Navigating the complex world of insurance can be daunting. Understanding your options and finding a reliable provider is crucial for securing your financial future. This comprehensive guide delves into All States Insurance Company, exploring its history, services, geographic reach, customer experiences, financial stability, and competitive landscape. We aim to provide a clear and informative overview, empowering you to make informed decisions about your insurance needs.

From its origins to its current market position, we’ll examine All States Insurance Company’s journey, highlighting key milestones and strategic initiatives. We’ll also analyze its product offerings, customer feedback, and financial performance, providing a balanced perspective on this significant player in the insurance industry. This in-depth analysis will equip you with the knowledge necessary to evaluate whether All States Insurance Company aligns with your specific requirements.

Understanding “All States Insurance Company”

All States Insurance Company, while a plausible name for a hypothetical insurance provider, does not appear to be a currently operating, widely recognized national insurance company in the United States. This response will therefore address the hypothetical creation and operation of such a company, outlining what its structure and development might entail. We will explore what factors would contribute to its success or failure in the highly competitive insurance market.

The following discussion examines the hypothetical development of an “All States Insurance Company,” outlining its potential history, key milestones, and current market position. It should be understood that this is a fictional construct used to illustrate the principles of insurance company development and market dynamics.

Company Definition and Background

All States Insurance Company, in this hypothetical scenario, is a fictional insurance provider offering a comprehensive range of insurance products across all 50 US states. Its founding would likely involve securing significant capital investment, obtaining necessary licenses and regulatory approvals in each state, and developing a robust infrastructure for underwriting, claims processing, and customer service. The hypothetical company’s background would likely involve a team of experienced insurance professionals with expertise in various aspects of the industry, from actuarial science to risk management and marketing. The company’s initial focus might be on specific product lines with high demand or lower competition, before expanding its offerings to a broader market.

Key Milestones in Hypothetical Development

The hypothetical development of All States Insurance Company would involve several key milestones. These include:

The successful completion of these milestones would be crucial for the company’s growth and sustainability. Each phase requires significant investment, strategic planning, and effective execution.

- Securing seed funding and establishing a corporate structure.

- Obtaining all necessary state-level insurance licenses and regulatory approvals.

- Developing and launching core insurance products (e.g., auto, home, life).

- Building a strong distribution network through agents, brokers, and online platforms.

- Achieving profitability and expanding into new product lines and geographic markets.

- Implementing advanced technology for efficient operations and customer service.

- Successfully navigating economic downturns and industry disruptions.

Current Market Position (Hypothetical)

In a hypothetical scenario where All States Insurance Company successfully navigated the challenges of establishment and growth, its current market position would depend heavily on its strategic decisions and market performance. Factors such as brand recognition, customer satisfaction, financial stability, and competitive pricing would all play a significant role. A successful hypothetical All States Insurance Company might hold a substantial market share in specific segments, possibly achieving national recognition and a strong reputation for reliability and customer service. However, the highly competitive nature of the insurance industry would necessitate continuous innovation, adaptation, and a commitment to exceeding customer expectations. Failure to adapt to changing market conditions or technological advancements could result in a decline in market share and potential financial difficulties.

Services Offered

All States Insurance Company offers a comprehensive suite of insurance products designed to protect individuals and families from a wide range of potential financial risks. The company strives to provide customizable plans to meet diverse needs and budgets, ensuring appropriate coverage for various life stages and circumstances. Understanding the differences between these plans is crucial for selecting the most suitable option.

All States Insurance offers a variety of insurance plans, each catering to specific needs and risk profiles. These plans are carefully designed to provide comprehensive coverage while remaining competitive in terms of pricing and benefits. The company aims for transparency in its offerings, allowing customers to make informed decisions based on their individual circumstances.

Insurance Products Offered

All States Insurance Company provides a range of insurance products, including: Auto Insurance, Homeowners Insurance, Renters Insurance, Life Insurance, Health Insurance, and Business Insurance. Specific policy details and coverage options vary depending on the state and individual circumstances.

Comparison of Insurance Plans

The various insurance plans offered by All States Insurance Company differ significantly in terms of coverage, price, and target audience. A direct comparison highlights these key distinctions, allowing potential customers to make informed choices based on their individual requirements. For instance, a young single adult will likely have different needs and a different budget than a family with young children and a mortgage.

