Navigating the complexities of auto insurance can feel overwhelming, especially when faced with the unexpected costs associated with a vehicle accident. AAA Gap Insurance offers a crucial safety net, bridging the financial gap between your car’s actual cash value and the outstanding loan balance after a total loss. This comprehensive guide explores the intricacies of AAA Gap insurance, detailing its benefits, costs, and how it can safeguard your financial well-being in the event of an accident.

We’ll delve into the specifics of AAA Gap Insurance coverage, outlining the claims process, eligibility requirements, and the crucial differences between this type of insurance and other financial products. Real-world scenarios will illuminate the significant impact this coverage can have, illustrating both its advantages and limitations. By the end, you’ll have a clear understanding of whether AAA Gap Insurance is the right choice for your financial protection.

What is AAA Gap Insurance?

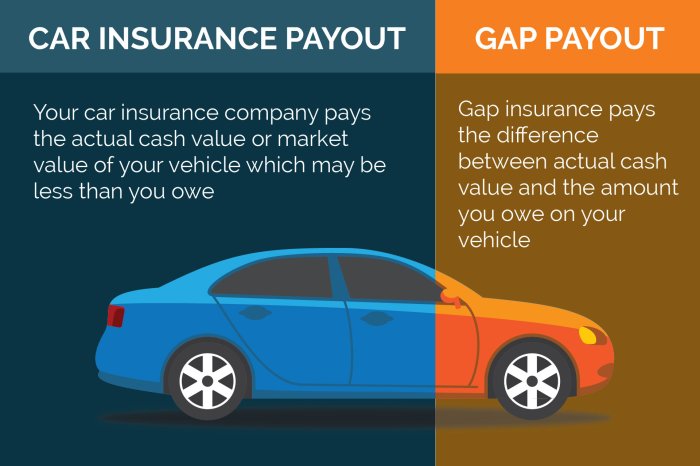

AAA Gap Insurance is a supplemental insurance product designed to protect you from financial loss if your vehicle is totaled or stolen and your existing auto insurance doesn’t fully cover the loan or lease payoff amount. In simpler terms, it bridges the gap between what your insurance pays and what you still owe on your car.

AAA Gap Insurance helps cover the difference between the actual cash value (ACV) of your vehicle and the amount you still owe on your loan or lease. This is particularly important because the ACV of a car depreciates quickly, meaning its value can drop significantly shortly after purchase.

Coverage Offered Under AAA Gap Insurance

AAA Gap Insurance typically covers the difference between the ACV of your vehicle and the outstanding loan or lease balance in the event of a total loss (due to accident or theft). This coverage can significantly reduce your financial burden after a major incident. It is important to note that specific coverage details may vary depending on your policy and the AAA plan you select. It’s always best to review your policy documents for complete information.

Situations Where AAA Gap Insurance is Beneficial

AAA Gap insurance is particularly valuable in situations where your vehicle depreciates rapidly, such as with a new car. Imagine purchasing a new car for $30,000 and financing the full amount. After a year, the car might only be worth $20,000 due to depreciation. If the car is totaled in an accident, your insurance might only pay out $20,000 (the ACV), leaving you with a $10,000 shortfall on your loan. AAA Gap insurance would cover this $10,000 gap, protecting you from significant financial responsibility. Another example would be leasing a vehicle. Lease agreements often stipulate a residual value that may be higher than the actual market value at the end of the lease term. If the vehicle is totaled during the lease, gap insurance can cover the difference between the insurance payout and the lease buyout amount, avoiding a substantial out-of-pocket expense.

How AAA Gap Insurance Works

AAA Gap insurance bridges the gap between what your auto insurance pays out after an accident or theft and the amount you still owe on your auto loan or lease. It protects you from potentially significant financial loss if your vehicle is declared a total loss. Understanding how it works is key to making an informed decision about purchasing this valuable coverage.

AAA Gap insurance operates by paying the difference between the actual cash value (ACV) of your vehicle and the amount you owe on your loan or lease. The ACV is determined by an independent appraisal, considering factors such as the vehicle’s make, model, year, mileage, and condition. If the ACV is less than the amount you still owe, the gap insurance covers the remaining balance, preventing you from being left with substantial debt.

Filing a Claim with AAA for Gap Insurance

To file a claim, you’ll need to report the incident to both your auto insurance company and AAA. AAA will then guide you through the necessary steps, which typically involve providing documentation and cooperating with an appraisal process. The claim process involves verifying the total loss of your vehicle and determining the ACV. After the appraisal and verification, AAA will process the claim and pay the difference between the ACV and your loan or lease balance directly to your lender.

