Navigating the insurance claim process can be stressful, but understanding how to contact Allstate efficiently can significantly ease the burden. This guide provides a clear path to finding the appropriate Allstate insurance claim phone number for your specific needs, outlining various methods and addressing common challenges. We’ll explore different claim types, alternative contact methods, and accessibility features to ensure a smooth and informed experience.

From locating the correct number through various channels like the Allstate website, mobile app, and policy documents to understanding the nuances of different claim types and their associated phone numbers, this guide offers a comprehensive overview of the Allstate claim process. We’ll also delve into the steps involved in filing a claim, potential hurdles, and alternative contact methods for a complete picture of how to connect with Allstate effectively.

Finding the Allstate Claim Phone Number

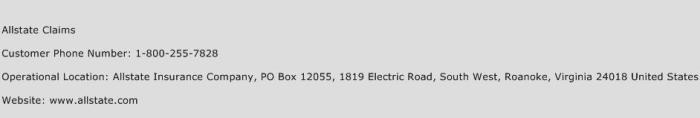

Locating the Allstate insurance claim phone number is a crucial step in the claims process. Having quick access to this number can significantly expedite the reporting and handling of your claim. Several methods exist to find this number, each with varying degrees of ease and speed.

Methods for Locating the Allstate Claim Phone Number

Several convenient methods exist for finding the Allstate claim phone number. These include using their official website, utilizing the Allstate mobile app, and referring to your insurance policy documents. Each method offers a unique approach to accessing this important contact information.

Detailed Steps for Finding the Allstate Claim Phone Number

The process of locating the Allstate claim phone number varies slightly depending on the method used. Below, we detail the steps involved in each method.

Comparison of Methods: Ease and Speed

The ease and speed of locating the Allstate claim phone number depend significantly on the method chosen. While the mobile app generally provides the quickest access, the website offers a more comprehensive resource, including FAQs and additional contact options. Policy documents, though readily available, may require more time to locate the specific number.

| Method | Steps | Ease of Use | Speed |

|---|---|---|---|

| Allstate Website | 1. Navigate to the Allstate website. 2. Look for a “Claims” or “File a Claim” section. 3. This section usually contains a phone number or a link to a claims assistance page with the number prominently displayed. | Easy; clear navigation usually guides users to the claims section. | Moderate; requires navigating a website. |

| Allstate Mobile App | 1. Open the Allstate mobile app. 2. Locate the “Claims” or “File a Claim” section (often easily accessible from the main menu). 3. The claim phone number is usually prominently displayed. | Very Easy; designed for quick access to key information. | Fast; immediate access once the app is opened. |

| Policy Documents | 1. Locate your Allstate insurance policy documents (either physical or digital). 2. Search for the contact information section, which typically includes the claims phone number and other important contact details. | Moderate; requires searching through documents. | Slow; may require significant time spent searching. |

Understanding Different Claim Types and Phone Numbers

Allstate offers a range of insurance products, and understanding how to file a claim for each differs slightly. While a single, general customer service number may initially direct you, efficient claim processing often involves contacting a specialized department depending on the nature of your claim. This section clarifies the various claim types and associated contact methods.

Allstate handles claims for various insurance policies. Knowing which type of claim you need to file will help you reach the appropriate department quickly and efficiently. This will streamline the claims process and ensure a smoother experience.

Allstate Claim Types and Contact Information

The following list details the common types of insurance claims Allstate handles and whether each has a dedicated phone number. Note that Allstate’s website and mobile app are also valuable resources for starting the claims process.

- Auto Claims: Typically, auto claims have a dedicated phone number or a specific section within the Allstate app or website. This allows for specialized handling of accident reports, vehicle damage assessments, and related processes. Contacting the auto claims department directly usually leads to faster processing.

- Homeowners Claims: Similar to auto claims, homeowners insurance claims often have a dedicated contact method. This ensures specialized handling for issues like property damage from weather events, theft, or fire. The process may involve a claims adjuster visiting your property.

- Renters Claims: Renters insurance claims usually follow a similar process to homeowners claims, with a dedicated contact method for reporting incidents and initiating the claims process. The specifics of coverage and the claims process may differ slightly from homeowners insurance.

