Bundling your auto and home insurance can significantly reduce your premiums and simplify your financial life. This comprehensive guide explores the advantages and disadvantages of bundled policies, guiding you through the process of finding the best quotes and selecting the right coverage for your needs. We’ll delve into the factors influencing pricing, helping you make informed decisions and potentially save hundreds of dollars annually.

From understanding the components of a bundled policy to navigating the complexities of comparison websites and claim processes, we aim to demystify the world of auto and home insurance bundles. We’ll equip you with the knowledge and tools to confidently secure comprehensive coverage at the most competitive price.

Understanding Bundled Insurance Offers

Bundling your auto and home insurance policies can offer significant advantages, primarily in terms of cost savings and streamlined management. This section details the components of such bundles, explores potential cost benefits, and compares coverage options with individual policies. We will also examine common exclusions and limitations to ensure a clear understanding of what’s included and what isn’t.

Typical Components of Auto and Home Insurance Bundles

A typical auto and home insurance bundle combines your comprehensive auto insurance coverage with your homeowners or renters insurance. Auto coverage usually includes liability, collision, comprehensive, and uninsured/underinsured motorist protection. Home insurance typically covers dwelling protection, personal property, liability, and additional living expenses. The specific components can vary depending on the insurer and the chosen coverage levels.

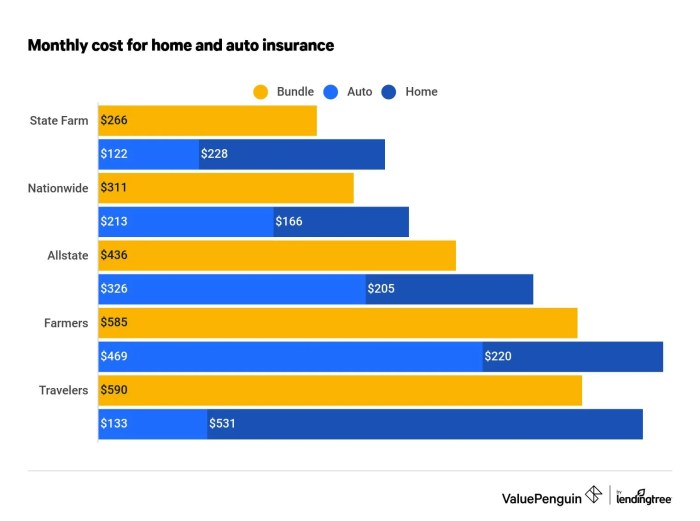

Potential Cost Savings with Bundled Policies

Insurers often offer discounts for bundling policies. These discounts can range from 5% to 25% or more, depending on the insurer, your location, and your individual risk profile. The savings stem from the insurer’s reduced administrative costs associated with managing a single customer account rather than two separate ones. For example, a family paying $1200 annually for auto insurance and $800 for home insurance might see a combined cost of $1700 with a 15% bundle discount, saving them $250 annually.

Coverage Options in Bundled vs. Individual Policies

Generally, the coverage options available in a bundled policy are similar to those offered with individual policies. However, the level of customization might be slightly more limited with a bundled plan. You can typically choose your coverage levels for both auto and home insurance within the bundle, but the selection might be constrained compared to purchasing policies separately. For instance, while you can select high liability limits for both in a bundled plan, the insurer may offer fewer tiers of coverage choices compared to buying policies independently.

Common Exclusions or Limitations in Bundled Insurance Plans

While bundling offers advantages, it’s crucial to understand potential limitations. Some insurers may exclude certain coverage options from bundled plans or impose stricter underwriting guidelines. For example, certain high-risk properties or vehicles might not be eligible for the bundled discount. Also, specific add-ons or endorsements, such as earthquake coverage or valuable personal property coverage, may not be discounted or might be subject to different terms and conditions. Always carefully review the policy documents to understand any exclusions or limitations.

