Finding the best auto insurance rates can feel like navigating a maze, but understanding the key factors involved empowers you to make informed decisions and save money. This guide unravels the complexities of auto insurance pricing, providing you with the knowledge and strategies to secure the most competitive rates possible. We’ll explore everything from understanding coverage types to leveraging discounts and navigating the claims process, ensuring you’re well-equipped to find the perfect policy for your needs.

From comparing quotes and identifying hidden fees to understanding the impact of your driving history and demographics, we’ll cover all the essential aspects of securing affordable auto insurance. This comprehensive resource will equip you with the tools and knowledge to confidently navigate the world of auto insurance and achieve significant savings.

Understanding “Auto Insurance Best Rates”

Securing the best auto insurance rates involves understanding the numerous factors that influence the cost of your premiums. A thorough understanding of these factors empowers you to make informed decisions and potentially save money. This section will explore the key elements impacting your insurance costs, including coverage types and individual risk profiles.

Factors Influencing Auto Insurance Costs

Several interconnected factors determine your auto insurance premium. These include your driving history (accidents and violations), age and experience, location (crime rates and accident frequency), the type of vehicle you drive (its value, safety features, and repair costs), and the coverage you choose. Insurance companies use sophisticated algorithms to assess risk and price policies accordingly. For example, a young driver with a history of speeding tickets will likely pay significantly more than an older driver with a clean record. Similarly, a high-performance sports car will generally cost more to insure than a fuel-efficient sedan due to higher repair costs and a greater risk of theft.

Types of Auto Insurance Coverage and Their Impact on Price

Different types of auto insurance coverage offer varying levels of protection and, consequently, impact your premium. Liability coverage, which pays for damages to others in an accident you cause, is typically mandatory. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage covers damage from events like theft, fire, or vandalism. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver lacking sufficient insurance. Adding more comprehensive coverage will generally increase your premium, but it also provides greater financial protection. Conversely, opting for only the minimum required liability coverage will result in lower premiums but leaves you with less financial protection in the event of an accident.

Comparison of Common Insurance Rating Factors

Insurance companies use a variety of factors to assess risk and determine premiums. Let’s compare how age, driving history, location, and vehicle type influence rates:

| Factor | Impact on Premium | Example |

|---|---|---|

| Age | Younger drivers generally pay more due to higher accident rates; rates typically decrease with age and experience. | A 18-year-old driver will likely pay more than a 40-year-old driver with the same driving record. |

| Driving History | Accidents and traffic violations significantly increase premiums. A clean driving record leads to lower rates. | Multiple speeding tickets or a DUI will result in higher premiums compared to a driver with no violations. |

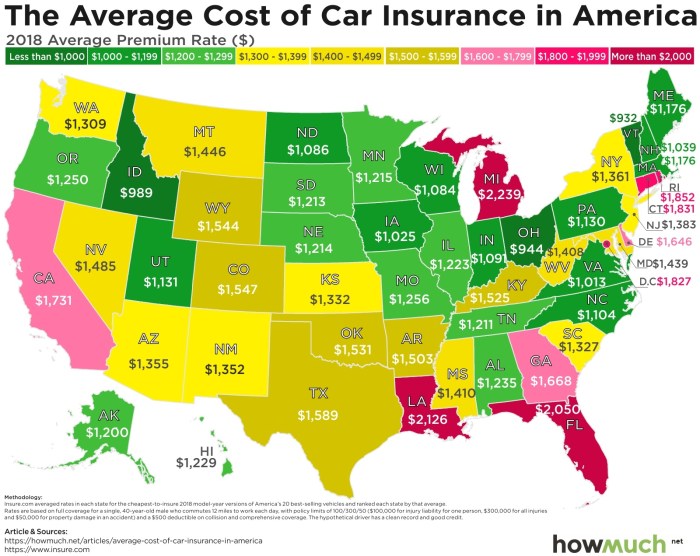

| Location | Areas with high accident rates or theft rates typically have higher insurance premiums. | Urban areas often have higher rates than rural areas due to increased traffic density and crime. |

| Vehicle Type | More expensive, high-performance vehicles, or those with a history of theft or accidents, will have higher premiums. | A luxury SUV will generally cost more to insure than a compact sedan. |

Average Cost of Insurance for Different Vehicle Types

The table below provides a general comparison of average annual insurance costs for different vehicle types. Note that these are estimates and actual costs will vary based on the factors discussed above.

| Vehicle Type | Average Annual Cost (Estimate) |

|---|---|

| Compact Car | $1,200 |

| Sedan | $1,400 |

| SUV | $1,600 |

| Luxury Car | $2,000+ |

Finding the Best Rates

Securing the most competitive auto insurance rates requires a proactive and informed approach. By strategically comparing quotes and meticulously reviewing policy details, you can significantly reduce your annual premiums while ensuring adequate coverage. This involves understanding the nuances of different policies and identifying potential hidden costs.

Comparing auto insurance quotes from multiple providers is crucial for finding the best rates. Different companies use varying algorithms to assess risk and price policies, leading to significant differences in premiums for the same coverage. A simple comparison can save hundreds, even thousands, of dollars annually.

Comparing Auto Insurance Quotes

To effectively compare quotes, utilize online comparison tools that allow you to input your information once and receive quotes from multiple insurers simultaneously. This saves time and ensures a consistent basis for comparison. Focus on comparing similar coverage levels – don’t compare a basic policy to a comprehensive one. Consider factors like deductibles and coverage limits, as these significantly impact the premium. For example, a higher deductible will usually result in a lower premium, but you’ll pay more out-of-pocket in the event of a claim. Conversely, higher coverage limits provide greater protection but come with higher premiums. Always ensure you are comparing apples to apples.