- Life Insurance Claims: Life insurance claims typically involve a more involved process and often have a separate department and contact information. This often requires more documentation and a more detailed review process compared to property or auto claims.

- Umbrella Claims: Umbrella insurance claims, which provide excess liability coverage, usually involve a more complex process and require contacting a specialized claims department.

Determining the Correct Allstate Claim Phone Number

A flowchart can simplify the process of finding the appropriate contact information. While Allstate may consolidate some numbers, the following illustrates a general approach.

Flowchart:

Start –> What type of claim? –> Auto? (Yes: Auto Claims Number; No: Continue) –> Homeowners/Renters? (Yes: Homeowners/Renters Claims Number; No: Continue) –> Life Insurance? (Yes: Life Insurance Claims Number; No: Umbrella Claims Number or General Customer Service).

Navigating the Allstate Claim Process via Phone

Filing an Allstate insurance claim by phone is a straightforward process, but understanding the steps involved and the information required will ensure a smoother experience. This section Artikels the typical procedure, necessary information, and potential challenges you might encounter. Remember to always have your policy information readily available.

The process generally involves a series of steps, each requiring specific information from you. Accurate and complete information provided upfront will expedite the claim process and prevent delays. While Allstate strives for efficiency, unforeseen circumstances can occasionally lead to complications.

Information Requested During a Phone Claim

The Allstate representative will need several key pieces of information to process your claim. This information helps them verify your identity, understand the circumstances of the incident, and assess the damage or loss. Providing this information promptly and accurately will streamline the process.

Expect to be asked for details such as your policy number, the date and time of the incident, a description of what happened, the location of the incident, and the names and contact information of any involved parties. Depending on the type of claim, you may also be asked to provide details about the damaged property or the extent of your injuries.

Steps Involved in Filing a Phone Claim with Allstate

The steps for filing a claim may vary slightly depending on the type of claim (auto, home, etc.), but the general process is consistent. Following these steps will help you navigate the process efficiently.

- Call Allstate’s claims line: Locate the appropriate claim phone number based on your policy type. Be prepared to wait on hold; call volumes can fluctuate.

- Provide your policy information: The representative will ask for your policy number, your name, and possibly your date of birth to verify your identity.

- Report the incident: Clearly and concisely explain what happened, including the date, time, and location of the incident. Be as detailed as possible without unnecessary embellishment.

- Answer questions about the incident: The representative will ask clarifying questions to understand the circumstances surrounding your claim. Be prepared to provide additional information, such as witness details if applicable.

- Provide details of damages or injuries: Describe the extent of the damage to your property or the nature and extent of your injuries, including medical treatment received. If possible, have photos or documentation ready.

- Receive a claim number: Once the initial report is complete, you will receive a unique claim number. Keep this number for future reference.

- Follow up instructions: The representative will explain the next steps in the process, which may include submitting additional documentation or scheduling an inspection.

Potential Challenges During a Phone Claim

While most phone claims proceed smoothly, several potential challenges can arise. Being prepared for these possibilities can mitigate their impact.

Long wait times are common, especially during peak hours. Inaccurate or incomplete information can lead to delays in processing your claim. Difficulties in communicating effectively with the representative due to language barriers or technical issues can also create obstacles. Finally, disputes over the extent of damages or liability can complicate the process.

Alternative Contact Methods for Allstate Claims

While the Allstate claims phone number offers immediate assistance, several alternative methods provide flexibility for reporting and managing your claim. These options cater to different preferences and circumstances, offering varying levels of convenience, speed, and efficiency. Choosing the right method depends on your individual needs and the complexity of your claim.

