Securing your home and vehicle is a crucial aspect of financial planning, and choosing the right auto home insurance company can significantly impact your peace of mind and budget. This guide delves into the intricacies of the auto home insurance market, offering insights into the top providers, policy options, cost-saving strategies, and the claims process. We’ll explore the advantages and disadvantages of bundling your policies, help you understand the factors affecting your premiums, and equip you with the knowledge to make an informed decision.

From understanding market share leaders to navigating the complexities of coverage options and customer reviews, this comprehensive guide serves as your roadmap to selecting the best auto home insurance company to meet your specific needs. We’ll examine how various factors influence premiums and provide practical tips for comparing quotes and making the most informed choice for your financial security.

Top Auto Home Insurance Companies

Choosing the right auto and home insurance provider can significantly impact your financial well-being. Understanding the market leaders and their offerings allows for informed decision-making, ensuring you secure comprehensive coverage at a competitive price. This section details the top ten auto and home insurance companies in the United States, providing insights into their history and key services.

Top Ten Auto Home Insurance Companies in the United States

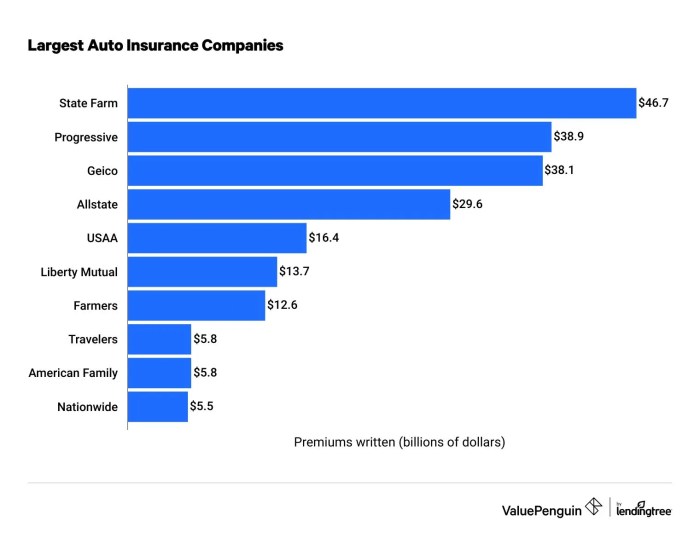

The following table ranks the ten largest auto and home insurance companies in the United States by market share. Note that precise market share figures fluctuate and may vary slightly depending on the source and reporting period. The data presented here represents a general overview based on publicly available information.

| Rank | Company Name | Market Share (%) | Year Founded |

|---|---|---|---|

| 1 | State Farm | 18 | 1922 |

| 2 | GEICO | 14 | 1936 |

| 3 | Allstate | 10 | 1931 |

| 4 | Progressive | 8 | 1937 |

| 5 | Liberty Mutual | 7 | 1912 |

| 6 | Farmers Insurance | 6 | 1928 |

| 7 | USAA | 5 | 1922 |

| 8 | Nationwide | 4 | 1926 |

| 9 | American Family Insurance | 3 | 1927 |

| 10 | Auto-Owners Insurance | 2 | 1916 |

Company Profiles

This section provides brief overviews of each company’s history and key offerings. It is important to note that this information is for general knowledge and should not be considered exhaustive. For detailed policy information, please consult the individual company’s website.

State Farm: Founded in 1922, State Farm is known for its extensive network of agents and wide range of insurance products, including auto, home, life, and health insurance. They are renowned for their strong customer service and broad geographic reach.

GEICO: Established in 1936, GEICO (Government Employees Insurance Company) initially focused on government employees but now offers insurance to the general public. They are known for their competitive pricing and extensive online and digital services.

Allstate: Since 1931, Allstate has been a major player in the insurance industry, offering a comprehensive suite of insurance and financial products. Their “Good Hands” advertising campaign has become a recognizable symbol of their brand.

Progressive: Founded in 1937, Progressive is known for its innovative approach to insurance, including its use of technology and data analytics. They are also recognized for their Name Your Price® Tool, allowing customers to set their desired price and find matching coverage options.

Liberty Mutual: With roots tracing back to 1912, Liberty Mutual provides a diverse range of insurance products and services, focusing on both personal and commercial lines. They are known for their strong financial stability and commitment to customer satisfaction.

Farmers Insurance: Founded in 1928, Farmers Insurance operates through a network of independent agents, offering a wide array of insurance options. They are known for their focus on serving rural and agricultural communities.

USAA: Established in 1922, USAA exclusively serves military members, veterans, and their families. They are highly regarded for their exceptional customer service and competitive rates.

