The quest for the auto insurance best price is a common one, driven by a desire to protect oneself financially while minimizing expenses. Understanding the nuances of insurance pricing, however, can feel overwhelming. This guide unravels the complexities, empowering you to navigate the market effectively and find the most suitable and affordable coverage for your needs. We’ll explore the factors that influence premiums, strategies for securing the best deals, and crucial insights into various coverage types.

From understanding your driving history’s impact to leveraging technology for efficient comparison shopping, we’ll provide a practical framework for making informed decisions. This guide is designed to demystify the process, enabling you to confidently secure the auto insurance best price without sacrificing essential protection.

Understanding “Auto Insurance Best Price” Search Intent

The search phrase “auto insurance best price” reveals a user actively seeking the most affordable auto insurance option. Understanding the nuances behind this simple query is crucial for effectively targeting potential customers and providing relevant information. This involves analyzing the diverse motivations driving the search, identifying the demographics involved, and mapping the typical user journey.

The motivations behind searching for “auto insurance best price” are multifaceted. Primarily, users are driven by a desire to save money. This could stem from budgetary constraints, a need to allocate funds elsewhere, or simply a preference for maximizing value. Beyond cost, some users may prioritize specific features or coverage levels while still seeking the lowest price. Others might be comparing quotes to ensure they are not overpaying for their current policy.

Demographics of “Auto Insurance Best Price” Searchers

Several demographic groups frequently use this search term. Young adults (18-25) often represent a significant portion, as they are typically new drivers with limited driving history and higher insurance premiums. Budget-conscious individuals, regardless of age, also constitute a large segment, particularly those with limited disposable income or those facing financial hardship. Additionally, individuals switching insurance providers or those renewing their policies are likely to perform such searches. Finally, those with multiple vehicles or drivers within a household might also actively seek the best price to manage their overall insurance costs.

Typical User Journey Following a “Auto Insurance Best Price” Search

The typical user journey usually begins with an online search, leading to comparison websites, insurance company websites, or independent insurance brokers. Users typically compare quotes from multiple providers, paying close attention to coverage details and premium costs. This process often involves inputting personal information and vehicle details into online quote forms. Users may then contact insurance providers directly to clarify details or seek further information. Ultimately, the user selects a policy based on their individual needs and budget, aiming for the best value proposition.

User Persona: The Budget-Conscious Driver

Let’s consider a representative user persona: Sarah, a 28-year-old single professional with a modest income. She drives a reliable but older sedan and is looking to renew her auto insurance. Sarah is highly price-sensitive and values a policy that offers adequate coverage without unnecessary extras. She spends considerable time comparing quotes online and is tech-savvy, utilizing comparison websites and online tools to find the best deal. Her primary motivation is finding the most affordable option that meets her minimum coverage requirements, and she prioritizes ease of online access and quick quote generation. She’s likely to be influenced by positive online reviews and clear, straightforward policy explanations.

Factors Influencing Auto Insurance Costs

Several interconnected factors determine the price of your auto insurance premium. Understanding these factors allows you to make informed decisions and potentially secure more affordable coverage. This section will detail the key influences on your insurance costs.

| Driving History | Vehicle Type | Location | Other Factors |

|---|---|---|---|

Driving History’s Impact on Insurance CostsYour driving record significantly impacts your insurance premium. A clean record with no accidents or traffic violations typically results in lower premiums. Conversely, accidents, especially those resulting in significant damage or injuries, lead to higher premiums. The severity and frequency of incidents directly correlate with increased costs. For example, a single at-fault accident might increase your premium by 20-30%, while multiple accidents or serious violations could lead to even larger increases or policy cancellations. Conversely, maintaining a clean driving record for several years can often earn you discounts. |

Vehicle Type’s Influence on Insurance RatesThe type of vehicle you drive plays a crucial role in determining your insurance costs. Generally, sports cars, luxury vehicles, and high-performance cars are considered riskier to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles usually attract lower premiums. For example, insuring a high-performance sports car will typically be significantly more expensive than insuring a compact economy car due to higher repair costs and a greater likelihood of theft or accidents. The vehicle’s safety rating also impacts insurance; vehicles with superior safety features may qualify for discounts. |

