Navigating the world of auto insurance can feel overwhelming. With countless providers and policy options, finding the best coverage at the right price requires careful consideration. This guide empowers you to confidently compare auto insurance quotes, understanding the factors that influence pricing and making informed decisions to protect your vehicle and your wallet.

We’ll delve into the motivations behind searching for auto insurance quotes, analyzing the user journeys and preferences of those seeking the best deals. We’ll also examine leading competitor websites, comparing their quote processes and user experiences to highlight best practices and potential pitfalls. By understanding these elements, you can effectively navigate the process and secure the most suitable auto insurance policy.

Understanding User Search Intent Behind “Auto Insurance Compare Quote”

The search query “auto insurance compare quote” reveals a user actively seeking the best possible insurance deal. This isn’t simply a passive information-gathering exercise; it signifies a strong intent to purchase a policy, albeit after careful consideration of available options. Understanding the nuances behind this search is crucial for effectively targeting potential customers and presenting relevant information.

The motivations behind searching for auto insurance quotes are multifaceted. Users aren’t just looking for the cheapest option; they’re balancing cost with coverage, seeking a policy that aligns with their specific needs and risk profile.

Motivations Behind Searching for Auto Insurance Quotes

Users searching for auto insurance quotes are driven by a variety of factors, including cost-effectiveness, comprehensive coverage, and ease of purchase. Some may be renewing their existing policy and seeking better rates, while others are new drivers or have recently changed vehicles, requiring new coverage. Still others might be dissatisfied with their current provider’s service or coverage options. The search reflects a proactive approach to managing personal finances and mitigating potential risks.

Key Factors Influencing Provider Choice

Several key factors significantly influence a user’s decision when selecting an auto insurance provider. Price is almost always a primary concern, but it’s rarely the sole deciding factor. Coverage options, including liability limits, collision and comprehensive coverage, and uninsured/underinsured motorist protection, play a crucial role. Customer service reputation, including ease of claims processing and responsiveness to inquiries, is also increasingly important. Finally, the provider’s financial stability and ratings contribute to the overall perception of reliability and trustworthiness. A user might prioritize a well-established company with a strong financial rating, even if it means paying a slightly higher premium.

Typical User Journey from Search to Purchase

The typical user journey begins with an online search, often using terms like “auto insurance compare quote.” They’ll likely visit several comparison websites or directly access the websites of individual insurers. Users then typically filter results based on their specific needs (e.g., coverage level, vehicle type, driving history). They’ll compare quotes side-by-side, carefully analyzing the details of each policy. Once a preferred policy is identified, the user will often proceed to complete an online application or contact the insurer directly to finalize the purchase. This process can range from a few minutes to several days, depending on the complexity of the user’s needs and the insurer’s application process.

User Persona: The Prudent Driver

A representative user persona could be “The Prudent Driver,” a 35-year-old professional, Sarah Miller. Sarah owns a mid-sized sedan and has a clean driving record. She’s financially responsible and values both cost-effectiveness and comprehensive coverage. Sarah is tech-savvy and prefers online interactions. She’s looking for a reputable insurer with competitive pricing and excellent customer service, prioritizing clear and transparent policy information. Sarah’s search for “auto insurance compare quote” reflects her desire to make an informed decision, balancing price and value to secure the best possible auto insurance policy.

Analyzing Competitor Websites and Their Quote Processes

Understanding the user experience on competing auto insurance websites is crucial for optimizing our own quote process. By analyzing their strengths and weaknesses, we can identify best practices and areas for improvement. This analysis focuses on three leading providers: Geico, Progressive, and State Farm, examining their user interfaces, quote tools, and presentation methods.

User Interface and Experience Comparison

The user interfaces of Geico, Progressive, and State Farm each offer a distinct experience. Geico prioritizes simplicity and speed, presenting a minimal design with a clear focus on the quote process. Progressive employs a more visually engaging interface with interactive elements, aiming to create a more entertaining experience. State Farm offers a more traditional approach, with a clean but less visually stimulating layout. Each approach targets different user preferences, with Geico appealing to those seeking efficiency, Progressive to those who prefer a more dynamic experience, and State Farm to users who value a straightforward, reliable presentation. The overall usability of each site varies depending on individual user preferences and technical proficiency.

