Securing your belongings and peace of mind is paramount, especially when renting. Understanding the intricacies of renters insurance can feel daunting, but navigating the landscape of Allstate renters insurance coverage doesn’t have to be. This guide offers a detailed exploration of Allstate’s offerings, empowering you to make informed decisions about protecting your assets and personal liability.

We’ll delve into the specifics of coverage options, optional add-ons, the claims process, cost factors, policy limitations, and customer service experiences. By the end, you’ll have a clear understanding of what Allstate renters insurance provides and how it can safeguard your lifestyle.

Coverage Details

Allstate renters insurance offers a range of coverage options designed to protect your belongings and provide financial security in the event of unforeseen circumstances. Understanding these options is crucial for selecting a policy that adequately meets your individual needs and budget. This section will detail the key aspects of Allstate renters insurance coverage.

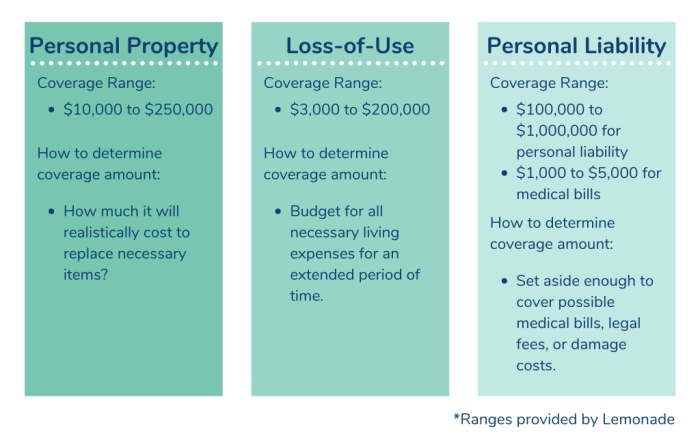

Personal Property Coverage

Allstate renters insurance covers your personal belongings against various perils, such as fire, theft, and vandalism. The amount of coverage you can obtain depends on the value of your possessions and the chosen policy. It’s important to accurately assess the value of your items to ensure sufficient coverage. For example, a policy with a $20,000 personal property limit would cover losses up to that amount. If your belongings are worth more, consider increasing the coverage limit to avoid underinsurance. Imagine a scenario where a fire destroys $25,000 worth of your belongings; a $20,000 policy would only cover $20,000, leaving you responsible for the remaining $5,000.

Liability Coverage

Renters insurance also provides liability coverage, protecting you against financial responsibility for injuries or damages caused to others on your property. This is crucial, as even a small accident can result in substantial legal and medical costs. For example, if a guest trips and falls in your apartment, injuring themselves, liability coverage could help pay for their medical expenses and any legal fees associated with a potential lawsuit. The amount of liability coverage offered varies by policy, typically ranging from $100,000 to $300,000 or more. Higher limits provide greater protection against significant financial losses.

Additional Living Expenses Coverage

In the event your apartment becomes uninhabitable due to a covered peril, such as a fire or water damage, this coverage helps pay for temporary housing and other essential living expenses while your home is being repaired. This can include costs associated with hotels, meals, and other necessities. The amount of coverage depends on the specific policy.

Comparison of Allstate Renters Insurance Plans

The following table compares different Allstate renters insurance plans and their features. Note that specific details and pricing may vary based on location and individual circumstances. Always contact Allstate directly for the most up-to-date information.

| Plan Name | Personal Property Coverage Limit | Liability Coverage Limit | Additional Living Expenses Coverage |

|---|---|---|---|

| Basic | $15,000 | $100,000 | $5,000 |

| Standard | $25,000 | $200,000 | $10,000 |

| Premium | $50,000 | $300,000 | $20,000 |

Additional Coverages

Allstate renters insurance offers several optional add-ons designed to enhance your coverage and provide greater peace of mind. These add-ons address specific risks not fully covered under standard renters insurance policies, allowing you to tailor your protection to your individual needs and circumstances. Understanding these options and their associated costs is crucial for making informed decisions about your insurance coverage.

Earthquake Coverage

Earthquake coverage is a valuable addition for renters living in seismically active areas. Standard renters insurance policies typically exclude earthquake damage. This optional coverage protects your personal belongings and provides liability coverage in the event of earthquake-related damage to your rental property. The cost of earthquake coverage varies depending on factors such as your location, the age and type of your building, and the coverage amount selected. For example, a renter in California might pay a significantly higher premium than a renter in a state with minimal seismic activity. While the cost might seem substantial, the potential financial burden of earthquake damage far outweighs the premium in high-risk zones.

Flood Coverage

Similar to earthquake coverage, flood insurance is a separate policy and not typically included in standard renters insurance. Flood damage can be devastating, leaving renters with significant financial losses. This optional coverage protects your personal property from flood damage, which can be caused by various events including heavy rainfall, overflowing rivers, and storm surges. The cost of flood insurance is influenced by factors like your location’s flood risk, the value of your belongings, and the level of coverage selected. A renter in a low-lying coastal area would expect to pay a higher premium compared to someone in an inland location with a low flood risk. Consider the potential for flood damage in your area when evaluating the cost-benefit ratio of this add-on.