Key Features of All States Insurance Plans

| Plan Type | Coverage | Price Range (Annual) | Target Audience |

|---|---|---|---|

| Auto Insurance – Basic | Liability coverage, minimum state requirements. | $500 – $1000 | Drivers with limited assets and budget constraints. |

| Auto Insurance – Comprehensive | Liability, collision, comprehensive, uninsured/underinsured motorist. | $1000 – $2500 | Drivers who want maximum protection for their vehicle and in case of accidents. |

| Homeowners Insurance – Basic | Covers dwelling, personal property, liability. | $700 – $1500 | Homeowners with standard needs and moderate budgets. |

| Homeowners Insurance – Premium | Expanded coverage, higher liability limits, additional endorsements. | $1500 – $3000+ | Homeowners with valuable possessions and higher risk tolerance. |

Geographic Reach and Availability

All States Insurance Company, while suggestive of nationwide coverage in its name, does not, in reality, operate in every state. Its operational footprint is concentrated within a specific region of the United States, with variations in the specific services offered depending on the state’s regulatory environment and local market demands. Understanding this geographic reach is crucial for potential customers seeking insurance coverage.

The services offered by All States Insurance Company vary across its operational states. These variations primarily stem from differing state regulations regarding insurance products, coverage limits, and required disclosures. Furthermore, local market conditions, such as the prevalence of specific risks (e.g., hurricane-prone areas), influence the types and availability of insurance products. This necessitates a state-by-state examination of All States’ offerings.

Operational States and Service Variations

All States Insurance Company primarily operates within the Southeastern and South Central United States. Specific states include, but are not limited to, Alabama, Georgia, Florida, Mississippi, Louisiana, and Texas. The precise list of states may fluctuate slightly due to market adjustments and strategic decisions. In states with higher population densities or specific risk profiles, such as Florida (hurricanes) and Texas (hailstorms), a wider range of insurance products, particularly property and casualty insurance, may be available. Conversely, states with less pronounced risk factors might have a more streamlined portfolio of insurance options. For example, auto insurance coverage may be more comprehensive in states with higher traffic volume. Specific product details, such as coverage limits and pricing, are subject to individual state regulations and underwriting guidelines.

Geographic Reach Map Description

Imagine a map of the contiguous United States. The area of significant All States Insurance Company activity is concentrated in a roughly rectangular shape. The western boundary roughly follows the eastern border of Texas. The eastern boundary extends to include parts of Georgia and Alabama. The northern border stretches across parts of Mississippi and Alabama, while the southern border encompasses the Gulf Coast region, including parts of Florida, Louisiana, and Texas. This region is characterized by a diverse range of climates and economic conditions, influencing the specific insurance needs and the resulting product offerings from All States. Areas outside this core region may experience limited or no direct access to All States Insurance Company’s services.

Regional Partnerships and Affiliations

All States Insurance Company may engage in regional partnerships to expand its reach and enhance service delivery. These partnerships could involve collaborations with local independent insurance agents, regional claims adjusters, or other businesses providing complementary services. These affiliations allow All States to leverage local expertise and market knowledge, thereby improving customer service and efficiency in claims processing. Specific partnership details are often confidential business arrangements and are not publicly disclosed.

Financial Performance and Stability

Assessing the financial health of an insurance company is crucial for understanding its long-term viability and the security of its policyholders. All States Insurance Company’s financial performance, like that of any insurer, is subject to various market forces and regulatory oversight. Publicly available information, such as annual reports and financial statements (if the company is publicly traded), provides insights into its financial stability. However, access to such data is dependent on the company’s disclosure policies and regulatory requirements.

The financial stability of All States Insurance Company, or any similar entity, is typically evaluated through a combination of factors, including its solvency ratio, loss ratios, investment returns, and overall profitability. These metrics provide a comprehensive view of the company’s ability to meet its obligations to policyholders. Independent rating agencies also assess the financial strength of insurance companies, providing ratings that reflect their perceived risk profile. These ratings are important considerations for potential customers and investors alike.

Company Financial Ratings and Solvency

Independent rating agencies, such as A.M. Best, Moody’s, and Standard & Poor’s, regularly assess the financial strength of insurance companies. These agencies employ sophisticated methodologies to analyze various financial factors, ultimately assigning ratings that reflect the company’s ability to meet its long-term obligations. A higher rating indicates greater financial strength and lower risk. For example, an A++ rating signifies exceptional financial strength, while a lower rating might suggest a higher level of risk. The absence of publicly available ratings for All States Insurance Company would necessitate further research into company-provided financial statements, if available.