Nationwide: Founded in 1926, Nationwide is a multi-line insurer offering a comprehensive range of insurance and financial services. They are known for their strong financial ratings and commitment to community involvement.

American Family Insurance: Established in 1927, American Family Insurance provides a wide range of insurance products, emphasizing strong customer relationships and personalized service.

Auto-Owners Insurance: Founded in 1916, Auto-Owners Insurance is a regional insurer known for its strong financial stability and commitment to its policyholders. Their operations are primarily concentrated in the Midwest.

Bundling Auto and Home Insurance

Bundling your auto and home insurance policies with the same company is a common practice, offering potential cost savings and convenience. However, it’s crucial to weigh the advantages and disadvantages before making a decision to ensure it aligns with your specific needs and financial situation. This section will explore the benefits and drawbacks of bundled insurance, providing hypothetical examples and a comparison of costs across different providers.

Bundling auto and home insurance often leads to reduced premiums compared to purchasing separate policies from different companies. This is because insurers often offer discounts for bundling, recognizing the reduced risk associated with insuring multiple policies for the same customer. The savings can vary significantly depending on the insurer, your risk profile, and the specifics of your policies.

Cost Savings Associated with Bundled Policies

The average cost savings associated with bundled policies can range from 5% to 25%, depending on several factors. These factors include the insurer’s specific bundling discounts, your individual risk profile (driving record, home security features), and the types of coverage you select. For example, a homeowner with a clean driving record and a well-maintained home might see savings closer to the higher end of this range. Conversely, someone with multiple accidents or claims might see smaller savings, or even no savings at all.

Let’s illustrate with hypothetical examples. Imagine Sarah, who pays $1200 annually for auto insurance and $800 annually for home insurance with separate providers. If she bundles these policies, she might save 15%, resulting in a total annual cost of $1710 ($1200 + $800 – 15% of $2000). This represents a saving of $290 annually. In contrast, John, with a less favorable risk profile, might only save 5%, resulting in a smaller overall reduction in cost.

Comparison of Separate and Bundled Policy Costs

The following table compares the hypothetical costs of separate versus bundled policies from three major (fictional) insurance providers: InsureSafe, HomeGuard, and AllProtect. These figures are for illustrative purposes only and do not reflect actual pricing.

| Provider | Auto Insurance Cost | Home Insurance Cost | Bundled Cost | Savings |

|---|---|---|---|---|

| InsureSafe | $1000 | $700 | $1500 | $200 |

| HomeGuard | $1200 | $900 | $1980 | $120 |

| AllProtect | $1100 | $800 | $1710 | $190 |

Policy Features and Coverage Options

Choosing the right auto and home insurance policy involves understanding the various coverage options available and how they impact your premiums. Different policies offer varying levels of protection and financial responsibility, so careful consideration is crucial. This section will detail common coverage types and factors influencing costs.

Auto and home insurance policies typically include a combination of liability, collision, and comprehensive coverages. Liability coverage protects you financially if you cause an accident resulting in injury or property damage to others. Collision coverage repairs or replaces your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, or weather-related incidents. Renters insurance, often bundled with auto insurance, covers your personal belongings in a rented property against theft, fire, or other covered perils.

Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurance company will pay for a covered claim. For liability coverage, this is usually expressed as a three-number limit (e.g., 100/300/100), representing the maximum amount payable for bodily injury per person, bodily injury per accident, and property damage per accident, respectively. Higher limits offer greater protection but result in higher premiums. Collision and comprehensive coverage limits are typically the actual cash value (ACV) or replacement cost of your vehicle, subject to your policy’s terms and conditions.

Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, as you are assuming more of the risk. Conversely, a lower deductible means higher premiums but lower out-of-pocket expenses in the event of a claim. For example, a $500 deductible on collision coverage means you would pay the first $500 of repair costs after an accident, while the insurance company covers the rest (up to your policy’s limit).

Factors Influencing Auto Home Insurance Premiums

Understanding the key factors influencing your premiums allows for informed decision-making. Several elements contribute to the overall cost:

The following factors play a significant role in determining the cost of your auto and home insurance premiums:

- Driving Record: Accidents and traffic violations significantly increase premiums. A clean driving record translates to lower costs.

- Vehicle Type and Age: The make, model, and age of your vehicle affect premiums. Expensive or high-performance cars typically have higher insurance rates than older, less expensive models.

- Location: Insurance rates vary based on geographic location, reflecting factors such as crime rates and accident frequency.

- Credit Score: In many states, insurance companies consider credit scores when determining premiums, with better scores often leading to lower rates.

- Coverage Levels: Choosing higher coverage limits and lower deductibles results in higher premiums, while the opposite leads to lower premiums.