Comparison of Bundled and Individual Plans

| Feature | Bundled Plan | Individual Plan | Cost Difference |

|---|---|---|---|

| Premium Cost | Generally lower due to discounts | Higher, no bundled discounts | Significant savings (5-25% or more) |

| Coverage Options | Similar but potentially less customizable | More extensive customization available | May vary, depending on insurer and specific needs |

| Administrative Convenience | Single billing and contact point | Separate billing and contact points for each policy | More convenient with bundled plan |

| Exclusions/Limitations | May have specific exclusions or stricter underwriting | Fewer limitations generally | May result in higher costs for specific needs |

Finding and Comparing Quotes

Securing the best bundled auto and home insurance deal requires diligent comparison shopping. Several avenues exist for obtaining quotes, each offering unique advantages and disadvantages. Understanding these options and employing effective strategies will significantly improve your chances of finding a policy that meets your needs and budget.

Online Comparison Websites

Numerous websites specialize in comparing insurance quotes from multiple providers. These platforms allow you to input your information once and receive quotes from various insurers simultaneously, streamlining the comparison process. Popular examples include websites like NerdWallet, The Zebra, and Policygenius. These sites often employ sophisticated algorithms to match you with insurers most likely to offer competitive rates based on your profile. However, it’s crucial to remember that these sites typically only show a subset of available insurers and may not include every company operating in your area.

Directly Contacting Insurers

While comparison websites are convenient, it’s also beneficial to contact insurers directly. This allows you to explore options not listed on comparison sites and potentially uncover exclusive deals or discounts. Visiting the websites of major insurance providers and requesting quotes directly can supplement your comparison website searches, providing a more comprehensive picture of available options. This approach allows for a deeper dive into policy details and direct communication with the insurer.

Tips for Effective Use of Comparison Websites

Accurately providing your personal information is paramount when using comparison websites. Inaccuracies can lead to inaccurate quotes or even disqualify you from certain policies. Be precise with details such as your address, driving history (including accidents and violations), and the details of your home (e.g., square footage, security systems). Also, understand that multiple searches on the same website within a short time frame might lead to higher quotes due to increased frequency detection. Finally, always review the fine print of each quote to ensure you understand the coverage provided before making a decision.

Step-by-Step Guide for Obtaining Quotes

- Gather necessary information: Compile all relevant details about your vehicles, home, driving history, and claims history.

- Use comparison websites: Input your information on several reputable comparison websites and record the quotes received.

- Contact insurers directly: Visit the websites of insurers not listed on comparison sites and request quotes directly.

- Compare quotes: Carefully analyze the quotes, considering coverage details, deductibles, and premiums.

- Review policy documents: Before making a decision, thoroughly review the policy documents of your top choices to understand the terms and conditions.

Factors Influencing Bundled Insurance Cost

Several factors significantly impact the cost of bundled auto and home insurance. These include your driving record (accidents, tickets), your credit score, the age and type of your vehicles, the value of your home, your location (crime rates, natural disaster risk), the level of coverage you select (deductibles, liability limits), and the presence of safety features in your home and vehicles (e.g., security systems, anti-theft devices). For instance, a driver with multiple speeding tickets will generally pay more than a driver with a clean record. Similarly, a home in a high-risk area for hurricanes will likely command higher premiums than a home in a low-risk area. Bundling itself often leads to discounts, but the overall cost is still determined by the individual risk factors.

Policy Features and Coverage

Bundled auto and home insurance offers significant convenience, but understanding the specific features and coverage details is crucial to ensure you have adequate protection. This section details key coverage elements, the importance of understanding policy limitations, and the claims process.

A typical bundled policy includes coverage for your vehicle(s), your home, and potentially other structures on your property. The specific components will vary based on your chosen provider and the selected coverage levels. It’s vital to carefully review your policy documents to understand exactly what is and isn’t covered.

Liability Limits and Deductibles

Liability limits define the maximum amount your insurance company will pay for damages or injuries you cause to others. For auto insurance, this covers bodily injury and property damage. For home insurance, this typically covers liability for accidents occurring on your property. Deductibles are the out-of-pocket expenses you pay before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles mean higher premiums. Understanding these limits and deductibles is essential for managing your financial risk. For example, a $100,000 liability limit on your auto policy means the insurer will cover up to $100,000 in damages or injuries you cause to others in an accident. A $1,000 deductible on your home insurance means you’ll pay the first $1,000 of any covered claim.

