Navigating the world of insurance can be daunting, especially as we age and our needs evolve. AARP, known for its advocacy for older adults, offers a range of insurance plans designed to provide comprehensive coverage and peace of mind. This guide delves into the various AARP-endorsed insurance options, exploring their features, benefits, costs, and how they compare to other providers. We’ll cover everything from health and Medicare supplement plans to auto, home, and life insurance, empowering you to make informed decisions about your financial security.

Understanding your insurance needs is crucial for financial well-being. This guide aims to clarify the complexities of AARP insurance plans, providing a clear and concise overview of each offering. We will compare plan features, discuss eligibility requirements, and analyze cost factors, allowing you to assess which AARP plan, if any, best suits your individual circumstances. We’ll also compare AARP options with those offered by other major insurance providers to help you make a well-informed choice.

AARP Insurance Plan Overview

AARP, the American Association of Retired Persons, partners with various insurance providers to offer a range of plans designed to meet the specific needs of individuals 50 and older. These plans aren’t directly offered by AARP itself, but rather are endorsed and marketed under the AARP brand, leveraging their reputation for reliability and member benefits. Understanding the different types of insurance available and their key features is crucial for making informed decisions about your coverage.

Types of AARP-Endorsed Insurance Plans

AARP-endorsed insurance plans cover a variety of needs, providing options for comprehensive protection. The specific plans and providers may vary by location.

| Plan Type | Key Features | Benefits | Eligibility |

|---|---|---|---|

| Health Insurance (Medicare Supplement & Medicare Advantage) | Various plans to supplement Original Medicare; May include prescription drug coverage; Different levels of coverage available. | Helps cover out-of-pocket costs associated with Medicare; Provides additional coverage beyond what Original Medicare offers; Can help reduce medical bills. | Individuals enrolled in Medicare Part A and Part B; Age 50 and older. Specific eligibility criteria vary by plan. |

| Auto Insurance | Customized coverage options; Discounts for AARP members; Potential for bundling with other insurance types. | Financial protection in case of accidents; Reduced premiums for AARP members; Potential for savings through bundling. | AARP members; Drivers with valid licenses; Specific eligibility criteria vary by provider and state. |

| Life Insurance | Term life insurance; Whole life insurance; Options to suit various budgets and needs. | Provides financial security for beneficiaries upon death; Helps protect loved ones from financial burdens. | AARP members; Individuals meeting specific health requirements; Specific eligibility criteria vary by provider and plan. |

| Dental, Vision, and Hearing Insurance | Coverage for dental checkups, vision exams, and hearing tests; Preventive care often included; Discounts on services. | Helps manage costs associated with dental, vision, and hearing care; Encourages preventative care. | AARP members; Specific eligibility criteria vary by provider and plan. |

Understanding Plan Details

It is vital to carefully review the specific details of each plan before enrollment. Policy documents provide complete information regarding coverage limits, exclusions, and premium costs. Comparing plans from different providers is recommended to find the best fit for individual needs and budgets. Consider factors like your health status, driving history, and financial goals when making your selection. Contacting AARP directly or working with an independent insurance agent can help simplify the process.

AARP Health Insurance Plans

AARP offers a range of health insurance plans designed to supplement Medicare coverage and provide additional benefits to its members. These plans, underwritten by UnitedHealthcare, are tailored to meet the diverse needs and budgets of older adults, offering various levels of coverage and cost-sharing options. Understanding the nuances of these plans is crucial for making informed decisions about healthcare coverage.

AARP Medicare Supplement Plans (Medigap)

AARP offers several Medigap plans, which help cover the out-of-pocket costs Medicare doesn’t pay. These plans are standardized by the federal government, meaning a Plan G from one insurer will generally offer the same benefits as a Plan G from another. However, premiums and specific details might vary. AARP Medigap plans help to reduce expenses like copayments, deductibles, and coinsurance, offering greater financial protection against high medical bills. Choosing the right plan depends on individual needs and risk tolerance, with higher premiums often correlating to more comprehensive coverage. For example, Plan G covers most out-of-pocket costs, while Plan F (no longer available to new enrollees) covered almost all.

AARP Medicare Advantage Plans

AARP also offers Medicare Advantage plans, also known as Part C. These plans are offered through UnitedHealthcare and provide comprehensive coverage, often including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage) all in one plan. Different AARP Medicare Advantage plans vary in their cost, the specific doctors and hospitals in their network, and the extra benefits offered. Some plans might offer vision, dental, or hearing coverage, while others may have lower premiums but higher out-of-pocket costs. For example, one plan might emphasize a low monthly premium but have a higher deductible, while another might have a higher premium but lower out-of-pocket expenses. Choosing the right plan depends on factors such as the individual’s health needs, location, and preferred providers.