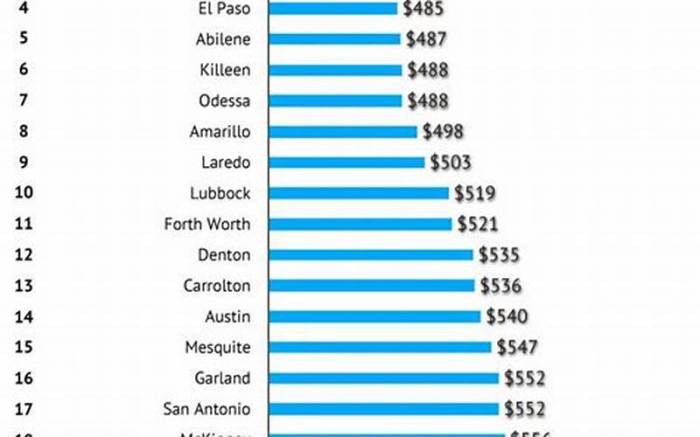

Location’s Effect on Insurance PricingYour location significantly influences your auto insurance rates. Insurance companies assess the risk of accidents, theft, and vandalism in different areas. Areas with high crime rates or a high frequency of accidents typically have higher insurance premiums. For instance, urban areas often have higher rates than rural areas due to increased traffic congestion and higher rates of theft. Conversely, living in a quiet, low-crime suburb may result in lower premiums. The specific zip code can even impact your rate. |

Other Factors Affecting Auto Insurance PremiumsBeyond the major factors, several others contribute to your insurance cost. These include your age and driving experience (younger, less experienced drivers typically pay more), your credit score (a good credit score can often lead to lower premiums), the type of coverage you choose (comprehensive coverage is typically more expensive than liability-only coverage), and the number of drivers on your policy. Discounts are often available for safe driving features like anti-theft devices or advanced driver-assistance systems (ADAS). Multiple-car discounts are also common. |

Finding the Best Auto Insurance Deals

Securing the best auto insurance rates requires a proactive and informed approach. By employing effective strategies and understanding the market, you can significantly reduce your annual premiums without compromising coverage. This involves careful comparison shopping, understanding your policy details, and leveraging various discounts.

Finding the lowest auto insurance rate isn’t simply about choosing the cheapest option; it’s about finding the best value for your specific needs and risk profile. This means balancing premium costs with the level of coverage provided.

Strategies for Securing Affordable Auto Insurance

Several strategies can help you lower your auto insurance costs. These include improving your driving record, bundling insurance policies, increasing your deductible, and choosing a higher coverage limit.

- Maintain a clean driving record: Accidents and traffic violations significantly increase premiums. Defensive driving and adherence to traffic laws are crucial.

- Bundle your insurance: Many insurers offer discounts when you bundle your auto insurance with other policies, such as homeowners or renters insurance.

- Increase your deductible: A higher deductible means lower premiums, but you’ll pay more out-of-pocket in the event of a claim. Carefully weigh the risk and reward.

- Consider higher coverage limits: While higher limits lead to higher premiums, they offer greater financial protection in the event of a serious accident. Evaluate your risk tolerance and financial capacity.

- Shop around and compare quotes: Different insurers offer different rates, even for the same coverage. Comparing quotes is essential to find the best deal.

Comparing Quotes from Different Insurers

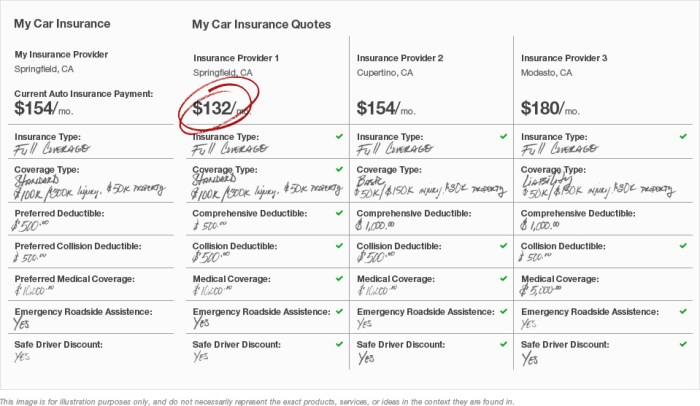

Comparing quotes effectively involves a systematic approach to ensure you’re making an apples-to-apples comparison. This means focusing on the coverage offered, not just the price.

- Use online comparison tools: Many websites allow you to compare quotes from multiple insurers simultaneously, simplifying the process.

- Contact insurers directly: While online tools are helpful, contacting insurers directly can provide more personalized quotes and allow you to ask specific questions.

- Ensure consistent coverage levels: When comparing quotes, ensure that the coverage levels (liability, collision, comprehensive, etc.) are the same across all quotes to make a fair comparison.

- Review policy details carefully: Don’t just focus on the premium; understand what each policy covers and its limitations.

