Navigating the California car insurance market can feel like driving through a dense fog. High costs and complex policies often leave drivers feeling overwhelmed and unsure of how to find the best coverage at an affordable price. This guide cuts through the confusion, providing a clear path to securing affordable car insurance in California, regardless of your driving history or budget. We’ll explore factors influencing insurance costs, effective strategies for lowering premiums, available discounts, and resources for low-income drivers.

From understanding the different types of coverage and comparing minimum versus recommended levels, to leveraging discounts and comparing quotes from multiple insurers, we’ll equip you with the knowledge and tools necessary to make informed decisions about your car insurance. We’ll also delve into the crucial aspects of understanding your policy and the process of filing a claim, ensuring a smooth and stress-free experience.

Understanding California’s Car Insurance Market

California’s car insurance market is a complex landscape shaped by numerous factors, resulting in a wide range of premiums across the state. Understanding these influences is crucial for securing affordable coverage. This section will explore the key determinants of car insurance costs, the various types of coverage available, and the differences between minimum requirements and recommended levels of protection.

Factors Influencing Car Insurance Costs in California

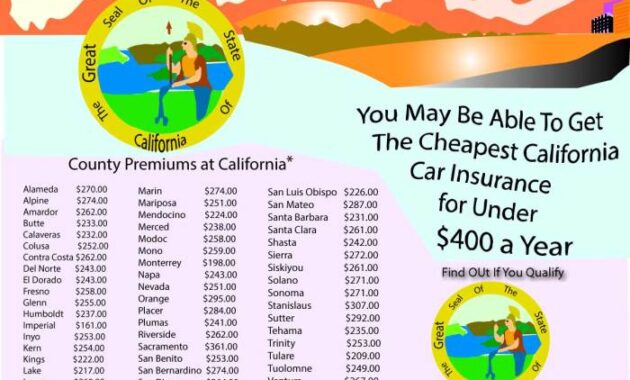

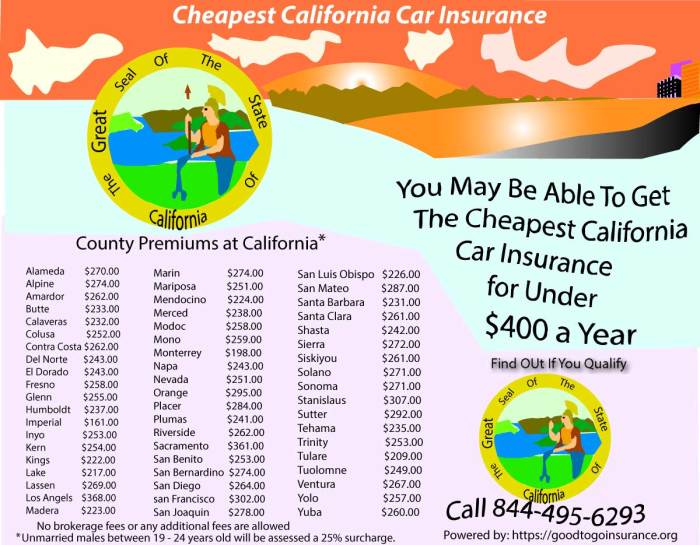

Several key factors contribute to the cost of car insurance in California. These include the driver’s driving record (accidents and traffic violations significantly impact premiums), age and driving experience (younger, less experienced drivers generally pay more), vehicle type and value (sports cars and luxury vehicles are typically more expensive to insure), location (insurance rates vary by zip code due to factors like crime rates and accident frequency), credit history (in many cases, a good credit score can lead to lower premiums), and coverage choices (selecting higher coverage limits naturally increases the cost). The insurer’s own risk assessment models also play a significant role, incorporating data analysis to determine individual risk profiles.

Types of Car Insurance Coverage in California

California offers various types of car insurance coverage, each designed to protect you in different situations. Liability coverage pays for damages or injuries you cause to others. Collision coverage repairs or replaces your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage from non-collision events such as theft, vandalism, or natural disasters. Uninsured/Underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Medical payments coverage helps pay for medical bills resulting from an accident, regardless of fault. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault.

Minimum Coverage Requirements vs. Recommended Coverage Levels

California mandates minimum liability coverage of 15/30/5, meaning $15,000 for injuries per person, $30,000 for injuries per accident, and $5,000 for property damage. However, these minimums may not be sufficient to cover significant damages in a serious accident. Experts often recommend higher liability limits, such as 100/300/100 or even more, to provide adequate protection. While collision and comprehensive coverage aren’t mandated, they’re strongly recommended to safeguard your vehicle investment. Similarly, uninsured/underinsured motorist coverage is crucial given the number of uninsured drivers on California roads.

