“student Loan Debt And Graduate School Enrollment Trends” – SNAP founder Evan Spiegel and his model wife, Miranda Kerr, have changed the lives of seniors by paying off at least $10 million in student loans.

Charles Hirschhorn, president of the Otis College of Art and Design, announced the major donation at Sunday evening’s graduation ceremony held at the Westin Los Angeles Airport Hotel in Los Angeles, California.

“student Loan Debt And Graduate School Enrollment Trends”

Snapchat founder Evan Spiegel and his model wife, Miranda Kerr, received honorary doctorates from Otis College of Art and Design. Robert Gauthier/Los Angeles Times via Getty Images

This Is The Average Student Loan Debt In Every State

“We know that for many of you and your families, the combined burden of student loans is the price you paid for an exceptional Otis College education,” Hirschhorn told the Class of 2022. “We understand that this debt can put your future at risk. and limit your creative ambitions. We don’t want that to happen.” He continued, “We are pleased to announce that Evan and Miranda have made the largest single gift in the history of Otis College through their Spiegel Family Foundation. Their gift will enable you to pay off your student loans.”

Otis spokesman Lawrence Aldava declined to confirm the specific amount of the gift when asked by parents, but he confirmed that Spiegel and Kerr’s donation exceeded the previous largest gift received by the college, which was $10 million.

Model Miranda Kerr smiles as she receives an honorary degree from Otis College of Art and Design in Los Angeles, California, and her husband, Evan Spiegel, founder of Snap, Inc., paid off college loans for graduates at the university. (Robert Gauthier/Los Angeles Times via Getty Images) Robert Gauthier/Los Angeles Times via Getty Images

“The announcement was really unusual,” Hirschhorn tells Parents. “College students have plenty of reasons to feel hopeless about their future, whether it’s debt or climate change or pandemics or hate crimes … so to see] people with joy, relief or confusion was incredibly profound.”

The Most Surprising College Students Debt Statistics And Trends In 2023 • Gitnux

Hirschhorn says Spiegel, who took summer classes at Otis as a teenager, Kerr and “Queer Eye” star and interior designer Bobby Burke all received honorary doctorates of fine arts.

Otis College of Art and Design graduates celebrate as Snapchat founder Evan Spiegel. Spiegal received an honorary degree from the college along with his wife, Miranda Kerr. Robert Gauthier/Los Angeles Times via Getty Images

Spiegel and Kerr did not immediately respond to the parents’ request for comment, but they said in a press release sent by Otis to parents:

“Otis College of Art and Design is an extraordinary institution that encourages young creatives to find their artistic voices and advance in a variety of fields and careers. It is our family’s privilege to support and support the Class of 2022, and we hope this gift to the graduates allowing them to pursue their passions, contribute to the world, and inspire humanity for years to come.