Personal Liability Endorsements

Personal liability coverage protects you from financial responsibility in case someone is injured or their property is damaged on your premises. While basic renters insurance includes a certain level of liability coverage, a personal liability endorsement can increase this limit significantly. This is particularly beneficial for renters who frequently entertain guests or have pets. Adding a personal liability endorsement is a straightforward process, typically involving contacting your Allstate agent or updating your policy online. The cost of this endorsement depends on the increased liability coverage amount you choose. For example, increasing your liability coverage from $100,000 to $300,000 will result in a higher premium, but provides significantly greater financial protection.

Advantages and Disadvantages of Optional Coverages

Understanding the pros and cons of each optional coverage helps in making an informed decision.

- Earthquake Coverage:

- Advantages: Protects belongings and liability from earthquake damage; crucial in high-risk areas.

- Disadvantages: Can be expensive, especially in high-risk zones; may not cover all earthquake-related damages.

- Flood Coverage:

- Advantages: Protects belongings from flood damage; essential in flood-prone areas.

- Disadvantages: Can be costly, especially in high-risk areas; separate policy from renters insurance.

- Personal Liability Endorsements:

- Advantages: Increases liability protection; crucial for renters who frequently entertain guests or have pets.

- Disadvantages: Increases premium; may be unnecessary for renters with low-risk lifestyles.

Claims Process

Filing a renters insurance claim with Allstate is designed to be straightforward. We understand that experiencing a covered loss can be stressful, and we aim to make the claims process as smooth and efficient as possible. This section Artikels the steps involved, common scenarios, required documentation, and how to submit a claim.

Filing a Renters Insurance Claim

The first step is to report your loss as soon as reasonably possible after the incident. You can do this either online through your Allstate account or by calling our dedicated claims line. Immediately securing the property to prevent further damage is also crucial. For example, if you’ve experienced water damage, you should take steps to mitigate further water intrusion.

Common Claim Scenarios and Handling

Allstate handles a variety of renters insurance claims. Common scenarios include theft, fire damage, water damage (from burst pipes or leaks, for instance), and vandalism. In the event of theft, you’ll need to file a police report and provide a detailed inventory of stolen items, including purchase dates and receipts if available. For fire damage, Allstate will work with you to arrange for temporary housing and begin the process of assessing and repairing the damage. Water damage claims often involve the services of a restoration specialist to mitigate further damage and repair affected areas. Vandalism claims require a police report and detailed documentation of the damage.

Required Documentation for a Successful Claim

Providing accurate and comprehensive documentation is essential for a smooth and efficient claims process. This typically includes a police report (if applicable), photos or videos of the damaged property, receipts or proof of ownership for damaged or stolen items, and a detailed description of the incident and the extent of the damage. Maintaining thorough records of your belongings, such as photos and appraisals for high-value items, can significantly expedite the claims process. For example, having dated photos of your electronics can help support your claim for their replacement value.

Submitting a Claim Online or by Phone

Submitting a claim online is often the quickest method. You can typically access a claims portal through your Allstate account online. You will be prompted to provide information about the incident, upload supporting documentation, and select a preferred method of contact. Alternatively, you can call Allstate’s claims line. A claims adjuster will guide you through the process, asking for similar information and documentation as the online process. They may schedule an inspection of the damaged property to assess the extent of the loss. In either case, be prepared to provide detailed information about the incident, the extent of the damage, and any relevant documentation.

Cost and Factors Affecting Premiums

Understanding the cost of Allstate renters insurance and the factors influencing your premium is crucial for budgeting and securing the right coverage. Several key elements contribute to the final price you pay, and being aware of these can help you make informed decisions. This section will detail these factors and provide examples to illustrate their impact.

Several factors influence the cost of your Allstate renters insurance premium. These include your location, the amount of coverage you choose, your credit score, and the specific features and add-ons you select. Allstate, like other insurers, uses a sophisticated algorithm that weighs these factors to determine your individual risk profile and subsequent premium.

Location’s Influence on Premiums

Your location significantly impacts your renters insurance premium. Areas with higher crime rates, a greater frequency of natural disasters (like hurricanes or wildfires), or higher property values generally have higher insurance premiums. For example, a renter in a high-crime urban area might pay considerably more than a renter in a quiet, low-crime suburban neighborhood, even if they have identical coverage amounts. This reflects the increased risk the insurance company assumes in high-risk areas.

Coverage Amount and Premium Relationship

The amount of coverage you select directly affects your premium. Higher coverage amounts mean higher premiums because you’re protecting a larger sum of your belongings. For instance, choosing a $50,000 coverage limit will result in a higher premium than a $25,000 limit. This is a simple reflection of the increased financial responsibility the insurer undertakes. It’s essential to find a balance between adequate coverage and affordability.

