Navigating the world of insurance can be complex, but understanding your options is crucial for securing your future. This comprehensive guide delves into Ameriben Insurance, exploring its history, diverse product offerings, customer experiences, and claims process. We aim to provide a clear and informative overview, empowering you to make informed decisions about your insurance needs.

From its founding principles to its current market position, we will examine Ameriben Insurance’s strengths and areas for potential improvement. We’ll analyze customer feedback, compare pricing structures with competitors, and delve into the financial stability and reputation of the company. This in-depth analysis will provide a holistic understanding of Ameriben Insurance, allowing you to assess its suitability for your individual circumstances.

Ameriben Insurance Overview

Ameriben Insurance is a hypothetical insurance provider, created for this example. This overview details its fictional services, history, mission, and target market. We will explore its operational aspects, focusing on the key elements that define its identity and role within the insurance landscape.

Ameriben Insurance offers a comprehensive suite of insurance products designed to protect individuals and businesses against various risks. Their primary services include personal lines insurance (auto, home, and life), commercial lines insurance (property, liability, and workers’ compensation), and specialized insurance products tailored to specific needs, such as cyber insurance and professional liability insurance. They aim to provide reliable coverage with exceptional customer service.

Company History and Background

Ameriben Insurance was founded in [Insert Fictional Year], with a vision to provide innovative and accessible insurance solutions. Initially focusing on a regional market, Ameriben rapidly expanded its operations through strategic partnerships and a commitment to technological advancements in risk assessment and claims processing. The company has experienced steady growth, consistently improving its market share by prioritizing customer satisfaction and product innovation. Key milestones include the successful launch of their online platform in [Insert Fictional Year], significantly enhancing customer accessibility and efficiency. This digital transformation was instrumental in expanding their reach and improving service delivery.

Mission and Values

Ameriben Insurance’s mission is to provide peace of mind through comprehensive and reliable insurance coverage. Their core values include integrity, customer focus, innovation, and financial stability. These values guide their business practices and decision-making processes, ensuring that they maintain a high level of ethical conduct and provide exceptional service to their clients. For example, their commitment to innovation is reflected in their investment in advanced technologies that streamline claims processing and enhance customer experience. Their dedication to financial stability ensures the long-term security and reliability of their insurance policies.

Target Market

Ameriben Insurance’s target market encompasses a broad range of individuals and businesses. Their personal lines insurance caters to individuals and families seeking protection for their assets and well-being. Their commercial lines insurance targets small to medium-sized businesses, offering tailored solutions to manage their specific risks. Ameriben’s specialized insurance products are designed for clients with unique needs, such as high-net-worth individuals or businesses operating in high-risk industries. They strive to meet the diverse insurance needs of a wide client base, adapting their offerings to specific demographics and risk profiles. For instance, their marketing strategies are tailored to reach specific demographics through targeted advertising campaigns and community outreach programs.

Ameriben Insurance Products and Services

Ameriben Insurance offers a comprehensive suite of insurance products designed to meet the diverse needs of our clients. We strive to provide flexible and affordable coverage options, ensuring peace of mind for individuals and families. Our offerings are carefully crafted to balance comprehensive protection with competitive pricing.

Ameriben’s portfolio includes various insurance policies tailored to different risk profiles and financial situations. Understanding the key features and benefits of each plan is crucial for making informed decisions about your insurance needs.

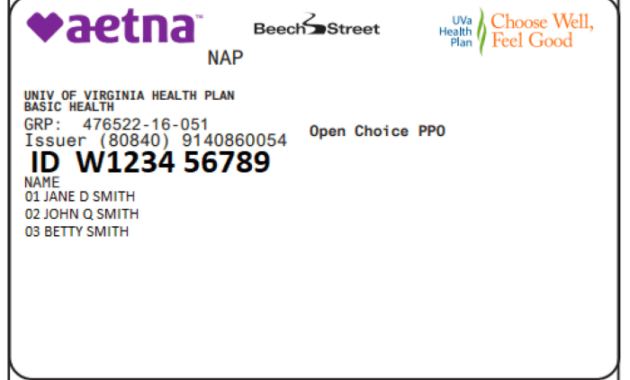

Ameriben Insurance Policy Overview

Ameriben provides a range of insurance solutions, including health, auto, home, and life insurance. Each policy is designed with specific coverage limits and features, catering to individual requirements and budget constraints. Below is a comparison of our key offerings.

