, Silver, Gold, and Platinum. These tiers represent different levels of cost-sharing. Bronze plans have the lowest premiums but the highest out-of-pocket costs, while Platinum plans have the highest premiums but the lowest out-of-pocket costs. Silver plans typically strike a balance between premiums and cost-sharing. Each plan must meet minimum essential health benefits (MEHB) standards, including coverage for hospitalization, prescription drugs, and preventive care. The specific benefits and cost-sharing details vary among plans within each metal tier and across insurance companies.

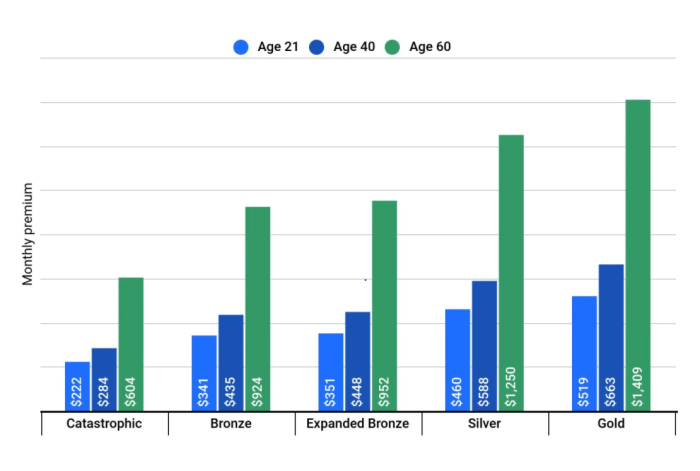

Premium Cost Comparison for Various ACA Plans

Premium costs for ACA plans in North Carolina vary based on several factors, most notably age and location. Older individuals generally pay higher premiums than younger individuals. Geographic location also plays a role, with premiums potentially higher in urban areas compared to rural areas due to differences in healthcare costs and provider networks. For example, a 30-year-old in Charlotte might pay a different premium for a Silver plan than a 60-year-old in rural eastern North Carolina. Precise premium costs are highly dependent on the specific plan chosen and the individual’s circumstances, and can be found on the Healthcare.gov website during the open enrollment period. It is important to compare plans to find the most suitable and affordable option.

Comparison of Key Features of Popular ACA Plans in NC

The following table illustrates a sample comparison of key features – deductibles, copays, and out-of-pocket maximums – for several hypothetical ACA plans in North Carolina. Actual plans and their features vary by insurer and year. This is for illustrative purposes only and should not be considered exhaustive or a substitute for researching current plan offerings.

| Plan Type | Deductible | Copay (Doctor Visit) | Out-of-Pocket Maximum |

|---|---|---|---|

| Bronze | $7,000 | $50 | $8,000 |

| Silver | $4,000 | $30 | $6,000 |

| Gold | $2,000 | $20 | $4,000 |

| Platinum | $1,000 | $10 | $2,000 |

Medicaid and CHIP in NC

North Carolina offers vital health insurance coverage to its residents through Medicaid and the Children’s Health Insurance Program (CHIP). These programs provide essential healthcare access to low-income individuals and families, significantly impacting the health and well-being of the state’s population. Understanding eligibility, benefits, and the application process is crucial for those who may qualify.

Eligibility Requirements for Medicaid and CHIP in North Carolina

Medicaid and CHIP eligibility in North Carolina is determined by several factors, including income, household size, and citizenship status. For Medicaid, income limits are based on the Federal Poverty Level (FPL), meaning eligibility is tied to how much a household earns compared to a nationally established poverty threshold. Families with incomes below a certain percentage of the FPL may qualify. Additional factors, such as age, disability, and pregnancy, may also impact eligibility. CHIP, designed for children and pregnant women, has its own specific income guidelines, often extending coverage to families earning slightly above the Medicaid income limits. Detailed income limits and other specific requirements can be found on the North Carolina Department of Health and Human Services website.