Student Loan Debt Statistics For 2022

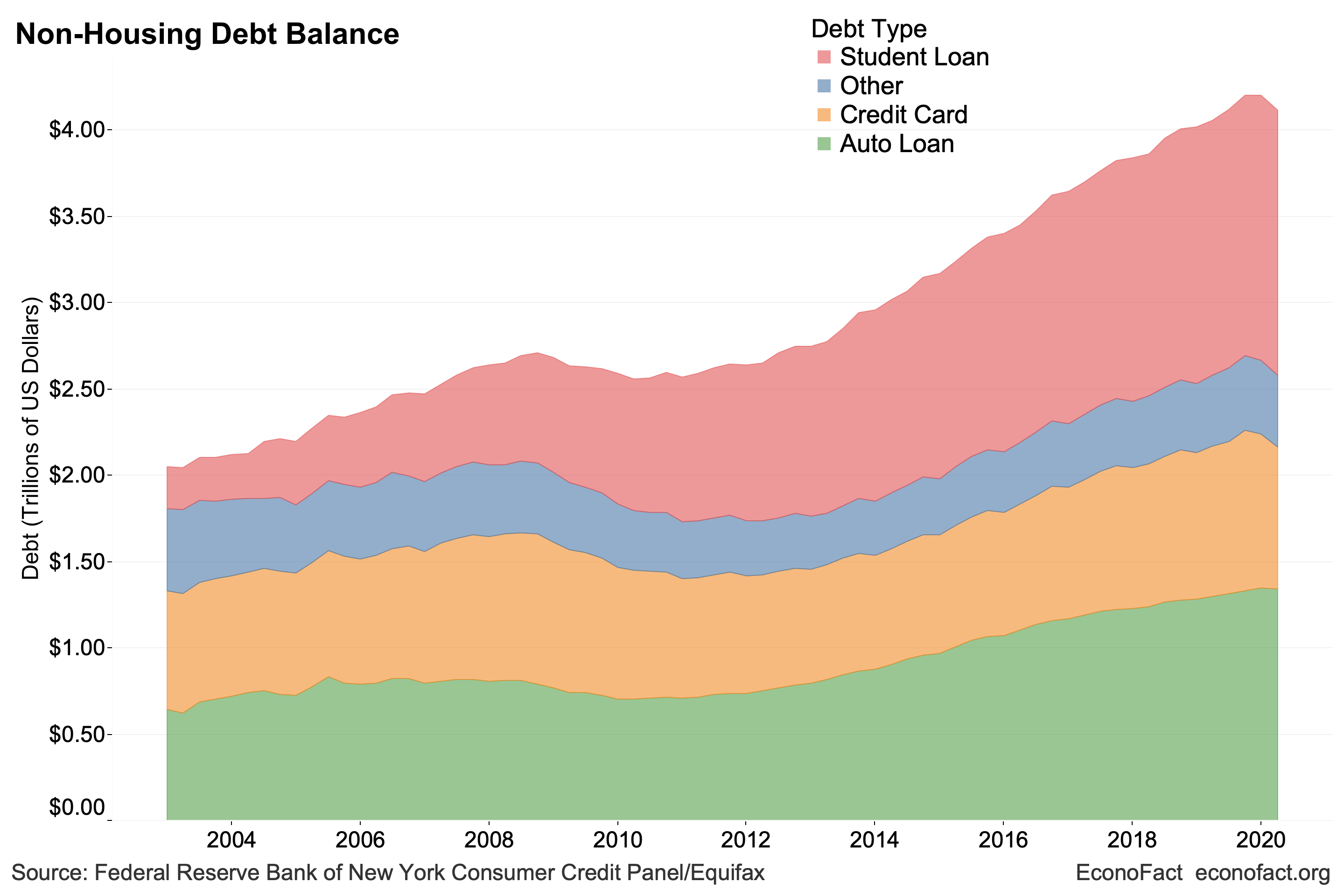

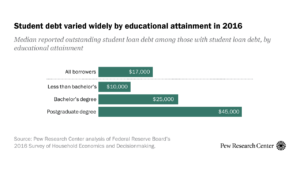

According to NBC News, President Biden is considering releasing some of the nation’s $1.73 trillion student loan debt. “The president took it very well. He gave the impression that this is a priority for his work, and he said he understands that this is on the minds of young people,” a congressional aide told NBC. Student loan debt has a “profound” impact on borrowers, says the Center for Law and Social Policy, a Washington, D.C.-based nonprofit. The organization says debt can keep people in jobs they don’t like or prevent them from buying a home or starting a family, especially among black or low-income borrowers.

Students at Otis College of Art and Design react to a gift from Snapchat founder Evan Spiegel and his wife Miranda Kerr. The couple is paying off school loans for high school graduates. Yaritza Velasquez-Medina (bottom center) sheds tears of joy at the announcement. Robert Gauthier/Los Angeles Times via Getty Images

Hirschhorn tells parents that 77% of Otis students are people of color and more than 90% have student loans.

Yaritza Velasquez-Medina, a graduate of the high school with a bachelor’s degree in fine arts, called the donation “a gift to a new life of opportunity.” Velázquez-Medina added that she is now motivated to start her own business, save for a house and supplement her and her parents’ retirement savings.