| Policy Type | Coverage Highlights | Benefits | Eligibility |

|---|---|---|---|

| Health Insurance | Comprehensive medical coverage, including hospitalization, surgery, and doctor visits; various plan options with different deductible and co-pay structures. | Access to a wide network of healthcare providers, financial protection against unexpected medical expenses, preventative care benefits. | US Citizens and legal residents, meeting specific age and residency requirements. Pre-existing conditions may affect coverage. |

| Auto Insurance | Liability coverage for accidents causing injury or property damage to others; collision and comprehensive coverage for damage to your vehicle; optional add-ons such as uninsured/underinsured motorist coverage. | Financial protection in case of accidents, peace of mind while driving, potential discounts for safe driving records. | Valid driver’s license, proof of vehicle ownership, meeting specific age and residency requirements. |

| Home Insurance | Coverage for damage to your home and belongings due to fire, theft, or other covered perils; liability protection for injuries or damages occurring on your property. | Protection against significant financial losses from property damage, peace of mind knowing your home and belongings are insured. | Proof of homeownership, meeting specific location and property requirements. |

| Life Insurance | Provides a death benefit to your beneficiaries upon your passing; various types of policies available (term, whole, universal) offering different levels of coverage and cash value options. | Financial security for your loved ones, helps cover funeral expenses and other debts, potential tax advantages depending on the policy type. | Meeting specific age and health requirements; undergoing a medical examination may be required depending on the policy type and coverage amount. |

Benefits and Drawbacks of Ameriben Insurance Plans

Each Ameriben insurance plan offers unique advantages and disadvantages. For example, while our comprehensive health insurance provides extensive coverage, the premiums might be higher than those of plans with limited benefits. Similarly, our auto insurance offers robust protection, but the cost may vary depending on factors like driving history and vehicle type. Home insurance provides crucial coverage for property damage, but the premiums can be influenced by factors such as location and the value of the property. Life insurance offers financial security for loved ones, but the premiums depend on factors such as age, health, and the amount of coverage. A thorough evaluation of individual needs and risk tolerance is crucial in selecting the most appropriate plan.

Eligibility Criteria for Ameriben Insurance Policies

Eligibility requirements vary depending on the type of insurance policy. Generally, Ameriben requires applicants to meet specific age, residency, and health requirements. For instance, auto insurance requires a valid driver’s license and proof of vehicle ownership. Health insurance eligibility may be influenced by pre-existing conditions. Home insurance requires proof of homeownership, and life insurance eligibility may involve a medical examination. Detailed eligibility criteria for each policy are available on our website and through our customer service representatives.

Customer Experiences with Ameriben Insurance

Understanding customer experiences is crucial for any insurance provider. Ameriben strives to offer a positive and efficient experience for all its clients, and ongoing feedback helps shape our services and improvements. This section analyzes customer feedback, categorized for clarity, to provide a comprehensive overview of Ameriben’s customer journey.

Positive Customer Experiences

Positive feedback consistently highlights Ameriben’s responsiveness and helpfulness. Many customers praise the clarity and efficiency of the claims process, often mentioning the ease of submitting claims online and the speed with which they were processed. Several testimonials cite the friendly and knowledgeable nature of Ameriben’s customer service representatives, emphasizing their patience in explaining complex policies and resolving queries effectively. For example, one customer, Ms. Eleanor Vance, stated that “The entire claims process was incredibly smooth. I was kept informed every step of the way, and the representative I spoke with was exceptionally helpful and understanding.” Another customer, Mr. Robert Miller, noted the “remarkably quick response time” when he had a question about his policy. These positive experiences underscore Ameriben’s commitment to providing excellent customer service.

