Best car insurance in canada – Navigating the world of car insurance in Canada can feel like driving through a maze. With numerous providers offering a wide range of coverage options, finding the best car insurance for your needs can be a daunting task. Understanding the Canadian car insurance landscape, including the regulatory framework and various coverage types, is crucial for making informed decisions.

This guide aims to demystify the process, equipping you with the knowledge and tools to make the right choice for your individual circumstances. We’ll explore key factors to consider, analyze top providers, and provide insights on how to get the best value for your money.

Understanding Canadian Car Insurance Landscape

Navigating the Canadian car insurance landscape can be complex due to its unique structure and regulations. Understanding the factors that influence pricing and coverage is crucial for making informed decisions. This section explores the key aspects of the Canadian car insurance market, including the regulatory framework and the different types of coverage available.

Regulatory Framework and its Impact

The Canadian car insurance market is highly regulated, with each province and territory having its own set of rules and regulations. This decentralized system leads to variations in pricing and coverage across the country.

The regulatory framework has a significant impact on the availability and cost of car insurance. Provincial regulations determine factors such as:

- Mandatory Coverage: All provinces and territories require drivers to carry a minimum level of liability insurance to protect others in case of an accident. This mandatory coverage varies across provinces.

- Pricing Regulations: Some provinces have regulations that restrict how insurance companies can set their rates, such as limiting the use of certain factors like credit score.

- Coverage Options: Provincial regulations also influence the types of coverage available to drivers, including optional coverage like collision and comprehensive.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage available in Canada is essential for choosing the right policy. Here’s a breakdown of common coverage options:

- Liability Coverage: This mandatory coverage protects you financially if you cause damage to another person’s property or injure someone in an accident. It covers the other driver’s medical expenses, vehicle repairs, and other related costs.

- Collision Coverage: This optional coverage protects your own vehicle from damage in an accident, regardless of who is at fault. It covers repairs or replacement costs, minus your deductible.

- Comprehensive Coverage: This optional coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It also covers repairs or replacement costs, minus your deductible.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or hit-and-run driver. It covers your medical expenses, vehicle repairs, and other related costs.

- Accident Benefits Coverage: This mandatory coverage provides financial assistance for medical expenses, lost wages, and other benefits if you are injured in an accident, regardless of who is at fault. It covers your own medical expenses, lost wages, and other related costs.

Key Factors to Consider When Choosing Car Insurance: Best Car Insurance In Canada

Choosing the right car insurance policy can be a daunting task, but it’s crucial to ensure you have adequate protection and financial security in case of an accident. To make an informed decision, it’s essential to carefully consider several key factors.

Coverage

The amount of coverage you need depends on your individual circumstances and risk tolerance. You should understand the different types of coverage available, such as liability, collision, comprehensive, and uninsured motorist coverage. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Collision coverage covers damage to your vehicle in an accident, regardless of fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Uninsured motorist coverage provides protection if you are involved in an accident with a driver who doesn’t have insurance.

Price

The cost of car insurance is a major consideration for most people. Factors like your driving history, age, location, and the type of vehicle you drive all affect your premium. It’s essential to get quotes from multiple insurers to compare prices and find the best deal.

Discounts

Many insurers offer discounts to reduce your premium. These discounts can be based on various factors, such as safe driving records, good credit scores, having multiple policies with the same insurer, or installing safety features in your vehicle.

Customer Service

When you need to file a claim or have a question about your policy, you want to be able to reach a helpful and responsive customer service representative. Look for an insurer with a strong reputation for customer service and a clear and easy-to-navigate claims process.

Claims Process

Understanding the claims process is crucial. Find out how the insurer handles claims, how long it takes to process a claim, and what documentation you need to provide. It’s also important to know how the insurer handles disputes and whether they have a reputation for fairness.

Driving History

Your driving history is one of the most significant factors that affect your car insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents or traffic violations, your premiums will be higher.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance costs. Sports cars and luxury vehicles are typically more expensive to insure than older, less expensive models. This is because these vehicles are often more expensive to repair or replace in case of an accident.

Location

Your location can also affect your car insurance premiums. Insurers consider the risk of accidents in different areas, such as urban centers versus rural areas. Areas with higher traffic density and more accidents tend to have higher insurance rates.

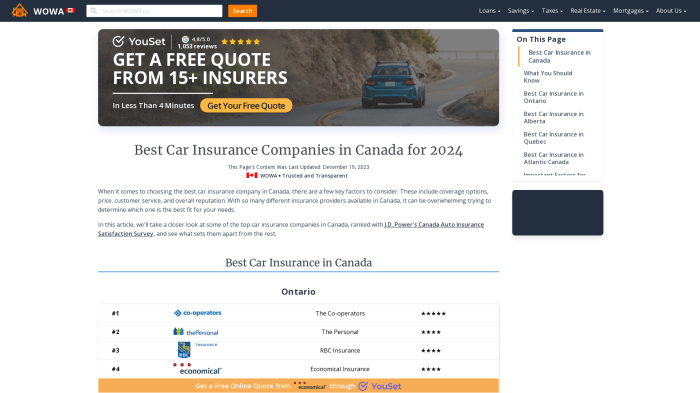

Top Car Insurance Providers in Canada

Choosing the right car insurance provider is crucial for ensuring adequate protection and peace of mind. Canada boasts a diverse landscape of insurance companies, each offering unique features and benefits.