Step-by-Step Guide for Obtaining Multiple Insurance Quotes

Obtaining multiple quotes is straightforward and crucial for finding the best deal. Follow these steps to efficiently gather quotes from various insurers.

- Gather necessary information: Collect your driver’s license information, vehicle information (make, model, year), and details about your driving history.

- Use online comparison tools: Start by using online comparison websites to get an initial overview of available rates.

- Contact insurers directly: Follow up with insurers that offer competitive rates through their online portals or by phone.

- Compare quotes side-by-side: Create a spreadsheet or use a comparison tool to list the premiums and coverage details of each quote.

- Review policy details thoroughly: Before making a decision, carefully read the policy documents to understand the terms and conditions.

Understanding Policy Details

Understanding your policy details is critical to ensure you have the right coverage at the best price. Failing to understand your policy can lead to unexpected costs in the event of an accident or claim.

“A thorough understanding of your policy’s terms and conditions is essential for making informed decisions and avoiding potential financial surprises.”

Types of Auto Insurance Coverage

Choosing the right auto insurance coverage can feel overwhelming, but understanding the different types available is crucial for protecting yourself and your vehicle. This section Artikels common coverage types, their benefits, drawbacks, and when they are most beneficial. Remember, your specific needs will determine the best combination of coverage for your situation.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. There are two main types: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and lost wages for injured individuals, while property damage liability covers the cost of repairing or replacing damaged property.

- Benefit: Protects you from potentially devastating financial consequences if you’re at fault in an accident.

- Drawback: Doesn’t cover your own medical bills or vehicle repairs if you’re at fault.

- Beneficial Situations: Any time you’re driving, as accidents can happen unexpectedly. Higher liability limits are especially important for those with higher net worth, as a serious accident could result in claims exceeding lower limits.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This includes accidents with another vehicle, an object, or even a single-car accident.

- Benefit: Covers your vehicle’s repairs or replacement after a collision, regardless of fault.

- Drawback: Usually comes with a deductible, meaning you pay a certain amount out-of-pocket before the insurance kicks in. Premiums can be higher.

- Beneficial Situations: Essential for newer vehicles or those with significant loan balances, as the cost of repairs could be substantial. It’s also helpful if you live in an area with frequent accidents.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Benefit: Provides broad protection against a wide range of potential damages not covered by collision.

- Drawback: Often includes a deductible, and premiums can be higher than collision-only coverage.

- Beneficial Situations: Highly recommended for newer vehicles, as the cost of repairs or replacement after events like theft or hail damage can be very high. It’s also advisable if you live in an area prone to severe weather or high crime rates.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills, lost wages, and vehicle repairs if the other driver is at fault and lacks sufficient insurance.

- Benefit: Offers crucial protection in situations where the at-fault driver is uninsured or doesn’t have enough coverage to cover your losses.

- Drawback: May increase premiums slightly.

- Beneficial Situations: Highly recommended, as a significant percentage of drivers are uninsured or underinsured. This coverage can prevent you from bearing the financial burden of an accident caused by someone without adequate insurance.

Discounts and Savings Opportunities

Securing the best auto insurance price often involves more than just comparing quotes. Many insurers offer a range of discounts that can significantly reduce your premium. Understanding these discounts and how to qualify for them is key to maximizing your savings. This section details common discounts, eligibility requirements, and strategies for leveraging these opportunities.

Common Auto Insurance Discounts

Numerous discounts are available, varying by insurer and location. These discounts can significantly lower your overall cost. Understanding which discounts apply to your situation is crucial for securing the lowest possible premium.

- Good Driver Discounts: Awarded for maintaining a clean driving record, typically free of accidents and traffic violations for a specified period (e.g., 3-5 years). The longer your clean record, the higher the discount percentage may be. Some insurers may offer tiered discounts based on the length of your accident-free history.

- Safe Driver Discounts (Telematics): These programs use telematics devices or smartphone apps to monitor your driving habits. Safe driving behaviors, such as maintaining consistent speeds and avoiding harsh braking or acceleration, result in discounts. The discount percentage is often directly tied to your driving score.

- Bundling Discounts: Insurers often offer discounts when you bundle multiple insurance policies, such as auto and homeowners or renters insurance, with the same company. This can lead to substantial savings compared to purchasing separate policies.

- Multi-Car Discounts: Insuring multiple vehicles under the same policy usually results in a discount on each vehicle’s premium. This discount is typically a percentage reduction applied to each car’s individual premium.

- Good Student Discounts: Students who maintain a certain GPA (generally a B average or higher) may qualify for a discount. This discount often requires proof of enrollment and academic standing.

- Defensive Driving Course Discounts: Completing a state-approved defensive driving course can lead to a discount, reflecting your commitment to safer driving practices. Proof of course completion is usually required.