Allstate’s Online Claim Portal

The Allstate online claim portal offers a convenient way to report and track your claim’s progress. It allows for self-service options, reducing the need for phone calls. Users can upload supporting documents, review claim status updates, and communicate with their adjuster through secure messaging.

| Method | Description | Pros | Cons |

|---|---|---|---|

| Online Portal | Access Allstate’s website to report, track, and manage your claim online. This involves creating an account (if you don’t already have one) and navigating to the claims section. | Convenient, accessible 24/7, allows for document uploads, tracks claim progress, secure messaging with adjuster. | Requires internet access and computer/mobile device literacy. May not be suitable for complex claims or those requiring immediate phone assistance. |

Submitting a Claim via Mail

Allstate also accepts claims submitted via mail. This method is suitable for individuals who prefer traditional communication or lack internet access. However, it is generally the slowest method.

| Method | Description | Pros | Cons |

|---|---|---|---|

| Print and complete the necessary claim forms, gather supporting documentation (photos, police reports, etc.), and mail the entire package to the address specified on the form or Allstate’s website. | No internet access required. May be preferred by some for documentation purposes. | Slowest method, lacks real-time updates, requires physical mailing and potential postage costs. More prone to delays and potential loss of documents. |

Contacting Allstate via Email

While not typically used for initial claim reporting, Allstate provides email addresses for specific inquiries or follow-ups. This method can be helpful for non-urgent questions or clarification requests after a claim has been filed. Response times may vary.

| Method | Description | Pros | Cons |

|---|---|---|---|

| Locate the appropriate Allstate email address for claims inquiries (this information may be found on their website or within your policy documents). Compose a detailed email including your policy number, claim number (if applicable), and the nature of your inquiry. | Convenient for non-urgent questions or follow-ups. Provides written record of communication. | Not suitable for immediate assistance or urgent matters. Response times can be slow and may not be as efficient for complex issues. |

Accessibility Features for Claim Reporting

Allstate recognizes the importance of providing accessible services to all customers, including those with disabilities. They offer a range of features designed to make the claim reporting process easier and more inclusive for individuals with diverse needs. These features aim to ensure a fair and equitable experience for everyone, regardless of their abilities.

Allstate’s commitment to accessibility extends to various aspects of the claim reporting process, from initial contact to final resolution. This commitment is reflected in the diverse accessibility features available to claimants.

Alternative Communication Methods

Allstate provides multiple ways to report a claim, accommodating individuals who may find traditional phone calls challenging. These options ensure that everyone has a convenient and accessible method to initiate the claims process. For example, individuals who are deaf or hard of hearing can utilize Allstate’s robust video relay service or text-based communication options. Those with speech impairments may find the written communication channels more suitable. The availability of these options ensures that communication barriers do not impede the reporting of a claim.

Large Print and Screen Reader Compatibility

For individuals with visual impairments, Allstate’s online claim reporting system and supporting documents are designed to be compatible with screen readers. This allows users to access and navigate the system using assistive technology. Furthermore, Allstate offers the option to receive claim-related documents in large print, enhancing readability and comprehension for those with low vision. The combination of screen reader compatibility and large print options ensures that visual information is accessible to a wider range of users.

Simplified Language and Navigation

Allstate’s claim reporting process is designed with clear and concise language to minimize confusion and improve understanding. The online portal features intuitive navigation, allowing users to easily find the information they need. This simplified approach benefits all users, but it is particularly beneficial for individuals with cognitive disabilities who may find complex language or navigation challenging. This streamlined approach aims to reduce potential barriers and make the process as straightforward as possible.

Final Review

Successfully filing an Allstate insurance claim hinges on readily accessing the correct contact information and understanding the process. This guide has equipped you with the knowledge and resources to efficiently locate the appropriate Allstate insurance claim phone number, navigate the claim process, and utilize alternative contact methods when necessary. Remember to keep your policy information handy and familiarize yourself with Allstate’s accessibility features for a smoother experience. By utilizing the strategies Artikeld here, you can confidently manage your insurance claim with Allstate.

Detailed FAQs

What if I don’t have my Allstate policy number?

You’ll likely need to provide alternative identifying information, such as your name, address, and date of birth, to verify your identity and access your policy information. Be prepared to answer security questions.

Are Allstate’s phone lines available 24/7?

Allstate’s availability varies depending on the claim type and the specific phone number. Check their website or app for specific hours of operation for the number you are calling.

Can I file a claim online instead of by phone?

Yes, Allstate offers an online portal for filing claims, often providing a faster and more convenient option. The availability of online filing varies depending on the claim type.

What happens if my call is disconnected during the claim process?

Allstate’s system may provide a reference number. If not, call back and explain the situation; they should be able to locate your claim based on the information you provided initially.