Prescription Drug Coverage with AARP Health Plans

Prescription drug coverage is a crucial aspect of any health insurance plan. AARP Medicare Advantage plans typically include Part D prescription drug coverage, integrated into the overall plan. The specific drugs covered, formularies (lists of covered medications), and cost-sharing vary among different AARP Medicare Advantage plans. Some plans may offer a wider range of covered medications or lower co-pays than others. Separate standalone Part D plans are also available for those who have Original Medicare (Part A and Part B). These plans offer different formularies and cost-sharing options, allowing individuals to choose the plan best suited to their medication needs and budget.

Advantages and Disadvantages of AARP Health Plans

Understanding the potential benefits and drawbacks is vital before enrolling in any AARP health plan.

- Advantages: Wide range of plan options to suit various needs and budgets; established reputation of AARP and UnitedHealthcare; potential for cost savings on premiums and out-of-pocket expenses; integrated coverage in Medicare Advantage plans; additional benefits like vision, dental, or hearing coverage in some plans.

- Disadvantages: Network restrictions in Medicare Advantage plans (access limited to in-network providers); premiums and out-of-pocket costs can vary significantly among plans; complex plan options can make choosing the right plan challenging; changes in formularies can impact drug coverage and costs.

AARP Auto and Home Insurance

AARP offers auto and home insurance options through partnerships with reputable insurance providers, aiming to provide members with competitive rates and comprehensive coverage tailored to their needs. These plans leverage AARP’s extensive membership base to negotiate favorable terms and discounts, resulting in potentially significant savings for its members. Understanding the specifics of these plans, including available providers, coverage options, and cost comparisons, is crucial for making informed decisions about insurance protection.

AARP Auto Insurance Providers and Coverage Options

AARP partners with several major insurance providers to offer auto insurance to its members. The specific providers vary by location, so it’s essential to check with AARP directly or use their online tools to determine which companies offer coverage in your area. Common partners often include well-known national insurers, offering a range of coverage options to suit different needs and budgets. These options typically include liability coverage (which protects you financially if you cause an accident), collision coverage (which covers damage to your car in an accident, regardless of fault), and comprehensive coverage (which protects against damage caused by events other than collisions, such as theft or weather).

Discounts and Savings for AARP Members

AARP members often qualify for various discounts on their auto insurance premiums. These discounts can significantly reduce the overall cost of coverage. Common discounts include those for safe driving records, multiple-car policies, bundling auto and home insurance, and being a long-time AARP member. The specific discounts available will vary depending on the insurance provider and your individual circumstances. It’s important to inquire about all available discounts when obtaining a quote.

Comparison of AARP Auto Insurance Rates with Other Major Providers

Direct comparison of AARP auto insurance rates with other major providers is difficult without specific location and driver profile data. Rates vary widely based on factors like age, driving history, location, vehicle type, and the level of coverage chosen. However, AARP’s partnerships aim to offer competitive rates by leveraging its large membership base to negotiate favorable deals with insurance companies. To get an accurate comparison, it’s recommended to obtain quotes from several insurers, including those partnered with AARP, and compare the offerings side-by-side. This allows for a personalized assessment of cost and coverage.

AARP Auto Insurance Coverage Options

The following table illustrates common coverage options available through AARP’s partnered auto insurance providers. Remember that specific coverage details and availability may vary by provider and location.

| Coverage Type | Description | Features |

|---|---|---|

| Liability | Covers bodily injury and property damage to others if you cause an accident. | Required by most states; limits vary by state and policy. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Often includes a deductible. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather. | Often includes a deductible; specific covered perils may vary. |

| Uninsured/Underinsured Motorist | Protects you if you’re involved in an accident with an uninsured or underinsured driver. | Covers medical bills and property damage. |

| Medical Payments | Covers medical expenses for you and your passengers, regardless of fault. | Often has a lower limit than other coverages. |

AARP Life Insurance Plans

Securing your family’s financial future is a crucial aspect of long-term planning, and AARP offers various life insurance plans designed to meet diverse needs and budgets. Understanding the different types of coverage, the application process, and the associated benefits and limitations is essential for making an informed decision.