- Bundling Policies: Bundling auto and home insurance with the same company often results in discounts.

- Driving Habits: Factors such as annual mileage and commuting distance can influence premiums. Drivers with lower mileage may qualify for discounts.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts.

Customer Reviews and Ratings

Understanding customer sentiment is crucial when choosing an auto home insurance provider. Reviews offer valuable insights into the experiences of real policyholders, providing a more nuanced perspective than marketing materials alone. Analyzing reviews allows potential customers to make informed decisions based on the collective experiences of others.

Reputable sources for obtaining customer reviews and ratings of auto home insurance companies provide a comprehensive overview of customer satisfaction. These sources typically employ rigorous methodologies to collect and analyze data, minimizing bias and ensuring the reliability of their ratings.

Sources of Customer Reviews and Ratings

Three reputable sources for obtaining customer reviews and ratings are J.D. Power, the Better Business Bureau (BBB), and Consumer Reports. J.D. Power conducts extensive customer satisfaction surveys, providing detailed rankings and insights into various aspects of the insurance experience. The BBB collects and displays customer complaints and reviews, offering a glimpse into both positive and negative experiences. Consumer Reports, known for its independent testing and analysis, provides ratings based on a combination of factors, including customer satisfaction and claims handling. These sources provide diverse perspectives and methodologies, offering a more complete picture of customer experiences.

Comparison of Average Customer Satisfaction Scores

A precise comparison of average customer satisfaction scores across the top five auto home insurance companies requires accessing current data from the sources mentioned above. These scores fluctuate over time, and specific numerical values are subject to change. However, a hypothetical example illustrates the process. Imagine that Company A consistently receives a 4.5-star average rating from J.D. Power, while Companies B, C, D, and E receive 4.2, 4.0, 3.8, and 3.5 stars, respectively. This hypothetical data would indicate that Company A generally boasts higher customer satisfaction compared to its competitors. Note: This is a hypothetical example; actual ratings vary significantly and should be verified with current data from J.D. Power, BBB, and Consumer Reports.

Summary of Common Complaints and Positive Feedback

Customer reviews often highlight recurring themes. Common complaints frequently revolve around claims processing delays, difficulties in contacting customer service representatives, and perceived unfair pricing practices. Conversely, positive feedback often centers on the ease of obtaining quotes, the helpfulness and responsiveness of customer service agents, and the efficient handling of claims. For example, many positive reviews might praise a company’s proactive communication during the claims process, while negative reviews might detail long wait times on hold and frustrating interactions with claims adjusters. The specific details and frequency of these complaints and compliments vary by company and are subject to change based on ongoing performance.

Claims Process and Customer Service

Filing an insurance claim, whether for auto or home, can be a stressful experience. Understanding the process and the level of customer service provided by different companies is crucial for a smoother resolution. This section Artikels the typical claims process and compares the responsiveness of three hypothetical insurance providers.

The typical claims process for both auto and home insurance involves several key steps. First, you must report the incident to your insurer as soon as reasonably possible. This usually involves a phone call or online report. Next, you’ll need to provide necessary documentation, such as police reports (for auto accidents), photos of the damage, and repair estimates. The insurer will then investigate the claim, potentially involving an adjuster who will assess the damage and determine the extent of coverage. Once the investigation is complete, the insurer will process your claim and issue payment, either directly to you or to the repair facility. The entire process can vary in length depending on the complexity of the claim and the insurer’s efficiency.

Auto Insurance Claim Process Illustration

The following flowchart visually represents the typical steps involved in filing an auto insurance claim:

Flowchart: Auto Insurance Claim Process

[Start] –> Report Accident to Insurer (Phone/Online) –> Provide Documentation (Police Report, Photos, etc.) –> Insurer Investigation (Adjuster Assessment) –> Claim Approval/Denial –> Payment to You/Repair Facility –> [End]

Claims Handling Speed and Customer Service Responsiveness Comparison

Let’s compare the claims handling speed and customer service responsiveness of three hypothetical companies: SafeDrive Insurance, HomeGuard Insurance, and Reliable Protection.

Scenario 1: Minor Auto Accident

Imagine a minor fender bender with minimal damage. With SafeDrive, the claim was processed within three business days, and the customer service representative was helpful and readily available. HomeGuard took a week to process the claim, and the customer experienced some difficulty getting through to a representative. Reliable Protection processed the claim within five business days, with a customer service experience described as average.

Scenario 2: Major Home Damage

Consider a scenario involving significant home damage due to a storm. SafeDrive assigned an adjuster within 24 hours and kept the customer informed throughout the process. HomeGuard took several days to assign an adjuster, leading to frustration for the customer. Reliable Protection’s response was somewhere in between, with the adjuster arriving within 48 hours and maintaining reasonable communication with the customer.