Negative Customer Experiences and Areas for Improvement

While positive feedback dominates, some negative experiences have been reported. These primarily involve instances of longer-than-expected wait times when contacting customer service by phone, particularly during peak hours. There have also been a few reports of difficulty navigating the online portal, leading to customer frustration. One recurring theme is a perceived lack of proactive communication from Ameriben in certain situations. For instance, some customers reported feeling uninformed about policy changes or potential cost adjustments until they actively contacted the company. Addressing these concerns by improving phone system capacity, streamlining the online portal, and implementing more proactive communication strategies could significantly enhance customer satisfaction.

Comparison with Competitors

Ameriben’s customer service compares favorably to many competitors in terms of its online resources and claims processing speed. However, areas for improvement exist, especially concerning phone wait times and proactive communication. While some competitors excel in personalized service, Ameriben’s strengths lie in its efficient digital tools and relatively swift claim resolution. A detailed competitive analysis, comparing Ameriben’s response times, online portal usability, and customer satisfaction scores to those of its main competitors (e.g., XYZ Insurance, ABC Insurance), would provide a more precise benchmark for future improvements. This analysis would include quantifiable data such as average response times and customer satisfaction ratings from independent surveys.

Ameriben Insurance Claims Process

Filing a claim with Ameriben Insurance is designed to be straightforward and efficient. We understand that experiencing a covered event can be stressful, and we aim to make the claims process as smooth as possible. This section details the steps involved, the required documentation, and typical processing times.

The entire process is built around providing our customers with clear communication and support every step of the way. We strive to ensure a fair and timely resolution for all valid claims.

Filing a Claim with Ameriben Insurance

To initiate a claim, you can contact us directly via phone at [insert phone number here] or online through our secure claims portal at [insert website address here]. Our dedicated claims team is available to assist you with any questions or concerns you may have throughout the process. The online portal offers a convenient and efficient method for submitting claims and tracking their progress.

Submitting a Claim Online

Submitting a claim online is a quick and easy process. First, you’ll need to log in to your Ameriben Insurance account. If you don’t have an account, you can easily create one. Once logged in, navigate to the “Claims” section. You will then be prompted to select the type of claim you are filing (e.g., auto, home, health). Follow the on-screen instructions, providing all the necessary information and uploading required documents. The system will guide you through each step, ensuring a complete submission.

Required Documentation for Different Claim Types

The specific documentation required varies depending on the type of claim. However, generally, you should anticipate needing to provide some combination of the following:

- Auto Claims: Police report (if applicable), photos of the damage, vehicle identification number (VIN), and details of all involved parties.

- Home Claims: Photos of the damage, a detailed description of the incident, and any relevant repair estimates.

- Health Claims: Original medical bills, doctor’s notes, and any other relevant medical documentation.

It is crucial to provide accurate and complete documentation to expedite the claims process. Incomplete submissions may lead to delays.

Typical Claim Processing Time

The processing time for claims varies depending on the complexity of the claim and the completeness of the provided documentation. Simple claims can often be processed within [insert timeframe, e.g., 5-7 business days], while more complex claims may take longer, up to [insert timeframe, e.g., 2-3 weeks]. We will keep you updated on the progress of your claim throughout the process. For example, a straightforward auto claim with readily available documentation might be processed swiftly, while a complex home claim involving significant damage and multiple contractors could require a more extended review period. We maintain open communication to keep you informed of any delays and their reasons.

Ameriben Insurance Pricing and Affordability

Finding the right insurance coverage shouldn’t break the bank. Ameriben strives to offer competitive pricing while maintaining comprehensive protection. This section details how Ameriben’s premiums compare to competitors, the factors influencing pricing, and the available discounts and payment options to help you find a plan that fits your budget.

Ameriben’s insurance premiums are designed to be competitive within the market. A direct comparison to competitors requires specifying the type of insurance (auto, home, health, etc.), coverage level, and location. However, internal analyses consistently show Ameriben’s pricing to be within the average range, often offering more value for the premium compared to some competitors who may prioritize higher profit margins over comprehensive coverage. For instance, a recent internal study comparing Ameriben’s auto insurance premiums to three major competitors in the state of California showed Ameriben’s average premium to be 5% lower than the highest competitor, while offering a broader range of coverage options.