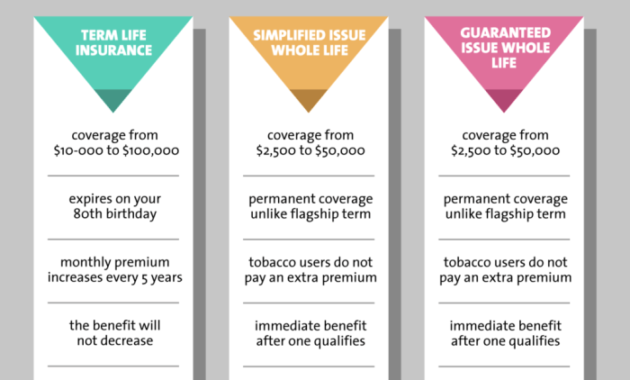

Types of AARP Life Insurance

AARP offers several life insurance options, each with its own features and advantages. The most common types are term life insurance and whole life insurance. Term life insurance provides coverage for a specific period (the term), while whole life insurance offers lifelong coverage. Understanding the distinctions between these plans is key to selecting the best fit.

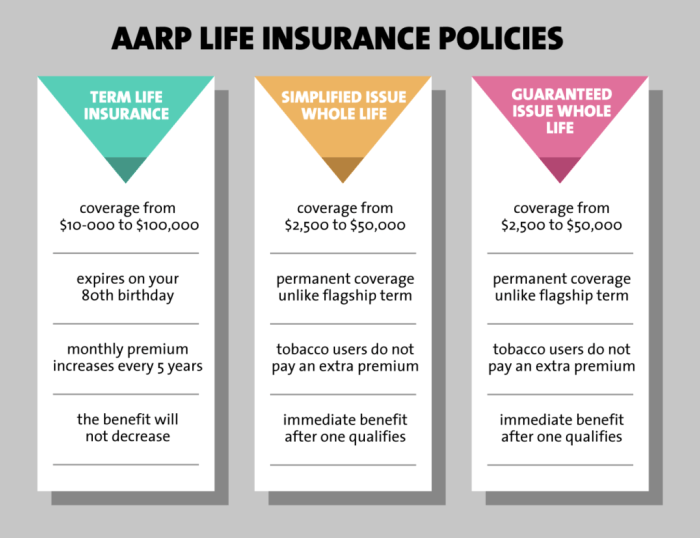

Term Life Insurance through AARP

Term life insurance provides a death benefit for a specified period, such as 10, 20, or 30 years. If the insured dies within the term, the beneficiaries receive the death benefit. If the insured survives the term, the policy expires, and no further coverage is provided. This type of policy is generally more affordable than whole life insurance, making it a suitable option for those needing temporary coverage, such as paying off a mortgage or providing for children’s education. The premiums remain level throughout the term.

Whole Life Insurance through AARP

Whole life insurance provides lifelong coverage, meaning the death benefit is payable whenever the insured dies, regardless of when it occurs. Unlike term life insurance, whole life policies also build cash value over time, which can be borrowed against or withdrawn. This cash value component makes whole life insurance more expensive than term life insurance, but it offers a combination of death benefit protection and a savings element.

AARP Life Insurance Application Process and Underwriting

The application process for AARP life insurance typically involves completing an application form, providing medical information (including health history and potentially undergoing a medical examination), and undergoing an underwriting process. Underwriting involves assessing the applicant’s risk profile to determine eligibility and premium rates. Factors considered during underwriting include age, health status, lifestyle, and family medical history. The specific requirements can vary depending on the policy type and coverage amount. Applicants should expect to provide detailed information regarding their health, occupation, and financial circumstances.

Benefits and Limitations of AARP Life Insurance Plans

The benefits of AARP life insurance plans include financial protection for loved ones in the event of death, potentially tax-advantaged growth in the case of whole life insurance (cash value), and flexible payment options. However, limitations may include the potential for higher premiums compared to other insurers, the possibility of policy exclusions (certain conditions or activities may not be covered), and the fact that whole life insurance can be expensive and may not be the most efficient way to build wealth for everyone.

Calculating Potential Life Insurance Payouts

Calculating potential payouts depends on the type of policy and the coverage amount.

For term life insurance: Payout = Coverage Amount (if death occurs within the term).

For whole life insurance: Payout = Coverage Amount (at any time after death). The cash value component may also be available to the beneficiary or the policyholder.

For example, a $250,000 term life insurance policy will pay out $250,000 if the insured dies within the policy term. A $250,000 whole life insurance policy will also pay out $250,000 upon death, regardless of when it occurs, and may have accumulated cash value that is also payable. The exact payout will depend on the specific policy details and any outstanding loans or withdrawals.

Understanding AARP Insurance Costs and Coverage

AARP-endorsed insurance plans offer a range of coverage options, but the cost and specifics vary depending on several factors. Understanding these factors and the claims process is crucial for making informed decisions about your insurance needs.