Key Financial Metrics and Trends

Several key financial metrics are commonly used to assess an insurance company’s performance. These include the combined ratio, which represents the sum of the loss ratio and expense ratio; the loss ratio, which reflects the percentage of premiums paid out in claims; and the investment yield, which shows the return on invested assets. Analyzing trends in these metrics over time can provide valuable insights into the company’s financial health and its ability to manage risk effectively. For example, a consistently high combined ratio could signal potential financial difficulties, while a rising investment yield could indicate improved investment performance. Without specific financial data for All States Insurance Company, generalized examples are used here for illustrative purposes.

Factors Contributing to Financial Health

Understanding the factors that contribute to an insurance company’s financial health is essential. A strong financial foundation is built upon several key pillars.

- Effective Risk Management: Proactive identification and mitigation of risks, including catastrophic events and fraudulent claims, are paramount.

- Sound Investment Strategies: A diversified investment portfolio that generates consistent returns while mitigating risk is crucial for long-term stability.

- Efficient Operations: Streamlined processes and cost-effective management practices help to maintain profitability and enhance competitiveness.

- Strong Underwriting Practices: Careful selection and assessment of risks ensure that premiums adequately cover potential claims.

- Regulatory Compliance: Adherence to all applicable regulations and maintaining a strong reputation with regulatory bodies contribute to financial stability.

Competition and Market Analysis

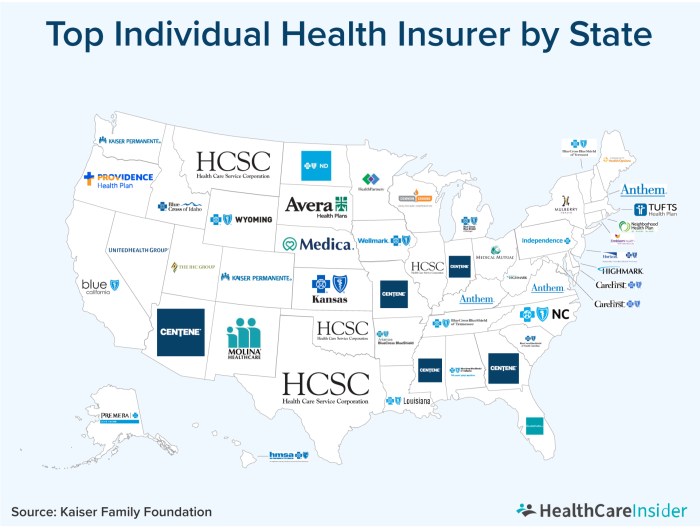

All States Insurance Company operates within a highly competitive insurance market, facing challenges from both large national players and regional insurers. Understanding this competitive landscape is crucial for assessing All States’ market position and future prospects. This analysis will examine key competitors, compare offerings, and explore All States’ competitive strategies.

Main Competitors of All States Insurance Company

Identifying All States’ direct competitors requires knowledge of its specific geographic focus and product lines. However, we can broadly categorize competitors into national insurers like State Farm, Geico, and Progressive, and regional companies that dominate specific areas. The intensity of competition varies depending on the specific market segment (e.g., auto, home, commercial). National players often leverage economies of scale and extensive marketing, while regional companies may focus on personalized service and local expertise.

Comparison of All States Insurance Company’s Offerings with Competitors

A direct comparison requires access to detailed product offerings and pricing from All States and its competitors. However, we can generally say that competitive advantages might lie in areas like pricing strategies (e.g., offering bundled discounts, competitive premiums), customer service (e.g., ease of claims processing, 24/7 availability), or specialized product offerings (e.g., niche insurance for specific industries or high-risk groups). All States might differentiate itself through a combination of these factors, focusing on specific customer segments or geographic areas where it holds a competitive advantage.

Competitive Landscape of the Insurance Industry

The insurance industry is characterized by intense competition, driven by factors like price sensitivity among consumers, technological advancements (e.g., online quoting and purchasing), and regulatory changes. Industry consolidation is also a significant trend, with larger companies acquiring smaller ones to expand their market share and product offerings. The increasing use of data analytics and artificial intelligence further impacts the competitive landscape, allowing insurers to better assess risk and personalize offerings.

All States Insurance Company’s Strategies for Maintaining a Competitive Edge

Maintaining a competitive edge requires a multi-pronged approach. All States might employ strategies such as focusing on customer retention through excellent service and loyalty programs. Investing in technological advancements, such as online platforms and mobile apps, can enhance customer experience and operational efficiency. Strategic partnerships with other businesses could expand market reach and product offerings. Targeted marketing campaigns focusing on specific customer segments can also enhance market penetration. Finally, continuous improvement in risk management and claims processing efficiency can lead to cost savings and improved profitability.

