Navigating the world of car insurance can feel overwhelming, especially when you’re trying to find the best deal. This guide provides a clear and concise overview of obtaining car insurance quotes in Missouri, covering everything from understanding state requirements to securing the most advantageous policy for your individual needs. We’ll delve into the factors influencing your premiums, the various coverage options available, and effective strategies for comparing quotes to find the perfect fit for your budget and lifestyle.

From understanding minimum coverage requirements and exploring different types of insurance to leveraging discounts and choosing the right provider, we aim to equip you with the knowledge and tools necessary to make informed decisions about your Missouri car insurance. This comprehensive resource is designed to simplify the process, saving you time and money in the long run.

Understanding Missouri Car Insurance Requirements

Driving in Missouri requires understanding the state’s car insurance regulations to ensure you’re legally protected and compliant. Failure to carry the minimum required insurance can lead to significant penalties, including fines and license suspension. This section Artikels the minimum requirements and explores different coverage options available to Missouri drivers.

Minimum Car Insurance Coverage in Missouri

Missouri law mandates minimum liability coverage for bodily injury and property damage. This means drivers must carry insurance that covers the costs of injuries or damages they cause to others in an accident. The minimum requirement is 25/50/25. This translates to $25,000 in coverage for injuries to one person, $50,000 for injuries to multiple people in a single accident, and $25,000 for property damage. It’s crucial to understand that this minimum coverage might not be sufficient to cover the costs associated with a serious accident.

Types of Car Insurance Coverage

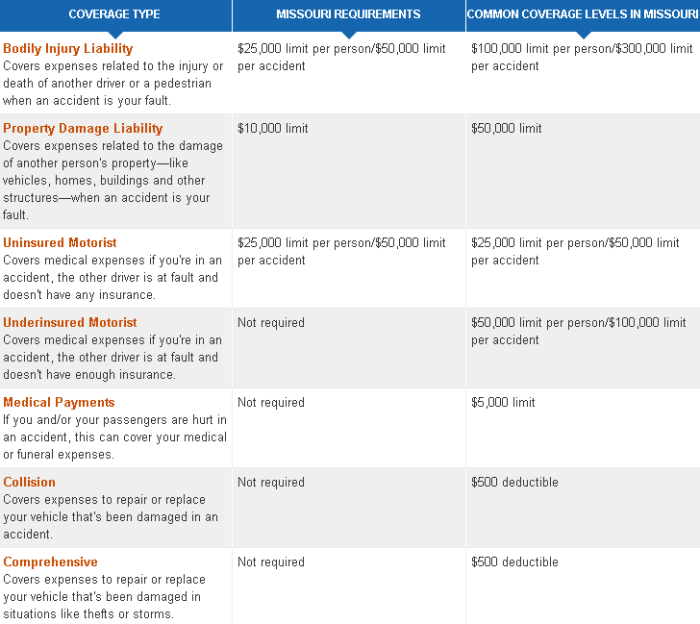

Several types of car insurance coverage are available in Missouri beyond the state-mandated minimum. Understanding these options allows drivers to tailor their coverage to their specific needs and risk tolerance.

Liability Coverage: As previously discussed, this covers injuries and damages you cause to others. It is the only type of coverage legally required in Missouri.

Collision Coverage: This covers damage to your vehicle regardless of fault. If you’re involved in an accident, collision coverage will pay for repairs or replacement of your car, even if you were at fault.

Comprehensive Coverage: This covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or weather-related damage. It provides broader protection than collision coverage alone.

Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical expenses and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance.

Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault. It’s helpful for covering smaller medical bills and can supplement health insurance.

Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault. It can also cover expenses for passengers in your vehicle who are not covered by your own health insurance.

Cost Comparison of Different Coverage Levels

The cost of car insurance in Missouri varies significantly depending on several factors, including coverage levels, driving history, age, location, and the type of vehicle. While precise cost comparisons are difficult without specific driver information, generally, higher coverage levels result in higher premiums. For example, a policy with 100/300/100 liability coverage will cost more than a policy with the minimum 25/50/25 liability coverage. Similarly, adding collision and comprehensive coverage will increase the overall premium. Obtaining quotes from multiple insurers is recommended to compare prices and coverage options.

