Securing affordable and comprehensive auto insurance is a priority for many drivers. This guide delves into the world of Allstate auto insurance quotes, providing a detailed exploration of the process, factors influencing costs, and a comparison with key competitors. We’ll navigate the various methods of obtaining quotes, examine the impact of individual factors, and uncover how to maximize potential savings through discounts and programs. Understanding Allstate’s offerings empowers you to make informed decisions about your vehicle protection.

From online quote generation to understanding policy details and navigating the claims process, we aim to equip you with the knowledge necessary to confidently choose the right Allstate auto insurance plan that best fits your needs and budget. This comprehensive overview ensures you’re well-prepared to compare options and make a smart choice for your vehicle insurance needs.

Allstate Auto Insurance Quotes

Allstate is one of the largest insurers in the United States, offering a wide range of auto insurance options. Getting a quote involves providing information about yourself, your vehicle, and your driving history through their website, app, or by contacting an agent. The process is designed to be relatively straightforward, aiming to provide a personalized quote based on your specific risk profile.

Allstate’s quote process uses a sophisticated algorithm to assess risk and generate a price. This process is designed to be transparent, though the specific details of the algorithm are proprietary.

Types of Allstate Auto Insurance Coverage

Allstate offers a comprehensive suite of auto insurance coverages to meet diverse needs. These coverages protect policyholders against various financial risks associated with car accidents and other incidents. The specific coverages available and their costs vary depending on individual circumstances and state regulations.

- Liability Coverage: This covers bodily injury and property damage caused to others in an accident where you are at fault. It’s typically required by law and usually includes both bodily injury liability and property damage liability.

- Collision Coverage: This pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s optional but highly recommended.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or hail. It’s also optional but valuable for protecting against non-accident-related damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical expenses and vehicle damage.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault. It’s helpful for covering smaller medical bills that may not reach the threshold for other coverages.

- Personal Injury Protection (PIP): (Available in some states) This covers medical expenses and lost wages for you and your passengers, regardless of fault. It can also cover expenses for other individuals in your vehicle.

Factors Influencing Allstate Auto Insurance Quote Variations

Several factors contribute to the variability of Allstate auto insurance quotes. Understanding these factors can help individuals make informed decisions about their coverage and potentially lower their premiums. These factors are considered by the Allstate system during the quote generation process.

- Driving History: Accidents, traffic violations, and even the number of years of driving experience significantly impact your quote. A clean driving record generally results in lower premiums.

- Vehicle Information: The make, model, year, and safety features of your vehicle influence the cost of insurance. Newer cars with advanced safety technology often have lower premiums.

- Location: Your geographic location plays a role, as accident rates and theft rates vary significantly by area. Higher-risk areas generally lead to higher premiums.

- Age and Gender: Statistically, younger drivers and certain gender demographics tend to have higher accident rates, which can affect premium costs.

- Coverage Level: The amount and type of coverage you choose directly impact your premium. Higher coverage limits result in higher premiums.

- Credit Score: In many states, insurance companies consider credit scores when determining premiums. A higher credit score often translates to lower premiums.

Obtaining Allstate Auto Insurance Quotes

Securing an Allstate auto insurance quote is a straightforward process, offering several convenient methods to suit individual preferences. Understanding the nuances of each approach will help you choose the best method for your needs and ensure you receive the most accurate and comprehensive quote possible. This will allow you to compare rates and find the coverage that best fits your budget and risk profile.

Methods for Obtaining Allstate Auto Insurance Quotes

Allstate provides three primary avenues for obtaining auto insurance quotes: online, by phone, and through a local agent. Each method presents unique advantages and disadvantages.

Online Quote Acquisition

Obtaining an Allstate auto insurance quote online offers speed and convenience. The process is generally quick, allowing for immediate comparisons of different coverage options. However, the lack of direct human interaction may limit the opportunity for personalized advice and clarification of complex policy details.