Coverage Options for Personal Belongings and Vehicles

Personal property coverage in home insurance protects your belongings from various perils, such as fire, theft, and vandalism. Coverage levels can vary; some policies offer replacement cost coverage, while others offer actual cash value, which considers depreciation. For vehicles, comprehensive coverage protects against damage from events other than collisions, such as theft, fire, or hail. Collision coverage pays for damage to your vehicle resulting from a collision, regardless of fault. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Choosing the right level of coverage for your belongings and vehicles is crucial to ensuring you’re adequately protected. For example, someone with valuable electronics might opt for a higher personal property coverage limit. Similarly, a new car owner might choose comprehensive and collision coverage to protect their investment.

Filing a Claim Under a Bundled Insurance Policy

The claims process for a bundled policy is generally similar to that of individual policies. Typically, you’ll contact your insurance company’s claims department, provide details of the incident, and follow their instructions for submitting supporting documentation, such as police reports or repair estimates. The insurer will then investigate the claim and determine coverage. The speed of claim settlement varies depending on the complexity of the claim and the insurer’s processes. It’s vital to report the incident promptly and cooperate fully with the investigation. For example, after a car accident, you would report the incident to your insurer immediately, provide details of the accident, and cooperate with any investigation or assessment of damages. Similarly, for a home fire, you would contact your insurer, provide details about the incident and any damages, and work with the adjuster to assess and settle the claim.

Common Scenarios Requiring Insurance Claims

Many situations can necessitate filing a claim under your bundled policy. Auto insurance claims commonly arise from collisions, theft, vandalism, and injuries sustained in accidents. Home insurance claims are frequently triggered by events such as fire, water damage, theft, and windstorms. For example, a collision with another vehicle would necessitate an auto insurance claim. A burst pipe causing water damage to your home would necessitate a home insurance claim. A theft of belongings from your home would also trigger a home insurance claim.

Factors Influencing Pricing

Several key factors interact to determine the final cost of your bundled auto and home insurance. Understanding these influences can empower you to make informed decisions and potentially lower your premiums. This section will detail how various elements contribute to your overall insurance cost.

Credit Score Impact on Premiums

Your credit score plays a significant role in determining your insurance premiums. Insurers often use credit-based insurance scores, which are different from your traditional FICO score, to assess risk. A higher credit score generally indicates a lower risk to the insurer, resulting in lower premiums. Conversely, a lower credit score may lead to higher premiums as insurers perceive a greater likelihood of claims. The exact impact varies by insurer and state, but the correlation is consistently observed. For example, a person with an excellent credit score might receive a 20-30% discount compared to someone with a poor credit score, all other factors being equal. It’s important to note that in some states, the use of credit scores in insurance pricing is regulated or prohibited.

Location and Home Characteristics

Your location and the characteristics of your home significantly influence your home insurance premium. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, typically have higher premiums due to the increased risk of claims. The age, construction materials, and security features of your home also factor into the assessment. A newer home built with fire-resistant materials and equipped with a security system will likely command a lower premium than an older home in a high-risk area with inadequate security. For instance, a home located in a coastal area with a history of flooding might see premiums significantly higher than a similar home located inland.

Driving History and Auto Insurance

Your driving history is a crucial factor in determining your auto insurance premium. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents, especially those deemed your fault, and traffic violations, such as speeding tickets or DUIs, will significantly increase your premiums. The severity of the accident or violation will also influence the impact. For example, a minor fender bender will likely have a smaller impact than a serious accident resulting in significant damage or injury.

Coverage Levels and Bundled Premium Impact

Choosing different levels of coverage for your auto and home insurance directly impacts your bundled premium. Higher coverage limits, such as higher liability limits on your auto insurance or higher dwelling coverage on your home insurance, generally result in higher premiums. However, higher coverage offers greater financial protection in the event of an accident or disaster. Conversely, opting for lower coverage limits will reduce your premiums but also leaves you with less financial protection. A careful evaluation of your risk tolerance and financial capacity is necessary to find the optimal balance between coverage and cost.

Factors Consumers Can Control to Reduce Premiums

Improving your credit score can lead to significant savings. Maintaining a clean driving record is crucial for lower auto insurance premiums. Installing home security systems and taking steps to mitigate risks, such as installing smoke detectors and upgrading your plumbing, can lower your home insurance premiums. Bundling your auto and home insurance with the same company often provides discounts. Shopping around and comparing quotes from different insurers is essential to finding the best rates. Consider increasing your deductibles; higher deductibles generally result in lower premiums.