Minimum vs. Recommended Coverage

The following table compares the minimum required insurance coverage with recommended levels. It’s important to note that the recommended levels are not legally mandated but reflect a more comprehensive level of protection.

| Coverage Type | Minimum Required | Recommended | Notes |

|---|---|---|---|

| Bodily Injury Liability | 25/50/25 | 100/300/100 or higher | Higher limits protect you from substantial financial liability. |

| Property Damage Liability | $25,000 | $100,000 or higher | Covers damage to other vehicles or property. |

| Collision | Not Required | Recommended | Covers damage to your vehicle in an accident, regardless of fault. |

| Comprehensive | Not Required | Recommended | Covers damage to your vehicle from non-collision events. |

| Uninsured/Underinsured Motorist | Not Required | Recommended | Protects you if involved in an accident with an uninsured driver. |

Factors Affecting Car Insurance Quotes in Missouri

Several key factors influence the cost of car insurance in Missouri. Understanding these factors can help you make informed decisions and potentially save money on your premiums. These factors interact in complex ways, so your individual rate will be a unique reflection of your specific circumstances.

The Role of Age and Driving Experience

Younger drivers generally pay higher insurance premiums than older, more experienced drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess risk based on this data. As drivers gain experience and a clean driving record, their premiums typically decrease. For example, a 16-year-old driver with a learner’s permit will pay significantly more than a 50-year-old with a 20-year clean driving history. The accumulation of years of safe driving demonstrably reduces perceived risk.

Credit Score’s Influence on Insurance Rates

In Missouri, as in many other states, your credit score can significantly impact your car insurance premiums. Insurers use credit-based insurance scores to assess risk. A higher credit score generally translates to lower premiums, while a lower score can lead to higher rates. The reasoning behind this is that individuals with good credit history often demonstrate responsible financial behavior, which is correlated with responsible driving behavior, although this is a statistical correlation and not a direct causation. A person with a 750 credit score might see significantly lower rates compared to someone with a 550 credit score, all other factors being equal.

Driving History: Accidents and Tickets

Your driving history is a major factor in determining your insurance rates. Accidents and traffic violations, such as speeding tickets or DUIs, significantly increase your premiums. The severity of the accident or violation will also affect the increase. For instance, a minor fender bender will likely result in a smaller premium increase than a serious accident involving injuries or significant property damage. Similarly, multiple speeding tickets within a short period will likely lead to a greater increase than a single isolated incident.

Vehicle Type and Insurance Costs

The type of vehicle you drive also impacts your insurance premiums. Generally, more expensive vehicles, high-performance cars, and vehicles with a history of theft or accidents command higher insurance rates. For example, insuring a luxury sports car will be considerably more expensive than insuring a smaller, less expensive sedan. Features like anti-theft systems can sometimes mitigate this cost, however. The vehicle’s safety rating also plays a role; vehicles with high safety ratings may result in slightly lower premiums.

Geographic Location and Insurance Premiums

Where you live in Missouri affects your insurance rates. Areas with higher crime rates or more frequent accidents tend to have higher insurance premiums. This is because insurers consider the likelihood of claims in different areas. A driver residing in a densely populated urban area might pay more than a driver in a rural area with lower accident rates. The risk of theft is also a significant factor.

Factors Affecting Missouri Car Insurance Premiums: A Prioritized List

It’s important to note that the relative importance of these factors can vary depending on the individual insurer and specific circumstances. However, a general prioritization could look like this:

- Driving History: Accidents and tickets have the most significant impact.

- Age and Driving Experience: Younger drivers typically pay more.

- Credit Score: A substantial influence in Missouri.

- Vehicle Type: The cost and risk profile of your vehicle matter.

- Geographic Location: Your address impacts risk assessment.