- Vehicle Safety Feature Discounts: Vehicles equipped with safety features like anti-theft devices, airbags, anti-lock brakes (ABS), and electronic stability control (ESC) often qualify for discounts. The specific features and their corresponding discounts vary by insurer.

- Payment Plan Discounts: Paying your premium in full upfront often earns a discount compared to paying in installments. The discount amount varies by insurer.

Eligibility Requirements for Discounts

Eligibility for discounts depends on several factors, and requirements vary significantly among insurance companies. Always verify the specific requirements with your chosen insurer.

- Driving Record: Clean driving records are essential for good driver and safe driver discounts. The length of time without accidents and violations is a key factor.

- Academic Performance: Good student discounts necessitate providing proof of enrollment and maintaining a specified GPA.

- Vehicle Features: Discounts for vehicle safety features require the vehicle to possess the specific features listed by the insurer.

- Policy Bundling: Bundling discounts require having multiple insurance policies with the same company.

- Proof of Completion: Discounts for defensive driving courses necessitate providing proof of course completion to the insurer.

Maximizing Savings on Auto Insurance

Strategically leveraging discounts and comparing quotes are vital for achieving the lowest possible premium.

- Shop Around: Obtain quotes from multiple insurers to compare prices and available discounts.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial for maximizing discounts.

- Bundle Policies: Combine your auto insurance with other policies for potential savings.

- Explore Telematics Programs: Consider using a telematics program to monitor your driving and earn potential discounts.

- Take a Defensive Driving Course: Complete a course to qualify for additional discounts.

- Review Your Coverage Regularly: Ensure your coverage meets your needs without overspending.

Comparison of Discount Types and Potential Savings

The following table illustrates a hypothetical comparison of different discount types and their potential impact on a sample premium of $1200 per year. These are illustrative examples only and actual savings will vary.

| Discount Type | Potential Savings (%) | Potential Savings ($) |

|---|---|---|

| Good Driver | 15% | $180 |

| Safe Driver (Telematics) | 10% | $120 |

| Bundling | 5% | $60 |

| Multi-Car | 10% per car | $120 (per car) |

| Good Student | 10% | $120 |

Avoiding Insurance Scams

Navigating the world of auto insurance requires vigilance, as fraudulent activities unfortunately exist. Understanding common scams and employing preventative measures is crucial to protect yourself from financial loss and legal complications. This section details common scams, strategies for avoidance, and warning signs to watch out for.

Common Auto Insurance Scams and Fraudulent Practices

Auto insurance fraud encompasses a range of deceptive practices designed to illegally obtain insurance payouts. These schemes can involve policyholders, repair shops, and even some unscrupulous insurance agents.

| Scam Type | Description | Example |

|---|---|---|

| Staged Accidents | Collisions are intentionally caused to file fraudulent claims. This often involves multiple parties working together. | Two cars might deliberately collide in a low-traffic area, with pre-arranged injuries and exaggerated damage claims. |

| Inflated Repair Bills | Repair shops might overcharge for repairs or claim damage that wasn’t actually present. | A minor dent might be described as extensive damage requiring costly repairs, including unnecessary parts replacements. |

| False Claims | Policyholders might falsely claim that their vehicle was stolen, damaged, or involved in an accident that never occurred. | A policyholder might report their car stolen, then later reappear with the vehicle, hoping to receive a payout for its alleged loss. |

| Ghost Vehicles | Insurance is obtained for a vehicle that doesn’t actually exist, or for a vehicle that has already been scrapped. | A non-existent car is insured to collect premiums, with the intention of later filing a false claim. |

| Phantom Passengers | Claims are inflated by falsely reporting additional passengers injured in an accident. | A single-car accident might have claims for multiple passengers with fabricated injuries. |

Strategies to Avoid Becoming a Victim of Insurance Fraud

Protecting yourself from auto insurance fraud requires proactive measures and awareness.

| Preventive Measure | Explanation |

|---|---|

| Thoroughly Research Insurance Companies | Choose reputable and well-established insurers with a proven track record. Check online reviews and ratings. |

| Understand Your Policy | Carefully review your policy to understand your coverage, exclusions, and claim procedures. |

| Keep Detailed Records | Maintain accurate records of your vehicle’s maintenance, repairs, and insurance documentation. |

| Report Suspicious Activity | Report any suspicious activity or attempts at fraud to your insurer immediately. |

| Be Wary of Unusually Low Premiums | Extremely low premiums might indicate a scam or lack of sufficient coverage. |

| Obtain Multiple Quotes | Compare quotes from different insurers to ensure you’re getting a fair price and adequate coverage. |

| Use Reputable Repair Shops | Choose repair shops with a good reputation and avoid those that pressure you into unnecessary repairs. |