Benefits and Coverage Offered by Medicaid and CHIP

Medicaid and CHIP in North Carolina offer a comprehensive range of healthcare services. These include doctor visits, hospital care, prescription drugs, preventative care (like vaccinations and well-child visits), and mental health services. Specific benefits may vary slightly depending on the program and individual circumstances. Medicaid generally covers a broader range of services compared to CHIP, but CHIP is specifically designed to address the healthcare needs of children. Both programs aim to provide access to necessary medical care to ensure the health and well-being of their beneficiaries.

Application Process for Medicaid and CHIP in NC

Applying for Medicaid or CHIP in North Carolina can be done online through the state’s online application portal, or via paper application. Applicants will need to provide information about their household income, assets, and family composition. The application process involves verifying the provided information to ensure accuracy and eligibility. Once the application is submitted and processed, applicants will receive notification of their eligibility status. Assistance is available through various community organizations and state agencies to help individuals navigate the application process and ensure they have the support they need.

Key Differences Between Medicaid and CHIP

The following points highlight the key distinctions between Medicaid and CHIP in North Carolina:

- Target Population: Medicaid covers low-income adults, children, pregnant women, seniors, and individuals with disabilities. CHIP focuses specifically on children and pregnant women whose income is too high to qualify for Medicaid.

- Income Limits: Medicaid generally has lower income limits than CHIP. CHIP often extends coverage to families with slightly higher incomes than those eligible for Medicaid.

- Coverage: While both provide comprehensive healthcare, Medicaid typically covers a broader range of services than CHIP.

- Funding: Both programs are jointly funded by the federal and state governments, but the specific funding allocation differs between the two.

Employer-Sponsored Insurance in NC

Employer-sponsored health insurance (ESI) plays a significant role in providing health coverage to North Carolinians. While the Affordable Care Act (ACA) expanded access to health insurance, ESI remains a primary source of coverage for many working individuals and families in the state. Understanding the prevalence, affordability, and cost-benefit comparisons of ESI is crucial for navigating the complexities of the North Carolina healthcare landscape.

Employer-sponsored health insurance plans in North Carolina vary widely in terms of coverage, premiums, and out-of-pocket costs. The affordability of these plans is influenced by a number of factors, impacting both the employer and the employee.

Prevalence of Employer-Sponsored Insurance in North Carolina

Data from the U.S. Census Bureau and the North Carolina Department of Health and Human Services consistently show a significant portion of North Carolinians receiving health insurance through their employers. While precise figures fluctuate yearly, a substantial percentage of the working population relies on ESI. This prevalence highlights the importance of understanding the dynamics of these plans and their impact on access to healthcare within the state. Factors like industry, company size, and the economic climate influence the percentage of employees offered coverage. Larger companies are more likely to offer comprehensive plans than smaller businesses.

Factors Influencing Affordability of Employer-Sponsored Plans

Several factors influence the affordability of employer-sponsored health insurance plans in North Carolina. These include the employer’s contribution to premiums, the employee’s contribution, the plan’s deductible, co-pays, and out-of-pocket maximums. The type of plan offered (e.g., HMO, PPO) also plays a role. A high-deductible health plan (HDHP) with a health savings account (HSA) might be more affordable in terms of monthly premiums but can lead to higher out-of-pocket expenses if significant healthcare is needed. Negotiating favorable rates with insurance providers is crucial for employers to keep costs down. Furthermore, the overall health status of the employee pool affects the plan’s cost. A healthier workforce generally leads to lower premiums.

Comparison of Employer-Sponsored Insurance and ACA Plans

Comparing employer-sponsored insurance and ACA plans requires a nuanced approach, as the costs and benefits vary significantly depending on the specific plan details. Generally, employer-sponsored plans often offer broader networks of providers and potentially lower premiums for employees due to employer contributions. However, ACA plans offer standardized benefits and protections, ensuring coverage for pre-existing conditions. The out-of-pocket costs under each type of plan can vary greatly, making direct comparisons challenging without specific plan details. A family might find an employer-sponsored plan more affordable if the employer’s contribution is substantial, while an individual might find an ACA plan more cost-effective if their income qualifies them for subsidies.