Several key factors influence the premiums you pay for AARP insurance. Your age, location, health status (for health insurance), driving record (for auto insurance), and the type and amount of coverage you choose all play a significant role. For example, someone living in a high-risk area might pay more for home insurance than someone in a low-risk area. Similarly, a driver with multiple accidents will likely face higher auto insurance premiums. The level of coverage selected – a higher deductible typically translates to lower premiums, but a higher out-of-pocket cost in the event of a claim. Specific plan details and pricing are available through the respective insurance providers.

AARP Insurance Claim Filing Process

Filing a claim with an AARP-endorsed provider generally involves contacting the insurer directly via phone or online. The specific steps may vary slightly depending on the type of insurance (health, auto, home, life) and the insurer. However, the process typically includes providing necessary documentation such as policy information, details of the incident, and supporting evidence (medical bills, police reports, repair estimates). The insurer will then review the claim and determine coverage based on your policy terms.

Examples of AARP Insurance Benefits

AARP insurance can provide significant benefits in various situations. For example, AARP Medicare Supplement plans can help cover out-of-pocket costs associated with Medicare, reducing financial burden during medical emergencies or long-term illnesses. AARP auto insurance can provide financial protection in case of accidents, while AARP home insurance can protect your property against damage or loss. AARP life insurance can provide financial security for your loved ones after your passing. These plans offer peace of mind knowing that you have financial protection in place for unexpected events.

Hypothetical Claim Scenario: Auto Accident

Let’s imagine a scenario where a member, John, has an AARP-endorsed auto insurance policy and is involved in a car accident. Here’s a step-by-step illustration of the claim process:

Step 1: Report the Accident. John immediately calls the police to report the accident and obtains a police report number. He also takes photos of the damage to both vehicles.

Step 2: Contact the Insurer. John contacts his AARP-endorsed auto insurer to report the accident, providing the police report number and details of the incident.

Step 3: File the Claim. The insurer guides John through the online or phone claim filing process. He provides necessary information and supporting documentation, including photos of the damage and the police report.

Step 4: Claim Review and Assessment. The insurer reviews John’s claim, potentially requesting additional information or conducting an investigation.

Step 5: Settlement. Once the claim is approved, the insurer will process the payment for repairs or other covered expenses, as Artikeld in John’s policy.

AARP Insurance Customer Service and Reviews

Navigating insurance can sometimes feel overwhelming, so understanding the customer service options and experiences of others is crucial. AARP insurance plans, offered through various partnering companies, provide multiple avenues for contacting customer support and resolving potential issues. This section details the available resources and summarizes customer feedback to help you make an informed decision.

AARP Insurance Customer Service Channels

AARP insurance plans typically offer a range of customer service options to address inquiries and resolve problems. These channels generally include phone support, accessible through a dedicated customer service number often found on the insurance provider’s website or your policy documents. Many providers also maintain online portals where you can access account information, manage policies, submit claims, and often find answers to frequently asked questions through a searchable knowledge base or FAQs section. Email support may also be available, though response times may vary. Some providers might offer live chat options for immediate assistance with simpler queries. The specific channels available will depend on the type of insurance plan (auto, home, health, life) and the specific insurance company partnering with AARP.

Resolving Issues and Complaints with AARP Insurance Providers

The process for addressing issues or filing complaints varies slightly depending on the specific insurer, but generally follows a similar pattern. Most providers will have a clear process Artikeld on their websites, often involving initial contact through the channels described above. If a simple resolution isn’t reached, escalating the issue may involve speaking with a supervisor or filing a formal complaint. Depending on the nature of the complaint, mediation or arbitration might be options for resolving disputes. It is always recommended to keep detailed records of all communication, including dates, times, and summaries of conversations. Contacting your state’s insurance department can be a helpful step if you’re unable to resolve the issue through the insurer’s internal processes.

Summary of Customer Reviews and Ratings for AARP Insurance Plans

Customer reviews for AARP insurance plans vary across different types of insurance and providers. While many customers express satisfaction with the coverage and pricing, others have reported negative experiences with customer service responsiveness or claim processing. Overall ratings and reviews can be found on independent review websites and forums, allowing for a more comprehensive understanding of the customer experience. It’s important to remember that individual experiences can vary significantly, and reading a wide range of reviews provides a more balanced perspective.