Top Car Insurance Providers in Canada

A comprehensive comparison of top car insurance providers in Canada can help you make an informed decision. Here’s a table outlining key features and considerations for some of the leading providers:

| Provider | Coverage Options | Pricing | Customer Satisfaction | Claims Handling Experience | Strengths | Weaknesses |

|—|—|—|—|—|—|—|

| Intact Insurance | Comprehensive, collision, liability, and more | Competitive | High | Positive reviews | Strong financial stability, wide range of coverage options, online tools | Limited availability in some regions |

| Desjardins Insurance | Comprehensive, collision, liability, and more | Competitive | High | Positive reviews | Strong financial stability, focus on customer service, community involvement | Primarily available in Quebec |

| TD Insurance | Comprehensive, collision, liability, and more | Competitive | High | Positive reviews | Convenient online tools, discounts, strong customer support | May have limited coverage options in some areas |

| Belair Direct | Comprehensive, collision, liability, and more | Competitive | High | Positive reviews | Online-only provider, competitive rates, quick claims processing | Limited availability in some regions |

| RSA Insurance | Comprehensive, collision, liability, and more | Competitive | High | Positive reviews | Strong financial stability, wide range of coverage options, discounts | May have higher premiums for some drivers |

It’s important to note that these are just a few of the many reputable car insurance providers in Canada. Your specific needs and preferences will ultimately determine the best provider for you.

Understanding Coverage Options

Choosing the right car insurance coverage is crucial for protecting yourself financially in the event of an accident. Understanding the different types of coverage and their benefits can help you make an informed decision.

Types of Car Insurance Coverage

Car insurance policies in Canada typically include several types of coverage, each designed to protect you from specific risks. Here’s a breakdown of the most common types of coverage:

- Liability Coverage: This is the most essential type of car insurance and is required by law in Canada. It protects you financially if you cause damage to another person’s property or injure someone in an accident. Liability coverage is divided into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injuries you cause to others in an accident.

- Property Damage Liability: Covers damages you cause to another person’s vehicle or property in an accident.

- Collision Coverage: This coverage protects you if you damage your own vehicle in an accident, regardless of who is at fault. It covers the cost of repairs or replacement, minus your deductible.

- Comprehensive Coverage: This coverage protects you from damages to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It also covers the cost of repairs or replacement, minus your deductible.

Importance of Liability, Collision, and Comprehensive Coverage

These three types of coverage are crucial for different reasons:

- Liability Coverage: Protects you from financial ruin if you are found at fault in an accident. It can cover significant expenses related to injuries or property damage caused to others.

- Collision Coverage: Helps you repair or replace your vehicle if you are involved in an accident, even if you are not at fault. It can save you from significant out-of-pocket expenses.

- Comprehensive Coverage: Provides protection against a wide range of risks that could damage your vehicle. It helps you recover from unexpected events that could otherwise leave you with significant financial losses.

Optional Coverage Options

In addition to the standard coverage options, you can also choose to add optional coverage to your policy, depending on your individual needs and risk tolerance. Here are some common optional coverage options:

- Accident Forgiveness: This coverage can waive your first accident claim, protecting your driving record and preventing a potential increase in your insurance premiums.

- Rental Car Reimbursement: This coverage provides you with financial assistance to rent a car if your vehicle is damaged in an accident and needs repairs.

- Roadside Assistance: This coverage offers help with roadside emergencies, such as flat tires, dead batteries, and towing services.

- Other Optional Coverage: Other optional coverage options may include uninsured motorist coverage, underinsured motorist coverage, and medical payments coverage.

Getting the Best Value for Your Money

Finding the best car insurance in Canada is about more than just the lowest price; it’s about finding the right balance of coverage and affordability. To achieve this, you need to be a savvy shopper and know how to navigate the insurance landscape.

Comparing Car Insurance Quotes

To find the best value, it’s crucial to compare quotes from multiple insurers. Online comparison tools can be a valuable starting point, allowing you to enter your details and receive quotes from various providers.

Here’s a breakdown of how to get the most out of quote comparisons:

- Use multiple comparison websites: Don’t rely on just one platform. Different websites may partner with different insurers, giving you a broader range of options.

- Provide accurate information: Ensure you provide all the necessary details about your vehicle, driving history, and desired coverage. Inaccuracies can lead to inaccurate quotes.

- Consider the fine print: Pay attention to the coverage details, deductibles, and any exclusions included in each quote. Don’t just focus on the bottom line price.

- Don’t forget about discounts: Many insurers offer discounts for various factors, such as safe driving records, bundling policies, or having safety features in your car.