Documentation Required for a Gap Insurance Claim

The necessary documentation for a Gap Insurance claim will vary slightly depending on the specifics of your situation, but generally includes:

- A copy of your AAA Gap insurance policy.

- A completed claim form provided by AAA.

- Proof of ownership of the vehicle (title).

- A copy of your auto loan or lease agreement.

- Police report (if applicable).

- Your auto insurance claim information, including the settlement amount.

- Documentation from your lender confirming the outstanding loan or lease balance.

Providing complete and accurate documentation will expedite the claim process. Missing or incomplete documentation can lead to delays in receiving your payment.

Purchasing AAA Gap Insurance

Purchasing AAA Gap insurance is a straightforward process. You can typically purchase it directly through AAA during the application process for your auto loan or lease, or sometimes as an add-on later.

- Contact your local AAA office or visit their website.

- Inquire about the availability of Gap insurance and obtain a quote.

- Provide necessary vehicle and personal information as requested.

- Review the policy details carefully, including coverage limits and exclusions.

- Complete the application and payment process.

- Receive your insurance policy documentation.

It’s crucial to understand the terms and conditions of the policy before purchasing. The cost of the insurance will vary based on factors such as the vehicle’s value, loan amount, and your credit history.

Cost and Benefits of AAA Gap Insurance

AAA Gap insurance, while offering valuable protection, comes with a cost. Understanding this cost relative to other insurance types and weighing it against the potential financial benefits is crucial for determining if it’s the right choice for you. This section will explore the cost of AAA Gap insurance and compare it to other auto insurance options, ultimately highlighting the significant financial advantages it can provide.

AAA Gap Insurance Cost Compared to Other Auto Insurance

The cost of AAA Gap insurance varies depending on factors such as your vehicle’s make, model, year, and your location. Generally, it’s a relatively inexpensive addition compared to the overall cost of comprehensive or collision insurance. While comprehensive and collision insurance cover damage to your vehicle, they only cover the depreciated value. Gap insurance fills that gap, covering the difference between what your insurer pays and what you still owe on your loan or lease. Consider this example: Your car is totaled, your insurer pays out $15,000, but you still owe $20,000 on your loan. Gap insurance would cover the remaining $5,000. The cost of this protection is typically far less than the potential financial burden of being responsible for that $5,000. In contrast, increasing your liability coverage (to protect others) will likely have a more significant impact on your premium compared to adding Gap insurance.

Financial Benefits of AAA Gap Insurance

The primary benefit of AAA Gap insurance is the protection it offers against significant financial loss in the event of a total loss or theft of your vehicle. This is particularly valuable during the early years of a loan or lease when depreciation is highest. Without Gap insurance, you would be responsible for paying the difference between the depreciated value of your vehicle and the outstanding loan balance, potentially leaving you with a substantial debt. This could negatively impact your credit score and overall financial stability. The peace of mind provided by knowing this financial risk is mitigated is a considerable intangible benefit. Consider the stress relief of not having to worry about a significant unexpected financial burden in the event of a car accident.

Comparison of AAA Gap Insurance Plans

The specific plans and costs offered by AAA may vary by location and may not always be publicly available online. Contacting your local AAA office for a personalized quote is recommended. However, we can illustrate a hypothetical comparison of potential plan features and costs. Note that these are examples only and may not reflect actual AAA offerings.

| Plan Name | Coverage Amount | Monthly Cost (Estimate) | Additional Features |

|---|---|---|---|

| Basic Gap | Up to $10,000 | $5 | Loan/Lease payoff coverage |

| Standard Gap | Up to $20,000 | $10 | Loan/Lease payoff coverage, towing assistance |

| Premium Gap | Up to $30,000 | $15 | Loan/Lease payoff coverage, towing assistance, rental car reimbursement |

Eligibility and Requirements

Securing AAA Gap Insurance involves meeting specific eligibility criteria and fulfilling certain requirements. Understanding these aspects is crucial to determine your suitability for coverage and to ensure a smooth application process. The following sections detail the necessary conditions and limitations associated with AAA Gap Insurance.

Eligibility Criteria

Eligibility for AAA Gap Insurance primarily hinges on your vehicle and your AAA membership status. Generally, you must be a current AAA member in good standing. The vehicle itself must typically be less than a certain age (often five years old or newer, depending on the specific AAA plan), have a loan or lease, and meet other criteria, such as not being significantly modified or used for commercial purposes. Specific age limits and vehicle type restrictions vary depending on the specific AAA plan offered in your region. Contact your local AAA office for the most up-to-date information.