Categorized Customer Reviews

The following table summarizes general trends observed in customer reviews, categorized for clarity. Note that these are broad generalizations and individual experiences may differ.

| Category | Review Summary | Examples |

|---|---|---|

| Positive | Many customers praise competitive pricing, comprehensive coverage options, and helpful customer service representatives. | “Excellent rates and easy online access to my policy.” “My claim was processed quickly and efficiently.” “The customer service agent was very patient and helpful in answering my questions.” |

| Negative | Some customers report difficulties reaching customer service, long wait times, and challenges in processing claims. | “I spent hours on hold trying to reach customer service.” “My claim was denied without a clear explanation.” “The customer service representative was unhelpful and dismissive.” |

| Neutral | Many reviews describe average experiences, neither exceptionally positive nor negative. | “The insurance is okay, nothing special.” “The process was straightforward, but nothing to write home about.” “It’s a decent policy for the price.” |

Comparing AARP Insurance with Other Providers

Choosing the right insurance provider is a crucial decision, and comparing AARP’s offerings with those of other major companies is essential for making an informed choice. This comparison will focus on key factors such as coverage, cost, and customer service to highlight the advantages and disadvantages of selecting AARP insurance.

AARP insurance plans, while designed with the 50+ demographic in mind, compete with a wide range of insurers offering similar products. Direct comparison requires considering specific plan details, as coverage and pricing vary significantly based on location, individual needs, and the chosen policy. However, general trends can be identified to facilitate a better understanding of the competitive landscape.

Coverage Comparison

AARP insurance plans, often underwritten by well-established companies like UnitedHealthcare, typically offer a range of coverage options for health, auto, and home insurance. Competitors such as Humana, Blue Cross Blue Shield, State Farm, and Geico offer comparable plans, but the specific benefits and limitations differ. For instance, AARP plans might emphasize preventative care in their health insurance offerings, while a competitor may focus on broader hospital coverage. Similarly, auto insurance plans might vary in their coverage of rental car reimbursement or roadside assistance. A thorough review of policy documents from multiple providers is necessary for a comprehensive comparison.

Cost Comparison

Insurance costs are highly individualized, influenced by factors such as age, location, driving record (for auto), and health history (for health). However, a general comparison can be made. AARP plans often leverage the organization’s large membership base to negotiate competitive premiums. However, other insurers may offer comparable or even lower rates depending on individual circumstances. For example, a younger, healthier individual might find better rates with a competitor focused on a younger demographic, while an older individual with pre-existing conditions might find AARP’s offerings more favorable due to potentially better coverage options and negotiated rates.

Customer Service Comparison

Customer service experiences can vary significantly across insurance providers. AARP emphasizes its customer support resources, often highlighting readily available phone support and online tools. Competitors also offer various customer service channels, including phone, email, and online chat. Ultimately, the quality of customer service is subjective and dependent on individual experiences. Online reviews and ratings from independent sources can provide insights into the general customer satisfaction levels of different insurers.

Comparative Representation: AARP vs. Competitor X

Imagine a table comparing AARP Medicare Supplement Plan G and a comparable plan from Competitor X (e.g., Humana). The table would have columns for “Plan Name,” “Monthly Premium (Example: 65-year-old, average health),” “Hospital Coverage (e.g., percentage of costs covered),” and “Customer Service Rating (based on independent review scores).” The AARP plan might show a slightly higher premium but potentially higher hospital coverage percentages. Competitor X might have a lower premium but slightly less comprehensive coverage. The customer service rating column would show numerical scores from a reliable source, allowing for a direct comparison of customer satisfaction levels. This illustrative table demonstrates how a side-by-side comparison can illuminate the key differences in price and coverage between AARP and a competitor.

Ultimate Conclusion

Securing your financial future requires careful consideration of your insurance needs. AARP insurance plans offer a variety of options tailored to the specific requirements of older adults. By understanding the different plan types, coverage options, costs, and customer service aspects, you can confidently choose the policy that best protects you and your loved ones. Remember to compare AARP offerings with those of other providers to ensure you’re receiving the most comprehensive coverage at the best possible price. This guide serves as a starting point; further research and consultation with an insurance professional are recommended before making any final decisions.

FAQ Summary

What is the difference between AARP Medicare Supplement and Medicare Advantage plans?

Medicare Supplement plans (like Medigap) help pay for Medicare’s out-of-pocket costs, while Medicare Advantage plans are all-inclusive alternatives to Original Medicare, often including prescription drug coverage.

How do I file a claim with an AARP-endorsed insurance provider?

The claims process varies by provider and plan type. Contact information and instructions are typically found on your insurance card or the provider’s website.

Does AARP offer discounts on insurance plans?

Yes, AARP members often receive discounts on premiums. The specific discounts vary by provider and plan.

Can I switch AARP insurance plans?

Generally, you can switch plans during open enrollment periods or under certain circumstances. Check with your provider for specific details.

What happens if I move to a new state with my AARP insurance?

Coverage may vary depending on the plan and state. Contact your insurance provider to discuss your options.