Phone Quote Acquisition

Requesting a quote via phone allows for direct interaction with an Allstate representative. This provides the opportunity to ask questions and receive personalized guidance. However, this method may be less efficient than obtaining an online quote, requiring more time commitment. The availability of representatives may also vary depending on time of day and demand.

Agent Quote Acquisition

Working with a local Allstate agent provides a personalized, in-depth approach to quote acquisition. Agents can offer tailored advice based on your specific needs and circumstances. This approach allows for more thorough explanation of coverage options and a more comprehensive understanding of the policy. However, it may require scheduling an appointment and involve a greater time investment than other methods.

Step-by-Step Guide for Obtaining an Online Quote

Obtaining an Allstate auto insurance quote online is a relatively simple process.

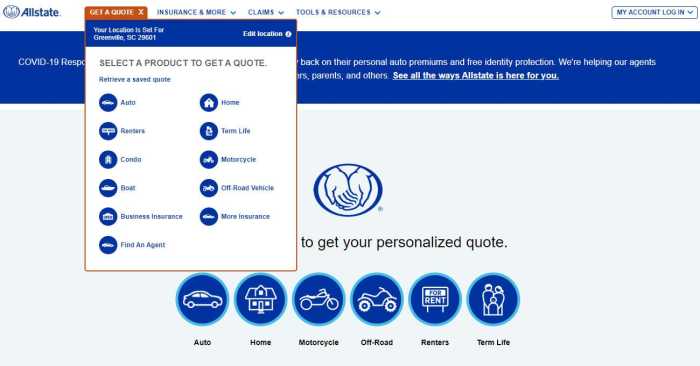

- Navigate to the Allstate Website: Begin by visiting the official Allstate website. Look for a prominent link or button typically labeled “Get a Quote” or a similar phrase.

- Select “Auto Insurance”: Once on the website, choose the “Auto Insurance” option from the available insurance types.

- Enter Vehicle Information: You’ll be prompted to provide details about your vehicle(s), including the year, make, model, and VIN. Accurate information is crucial for an accurate quote.

- Provide Driver Information: Next, input information about all drivers who will be listed on the policy. This includes details such as age, driving history, and address.

- Specify Coverage Preferences: Choose your desired coverage levels (liability, collision, comprehensive, etc.). Understanding the different coverage options is essential to selecting the right level of protection.

- Review and Submit: Carefully review all entered information for accuracy. Once confirmed, submit your request.

- Receive Your Quote: Allstate will typically provide your quote instantly online. This will detail the estimated cost of your insurance based on the provided information.

Factors Affecting Allstate Auto Insurance Quotes

Understanding the factors that influence your Allstate auto insurance quote is crucial for securing the best possible rate. Several key elements contribute to the final price, and being aware of them can help you make informed decisions. This information will clarify how these factors interact to determine your premium.

Driving History

Your driving record significantly impacts your Allstate auto insurance quote. A clean driving history, free of accidents and traffic violations, generally results in lower premiums. Conversely, accidents, speeding tickets, and other moving violations can substantially increase your rates. The severity and frequency of incidents play a key role. Allstate, like most insurers, uses a points system to assess risk based on your driving history.

| Factor | Description | Impact on Quote | Example |

|---|---|---|---|

| Driving History | Accidents, tickets, DUIs, and other driving infractions within a specific timeframe. | Higher premiums for more incidents and more severe infractions. Lower premiums for clean records. | A driver with three speeding tickets in the past three years will likely pay significantly more than a driver with a spotless record. |

Age

Age is another critical factor. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher insurance premiums. As drivers age and gain experience, their premiums typically decrease. This reflects the lower risk associated with more experienced drivers. Mature drivers, over a certain age, might also see slightly higher rates due to factors such as potential health concerns impacting driving ability.

| Factor | Description | Impact on Quote | Example |

|---|---|---|---|

| Age | Driver’s age range. | Younger drivers (under 25) generally pay higher premiums; rates often decrease with age and experience, potentially increasing slightly again in later years. | A 20-year-old driver will likely pay substantially more than a 40-year-old driver with a similar driving record. |