Student Loan Debt And The Impact On Housing

Yaritza Velasquez-Medina (center) and classmates at Otis College of Art and Design react to the news that Snap co-founder Evan Spiegel and his wife Miranda Kerr are paying off their Class of 2022 loan. (Robert Gauthier/Los Angeles Times via Getty Images) Robert Gauthier/Los Angeles Times via Getty Images

In other comments sent by the college, student Farhan Fallahifirouzi, who is studying fashion design with a minor in sustainability, said, “This is just the greatest gift I’ve ever received.”

He continued, “This gift just takes that weight off my shoulders and now I can take the money I’m making now and invest it in my future and what I want to do in the next 5, 10 years. couldn’t have been better.”

Elise Sole is a writer and editor based in Los Angeles who covers parenting. She was previously a news editor at Yahoo and also worked at Marie Claire and Women’s Health. Her writing has appeared on Shondaland, SheKnows, Happify, and more. What if I told you that there is a group of taxpayer-supported students larger than the populations of Chicago and Houston that we know little about? Welcome to the conversation about the four million students enrolled in graduate programs in the US. The Census Bureau reported that despite overall declines in college enrollment, graduate school enrollment

What Should The U.s. Do About Rising Student Loan Debt?

Despite this incredible influence in the debt debate, graduate students have received a small amount of political attention compared to undergraduates, and graduate education continues to escape any federal responsibility.

Graduate programs operated largely without federal government oversight—despite federal loans. Institutions that participate in federal student aid programs are required to complete more than a dozen comprehensive surveys as part of the Integrated Postgraduate Education Data System (IPEDS), but the only data available on postsecondary education focuses on enrollment numbers and no IPEDS survey of rates. does not report the completion of graduates. programs.

The lack of available graduate program data at the federal level has led many to blindly assume that all graduate schools serve students fairly and set them on a path to success. However, questions have been raised about the outcomes of graduate students in specific programs and institutions.

Whether graduate programs actually improve student outcomes is a question that deserves much attention and a policy response. This note highlights five key unknowns surrounding graduate students and graduate school debt that help hide its problems from the national conversation.

Chart: Where America’s Students Are In Debt

This increase shows that there is a strong interest in various graduate programs – even at a time of declining student enrollment. However, despite this increase, data on who completes graduate education is not available nationally, and graduate programs are not required to report any information about graduates to the public. This information is very important because undergrads are less likely to get the degree or certificate they claim on their resume, and we see at the undergraduate level that graduate students are far less likely to repay their loans and more likely. to default. This dynamic likely extends to graduate borrowers, and is likely even more pronounced, as they often have higher cumulative debt burdens. However, where collected, detailed information on graduate program completion is often kept within institutions, and publicly available information is often suppressed, ostensibly to protect student privacy. What is known about postsecondary completion at the federal level comes largely from the IPEDS Completion Survey and the National Longitudinal Survey, which is conducted periodically—essentially surveys of graduate students, not hard data.

Nationally representative sample surveys such as the National Survey of Student Assistance (NPSAS) and the Baccalaureate & Beyond (B&B) Survey provide useful information about postsecondary education. However, specific data is not collected at the program level, and institutions are not required to submit data on their student outcomes to these surveys, making it difficult to compare graduation rates across institutions. Also, these available surveys focus on different issues of post-secondary education, which limits the applicability of the results at the national level. In comparison, graduation rates for baccalaureate programs are collected by the federal government and published annually. In fact, there are three IPEDS surveys that focus on college graduation rates.

To make this information useful and accessible to researchers, policymakers, and prospective students, federal student data collected through IPEDS contributes to widely used public data tools such as the College Scorecard.

It should be noted that data on student outcomes at the undergraduate level are not without flaws. The federal ban on the Student Enrollment Record System is insufficient to fully understand how students are doing in higher education, and there is a clear need to improve transparency across the board, including repealing the ban by passing

Take Action On Dental Student Debt

. However, prospective undergraduate students at least have access to tools like the Scorecard, which includes.

Student loan graduate school, average graduate student loan debt, student loan forgiveness graduate school, student loan for graduate school, student loan debt consolidation, graduate student loan debt, graduate student loan options, refinance student loan debt, graduate student loan, graduate student loan debt forgiveness, graduate student plus loan, best graduate student loan