The Importance of Careful Policy Review

Reading the fine print is paramount. Insurance policies are complex legal documents, and overlooking crucial details can lead to unexpected costs and inadequate protection. Pay close attention to the definitions of covered events, exclusions, and limitations. Understand what constitutes a covered accident, what types of damage are excluded, and any restrictions on coverage. For instance, some policies might exclude certain types of damage from specific events, or have limitations on coverage for rental cars.

Potential Hidden Fees and Exclusions

Hidden fees and exclusions are often buried within the policy documents. Common examples include administrative fees, processing fees, or limitations on coverage for specific types of vehicles or drivers. Carefully examine the policy for any additional charges or restrictions beyond the stated premium. Some policies might have limited coverage for accidents involving uninsured or underinsured motorists, or for damage caused by certain weather events. Always ask clarifying questions if anything is unclear.

A Step-by-Step Guide to Obtaining and Comparing Online Quotes

Obtaining and comparing online quotes is a straightforward process. First, gather your personal information, including your driving history, vehicle details, and address. Next, visit several reputable insurance company websites or use an online comparison tool. Input your information accurately and consistently across all platforms. Review the quotes carefully, paying attention to coverage levels, deductibles, premiums, and any additional fees. Finally, compare the quotes side-by-side to identify the best option that balances cost and coverage. Remember that the cheapest option isn’t always the best if it lacks adequate protection.

Discounts and Savings

Securing the best auto insurance rates isn’t just about comparing prices; it’s about strategically leveraging available discounts to significantly reduce your overall premium. Many factors influence your eligibility, and understanding these can lead to substantial savings.

Many insurance companies offer a wide array of discounts designed to reward safe driving habits, responsible financial behavior, and other positive attributes. These discounts can significantly reduce your premiums, sometimes by hundreds of dollars annually. Effectively utilizing these discounts is key to finding the most affordable coverage.

Common Auto Insurance Discounts

A variety of discounts are commonly offered by most major insurance providers. These discounts often overlap, allowing for substantial savings when multiple eligibility criteria are met.

- Safe Driving Discounts: These are frequently based on your driving record. A clean record, free of accidents and traffic violations for a specified period (often three to five years), usually qualifies you for a significant discount. For example, a driver with a spotless record might receive a 15-20% discount compared to a driver with recent accidents or tickets.

- Bundling Discounts: Many insurers offer discounts for bundling your auto insurance with other types of insurance, such as homeowners or renters insurance. The discount percentage varies by insurer but can be substantial, often exceeding 10% or even reaching 20% depending on the bundled policies.

- Good Student Discounts: Students maintaining a certain grade point average (GPA) often qualify for discounts. The required GPA and the discount percentage vary by insurer and state, but generally, a GPA of 3.0 or higher is a common requirement. A good student discount might range from 5% to 25%.

- Vehicle Safety Features Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and anti-theft systems, often qualify for discounts. The discount percentage varies depending on the specific features and the insurer.

- Multi-Car Discounts: Insuring multiple vehicles under the same policy often results in a discount for each additional vehicle.

Discount Impact on Overall Cost

Let’s illustrate the potential savings with an example. Suppose your initial annual premium is $1200.

- Scenario 1: With a 15% safe driving discount and a 10% bundling discount, your premium would be reduced by $1200 * 0.15 = $180 (safe driving) and $1080 * 0.10 = $108 (bundling), resulting in a total discount of $288 and a final premium of $912.

- Scenario 2: Adding a 10% good student discount to Scenario 1 would further reduce the premium by $912 * 0.10 = $91.20, resulting in a final premium of $820.80.

Discounts Offered by Major Insurance Providers

The specific discounts offered vary significantly between insurance providers. However, most major insurers offer variations of the discounts listed above. It’s crucial to check directly with each provider to understand their specific discount programs and eligibility criteria. For example, State Farm, Geico, Progressive, and Allstate are known for offering many of these discounts, but the details will differ.

Utilizing Comparison Websites

Comparison websites, such as The Zebra, NerdWallet, and Policygenius, can greatly simplify the process of finding discounted rates. These sites allow you to input your information once and receive quotes from multiple insurers simultaneously. Many of these sites also highlight available discounts based on your provided information, making it easy to identify potential savings opportunities. Remember to always verify the information provided by comparison websites with the insurance company directly before making a decision.

Final Wrap-Up

Ultimately, securing the best auto insurance rates requires a proactive approach that combines thorough research, strategic comparison shopping, and a clear understanding of your coverage needs. By carefully considering the factors discussed in this guide, you can confidently navigate the insurance landscape, obtain competitive quotes, and secure a policy that provides comprehensive protection at a price that fits your budget. Remember, a little preparation goes a long way in saving you money and ensuring peace of mind on the road.

Expert Answers

What is the impact of credit score on auto insurance rates?

In many states, insurance companies use credit-based insurance scores to assess risk. A higher credit score generally correlates with lower premiums, while a lower score can lead to higher rates.

Can I get auto insurance if I have a DUI on my record?

Yes, but it will likely be more expensive. Insurance companies consider DUIs a significant risk factor and will adjust your premiums accordingly. You may need to seek out specialized high-risk insurance providers.

How often should I review my auto insurance policy?

It’s recommended to review your policy annually, or even more frequently if there are significant life changes (e.g., new car, change in driving habits, marriage).

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others, while collision coverage pays for repairs to your vehicle regardless of fault.