Average Cost of Insurance for Different Car Types in California

The table below presents estimated average annual car insurance costs for different vehicle types in California. These are averages and can vary significantly based on the factors discussed previously. It’s important to obtain personalized quotes from multiple insurers for accurate pricing.

| Car Type | Average Annual Cost (Estimate) | Factors Influencing Cost | Notes |

|---|---|---|---|

| Sedan (Mid-size) | $1200 – $1800 | Driver profile, location, coverage levels | This is a broad range; actual cost varies widely. |

| SUV (Mid-size) | $1500 – $2200 | Larger vehicle, higher repair costs | Generally more expensive to insure than sedans. |

| Pickup Truck | $1800 – $2500 | Higher risk profile, potential for work-related use | Costs can vary significantly based on truck size and features. |

| Sports Car | $2500+ | Higher repair costs, higher risk of accidents | Significantly more expensive due to higher repair costs and increased risk. |

Finding Affordable Insurance Options

Securing affordable car insurance in California requires a strategic approach. Understanding the factors influencing your premium and employing effective cost-saving strategies can significantly reduce your annual expenditure. This section Artikels key strategies and considerations for finding the most competitive rates.

Finding the right balance between coverage and cost is crucial. Several factors play a significant role in determining your insurance premium, and understanding these factors empowers you to make informed decisions to lower your costs.

Strategies for Reducing Car Insurance Premiums

Several effective strategies can help California drivers lower their car insurance premiums. These strategies range from simple adjustments to your driving habits to more involved choices regarding your policy.

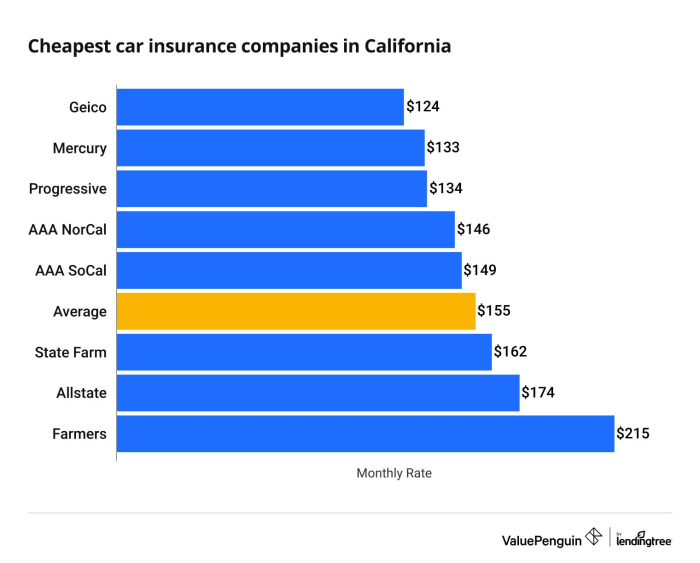

- Shop Around and Compare Quotes: Obtaining quotes from multiple insurance providers is essential. Different companies utilize varying rating algorithms, leading to significant price differences for the same coverage. Online comparison tools can streamline this process.

- Bundle Your Insurance: Combining your car insurance with other types of insurance, such as homeowners or renters insurance, from the same provider often results in discounts.

- Maintain a Good Driving Record: A clean driving record, free of accidents and traffic violations, is a significant factor in determining your premium. Defensive driving and adherence to traffic laws are crucial.

- Consider Increasing Your Deductible: A higher deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, typically translates to lower premiums. Carefully weigh the financial implications before making this decision.

- Choose a Less Expensive Car: The make, model, and year of your vehicle significantly influence your insurance costs. Luxury vehicles and high-performance cars generally command higher premiums due to higher repair costs and increased theft risk.

- Take a Defensive Driving Course: Completing a state-approved defensive driving course can often lead to premium discounts. These courses demonstrate your commitment to safe driving practices.

- Explore Discounts: Many insurance companies offer various discounts, such as good student discounts, multi-car discounts, and discounts for safety features in your vehicle. Inquire about available discounts when obtaining quotes.

Factors Insurance Companies Consider When Determining Rates

Insurance companies use a complex algorithm to calculate premiums. Several key factors contribute to this calculation, and understanding these factors helps you anticipate your premium.

- Vehicle Information: The make, model, year, and safety features of your vehicle significantly influence your premium. Newer cars with advanced safety features often receive lower rates.