Scenario 3: Total Loss Auto Claim

In a scenario involving a total loss of an automobile, SafeDrive’s claims process was efficient, with the settlement offer received within two weeks. HomeGuard’s process was slower, taking over three weeks to reach a settlement. Reliable Protection’s response time was again average, taking approximately two and a half weeks to process the claim.

These hypothetical scenarios illustrate that claims handling speed and customer service responsiveness can vary significantly between insurance companies. While these are hypothetical examples, they highlight the importance of researching insurers and understanding their claims processes before purchasing a policy.

Choosing the Right Auto Home Insurance Company

Selecting the right auto home insurance company is crucial for securing your financial well-being in the event of an accident or disaster. The decision shouldn’t be taken lightly, as the wrong choice can lead to inadequate coverage, poor customer service, and ultimately, significant financial burdens. A thorough understanding of key factors and a systematic approach to comparison shopping will help you find the best fit for your needs and budget.

Finding the ideal auto home insurance provider involves carefully weighing several critical factors. Price is naturally a primary concern, but it shouldn’t be the sole determinant. Equally important are the breadth and depth of coverage offered, the responsiveness and helpfulness of the customer service team, and the financial stability of the insurance company itself. Ignoring any of these aspects could leave you vulnerable in a time of need.

Key Considerations in Choosing an Auto Home Insurance Provider

Price competitiveness is important, but comprehensive coverage should not be sacrificed for lower premiums. Consider the deductible amounts; higher deductibles generally result in lower premiums, but you’ll pay more out-of-pocket in the event of a claim. Examine the specific coverage details, including liability limits, collision and comprehensive coverage, uninsured/underinsured motorist protection, and personal injury protection. Ensure that the policy adequately protects your assets and meets your individual circumstances. For example, if you have a newer, more expensive vehicle, you might need higher coverage limits than someone with an older car. Customer service reputation is vital; check online reviews and ratings to gauge the company’s responsiveness to customer inquiries and claims. Finally, research the insurer’s financial strength rating from independent agencies like A.M. Best to ensure they can meet their obligations in the event of a large-scale claim. A financially stable company is less likely to default on a claim payment.

Comparing Quotes and Choosing the Best Policy

A systematic approach to comparing quotes is essential to finding the best value. First, gather information about your vehicles, homes, and driving history. This includes details like make, model, year, and VIN for your vehicles, and the value and location of your home. Second, obtain quotes from at least three to five different insurance companies. Use a combination of online comparison tools and direct contact with individual companies. Third, carefully compare the quotes, paying close attention to the coverage details and not just the premium amounts. Fourth, consider any discounts offered, such as those for bundling auto and home insurance, safe driving records, or security systems in your home. Fifth, read the policy documents carefully before making a final decision to ensure you understand all terms and conditions. For example, compare the deductibles offered by different companies. A $500 deductible might seem attractive, but a $1000 deductible will likely offer a lower premium.

Utilizing Online Comparison Tools

Many websites offer online comparison tools that allow you to quickly obtain quotes from multiple insurance providers simultaneously. These tools typically require you to input basic information about your vehicles, home, and driving history. The results will display a range of quotes from different companies, allowing for easy comparison. Remember that these tools often provide only a basic overview, and it’s essential to review the full policy details with each company before making a decision. For instance, websites like The Zebra, NerdWallet, and Policygenius allow users to compare quotes from multiple insurers. These platforms often have filtering options to help you refine your search based on your specific needs and preferences. It is crucial to note that the quotes obtained through these tools are estimates, and the final price may vary depending on a more detailed review of your specific risk profile.

Final Review

Ultimately, finding the right auto home insurance company involves careful consideration of your individual circumstances and priorities. By understanding the market, comparing options, and considering factors like coverage, customer service, and financial stability, you can confidently select a provider that offers the best protection and value. Remember, proactive research and informed decision-making are key to securing the right coverage at the best possible price, ensuring both your home and vehicle are adequately protected.

Answers to Common Questions

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident, covering damages to others’ property or injuries. Collision coverage protects your vehicle in an accident, regardless of fault.

How often can I expect my insurance premiums to change?

Premiums can change annually, or even more frequently depending on your policy and the insurer’s practices. Factors like driving record changes or claims filed can trigger adjustments.

What is a deductible, and how does it affect my premiums?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically lead to lower premiums, and vice versa.

Can I bundle my insurance with a company that doesn’t insure my home or auto?

No, bundling typically requires both your auto and home insurance to be with the same company. Different companies have different products and services.