Hypothetical Scenario: Employee Contributions and Overall Costs for Different Family Sizes

Let’s consider a hypothetical scenario for a family using an employer-sponsored PPO plan. Assume the employer contributes 75% of the premium.

| Family Size | Monthly Premium | Employer Contribution | Employee Contribution | Annual Employee Cost |

|---|---|---|---|---|

| Individual | $500 | $375 | $125 | $1500 |

| Family of Two | $1200 | $900 | $300 | $3600 |

| Family of Four | $1800 | $1350 | $450 | $5400 |

This example illustrates how employee contributions and overall costs can increase significantly with family size, even with a substantial employer contribution. Actual costs will vary depending on the specific plan, employer contribution percentage, and the employee’s location. The out-of-pocket costs (deductibles, co-pays, etc.) are not included in this simplified illustration but significantly affect the total cost of healthcare.

Navigating Health Insurance Costs

Understanding and managing your healthcare costs is crucial for maintaining financial well-being, especially with health insurance. This section provides strategies for reducing expenses, understanding your policy, and navigating the appeals process. Effective cost management can significantly impact your overall financial health.

Reducing Healthcare Expenses

Several strategies can help lower your healthcare expenses. Negotiating medical bills directly with providers can often result in reduced charges. Many providers are willing to work with patients on payment plans or discounts. Additionally, utilizing generic medications instead of brand-name drugs can lead to substantial savings. Generic medications are often bioequivalent to their brand-name counterparts, offering the same therapeutic benefits at a lower cost. Finally, comparing prices for medical services, such as lab tests or imaging, across different facilities can reveal significant price variations and help you choose the most cost-effective option. For example, a routine blood test might cost $50 at one lab but $100 at another.

Understanding Your Health Insurance Policy

Thorough comprehension of your health insurance policy is essential. Knowing your deductible, copay, coinsurance, and out-of-pocket maximum will allow you to budget effectively for healthcare expenses. Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Your copay is a fixed amount you pay for each doctor’s visit or prescription. Coinsurance is the percentage of costs you share with your insurer after meeting your deductible. The out-of-pocket maximum is the most you’ll pay in a year for covered services. Understanding these terms empowers you to make informed decisions about your healthcare and anticipate costs. For instance, if you know your deductible is $1000, you can plan accordingly for potential medical expenses.

Appealing a Denied Claim

If your health insurance claim is denied, understanding the appeals process is vital. Most insurance companies have a formal appeals process Artikeld in your policy documents. This usually involves submitting additional information or documentation to support your claim. The appeals process often includes multiple levels of review, allowing you to escalate your case if necessary. It’s important to carefully review the denial reason and gather all relevant supporting documentation, such as doctor’s notes or medical records. For example, if your claim is denied due to a lack of pre-authorization, you can appeal by providing evidence that you attempted to obtain pre-authorization but were unable to do so due to unforeseen circumstances.

Utilizing Preventative Care to Minimize Future Health Costs

Preventative care plays a significant role in minimizing future health costs. Regular checkups, screenings, and vaccinations can detect and address health issues early, preventing them from escalating into more expensive treatments. For instance, regular blood pressure checks can help detect hypertension early, allowing for lifestyle changes or medication to prevent serious complications like stroke or heart disease. Similarly, routine cancer screenings can detect cancer at an early, more treatable stage, saving significant costs associated with advanced-stage cancer treatment. Preventive care is often covered at little to no cost under most insurance plans, making it a cost-effective investment in your long-term health.

Illustrative Examples

Understanding the complexities of affordable health insurance in North Carolina can be challenging. Let’s illustrate with real-world examples to clarify the process and potential cost savings.