Negotiating with Insurance Providers

While online comparison tools are helpful, it’s also beneficial to contact insurers directly to discuss your needs and potentially negotiate a better rate.

- Shop around: Armed with quotes from multiple insurers, you’re in a better position to negotiate. Let them know you’re considering other options.

- Highlight your positive attributes: Emphasize your safe driving record, years of experience, and any other factors that might make you a low-risk driver.

- Be prepared to walk away: If an insurer isn’t willing to negotiate, don’t be afraid to look elsewhere.

Securing Discounts

Insurance companies offer various discounts to lower your premiums. It’s essential to understand what discounts you’re eligible for and how to secure them.

- Safe driving record: Maintain a clean driving record with no accidents or violations.

- Defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving.

- Bundling policies: Combining your car insurance with home or renter’s insurance can often lead to significant discounts.

- Vehicle safety features: Cars equipped with anti-theft devices, airbags, and other safety features can qualify for lower premiums.

- Loyalty discounts: Some insurers offer discounts to customers who have been with them for a certain period.

- Payment in full: Paying your premium in full upfront may result in a discount.

Understanding Your Individual Needs

Finding the best value isn’t just about getting the lowest price; it’s about finding the right coverage for your specific situation.

- Assess your risk tolerance: Consider your financial situation and how much risk you’re willing to take. A higher deductible means lower premiums but also higher out-of-pocket costs in case of an accident.

- Evaluate your driving habits: If you drive frequently, live in a high-risk area, or drive a high-performance vehicle, you might need more comprehensive coverage.

- Review your coverage options: Understand the different types of coverage available and choose the ones that best suit your needs.

Managing Your Car Insurance Policy

Once you’ve chosen the best car insurance policy for your needs, it’s crucial to understand how to manage it effectively. This includes knowing how to file a claim, preventing accidents, and reviewing your policy regularly.

Filing a Claim

Filing a claim can be a stressful experience, but it’s important to know the process. Here’s a general overview:

- Contact your insurer immediately after an accident. They will guide you through the next steps and provide instructions for reporting the claim.

- Gather all relevant information, including the date and time of the accident, the location, the names and contact information of all parties involved, and any witness details.

- Take photos and videos of the damage to your vehicle and the accident scene, if possible.

- Obtain a police report if necessary. This is often required for claims involving serious accidents or injuries.

- Be honest and accurate when providing information to your insurer.

- Keep track of all communication with your insurer, including dates, times, and names of individuals you spoke with.

Your insurer will investigate the claim and determine your coverage. They will then process your claim and, if approved, issue payment for covered damages.

Preventing Accidents, Best car insurance in canada

Maintaining a good driving record is essential for keeping your car insurance premiums low. Here are some tips for preventing accidents:

- Follow traffic laws: This includes obeying speed limits, using turn signals, and stopping at red lights and stop signs.

- Be aware of your surroundings: Keep your eyes on the road and be alert to potential hazards, such as pedestrians, cyclists, and other vehicles.

- Maintain your vehicle: Regularly check your tires, brakes, lights, and other components to ensure they are in good working condition.

- Avoid distractions: Put away your phone and avoid eating, drinking, or talking while driving.

- Drive defensively: Be prepared for unexpected situations and anticipate the actions of other drivers.

By following these tips, you can reduce your risk of getting into an accident and maintain a good driving record.

Reviewing Your Policy

It’s important to review your car insurance policy regularly, at least once a year, to ensure it still meets your needs. Here are some things to consider:

- Your driving habits: Have you recently changed your driving habits, such as driving less frequently or taking on a new commute?

- Your vehicle: Have you recently purchased a new car or made significant modifications to your existing vehicle?

- Your financial situation: Have you experienced any changes to your income or expenses that might affect your ability to afford your current coverage?

- Available discounts: Have you recently acquired any new discounts, such as a safe driving record or a new security system for your car?

If any of these factors have changed, you may need to adjust your coverage or explore other options to ensure you’re getting the best value for your money. You may also want to compare rates from other insurers to see if you can find a better deal.

Last Point

By carefully evaluating your needs, comparing quotes, and understanding the nuances of coverage options, you can find the best car insurance in Canada to protect yourself and your vehicle. Remember, choosing the right insurance is not just about finding the cheapest option but about securing comprehensive coverage that provides peace of mind on the road.

FAQ Explained

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever you experience significant life changes such as a new car, a change in your driving record, or a move to a different location.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident and injure someone or damage their property. Collision coverage covers damage to your own vehicle in an accident, regardless of fault.

What are some common discounts offered by car insurance providers?

Common discounts include safe driving discounts, multi-car discounts, good student discounts, and bundling discounts for combining home and auto insurance.

How can I improve my driving record to get lower car insurance rates?

Maintain a clean driving record by avoiding traffic violations, speeding tickets, and accidents. Consider taking defensive driving courses to improve your driving skills and potentially earn discounts.