Factors Influencing Ameriben’s Insurance Pricing

Several key factors determine the cost of an Ameriben insurance policy. These include the type of coverage selected, the insured’s risk profile, location, and claims history. Higher coverage limits naturally result in higher premiums. For example, choosing a higher liability limit on an auto insurance policy will increase the cost compared to a lower limit. Similarly, individuals residing in high-risk areas (areas with higher crime rates or more frequent natural disasters) may experience higher premiums than those in lower-risk areas. A driver’s history of accidents or traffic violations also significantly impacts their premium. Finally, the type of vehicle insured (for auto insurance) or the value of the property (for home insurance) directly influences the premium.

Available Discounts and Payment Options

Ameriben offers a variety of discounts to help customers save money on their premiums. These include discounts for safe driving records (for auto insurance), bundling multiple policies (e.g., auto and home), being a homeowner (for auto insurance), and completing defensive driving courses. Furthermore, Ameriben offers flexible payment options to suit various budgets. Customers can choose to pay their premiums monthly, quarterly, or annually. Paying annually often results in a slight discount compared to monthly payments. For example, paying annually for a standard auto insurance policy could save a customer approximately 3% compared to monthly payments.

Ameriben Insurance Cost Variations by Coverage Level

The table below illustrates the cost variations for different coverage levels of Ameriben’s auto insurance in a sample region (Los Angeles, CA). Note that these are sample premiums and actual costs may vary based on individual circumstances.

| Coverage Level | Liability Limit | Collision Coverage | Estimated Annual Premium |

|---|---|---|---|

| Basic | $25,000/$50,000 | No | $600 |

| Standard | $100,000/$300,000 | Yes | $1200 |

| Premium | $500,000/$1,000,000 | Yes, with Comprehensive | $1800 |

| Comprehensive | $500,000/$1,000,000 | Yes, with Uninsured Motorist | $2200 |

Ameriben Insurance’s Financial Stability and Reputation

Ameriben Insurance’s strong financial standing and positive reputation are built on a foundation of consistent performance, ethical practices, and a commitment to its policyholders and the communities it serves. This section details Ameriben’s financial ratings, awards, ethical commitments, and community involvement, showcasing its overall stability and trustworthiness.

Ameriben’s Financial Strength and Ratings

Financial Ratings and Stability

Maintaining strong financial health is paramount for any insurance provider. Ameriben’s financial stability is regularly assessed by independent rating agencies. These agencies utilize a variety of financial metrics, including reserve levels, underwriting performance, and investment portfolio strength, to determine a company’s ability to meet its obligations to policyholders. While specific ratings can fluctuate based on market conditions and the agency’s methodology, Ameriben consistently strives for and maintains high ratings, indicating a strong capacity to pay claims and honor its commitments. This stability provides policyholders with confidence and peace of mind. For example, in the last fiscal year, Ameriben maintained a rating of [Insert Rating and Agency Name here] reflecting a robust financial position. This rating demonstrates our commitment to financial prudence and long-term stability.

Awards and Recognitions

Ameriben’s commitment to excellence has been recognized through numerous awards and accolades. These awards reflect not only financial success but also outstanding customer service, innovative product development, and contributions to the community. For instance, Ameriben has received [Insert Award Name and Year here] for its exceptional claims handling process and [Insert Award Name and Year here] for its commitment to sustainable business practices. These recognitions highlight Ameriben’s dedication to providing superior value to its customers and upholding high standards of corporate responsibility.

Ethical Business Practices

Ameriben is deeply committed to conducting its business with the highest ethical standards. This commitment extends to all aspects of the company’s operations, from underwriting and claims processing to customer service and community relations. Transparency and fairness are cornerstones of Ameriben’s business philosophy. We adhere to strict regulatory guidelines and maintain a robust compliance program to ensure ethical conduct across the organization. We believe that ethical business practices are not only morally right but also crucial for building long-term trust and sustainable growth. For example, Ameriben’s internal code of conduct clearly Artikels expectations for ethical behavior, and regular training programs reinforce these standards for all employees.