- Driving History: Accidents, traffic violations, and at-fault accidents significantly impact your premium. A clean driving record is crucial for securing lower rates.

- Location: Your address and the location where your vehicle is primarily parked affect your premium. Areas with higher accident rates or theft rates typically result in higher premiums.

- Age and Gender: Statistically, younger drivers and certain gender demographics are associated with higher accident rates, which can influence premiums.

- Credit Score: In many states, including California, your credit score is a factor in determining your insurance rates. A higher credit score often correlates with lower premiums.

- Coverage Level: The type and amount of coverage you select (liability, collision, comprehensive, etc.) directly impacts your premium. Higher coverage levels generally lead to higher premiums.

Impact of Driving History and Credit Score on Insurance Costs

Driving history and credit score are two of the most influential factors affecting car insurance rates. A poor driving record or low credit score can lead to significantly higher premiums.

A single at-fault accident can result in a premium increase of hundreds of dollars annually. Multiple accidents or serious violations can lead to even more substantial increases. Similarly, a low credit score can increase premiums by a considerable amount. Insurance companies often view individuals with poor credit as higher risk, leading to higher premiums to offset potential losses.

For example, a driver with a clean driving record might pay $1000 annually, while a driver with one at-fault accident might pay $1500, and a driver with multiple accidents and a low credit score might pay $2500 or more. These figures are illustrative and vary widely based on other factors.

Discounts and Savings

Saving money on car insurance in California is achievable through various discounts and smart strategies. Understanding these options and actively pursuing them can significantly reduce your annual premiums. This section details common discounts and methods for comparing quotes to find the best value.

Discounts for Safe Drivers

Many insurance companies reward safe driving habits with lower premiums. These discounts often involve factors like your driving record, the absence of accidents or traffic violations within a specific timeframe (typically three to five years), and sometimes even your completion of defensive driving courses. The specific criteria and discount percentages vary among insurers, so it’s crucial to check with each company individually. For example, a driver with a clean driving record for five years might receive a 10-20% discount compared to a driver with multiple accidents or speeding tickets. Some companies may also offer discounts for installing telematics devices in your car that monitor your driving behavior.

Discounts for Good Students

Good students often qualify for discounts on their car insurance premiums. This discount typically requires maintaining a certain grade point average (GPA), usually a B average or higher, and being enrolled in a full-time program at an accredited college or university. The student must also be listed on the parent’s policy or be the primary driver of the insured vehicle. The discount percentage varies by insurer, but it can be substantial, potentially reaching 15-25% or more in some cases. Proof of enrollment and academic standing is generally required.

Discounts for Multiple-Car Policies

Insuring multiple vehicles under a single policy with the same company often results in a multi-car discount. This discount recognizes the reduced risk associated with insuring several cars from one household. The discount percentage varies depending on the number of vehicles insured and the insurer, but it can lead to considerable savings, often ranging from 10% to 25% or more on each additional vehicle. For example, insuring two cars might offer a 15% discount on each car compared to insuring them separately.

Bundling Home and Auto Insurance

Bundling your home and auto insurance with the same provider is a common strategy to lower your overall costs. Insurance companies frequently offer discounts for bundling, recognizing the convenience and loyalty of customers who consolidate their insurance needs. The discount percentage varies, but it can be substantial, potentially saving you 10% to 20% or more on your total premium. This savings stems from the administrative efficiencies and reduced risk assessment for the insurance company. It’s important to compare bundled rates from different companies to ensure you’re getting the best deal, as the discounts and specific offerings vary significantly.

Comparing Quotes from Multiple Insurers

Comparing quotes from several insurers is essential for finding the most affordable car insurance. This involves obtaining quotes from at least three to five different companies, providing consistent information across all applications to ensure accurate comparisons. Pay close attention to the coverage details and deductibles associated with each quote, as these factors can significantly impact the overall cost. Use online comparison tools or contact insurers directly to gather quotes. Remember to consider factors beyond price, such as the insurer’s reputation for customer service and claims handling. For example, one insurer might offer a slightly higher premium but have a much better reputation for prompt claims processing, potentially offsetting the higher cost in the long run.

A Step-by-Step Guide for Obtaining and Comparing Car Insurance Quotes

- Gather Necessary Information: Compile your driver’s license information, vehicle information (make, model, year), address, and driving history (accident and violation records).

- Use Online Comparison Tools: Utilize online comparison websites to receive quotes from multiple insurers simultaneously. These tools often allow you to input your information once and receive several quotes for comparison.