Effectiveness of Different Quote Comparison Tools

The three companies utilize different approaches to quote comparison. Geico uses a streamlined, single-page process. Progressive allows users to compare multiple quotes simultaneously, highlighting differences in coverage and pricing. State Farm offers a more granular comparison tool, allowing users to customize their comparison criteria. Progressive’s simultaneous comparison is particularly effective for users who want a quick overview of multiple options. Geico’s simplicity caters to users who prioritize speed and ease of use, while State Farm’s granular approach appeals to users who require more detailed information for informed decision-making. The effectiveness of each tool depends on the user’s level of engagement and the depth of information they seek.

Strengths and Weaknesses of Quote Presentation Methods

Geico’s quote presentation is concise and easy to understand, emphasizing key coverage details and pricing. However, it lacks the detailed breakdown offered by competitors. Progressive presents quotes in a visually appealing format, using charts and graphs to highlight key differences. This approach is engaging but can be overwhelming for some users. State Farm offers a more comprehensive presentation, providing detailed explanations of coverage options and pricing components. While comprehensive, this approach can be less user-friendly for those seeking a quick overview. The ideal approach balances clarity and comprehensiveness, catering to diverse user preferences and technical proficiency.

Comparison of Key Features

| Feature | Geico | Progressive | State Farm |

|---|---|---|---|

| User Interface | Minimalist, streamlined | Visually engaging, interactive | Clean, traditional |

| Quote Comparison Tool | Single-page, concise | Simultaneous comparison of multiple quotes | Granular comparison, customizable criteria |

| Quote Presentation | Concise, emphasizes key details | Visually appealing, uses charts and graphs | Comprehensive, detailed explanations |

| Overall Speed | Very Fast | Moderate | Moderate |

Content Ideas for Engaging Users Seeking Quotes

Attracting and retaining users on an auto insurance quote comparison page requires a compelling user experience. This involves not only a streamlined quote process but also clear, concise information presented in an engaging manner. Effective use of headlines, visual aids, and frequently asked questions can significantly improve user engagement and conversion rates.

Compelling Headlines and Subheadings

Effective headlines and subheadings are crucial for grabbing user attention and guiding them through the quote comparison process. They should be concise, benefit-oriented, and clearly communicate the value proposition. For instance, instead of a generic headline like “Get a Car Insurance Quote,” a more compelling option could be “Compare Car Insurance Quotes & Save Up to 40%.” Similarly, subheadings should break down complex information into digestible chunks. For example, instead of “Policy Details,” a more engaging subheading could be “Understand Your Coverage: Key Features Explained.” Other compelling headline examples include “Find the Perfect Auto Insurance Plan,” “Compare Prices From Top-Rated Insurers,” and “Get Your Free Auto Insurance Quote in Minutes.” Subheading examples could include “Coverage Options Tailored to Your Needs,” “Pricing Transparency: No Hidden Fees,” and “Easy Online Comparison: Save Time and Money.”

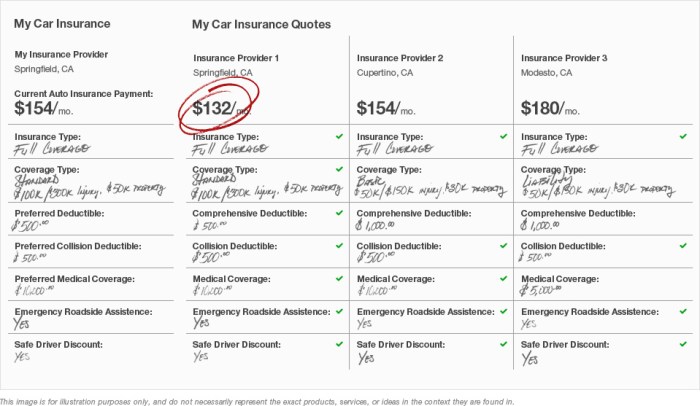

Presenting Insurance Policy Details

Presenting insurance policy details clearly and concisely requires a structured approach. Using bullet points, tables, and concise language can significantly improve readability. A table comparing key features and prices across different insurers is highly effective. For example, a table could compare coverage limits, deductibles, and premiums for liability, collision, and comprehensive coverage across three leading insurers. Each policy’s key features should be explained in plain language, avoiding jargon and technical terms. Consider using visual cues like icons to represent different coverage types (e.g., a shield for liability, a car for collision). Furthermore, clearly outlining what is and is not included in each policy is crucial for transparency and avoiding misunderstandings. Highlighting unique selling points or benefits of each policy will further aid comparison.