Location

Your location plays a significant role in determining your insurance rate. Areas with higher crime rates, more accidents, and more expensive car repairs typically have higher insurance premiums. Allstate considers the risk associated with your specific address, factoring in local statistics on accidents and theft.

| Factor | Description | Impact on Quote | Example |

|---|---|---|---|

| Location | Geographic location of the driver’s residence and where the vehicle is primarily parked. | Higher premiums in areas with higher accident rates, theft rates, and repair costs. | A driver living in a densely populated urban area with high crime rates will likely pay more than a driver in a rural area with lower crime and accident rates. |

Vehicle Type

The type of vehicle you drive significantly influences your insurance costs. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. Safety features also play a role; vehicles with advanced safety technology may receive discounts.

| Factor | Description | Impact on Quote | Example |

|---|---|---|---|

| Vehicle Type | Make, model, year, and safety features of the vehicle. | Higher premiums for more expensive, high-performance, or easily stolen vehicles. Lower premiums for less expensive vehicles with good safety ratings. | Insuring a new luxury SUV will cost more than insuring an older, smaller sedan, even with similar driving records. |

Comparing Allstate Quotes to Competitors

Choosing the right auto insurance provider often involves comparing quotes from different companies to find the best coverage at the most competitive price. While Allstate is a well-established and reputable insurer, it’s crucial to compare its offerings to those of its major competitors, such as Geico, Progressive, and State Farm, to make an informed decision. This comparison will highlight key differences in coverage options and pricing structures.

Comparing Allstate’s auto insurance quotes with those of Geico, Progressive, and State Farm reveals significant variations in pricing and coverage details. These differences stem from various factors, including individual driver profiles, vehicle types, location, and the specific coverage options selected. While one company might offer a lower premium for a particular driver, another might provide more comprehensive coverage for a slightly higher cost. Therefore, a thorough comparison is necessary to determine the best value proposition for individual needs.

Coverage Options Comparison

Allstate, Geico, Progressive, and State Farm offer a range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. However, the specifics of these coverages, such as policy limits and optional add-ons, can vary significantly between insurers. For example, Allstate might offer a more robust suite of optional add-ons, such as roadside assistance or rental car reimbursement, while Geico might focus on competitive pricing for basic coverage. Progressive is known for its Name Your Price® Tool, allowing customers to customize their coverage and price, while State Farm emphasizes its long-standing reputation and extensive agent network. Direct comparison of policy documents is necessary for precise detail.

Pricing Differences

Pricing disparities among these insurers are substantial and depend heavily on individual risk profiles. A driver with a clean driving record and a newer vehicle will likely receive lower premiums across the board, but the specific price quoted by each insurer will still vary. For example, Geico often advertises itself as having very competitive rates, while State Farm’s premiums may be higher, reflecting its broader range of services and established reputation. Allstate’s pricing typically falls somewhere in between, depending on the specific circumstances. Online quote comparison tools can provide a starting point, but obtaining individual quotes from each company is crucial for an accurate assessment.

Strengths and Weaknesses Compared to Competitors

Understanding the relative strengths and weaknesses of each insurer is essential for making an informed decision.

- Allstate: Strengths include a wide range of coverage options and a strong reputation. Weaknesses might include potentially higher premiums compared to some competitors, depending on the individual’s risk profile.

- Geico: Strengths include competitive pricing and a streamlined online experience. Weaknesses might include fewer add-on options compared to some competitors.

- Progressive: Strengths include its Name Your Price® Tool, offering customizable coverage and pricing. Weaknesses might be a less extensive agent network compared to State Farm.

- State Farm: Strengths include a vast agent network and a long-standing reputation for reliability. Weaknesses might include potentially higher premiums compared to some competitors.