- Contact Insurers Directly: Contact insurers directly to obtain quotes, particularly if you have unique circumstances or complex insurance needs. This ensures you’re getting the most accurate and personalized quote.

- Compare Quotes Carefully: Review each quote thoroughly, paying close attention to coverage limits, deductibles, and any additional fees or discounts offered. Compare apples to apples; ensure the coverage levels are similar across all quotes.

- Review Insurer Ratings: Check the financial stability ratings of insurers before making a decision. Look for independent ratings from organizations like A.M. Best or Standard & Poor’s.

- Choose the Best Policy: Select the policy that best meets your needs and budget, balancing cost with the level of coverage and the insurer’s reputation.

Government Programs and Assistance

Finding affordable car insurance in California can be challenging, especially for low-income individuals. Fortunately, several state programs and resources are available to help alleviate the financial burden. These programs offer various forms of assistance, from direct financial aid to guidance on finding affordable insurance options. Understanding these resources is crucial for California drivers seeking cost-effective coverage.

California doesn’t have a specific state-funded program that directly subsidizes car insurance premiums. However, several programs indirectly assist low-income individuals in obtaining affordable coverage. These programs often focus on broader financial assistance or connecting individuals with resources that can help them secure more affordable insurance.

Low-Income Driver Assistance Programs

Several non-profit organizations and government-affiliated programs offer support to low-income drivers seeking affordable car insurance. These programs may provide counseling, resources to compare insurance rates, or connect individuals with insurers offering low-cost plans. Eligibility criteria typically involve demonstrating financial need and meeting specific residency requirements. The level of assistance varies depending on the program and the individual’s circumstances. For example, some programs may offer financial aid for a limited period, while others may provide ongoing support and guidance.

Eligibility Criteria for Assistance Programs

Eligibility requirements vary widely across different assistance programs. Generally, applicants need to demonstrate financial need, often through proof of income, household size, and assets. Residency requirements are also common, usually limiting assistance to California residents. Some programs may prioritize specific groups, such as families with children, the elderly, or individuals with disabilities. Detailed eligibility criteria are usually available on each program’s website. It is important to check the specific requirements of each program before applying.

Relevant Websites and Organizations

Finding the right resources can significantly impact your ability to secure affordable car insurance. Below is a list of relevant websites and organizations that offer aid to low-income drivers in California. It’s crucial to contact these organizations directly to determine their current offerings and eligibility requirements, as programs and their details can change.

- California Department of Insurance (CDI): The CDI website provides general information on car insurance, including consumer guides and resources for finding affordable coverage. They may not directly offer financial assistance, but their resources can be invaluable in navigating the insurance market.

- Legal Aid Organizations: Legal aid societies in California often provide assistance to low-income individuals facing legal challenges, which may include issues related to car insurance. They can offer advice and representation in disputes with insurance companies.

- Community Action Agencies: These local organizations often provide a wide range of services to low-income families, including assistance with finding affordable car insurance. They can connect individuals with relevant resources and programs.

- United Way: United Way 211 is a helpline that connects individuals with local resources, including those that offer assistance with car insurance. They can provide referrals and information based on your specific needs and location.

Understanding Your Policy

Understanding your car insurance policy is crucial for ensuring you have the right coverage and avoiding unexpected costs. A thorough review of your policy documents will empower you to make informed decisions and effectively manage your insurance needs. Failing to understand your policy can lead to gaps in coverage or unnecessary expenses.

Policy Terms and Definitions

Several key terms define the scope and limitations of your car insurance policy. Familiarizing yourself with these terms is vital for a clear understanding of your coverage. Misinterpreting these terms could result in disputes with your insurer when filing a claim.

- Liability Coverage: This covers damages or injuries you cause to others in an accident. It typically includes bodily injury liability and property damage liability. For example, if you cause an accident resulting in $50,000 in medical bills for the other driver and $10,000 in damage to their car, your liability coverage would pay for these expenses, up to your policy limits.

- Collision Coverage: This covers damage to your vehicle caused by a collision with another vehicle or object, regardless of fault. If you hit a tree, collision coverage would pay for the repairs to your car, minus your deductible.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or hail. If your car is stolen, comprehensive coverage would help replace or repair it, subject to your deductible and policy limits.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the at-fault driver doesn’t have sufficient insurance.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

- Premium: This is the amount you pay regularly to maintain your insurance coverage.

Understanding Your Insurance Declaration Page

The declaration page is a summary of your policy’s key information. It’s the first page of your policy and contains vital details you need to know. Carefully reviewing this page ensures you’re aware of your coverage limits, effective dates, and other essential information.