Red Flags to Watch Out for When Dealing with Insurance Companies

Certain warning signs can indicate potential fraud or unethical practices by insurance companies.

| Red Flag | Description |

|---|---|

| High-Pressure Sales Tactics | Aggressive sales tactics that pressure you into purchasing a policy without adequate explanation. |

| Unclear Policy Language | Policy documents that are difficult to understand or contain ambiguous wording. |

| Unreasonable Delays in Claim Processing | Excessive delays in processing your claim without clear explanation. |

| Unwillingness to Answer Questions | Resistance from the insurer to answer your questions or provide clarification. |

| Requests for Unnecessary Information | Requests for personal information that seems irrelevant to your claim. |

The Role of Technology in Finding Best Prices

Technology has revolutionized the way we shop for auto insurance, making the process significantly faster, more efficient, and transparent. Gone are the days of solely relying on phone calls and in-person visits to multiple insurance agents. Now, consumers have access to a vast array of online tools and resources that empower them to compare quotes, understand coverage options, and ultimately secure the best possible price for their needs.

Online comparison tools have dramatically altered the landscape of auto insurance shopping. These tools, often websites or apps, allow users to input their personal information and driving history, then receive multiple quotes from different insurance providers instantaneously. This eliminates the need to contact each company individually, saving considerable time and effort. The ability to compare side-by-side quotes, highlighting key differences in coverage and pricing, makes informed decision-making significantly easier.

Online Comparison Tools and Their Impact

The proliferation of online comparison tools has created a highly competitive market for auto insurance. Insurance companies are incentivized to offer competitive rates to attract customers using these platforms. This increased competition directly benefits consumers, who can often find lower premiums than they would through traditional methods. For example, a consumer might find that Company A offers a comprehensive policy for $800 annually through an online comparison site, while Company B offers a similar policy for $950 through a direct contact. The online tool clearly reveals this $150 difference, empowering the consumer to make a more financially savvy choice. Furthermore, the ease of use of these tools has broadened access to insurance for individuals who might previously have found the process daunting or time-consuming.

Using Apps and Websites for Insurance Quotes

Numerous apps and websites specialize in providing auto insurance quotes. Many operate by partnering with a network of insurance providers, allowing users to compare quotes from multiple sources simultaneously. These platforms typically offer user-friendly interfaces, guiding users through the quote process with clear instructions and easily understandable terminology. Some platforms even incorporate advanced features such as personalized recommendations based on individual needs and risk profiles. For instance, an app might suggest different coverage levels based on the user’s vehicle type and driving history, or highlight discounts available for specific driver profiles (e.g., safe driving history, good student discounts). The convenience and accessibility of these tools make them attractive to a wide range of consumers.

Advantages and Disadvantages of Online Tools

Using online tools for auto insurance offers several significant advantages. The speed and convenience of obtaining multiple quotes are undeniable. The transparency provided by side-by-side comparisons allows for informed decision-making. Moreover, these tools often provide access to a broader range of insurance providers than might be available through traditional channels. However, there are also disadvantages to consider. The accuracy of the information provided depends on the accuracy of the data input by the user. Inaccurate information can lead to inaccurate quotes. Additionally, while many platforms prioritize user privacy, it’s essential to be aware of the data collected and how it is used. Finally, some consumers may prefer the personalized attention and advice provided by a human insurance agent, which online tools may not fully replicate.

Final Review

Finding the auto insurance best price isn’t simply about securing the lowest premium; it’s about finding the optimal balance between cost and comprehensive coverage. By understanding the factors influencing premiums, employing effective comparison strategies, and being aware of potential scams, you can make informed choices that protect your financial well-being and provide peace of mind. Remember, proactive research and a clear understanding of your needs are key to achieving your goal of securing the best possible auto insurance value.

FAQ Resource

What is the best time of year to buy auto insurance?

There isn’t a universally “best” time, but shopping around during the off-season (typically fall and winter) might yield some slight advantages as insurers may have less demand.

Can I get auto insurance without a driving history?

Yes, but it will likely be more expensive. Insurers will use other factors to assess risk, and you may need to provide additional information.

How often should I review my auto insurance policy?

It’s advisable to review your policy annually, or whenever there’s a significant life change (e.g., new car, change in driving habits, marriage).

What is the difference between liability and collision coverage?

Liability covers damages you cause to others; collision covers damages to your own vehicle, regardless of fault.