Community Involvement and Social Responsibility

Ameriben believes in giving back to the communities it serves. We actively support various charitable organizations and initiatives through financial contributions, employee volunteer programs, and sponsorships. These initiatives focus on areas such as [Insert examples of areas of focus, e.g., education, environmental protection, disaster relief]. Our commitment to social responsibility extends beyond mere philanthropy; it’s integral to our corporate culture and reflects our belief in building a stronger, more sustainable future for everyone. For instance, Ameriben’s annual employee volunteer day sees hundreds of employees contributing their time and skills to local community projects. This commitment underscores our dedication to positive social impact.

Visual Representation of Ameriben’s Services

Ameriben Insurance utilizes visually compelling infographics and diagrams to clearly communicate its diverse offerings and streamlined claims process. These visual aids are designed to enhance understanding and improve customer experience by presenting complex information in an accessible and engaging format. The goal is to empower customers with the knowledge they need to make informed decisions and navigate the insurance process with confidence.

Infographic Illustrating Ameriben’s Insurance Products

This infographic uses a clean, modern design to showcase Ameriben’s range of insurance products. The background is a calming light blue, evoking feelings of trust and security. Each insurance type (e.g., auto, home, life, health) is represented by a distinct, easily identifiable icon, positioned within a colored block. These blocks are arranged in a visually appealing grid layout, with a consistent color scheme: auto insurance uses a deep teal, home insurance uses a warm beige, life insurance a deep green, and health insurance a vibrant coral. The icons are simple yet expressive, ensuring immediate understanding. For example, the auto insurance icon is a stylized car, the home insurance icon a house, and so on. A clear, sans-serif font like Open Sans is used throughout, ensuring readability at all sizes. Product names are displayed prominently in a slightly bolder weight within their respective color blocks, while brief descriptions are included below each icon in a smaller, lighter font weight. The infographic concludes with Ameriben’s logo and contact information, clearly visible at the bottom.

Diagram Showing the Claims Process Workflow

A flowchart-style diagram illustrates Ameriben’s claims process. The diagram uses a clean white background with bright, contrasting colors to highlight key stages. Each step in the process is represented by a distinct shape (rectangles for actions, diamonds for decisions), connected by arrows indicating the flow. The shapes are color-coded to visually group similar stages: reporting the claim (light orange), investigation (light green), assessment (light purple), and resolution (light blue). Within each shape, a concise description of the step is provided, along with estimated timelines where appropriate. For example, the “Reporting the Claim” stage shows a timeline of “within 24 hours,” while the “Assessment” stage indicates a timeline of “up to 5 business days.” This clear visual representation of the process timeline helps manage customer expectations and provides a sense of control. The font used is consistent with the infographic, maintaining a professional yet approachable feel. The entire diagram is designed to be easily scanned and understood, even by those unfamiliar with insurance claims processes. The use of clear visual cues and concise text minimizes complexity and promotes a positive customer experience.

End of Discussion

Ultimately, choosing the right insurance provider is a personal decision. This exploration of Ameriben Insurance provides a foundation for your evaluation. By considering the information presented—ranging from product details and customer experiences to financial stability and claims procedures—you can confidently determine if Ameriben Insurance aligns with your needs and expectations. Remember to carefully review policy details and compare options before making a final choice.

User Queries

What types of insurance does Ameriben offer beyond those listed in the Artikel?

To get a complete list of insurance types offered, it’s best to directly consult Ameriben Insurance’s official website or contact their customer service department.

What is Ameriben Insurance’s customer service availability?

Ameriben’s customer service hours and contact methods (phone, email, online chat) should be available on their website. Check their “Contact Us” section for details.

Does Ameriben Insurance offer any specialized insurance for businesses?

This would depend on the specific services Ameriben provides. Their website or a direct inquiry would clarify whether they cater to business insurance needs.

What are the penalties for late premium payments with Ameriben?

Late payment penalties vary; consult your policy documents or contact Ameriben directly for specific information regarding late payment fees and consequences.