Finding and Comparing Car Insurance Quotes in Missouri

Securing the best car insurance rate in Missouri requires diligent comparison shopping. Many resources are available to help you navigate this process efficiently, allowing you to find a policy that suits your needs and budget. This section Artikels methods for obtaining and comparing quotes, empowering you to make an informed decision.

Finding the right car insurance can feel overwhelming, but utilizing available tools simplifies the process significantly. Online quote comparison tools and direct contact with insurance providers are two primary avenues for obtaining quotes. Careful consideration of the details provided and a structured approach to comparison will lead to a more favorable outcome.

Online Car Insurance Quote Acquisition

Several websites specialize in providing car insurance quotes from multiple providers simultaneously. These platforms typically require you to input basic information, such as your address, driving history, and the type of vehicle you own. The system then generates quotes from various insurers, allowing for easy side-by-side comparison. Some popular examples include websites that aggregate quotes from a large network of insurance companies, offering a convenient one-stop shop for comparison shopping. These sites typically maintain partnerships with numerous insurance providers, enabling users to access a broad range of options. Other sites focus on specific types of insurance, providing specialized comparison tools tailored to particular needs.

Comparing Quotes from Different Providers

Once you have collected quotes from several insurers, carefully review each policy’s details. Pay close attention to the coverage offered, deductibles, premiums, and any additional fees or discounts. Don’t solely focus on the premium; ensure the coverage aligns with your needs and risk tolerance. Consider factors like liability limits, collision and comprehensive coverage, uninsured/underinsured motorist protection, and roadside assistance. A lower premium with inadequate coverage could prove costly in the event of an accident. A spreadsheet or a simple comparison chart can be extremely helpful in organizing this information for easier analysis. This structured approach allows for a clear, concise comparison of key aspects, facilitating informed decision-making.

Step-by-Step Guide for Efficient Quote Acquisition

The process of obtaining multiple car insurance quotes can be streamlined by following these steps:

- Gather necessary information: Compile your driver’s license, vehicle information (year, make, model), address, and driving history (including accidents and violations).

- Utilize online comparison tools: Visit several online quote comparison websites and input your information. Note that the information requested might vary slightly between platforms.

- Contact insurance providers directly: Supplement online quotes by contacting insurance companies directly. This allows you to ask specific questions and clarify any uncertainties.

- Compare quotes side-by-side: Use a spreadsheet or chart to compare premiums, coverage details, and deductibles from each provider.

- Review policy details carefully: Before making a decision, thoroughly review the policy documents from your top choices to ensure full understanding of the terms and conditions.

Examples of Questions to Ask Insurance Providers

When comparing quotes, it’s crucial to ask clarifying questions to ensure you fully understand the terms and conditions. Examples include:

- What specific coverage does this policy include, and what are the limits?

- What are the deductibles for collision and comprehensive coverage?

- Are there any discounts available, such as for safe driving records or bundling policies?

- What is the claims process like, and how quickly can I expect a response?

- What are the options for payment, and are there any penalties for late payments?

Discounts and Savings on Missouri Car Insurance

Securing affordable car insurance in Missouri is achievable through various discounts offered by insurance companies. Understanding these discounts and how to qualify for them can significantly reduce your premiums. This section details common discounts and the potential savings associated with bundling policies.

Common Car Insurance Discounts in Missouri

Several discounts are widely available to Missouri drivers. These discounts can substantially lower your insurance costs, making it more affordable to maintain adequate coverage. Eligibility criteria vary by insurance provider, so it’s crucial to check with your insurer for specific details.

Good Student Discount

This discount rewards students who maintain a high grade point average (GPA). Generally, a GPA of 3.0 or higher qualifies, but the specific requirements depend on the insurance company and the student’s age. The discount percentage can range from 5% to 25%, resulting in considerable savings for eligible students. For example, a student with a 3.5 GPA might receive a 15% discount on their annual premium.

Safe Driver Discount

Insurance companies often reward drivers with clean driving records. This typically involves having no accidents or traffic violations for a specified period, often three to five years. The discount percentage varies, but it can be substantial, potentially reaching 20% or more. A driver with a spotless record for five years might see a 20% reduction in their premium.