Choosing the Right Policy

Selecting the optimal bundled auto and home insurance policy requires careful consideration of several key factors. The right policy will offer adequate coverage at a price that fits your budget while aligning with your specific needs and risk profile. Making informed decisions at this stage is crucial to ensuring you’re adequately protected and financially secure.

Policy Selection Checklist

A comprehensive checklist helps streamline the decision-making process. Before committing to a policy, ensure you’ve thoroughly reviewed the following aspects.

- Coverage Amounts: Verify that liability limits, property coverage, and uninsured/underinsured motorist coverage are sufficient to protect your assets and meet your financial responsibilities in the event of an accident or loss.

- Deductibles: Understand the impact of different deductible amounts on your premium. Higher deductibles generally lead to lower premiums, but you’ll pay more out-of-pocket in the event of a claim.

- Discounts: Inquire about available discounts, such as multi-policy discounts (bundling), safe driver discounts, or discounts for security systems in your home.

- Policy Exclusions: Carefully review what is not covered by the policy. Understanding these exclusions is vital to avoid unexpected costs in case of a claim.

- Customer Service Reputation: Research the insurer’s reputation for prompt and efficient claim handling and customer service responsiveness.

- Financial Stability: Assess the insurer’s financial strength ratings from independent rating agencies (like A.M. Best) to ensure their ability to pay claims.

Reviewing Policy Documents

Thoroughly reviewing policy documents before signing is paramount. Don’t just skim the surface; take the time to understand the details of your coverage, exclusions, and terms and conditions. This proactive approach can prevent misunderstandings and disputes later. Pay close attention to the definitions of key terms, the claims process, and any specific conditions that might affect your coverage. If anything is unclear, contact the insurer directly for clarification before signing.

Negotiating Insurance Rates

Negotiating with insurers can sometimes lead to more favorable rates. Be prepared to compare quotes from multiple insurers, highlighting the better rates offered by competitors. Consider bundling your auto and home insurance, as this often results in significant discounts. You can also explore options like increasing your deductibles or opting for less comprehensive coverage if it aligns with your risk tolerance and financial situation. Clearly articulate your needs and budget, and don’t hesitate to politely push for a better deal. For example, if you have a spotless driving record for many years, you can use this as leverage to negotiate a lower premium.

Assessing Insurer Financial Stability and Reputation

Assessing the financial strength and reputation of an insurance provider is crucial for ensuring they can meet their obligations when you need them most. Check independent rating agencies like A.M. Best for financial strength ratings. These ratings reflect the insurer’s ability to pay claims. Higher ratings indicate greater financial stability. Simultaneously, research customer reviews and complaints to gauge the insurer’s reputation for customer service and claims handling. Look for patterns of positive or negative experiences. For example, a consistently high number of complaints regarding slow claim processing should raise concerns.

Policy Selection Decision-Making Flowchart

This flowchart visually guides the selection process:

[Imagine a flowchart here. The flowchart would start with “Obtain multiple quotes.” Then branch to “Compare coverage amounts and deductibles.” This would lead to “Assess insurer financial strength and reputation.” Then to “Review policy documents thoroughly.” Finally, culminating in “Select the best policy based on needs and budget.”]

Closure

Securing the best auto and home insurance bundle requires careful planning and comparison. By understanding the factors influencing pricing, utilizing online resources effectively, and meticulously reviewing policy details, you can achieve significant cost savings without compromising essential coverage. Remember, taking the time to research and compare quotes empowers you to make a financially sound and well-informed decision that protects your assets and provides peace of mind.

Detailed FAQs

What happens if I make a claim on one part of my bundled policy?

Making a claim on one aspect (auto or home) generally doesn’t affect your premiums on the other, unless the incidents are related.

Can I bundle policies from different insurance companies?

No, bundling typically requires purchasing both auto and home insurance from the same provider.

How often should I review my bundled insurance policy?

It’s recommended to review your policy annually or whenever there’s a significant life change (e.g., moving, new vehicle).

What if my credit score is low? Will this significantly impact my bundled insurance rates?

A lower credit score can lead to higher premiums. However, shopping around and maintaining good payment history can help mitigate the impact.

Does bundling affect my eligibility for discounts?

Bundling often unlocks additional discounts beyond those offered for individual policies. Check with insurers for specifics.