Frequently Asked Questions (FAQs) About Auto Insurance Quotes

A comprehensive FAQ section addresses common user concerns and provides quick answers. This section should cover topics such as the information needed to get a quote, the factors affecting insurance premiums, the types of coverage available, the process of filing a claim, and how to understand policy documents. For example, one FAQ could be “What information do I need to provide to get an auto insurance quote?”, with an answer listing driver’s license information, vehicle details, and driving history. Another could address “How does my driving record affect my insurance premium?”, explaining the impact of accidents and traffic violations. A third could cover “What types of coverage are available?”, detailing liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Using Visual Elements to Improve Understanding of Pricing

Visual elements such as charts and graphs can significantly enhance the understanding of pricing comparisons. A bar chart comparing premiums across different insurers for a specific coverage level is highly effective. A pie chart can visually represent the breakdown of the total premium, showing the proportion allocated to different coverage types. For example, a bar chart could show the premiums for a basic liability policy from three different insurers, highlighting the price differences. A pie chart could illustrate the proportion of the total premium dedicated to liability, collision, and comprehensive coverage. Using clear labels and a consistent color scheme enhances readability and understanding. The use of interactive elements, such as allowing users to adjust coverage levels and see the impact on the premium, further improves engagement.

Optimizing the Quote Comparison Process for User Experience

A seamless and efficient quote comparison process is crucial for converting website visitors into customers. Frustration during this stage often leads to high bounce rates and lost opportunities. Optimizing this process requires understanding user pain points and implementing strategies to simplify the experience.

Many factors contribute to a poor user experience when comparing auto insurance quotes online. Lengthy forms, confusing jargon, and a lack of transparency about the data collected all contribute to user frustration. Furthermore, slow loading times and poorly designed comparison tables can make it difficult for users to quickly assess their options. Addressing these issues is key to increasing conversion rates and improving overall customer satisfaction.

Pain Points in the Online Quote Comparison Process

Identifying common frustrations experienced by users during the quote comparison process is the first step towards optimization. Common pain points include excessive form fields requiring unnecessary personal information, complex and confusing insurance terminology, lack of clear explanations of coverage options, and difficulty in comparing quotes across different providers due to inconsistent presentation formats.

Best Practices for Simplifying Form Filling

Streamlining the form-filling process is paramount to reducing user abandonment. This involves minimizing the number of required fields, using clear and concise language, and employing progressive profiling techniques. Progressive profiling gradually gathers information over multiple interactions, reducing initial form length and improving user engagement. For example, instead of requesting the entire driving history upfront, the form could start with basic details and request further information only if necessary. Pre-filling forms with information already available from other sources, such as a user’s Google account, when permitted and with proper consent, can also significantly reduce effort.

Strategies for Reducing Bounce Rates and Increasing Conversions

Several strategies can effectively reduce bounce rates and increase conversions during the quote comparison process. These include implementing a user-friendly interface with clear navigation, providing instant feedback to users during form submission, using clear and concise language to explain complex concepts, and offering multiple quote comparison options to cater to various user preferences. A visually appealing website design that uses a responsive layout (adapting to various screen sizes) also plays a crucial role in maintaining user engagement. For instance, a company could implement a progress bar to show users how far along they are in the process, offering a sense of accomplishment and reducing anxiety.

Streamlined Workflow for Obtaining and Comparing Auto Insurance Quotes

A well-designed workflow should guide users through the process intuitively and efficiently. This involves a clear and concise initial landing page, a simple and short quote request form, quick quote generation, a user-friendly comparison table that clearly highlights key differences between policies, and a straightforward process for selecting and purchasing a policy. For example, the comparison table could highlight key features like coverage limits, deductibles, and premiums in a clear and easy-to-understand format, potentially using visual aids like color-coding to emphasize differences. This allows users to quickly identify the policy that best suits their needs without having to sift through lengthy policy documents.

Exploring Different Methods for Presenting Insurance Information

Clearly presenting complex insurance information is crucial for user engagement and comprehension. Different methods offer varying levels of effectiveness in conveying key details and encouraging users to proceed with a quote. The choice of presentation significantly impacts the user experience and ultimately, conversion rates.

Bullet Points versus Paragraphs for Explaining Policy Details

Bullet points and paragraphs each offer distinct advantages in presenting policy details. Bullet points are ideal for highlighting key features and benefits concisely. They allow users to quickly scan and absorb information, particularly useful for those seeking a quick overview. Paragraphs, on the other hand, provide a more in-depth explanation of each point, allowing for nuanced details and context. For example, a bullet point might state “Liability coverage protects you in case of accidents you cause,” while a paragraph would elaborate on the specific limits of coverage, what types of damages are included, and potential exclusions. The most effective approach often involves a combination of both; bullet points for a quick summary followed by paragraphs for a more detailed explanation where necessary.