Understanding Allstate’s Discounts and Programs

Securing affordable auto insurance often hinges on understanding and leveraging available discounts. Allstate offers a range of programs designed to reward safe driving habits, academic achievements, and responsible insurance practices. These discounts can significantly reduce your premium, making Allstate a potentially cost-effective choice. Understanding these programs and their eligibility criteria is crucial for obtaining the best possible rate.

Allstate’s discount programs are designed to incentivize safe driving and responsible behavior. Eligibility requirements vary depending on the specific program, and it’s important to verify your eligibility directly with Allstate or through your insurance agent. The discounts can stack, meaning you may qualify for multiple discounts, leading to substantial savings.

Safe Driver Discount

Allstate’s Safe Driver Discount rewards drivers with a proven history of safe driving. This typically involves a clean driving record, free from accidents and traffic violations over a specified period. The length of the required clean driving history and the percentage discount offered can vary by state and specific policy. For example, a driver with a five-year clean driving record in California might receive a 10% discount, while a driver in Texas with the same record might receive a 15% discount. The specific discount percentage is determined by Allstate’s underwriting criteria.

Good Student Discount

This discount is aimed at students who maintain a high grade point average (GPA). The required GPA and the resulting discount percentage vary by state and Allstate’s specific policy. Generally, students need to maintain a GPA above a certain threshold, often a “B” average or higher. For instance, a student maintaining a 3.5 GPA might qualify for a 10% discount, while a student with a 3.0 GPA might not be eligible. Proof of academic standing, such as a transcript, is usually required.

Multi-Car Discount

Insuring multiple vehicles under a single Allstate policy often leads to a multi-car discount. The discount percentage increases with the number of vehicles insured. For example, insuring two cars might yield a 5% discount, while insuring three or more could result in a 10% or even higher discount. This discount is a significant incentive for families or individuals owning multiple vehicles. The exact percentage discount depends on the specific policy and location.

Other Potential Discounts

Beyond these core discounts, Allstate may offer additional programs depending on your location and specific circumstances. These could include discounts for:

- Homeowners/Renters Insurance Bundling: Combining auto and home insurance policies under Allstate can often lead to significant savings.

- Defensive Driving Course Completion: Completing a state-approved defensive driving course might earn you a discount.

- Vehicle Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes or anti-theft systems might qualify for a discount.

It is crucial to contact Allstate directly to determine which discounts apply to your specific situation and to obtain the most up-to-date information. The availability and percentage of each discount can vary.

Illustrative Example

Let’s imagine a hypothetical scenario: John is a good student with a 3.8 GPA, has a clean driving record for five years, and insures two cars with Allstate. If he qualifies for a 10% good student discount, a 15% safe driver discount, and a 5% multi-car discount, his total discount could be 30% (10% + 15% + 5%). If his initial quote without discounts was $1200, his final premium after applying all discounts would be $840 ($1200 * 0.70). This is a significant savings, highlighting the potential impact of Allstate’s discount programs.

Allstate’s Customer Service and Claims Process

Allstate offers a variety of customer service channels and a streamlined claims process designed to assist policyholders throughout their insurance journey. Understanding these resources can help ensure a smooth experience in the event of an accident or other covered incident.

Allstate prioritizes efficient and accessible customer service. Policyholders can reach Allstate representatives through several methods, each offering varying levels of immediacy and convenience. The claims process itself is designed to minimize stress and maximize efficiency for those involved in an accident.

Allstate Customer Service Channels

Allstate provides multiple avenues for customers to contact them. These include a 24/7 customer service phone line, readily available online chat support through their website, a comprehensive and user-friendly mobile app, and email support. Each channel offers a different level of immediate response, allowing customers to choose the method best suited to their needs and the urgency of their situation. For example, the phone line is ideal for immediate assistance after an accident, while email might be preferred for less urgent inquiries.

Filing a Claim with Allstate

The Allstate claims process is generally straightforward. First, policyholders should report the incident as soon as possible. This can be done through any of the aforementioned customer service channels. Next, Allstate will assign a claims adjuster who will investigate the incident, gathering information from all parties involved and reviewing relevant documentation. Following the investigation, the adjuster will assess the damage and determine the amount of coverage under the policy. Finally, Allstate will process the claim and issue payment based on the assessment. Throughout this process, customers are kept informed of the progress of their claim.