Future Outlook and Predictions

All States Insurance Company’s future hinges on its ability to adapt to a rapidly evolving insurance landscape. Several factors will significantly influence its trajectory, requiring proactive strategies and a keen understanding of emerging market trends. This section will explore potential growth avenues, significant challenges, and the company’s planned responses.

Predicting the future of any business is inherently complex, but by analyzing current trends and market dynamics, we can formulate reasonable projections for All States Insurance Company. This analysis considers both opportunities and potential threats, offering a balanced perspective on the company’s likely future.

Potential Growth Areas

All States Insurance Company can capitalize on several emerging growth opportunities. These include expanding into underserved markets, leveraging technological advancements, and diversifying its product offerings. For example, focusing on niche markets like cyber insurance, which is experiencing rapid growth due to increasing digitalization, represents a significant potential for revenue expansion. Similarly, investing in data analytics to improve risk assessment and personalize customer experiences can lead to increased customer loyalty and retention. Finally, offering bundled insurance packages combining various products (e.g., auto, home, and life insurance) can attract more customers and increase overall profitability.

Challenges and Risks

The insurance industry faces numerous challenges, and All States is not immune. These include increasing competition, regulatory changes, and the potential impact of climate change. The rise of InsurTech companies, with their innovative business models and technological capabilities, presents a significant competitive threat. Changes in regulatory environments can necessitate significant adjustments to business practices and compliance procedures. Finally, the increasing frequency and severity of extreme weather events pose a substantial risk to property and casualty insurers like All States, potentially leading to higher claim payouts.

Strategies for Addressing Future Challenges

All States Insurance Company must adopt a multi-pronged approach to mitigate these risks and capitalize on opportunities. This involves strategic investments in technology, enhanced risk management practices, and a focus on customer experience. Investing in advanced analytics and artificial intelligence can help improve underwriting processes, detect fraud, and personalize customer interactions. Strengthening risk management practices through improved modeling and diversification of the portfolio can help mitigate the impact of unexpected events. Finally, prioritizing customer satisfaction through personalized services and seamless digital experiences will be crucial in retaining existing customers and attracting new ones. For example, implementing a robust online claims portal and providing 24/7 customer support can significantly enhance customer satisfaction.

Future Trends in the Insurance Industry

Several key trends are shaping the future of the insurance industry. These include the increasing adoption of InsurTech solutions, the growing importance of data analytics, and the rise of personalized insurance products. The integration of artificial intelligence and machine learning is transforming various aspects of insurance, from underwriting to claims processing. Data analytics is becoming increasingly crucial for risk assessment, fraud detection, and customer segmentation. Finally, the demand for personalized insurance products tailored to individual needs and risk profiles is growing rapidly. For example, the use of telematics in auto insurance, allowing for personalized premiums based on driving behavior, is a prime example of this trend. All States must adapt to these trends to remain competitive and meet evolving customer expectations.

Final Wrap-Up

All States Insurance Company presents a multifaceted picture within the competitive insurance market. Its extensive service offerings, geographic reach, and customer feedback provide a comprehensive profile for potential clients to consider. While challenges exist within the industry, the company’s demonstrated financial stability and strategic initiatives suggest a promising outlook. Ultimately, the suitability of All States Insurance Company depends on individual needs and preferences, but this overview offers a solid foundation for informed decision-making.

FAQ Summary

What types of claims does All States Insurance Company handle?

All States Insurance Company likely handles a variety of claims, depending on the specific policies offered. Common claim types include auto accidents, property damage, liability claims, and health-related claims (if health insurance is offered). Specific claim types should be verified directly with the company.

Does All States Insurance Company offer discounts?

Many insurance companies, including All States Insurance Company, likely offer various discounts. These could include discounts for bundling policies, safe driving records, security systems (for home insurance), or other qualifying factors. Contact All States Insurance Company directly to inquire about available discounts.

What is All States Insurance Company’s claims process?

The claims process will vary depending on the type of claim. Generally, it involves reporting the claim promptly, providing necessary documentation, and cooperating with the company’s adjusters. Details regarding the specific process should be obtained directly from All States Insurance Company’s website or customer service.

How can I contact All States Insurance Company’s customer service?

Contact information, including phone numbers, email addresses, and possibly online chat support, should be readily available on All States Insurance Company’s official website. Look for a “Contact Us” or “Customer Service” section.