Credit Score’s Impact on Premiums

In many states, insurers like Allstate can use your credit score to help determine your premium. A higher credit score often correlates with a lower premium, as it suggests a lower risk of late payments or claims. Conversely, a lower credit score may lead to a higher premium. For example, a renter with an excellent credit score (750+) might receive a significantly lower rate compared to someone with a fair or poor credit score (below 650). This is because statistically, individuals with good credit demonstrate responsible financial behavior, which reduces the insurer’s risk.

Allstate Pricing Compared to Competitors

Allstate’s pricing is competitive within the renters insurance market, but it’s essential to compare quotes from multiple providers to ensure you’re getting the best value. The exact pricing will vary depending on your specific circumstances and location. Direct comparison of premiums requires obtaining quotes from several companies using identical coverage parameters. It’s advisable to compare quotes based on your individual needs and risk profile before making a decision.

Illustrative Table of Premium Variations

| Factor | Low Risk | Medium Risk | High Risk |

|---|---|---|---|

| Location | Suburban, low crime | Urban, moderate crime | Urban, high crime, disaster-prone |

| Coverage Amount | $25,000 | $50,000 | $75,000 |

| Credit Score | 750+ | 650-749 | Below 650 |

| Estimated Monthly Premium (Example) | $15 | $25 | $40 |

Note: The premium amounts in this table are illustrative examples only and may not reflect actual pricing. Actual premiums will vary based on many factors, and this table is for comparative purposes only.

Policy Exclusions and Limitations

Understanding what your Allstate renters insurance policy doesn’t cover is just as important as knowing what it does. This section details specific situations and items excluded from coverage, limitations on liability, and the appeals process for denied claims. Careful review of your policy documents is always recommended.

Allstate renters insurance, like most insurance policies, has exclusions and limitations designed to manage risk and prevent abuse. These exclusions are clearly defined in your policy documents. It’s crucial to understand these limitations to avoid unexpected financial burdens in the event of a covered loss.

Excluded Property and Situations

Several types of property and events are typically excluded from Allstate renters insurance coverage. This isn’t an exhaustive list, and specific exclusions may vary depending on your policy and state. Always refer to your policy for the complete details.

- Intentional Acts: Damage caused intentionally by you or a member of your household is generally not covered.

- Earthquakes and Floods: These are usually considered separate perils requiring specific endorsements or additional coverage.

- Wear and Tear: Gradual deterioration of belongings due to normal use is not covered.

- Certain Pests: Damage caused by insects or rodents is often excluded unless it results from a sudden and accidental event covered by the policy.

- Neglect: Damage resulting from failure to maintain your property (e.g., neglecting a leaky pipe) is usually excluded.

Limitations of Liability Coverage

Liability coverage protects you against financial responsibility for injuries or property damage you cause to others. However, this coverage has limitations.

The amount of liability coverage you have is a crucial factor. For example, if your policy provides $100,000 in liability coverage and you cause $150,000 in damages, you would be personally responsible for the remaining $50,000. Additionally, certain types of liability claims, such as those involving intentional acts or business-related activities, may not be covered.

Appealing a Denied Claim

If Allstate denies your claim, you have the right to appeal their decision. The appeals process is usually Artikeld in your policy documents. Generally, this involves submitting additional documentation supporting your claim and clearly explaining why you believe the denial was incorrect. It’s advisable to keep meticulous records of all communications with Allstate and any supporting evidence. You may wish to consult with an attorney if you are dissatisfied with the outcome of the appeals process.

Visual Representation of Common Exclusions

Imagine a Venn diagram. The large circle represents all possible events that could cause damage to your property or lead to liability. A smaller circle inside represents events covered by your Allstate renters insurance. The area outside the smaller circle represents common exclusions. Examples within this outer area could include labels such as “Intentional Acts,” “Wear and Tear,” “Earthquakes,” “Floods,” and “Neglect.” This visually demonstrates that not all events are covered, highlighting the importance of understanding your policy’s limitations.

Wrap-Up

Choosing the right renters insurance is a crucial step in protecting your personal belongings and financial well-being. Allstate offers a range of coverage options to suit various needs and budgets, but careful consideration of your individual circumstances is essential. This guide has provided a framework for understanding Allstate renters insurance coverage, enabling you to make informed decisions based on your specific requirements and risk profile. Remember to compare options and contact Allstate directly for personalized advice.

FAQs

What is the difference between actual cash value and replacement cost coverage for personal property?

Actual cash value (ACV) considers depreciation, meaning you receive the item’s current value minus depreciation. Replacement cost coverage, however, pays for the cost of replacing the item with a new one of like kind and quality, regardless of depreciation.

Does Allstate renters insurance cover damage caused by a roommate?

Generally, damage caused by a roommate is covered under your liability coverage, unless the damage was intentional or a result of negligence you were aware of. Specific policy details should be reviewed.

What if I need to file a claim while traveling?

Allstate provides various methods to file a claim, including online and phone options. Their customer service representatives can guide you through the process regardless of your location. You’ll likely need to provide details about the incident and supporting documentation.

How long does it take to get a claim payout?

The timeframe for claim payouts varies depending on the complexity of the claim and the required documentation. Allstate aims for timely processing, but it’s best to contact them directly for an estimated timeframe in your specific situation.