Visual Representation of the Allstate Claims Process

Imagine a flowchart. The process begins with a “Start” box. An arrow leads to a “Report Incident” box, branching to various methods (phone, app, website). Another arrow points to a “Claim Assignment” box, where a claims adjuster is assigned. This connects to an “Investigation” box, showing gathering information and reviewing documents. The next box is “Damage Assessment,” leading to a “Payment Processing” box, which finally leads to an “End” box. This visual representation simplifies the multi-step process into a clear, easily understood sequence.

Analyzing Allstate’s Policy Details

Understanding the specifics of an Allstate auto insurance policy is crucial for ensuring you have the right coverage for your needs. This involves examining key features, exclusions, and the policy’s overall terms and conditions. A thorough review allows you to make informed decisions about your insurance protection.

Policy details can vary based on factors like your location, driving history, and the vehicle you insure. However, certain core elements remain consistent across most Allstate policies.

Key Features and Exclusions of a Sample Allstate Auto Insurance Policy

A typical Allstate auto insurance policy includes coverage for liability, collision, and comprehensive damage. Liability coverage protects you financially if you cause an accident resulting in injuries or property damage to others. Collision coverage repairs or replaces your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage from events other than collisions, such as theft, vandalism, or hail. However, policies typically exclude coverage for certain events or circumstances. For instance, damage caused by wear and tear, or driving under the influence of alcohol or drugs, is usually not covered. Specific exclusions will be clearly detailed within the policy document itself.

Policy Terms and Conditions

Allstate’s policy terms and conditions Artikel the responsibilities of both the insured and the insurer. These terms specify the circumstances under which coverage applies, the process for filing a claim, and the procedures for resolving disputes. The policy will also detail the cancellation process, renewal options, and any applicable fees or penalties. Understanding these terms is essential to ensure you are fulfilling your obligations and are aware of your rights as a policyholder. For example, the policy may specify a timeframe for notifying Allstate of an accident or a requirement to cooperate fully with their investigation.

Sample Policy Excerpt (Descriptive)

Imagine a section of the policy outlining liability coverage. It would state the limits of liability for bodily injury and property damage. For example, it might specify a $100,000 limit for bodily injury per person and a $300,000 limit per accident. The section would also describe the situations in which this coverage applies, clarifying that it covers injuries or property damage caused by the insured while operating their covered vehicle. Furthermore, the excerpt would likely explain that the coverage applies only if the insured is legally responsible for the accident. Another section might detail the deductible applicable to collision coverage, explaining that the insured is responsible for paying this amount before Allstate begins to cover the repair costs. The policy would clearly define what constitutes a covered “accident” in the context of collision and comprehensive coverage.

Last Point

Navigating the complexities of auto insurance can feel overwhelming, but understanding the nuances of Allstate auto insurance quotes empowers you to make informed choices. By comparing options, leveraging discounts, and understanding the factors affecting your premiums, you can secure comprehensive coverage that aligns with your budget and lifestyle. Remember to carefully review policy details and consider your individual needs when selecting an auto insurance provider. This guide serves as a starting point for a more informed decision-making process regarding your auto insurance needs.

Query Resolution

What types of coverage does Allstate offer?

Allstate offers a range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. Specific options and availability may vary by state.

How long does it take to get an Allstate auto insurance quote?

The time it takes to receive a quote depends on the method used. Online quotes are typically instantaneous, while phone or in-person quotes may take a few minutes to complete.

Can I bundle my auto and home insurance with Allstate?

Yes, Allstate offers multi-policy discounts for bundling auto and homeowners or renters insurance, potentially leading to significant savings.

What happens if I need to file a claim?

Allstate provides various methods for filing a claim, including online, phone, and through a local agent. The claims process typically involves providing details about the accident and cooperating with Allstate’s adjusters.