Multi-Car Discount

Insuring multiple vehicles under one policy with the same insurance company often qualifies you for a multi-car discount. This discount incentivizes customer loyalty and can range from 10% to 25% depending on the number of vehicles and the insurer. For instance, insuring two cars could result in a 15% discount on the total premium.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is another effective way to save money. Insurance companies frequently offer discounts for bundling policies, recognizing the increased loyalty and reduced administrative costs. The discount percentage for bundling can vary widely depending on the specific policies bundled and the insurance provider. A typical discount could range from 10% to 25% or more on the combined premiums.

Summary of Discounts and Eligibility Criteria

| Discount Type | Eligibility Criteria | Potential Savings | Example |

|---|---|---|---|

| Good Student | High GPA (typically 3.0 or higher) | 5-25% | 15% discount for a 3.5 GPA |

| Safe Driver | Clean driving record (no accidents or violations for 3-5 years) | 10-20%+ | 20% discount for a 5-year clean record |

| Multi-Car | Insuring multiple vehicles with the same company | 10-25% | 15% discount for insuring two cars |

| Bundled Policies | Combining car insurance with other types of insurance (homeowners, renters) | 10-25%+ | 20% discount for bundling car and homeowners insurance |

Understanding Insurance Policies and Coverage

Choosing the right car insurance policy in Missouri involves understanding the various coverage options available. A comprehensive policy typically includes several key components, each designed to protect you in different scenarios. Understanding these components is crucial for making informed decisions about your coverage needs and ensuring adequate protection.

Typical Components of a Car Insurance Policy

A standard Missouri car insurance policy usually includes several types of coverage. These can vary depending on the insurer and the specific policy chosen, but common components include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP). The specifics of each coverage type, such as limits and deductibles, are Artikeld in the policy documents.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. Liability coverage is usually expressed as a three-number combination, such as 25/50/25, representing $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage. This means the insurer will pay up to these limits for damages you cause. Collision coverage, on the other hand, covers damage to your own vehicle, regardless of who is at fault. For example, if you hit a tree, your collision coverage would pay for the repairs, even if you were the only one involved.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This means that even if you are at fault for the accident, your collision coverage will help cover the cost of repairing your car. The amount paid will be reduced by your deductible, which is the amount you agree to pay out-of-pocket before the insurance company starts paying. For example, if you have a $500 deductible and your car repairs cost $2,000, your insurance company will pay $1,500. It’s important to note that collision coverage is optional, unlike liability coverage which is mandatory in Missouri.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is crucial protection against drivers who lack adequate insurance or are uninsured. If you are injured in an accident caused by an uninsured or underinsured driver, your UM/UIM coverage will help pay for your medical bills, lost wages, and other expenses, even if the at-fault driver doesn’t have enough insurance to cover your losses. For instance, if you’re seriously injured by a hit-and-run driver, your UM/UIM coverage could be the difference between covering your medical bills and facing significant financial hardship. This coverage is particularly important in Missouri, where uninsured drivers may be prevalent.

Examples of Coverage Application

Consider these scenarios: In the first, you rear-end another car, causing $3,000 in damage to their vehicle and $2,000 in injuries. Your liability coverage would pay for these damages, up to your policy limits. In the second, a deer runs into your car, causing $4,000 in damage. Your comprehensive coverage would pay for the repairs (minus your deductible). Finally, imagine you’re hit by an uninsured driver who causes $10,000 in medical bills. Your uninsured/underinsured motorist coverage would help cover these expenses.

Choosing the Right Car Insurance Provider in Missouri

Selecting the right car insurance provider is crucial for securing adequate coverage at a competitive price. Several factors should be carefully considered to ensure a positive and reliable insurance experience. This involves assessing the insurer’s reputation, evaluating their customer service capabilities, and understanding their claims process. Choosing between a large national company and a smaller, regional provider also requires careful consideration of their respective strengths and weaknesses.