Using Visual Aids to Clarify Complex Information

Visual aids, such as infographics, significantly enhance user understanding. Consider an infographic depicting the different types of auto insurance coverage as concentric circles, with liability coverage at the core, followed by collision, comprehensive, and uninsured/underinsured motorist coverage as expanding layers. Each layer could include a brief description and a visual representation, such as a car with damage for collision coverage. Another example could be a bar chart comparing the average premiums for different coverage levels or driver profiles (e.g., young drivers vs. experienced drivers). The visual representation of data makes complex information more accessible and memorable.

Benefits of Using Interactive Elements to Engage Users

Interactive elements like premium calculators greatly improve user engagement. A user-friendly calculator allows potential customers to input their details (vehicle type, driving history, location) and instantly receive a premium estimate. This provides immediate value and encourages further interaction. The calculator could also incorporate visual elements, such as a graph showing how different coverage options impact the overall premium. This hands-on experience fosters a deeper understanding of the cost implications of various choices and encourages users to proceed with a full quote request.

Key Benefits of Different Types of Auto Insurance Coverage

Understanding the benefits of different coverage types is essential for informed decision-making. A clear presentation of this information is vital for effective communication.

- Liability Coverage: Protects you financially if you cause an accident resulting in injuries or property damage to others. This is typically required by law.

- Collision Coverage: Pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

Illustrating Key Concepts Related to Auto Insurance Quotes

Understanding how auto insurance quotes are calculated can seem daunting, but breaking down the key factors involved simplifies the process. This section will illustrate the influence of various elements on your premium and explain how coverage options and deductibles interact.

Visualizing the impact of different factors on your insurance premium is crucial. Imagine a bar graph. The vertical axis represents the premium cost, and the horizontal axis shows different factors. One bar could represent a driver with a clean driving record, showing a relatively short bar indicating a lower premium. Another bar could depict a driver with multiple accidents and speeding tickets; this bar would be significantly taller, reflecting a much higher premium. Similarly, different vehicle types would be represented by separate bars. A smaller, fuel-efficient car might have a shorter bar than a powerful sports car or a large SUV, reflecting the higher risk and repair costs associated with the latter. The graph clearly demonstrates how these factors individually and cumulatively affect the final cost.

Comparison of Different Coverage Options

Let’s compare two scenarios for a hypothetical driver, Sarah, insuring a mid-sized sedan. Scenario A involves minimum coverage, including liability only (covering damages to others). Scenario B includes comprehensive and collision coverage (covering damages to Sarah’s car in an accident or from other events). Assume Sarah’s annual premium for minimum liability coverage (Scenario A) is $500. Adding comprehensive and collision coverage (Scenario B) increases the premium to $1200 annually. The difference ($700) reflects the added protection for Sarah’s vehicle. While Scenario B is significantly more expensive upfront, it offers substantially greater financial protection in the event of an accident or damage to her car. If Sarah were involved in a collision causing $5,000 worth of damage to her vehicle, Scenario A would leave her responsible for the entire cost, while Scenario B would only require her to pay her deductible (e.g., $500), with the insurer covering the remaining $4,500. This illustrates the trade-off between cost and coverage.

Deductibles and Premiums: An Interplay

Deductibles and premiums are inversely related. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible means a lower premium, and vice versa. Consider two options for Sarah’s comprehensive coverage: a $500 deductible and a $1000 deductible. The higher $1000 deductible would result in a lower annual premium compared to the $500 deductible. This is because the insurance company is assuming less risk with a higher deductible, as you are responsible for a larger portion of the cost in the event of a claim. Choosing a higher deductible can lead to significant savings over time, but it’s essential to consider your financial capacity to cover a larger out-of-pocket expense in the event of an accident or claim.

Final Thoughts

Ultimately, comparing auto insurance quotes is a crucial step in securing affordable and comprehensive coverage. By understanding your needs, researching providers, and utilizing online comparison tools effectively, you can significantly reduce the stress and complexity associated with finding the right policy. Remember to thoroughly review policy details and consider your individual circumstances to make a well-informed decision. Take control of your auto insurance costs – your peace of mind is worth it.

FAQ Resource

What factors affect my auto insurance quote?

Your driving record, age, location, vehicle type, and the coverage level you choose all significantly influence your auto insurance quote.

How often should I compare auto insurance quotes?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change (e.g., new car, change in address, driving record changes).

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally results in a lower premium, and vice versa.

What types of auto insurance coverage are available?

Common types include liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. The best coverage for you depends on your individual needs and risk tolerance.