The following scenarios depict typical North Carolina families and their experiences with various insurance options, highlighting the financial implications of different choices and the benefits of preventative care.

A Typical North Carolina Family’s Insurance Journey

The Miller family, consisting of two working parents, John and Mary, and their two children, ages 8 and 12, live in Charlotte. John works for a small business that doesn’t offer health insurance, while Mary works part-time with benefits that are insufficient to cover the entire family. Initially, they struggled to find affordable coverage. They explored the NC HealthCare.gov marketplace and found a plan through the ACA that met their needs, utilizing a tax credit to reduce their monthly premiums. While their deductible was relatively high, the monthly payments were manageable, and the peace of mind knowing they had coverage was invaluable. They actively sought preventative care, including annual checkups and vaccinations for the children, recognizing the long-term cost savings this approach offered.

Cost Savings Associated with Preventative Care

Consider the Smith family, also residing in North Carolina. They opted for a health plan with a higher deductible but lower monthly premiums. They diligently engaged in preventative care, including annual physicals, routine dental checkups, and screenings for common health issues. This proactive approach prevented a costly emergency room visit when their youngest child developed a severe ear infection that could have escalated if not addressed early. The early detection and treatment, facilitated by regular checkups, resulted in significantly lower overall healthcare expenses compared to what they would have faced had they delayed care. Specifically, the cost of the early intervention (doctor’s visit, medication) was far less than the potential cost of an emergency room visit, hospitalization, and extended treatment had the infection worsened. This illustrates how preventative care can translate into substantial long-term cost savings.

Visual Representation of Health Insurance Costs

Imagine a pie chart illustrating the breakdown of a typical health insurance plan’s annual cost. The largest slice represents the premiums, the recurring monthly payments for the plan’s coverage. A significant portion is dedicated to the deductible, the amount the insured must pay out-of-pocket before the insurance company begins to cover expenses. A smaller slice represents the co-pay, the fixed amount paid at the time of service for doctor visits or other medical care. Another smaller slice reflects the co-insurance, the percentage of costs the insured shares with the insurance company after meeting the deductible. Finally, a small slice represents out-of-pocket maximum, the total amount the insured will pay in a given year, after which the insurance company covers 100% of the costs. This visual representation clearly demonstrates the various components that contribute to the overall cost of health insurance, emphasizing the importance of understanding each element when selecting a plan.

Ending Remarks

Navigating the world of affordable health insurance in North Carolina can be challenging, but with the right information and resources, it doesn’t have to be overwhelming. By understanding the ACA, Medicaid, CHIP, employer-sponsored options, and the marketplace, you can confidently choose a plan that meets your healthcare needs and financial capabilities. Remember to leverage available resources and actively manage your healthcare costs to ensure long-term financial stability and well-being.

Essential FAQs

What if I lose my job and my employer-sponsored insurance?

You may be eligible for COBRA, which allows you to continue your employer-sponsored coverage for a limited time at your own expense. Alternatively, you can explore options through the NC Health Insurance Marketplace or Medicaid/CHIP, depending on your income and circumstances.

Can I get help paying for my health insurance premiums?

Yes, the ACA offers subsidies and tax credits to help individuals and families afford health insurance premiums. The amount you receive depends on your income and household size. The NC Health Insurance Marketplace can determine your eligibility and calculate your potential savings.

What is a deductible, and how does it work?

A deductible is the amount you must pay out-of-pocket for covered healthcare services before your insurance company begins to pay. Once you meet your deductible, your insurance will typically cover a larger percentage of your medical expenses.

What is the difference between a PPO and an HMO plan?

A PPO (Preferred Provider Organization) generally offers more flexibility in choosing doctors and hospitals, but often comes with higher premiums. An HMO (Health Maintenance Organization) usually requires you to choose a primary care physician within the network and may have lower premiums but less flexibility.