Factors to Consider When Selecting a Car Insurance Company

Choosing a car insurance company involves more than just comparing prices. A thorough evaluation considers several key aspects that impact your overall experience.

Company Reputation and Financial Stability

A company’s reputation is vital. Look for companies with a long history of fair claims handling and strong financial stability. You can research a company’s rating through independent agencies like AM Best, which assesses the financial strength and stability of insurance companies. A high rating indicates a lower risk of the company failing to pay claims. Online reviews and customer testimonials can also offer valuable insights into a company’s reputation for customer satisfaction. For example, a company consistently receiving positive reviews for prompt claim settlements and responsive customer service suggests a positive experience for policyholders.

Customer Service Quality and Accessibility

Effective and readily available customer service is paramount. Consider how easily you can contact the company, whether through phone, email, or online chat. Look for companies with readily available customer service representatives who are knowledgeable, helpful, and responsive to inquiries. A company with multiple contact options and consistently positive customer service reviews demonstrates a commitment to customer satisfaction.

Claims Process Efficiency and Transparency

Understanding the claims process is crucial. Research how the company handles claims, from reporting an accident to receiving payment. Look for companies with a straightforward and transparent claims process, readily available information on claim procedures, and positive customer feedback regarding the efficiency and fairness of their claims handling. A company with a streamlined online claims portal and a history of quick claim settlements would be advantageous.

Strengths and Weaknesses of Different Insurance Providers

Large National Companies vs. Regional Providers

Large national companies often offer extensive coverage options, competitive pricing due to economies of scale, and a wide network of agents and service centers. However, they might prioritize efficiency over personalized service, potentially leading to impersonal interactions and less flexibility in policy customization. Regional providers, conversely, may offer more personalized service and a greater understanding of local needs and regulations. However, their coverage options might be more limited, and their financial strength might be less robust compared to national giants. The choice depends on individual priorities and needs. For example, a driver prioritizing personalized service might favor a regional provider, while someone seeking broad coverage and a wide service network might opt for a national company.

Researching and Evaluating Insurance Companies

Utilizing Online Resources and Comparison Tools

Several online resources facilitate comparison shopping. Websites like those of independent insurance agencies or comparison websites allow you to input your information and receive quotes from multiple insurers simultaneously. This allows for a side-by-side comparison of prices and coverage options from various companies. These tools can save significant time and effort in the research process.

Checking Company Ratings and Reviews

Before committing to a provider, check their ratings with independent agencies like AM Best and read online reviews on sites such as Yelp or Google Reviews. This provides insight into the company’s financial stability and customer satisfaction. Pay attention to recurring themes in the reviews – consistent positive or negative feedback highlights potential strengths or weaknesses. For instance, numerous complaints about slow claim processing would be a significant red flag.

Wrap-Up

Securing affordable and comprehensive car insurance in Missouri requires careful planning and research. By understanding the factors influencing your premiums, comparing quotes from multiple providers, and taking advantage of available discounts, you can significantly reduce your costs and ensure you have the right level of protection. Remember, choosing the right car insurance policy is a crucial step in protecting yourself, your vehicle, and your financial future. This guide provides a foundation for making informed decisions, leading to a more secure and financially sound driving experience.

User Queries

What is the minimum liability coverage required in Missouri?

Missouri requires a minimum of $25,000 bodily injury liability coverage per person, $50,000 per accident, and $10,000 property damage liability coverage.

How does my credit score affect my car insurance rates?

In Missouri, insurers can use your credit score to determine your rates. A higher credit score generally translates to lower premiums.

Can I bundle my car insurance with other types of insurance?

Yes, bundling your car insurance with home or renters insurance often results in significant discounts.

What happens if I’m in an accident and don’t have enough coverage?

If your coverage is insufficient to cover the damages or injuries resulting from an accident, you could be personally liable for the remaining costs.

How long does it typically take to get a car insurance quote?

Online quotes are often instantaneous, while quotes from agents may take a few days depending on the complexity of your request.