The declaration page typically includes:

- Policy Number: A unique identifier for your insurance policy.

- Named Insured: The individual(s) covered under the policy.

- Vehicle Information: Make, model, year, and VIN of the insured vehicle(s).

- Coverage Limits: The maximum amount your insurer will pay for each type of coverage.

- Premium Amount: The total cost of your insurance policy.

- Effective Dates: The period your policy is in effect.

Common Policy Exclusions and Limitations

This infographic would visually represent common situations not covered by standard auto insurance policies.

An infographic illustrating common policy exclusions and limitations would include:

- Damage caused by wear and tear: A cracked windshield due to age is generally not covered.

- Damage from driving under the influence: Accidents caused by drunk driving are typically excluded.

- Damage from racing or illegal activities: Insurance usually doesn’t cover damage resulting from illegal activities.

- Damage to personal property in your vehicle: Damage to items inside your car is generally not covered by collision or comprehensive coverage.

- Coverage limitations based on location: Some policies may have limitations on coverage in certain geographic areas.

- Specific exclusions based on vehicle modifications: Modifications that haven’t been properly disclosed may void coverage.

Filing a Claim

Filing a car insurance claim in California can seem daunting, but understanding the process can make it significantly less stressful. This section details the steps involved, from initial reporting to final settlement. Remember, prompt and accurate reporting is crucial for a smooth claim process.

Steps Involved in Filing a Car Insurance Claim

After a car accident in California, promptly reporting the incident to your insurance company is paramount. This initiates the claims process and allows your insurer to begin investigating the accident and assessing damages. Failing to report the accident in a timely manner could jeopardize your claim. The steps generally involve reporting the accident, gathering necessary documentation, cooperating with your insurance company’s investigation, and negotiating a settlement.

Gathering Necessary Documentation

Comprehensive documentation is essential for a successful insurance claim. This significantly aids in expediting the claims process and supporting your claim’s validity. Insufficient documentation can lead to delays or even claim denials. Key documents include police reports (if applicable), photos and videos of the accident scene and vehicle damage, medical records documenting injuries, repair estimates from certified mechanics, and contact information for all involved parties and witnesses.

Communicating with Your Insurance Company

Effective communication with your insurance company is vital throughout the claims process. Promptly respond to all inquiries, provide all requested documentation, and keep detailed records of all communications. Maintain a professional and courteous tone in all interactions. If you have questions or concerns, don’t hesitate to contact your claims adjuster directly or your insurance company’s customer service department. Keeping detailed records of all communication, including dates, times, and the names of individuals you spoke with, is crucial.

Claim Filing Process Flowchart

The claim filing process can be visualized as a series of sequential steps:

1. Accident Occurs: The initial incident triggering the need for a claim.

2. Report to Insurance Company: Immediately notify your insurance company of the accident, usually by phone.

3. Gather Documentation: Collect all relevant documentation as described previously.

4. File a Claim Form: Complete and submit the necessary claim forms provided by your insurer.

5. Insurance Company Investigation: Your insurer investigates the accident, possibly including contacting witnesses and reviewing police reports.

6. Damage Assessment: Your insurer assesses the damage to your vehicle and any medical expenses.

7. Settlement Negotiation: You and your insurer negotiate a settlement amount. This may involve multiple discussions.

8. Claim Settlement: Once an agreement is reached, the insurance company disburses the settlement funds.

Closing Notes

Finding affordable car insurance in California doesn’t have to be a daunting task. By understanding the factors influencing your rates, actively seeking discounts, and comparing quotes from multiple providers, you can significantly reduce your premiums without compromising on essential coverage. Remember to carefully review your policy, understand its terms, and utilize available resources to secure the best possible protection for your vehicle and your financial well-being. Armed with the right knowledge, you can confidently navigate the California car insurance landscape and find a policy that suits your needs and budget.

FAQ Summary

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility required by the state of California for drivers with certain driving violations, such as DUIs. It’s not a type of insurance itself, but rather a certificate filed with the DMV demonstrating you have the minimum required liability coverage.

Can I pay my car insurance monthly?

Most insurance companies offer monthly payment plans, often with a small additional fee. However, it’s advisable to inquire directly with your chosen provider about their payment options.

How often can I get a new car insurance quote?

You can obtain new car insurance quotes as often as you like. Shopping around regularly is recommended to ensure you’re getting the best possible rate.

What happens if I cancel my car insurance policy?

Cancelling your policy can result in a lapse in coverage and may impact your ability to obtain insurance in the future. You may also incur cancellation fees.