Application Requirements

The application process usually involves providing documentation to verify your AAA membership, vehicle ownership, and the outstanding loan or lease amount. This commonly includes proof of insurance, a copy of your vehicle’s title, and details of your financing agreement. AAA may also require a vehicle identification number (VIN) and information about your vehicle’s purchase price. Failing to provide all necessary documentation may delay or prevent the approval of your application.

Limitations and Exclusions

It’s important to be aware that AAA Gap Insurance, like any insurance product, has limitations and exclusions. Coverage typically does not extend to situations involving intentional damage, racing accidents, or modifications that substantially alter the vehicle’s value. Additionally, there might be deductibles or co-payments required before coverage kicks in. Specific exclusions can vary depending on your policy; therefore, reviewing the policy documents carefully is crucial. For example, damage caused by a natural disaster might have coverage limitations depending on the specific policy terms and the extent of the damage. A common exclusion might be damage caused by wear and tear, such as normal tire degradation. Always carefully review your policy’s terms and conditions to fully understand the scope of coverage and any exclusions.

Illustrative Scenarios

Understanding how AAA Gap insurance applies in different situations is crucial for assessing its value. Let’s examine scenarios where this insurance provides significant benefits and where it might not be necessary. These examples illustrate the practical implications of having or not having gap coverage.

Scenario: Significant Benefit from AAA Gap Insurance

Imagine Sarah buys a new car for $30,000. After a year, she owes $25,000 on her loan. Unfortunately, she’s involved in a serious accident, and the car is totaled. The insurance company assesses the car’s actual cash value (ACV) at $20,000, due to depreciation. Without gap insurance, Sarah would be responsible for the $5,000 difference between the loan amount and the ACV. However, with AAA Gap insurance, this $5,000 gap would be covered, saving her from a significant financial burden. This illustrates the core purpose of gap insurance: bridging the difference between what you owe and what your car is worth after a total loss.

Scenario: No Benefit from AAA Gap Insurance

Consider John, who purchased a used car for $10,000 three years ago. He paid off the loan in full a year ago. Recently, his car was in a minor accident causing some cosmetic damage. The repair cost was $1,500, covered by his collision insurance. Because John owned the car outright and had no outstanding loan, gap insurance would have been unnecessary in this situation. Gap insurance only addresses the shortfall between loan amount and ACV in the event of a total loss; it does not cover repair costs or damage to a fully paid-off vehicle.

Car Accident Scenario: Financial Burden Comparison

Let’s visualize a text-based representation of a car accident scenario:

| Scenario | Loan Amount | Actual Cash Value (ACV) | Insurance Payout | Out-of-Pocket Cost | Gap Insurance Coverage |

|——————–|————-|————————-|——————–|———————|————————|

| Without Gap | $25,000 | $20,000 | $20,000 | $5,000 | No |

| With Gap | $25,000 | $20,000 | $25,000 | $0 | Yes |

This table clearly shows how gap insurance eliminates the out-of-pocket expense in a total loss scenario where the ACV is lower than the loan amount. The difference is significant, potentially saving a customer thousands of dollars.

Final Summary

Ultimately, the decision of whether or not to purchase AAA Gap Insurance hinges on a careful assessment of your individual financial situation and risk tolerance. Weighing the cost against the potential financial burden of a significant accident is paramount. By understanding the nuances of this coverage, you can make an informed decision that best protects your financial interests. Remember to thoroughly review the policy details and compare it to other available options before making a commitment. Your financial security is worth the effort.

Questions and Answers

What happens if my car is stolen and I have AAA Gap Insurance?

AAA Gap Insurance covers the difference between the actual cash value of your vehicle and the outstanding loan balance, even in cases of theft, provided the theft is covered under your auto insurance policy.

Can I get AAA Gap Insurance if my car is leased?

Eligibility for AAA Gap Insurance on leased vehicles depends on specific policy terms. Contact AAA directly to confirm coverage.

How long does the claims process typically take?

The claims process varies but generally takes several weeks, depending on the complexity of the claim and the necessary documentation.

What if I have already filed a claim with my regular auto insurance?

You will typically need to file a separate claim with AAA for Gap Insurance coverage after your primary auto insurance claim is settled.

Is there a waiting period before the coverage begins?

Some policies may have a short waiting period before the gap insurance coverage is effective. Check your policy details for specifics.