Navigating the world of auto insurance can feel like driving through a dense fog. Numerous providers, varying coverage options, and fluctuating premiums create a complex landscape. Understanding how to effectively compare auto insurance rates is crucial for securing the best possible coverage at a price that fits your budget. This guide will illuminate the process, empowering you to make informed decisions and potentially save significant money.

From understanding your individual needs and researching key influencing factors to mastering online comparison tools and deciphering policy details, we’ll provide a comprehensive overview of the auto insurance comparison process. We’ll also explore effective strategies for lowering your premiums and highlight the importance of understanding your coverage to avoid costly surprises.

Understanding the Search Intent Behind “Auto Insurance Compare Rates”

The search query “auto insurance compare rates” reveals a user actively seeking the best value for their car insurance. This seemingly simple phrase masks a variety of underlying needs and motivations, reflecting different stages in the customer journey. Understanding these nuances is crucial for effectively targeting potential customers and providing relevant information.

The primary driver behind this search is a desire for cost savings. However, the specific needs and motivations vary considerably depending on individual circumstances and the stage of the purchase process.

User Needs and Motivations

Users searching for “auto insurance compare rates” are driven by a range of factors, including the need to find affordable coverage, secure better policy terms, switch providers, or simply understand the market landscape better. Some might be shopping for insurance for the first time, while others may be renewing their existing policy and seeking a more competitive deal. The urgency and depth of their research also vary widely.

Stages of the Customer Journey

The search query indicates different stages within the customer journey. Some users are in the early stages of research, simply exploring their options and gathering information. Others are further along, actively comparing quotes from different providers and preparing to make a purchase decision. A final group might be nearing the end of the process, ready to finalize their selection and purchase a policy.

Demographics and Psychographics

The demographic and psychographic profile of users searching for “auto insurance compare rates” is broad. It encompasses individuals of various ages, income levels, and life stages. However, certain characteristics tend to be common. These users are likely to be price-conscious and digitally savvy, comfortable using online tools and resources to research and compare products. They might be homeowners, renters, or individuals with varying levels of driving experience. The shared trait is a proactive approach to managing their finances and seeking the best possible value for their money.

User Needs, Search Intent, and Customer Journey

| User Need | Search Intent | Stage of Journey | Example Search Query Variation |

|---|---|---|---|

| Find the cheapest auto insurance | Price comparison | Awareness/Consideration | “cheapest car insurance quotes” |

| Compare coverage options and benefits | Information gathering | Awareness/Consideration | “compare auto insurance coverage” |

| Switch to a new provider with better rates | Active comparison and selection | Decision/Action | “best auto insurance companies near me” |

| Renew policy at a lower cost | Price comparison and renewal | Decision/Action | “auto insurance renewal compare rates” |

| Understand different types of auto insurance | Education and understanding | Awareness | “types of car insurance explained” |

Factors Influencing Auto Insurance Rates

Securing affordable auto insurance involves understanding the numerous factors that influence premium costs. These factors are carefully considered by insurance companies to assess risk and determine appropriate pricing. A thorough understanding of these factors can empower you to make informed decisions about your coverage and potentially lower your premiums.

Driver Profile and Insurance Costs

Your personal characteristics significantly impact your insurance rates. Insurance companies analyze your driving history, age, and even credit score to assess your risk profile. Younger drivers, particularly those with less experience, generally face higher premiums due to statistically higher accident rates. Conversely, older drivers with clean records often benefit from lower rates, reflecting their generally safer driving habits. A history of accidents or traffic violations will undoubtedly increase your premiums, as will a poor credit score, as it can be an indicator of higher risk. For example, a 20-year-old driver with a speeding ticket will likely pay significantly more than a 50-year-old with a perfect driving record.

Vehicle Type and Features

The type of vehicle you drive plays a crucial role in determining your insurance premiums. Sports cars and luxury vehicles are often more expensive to insure than sedans or smaller vehicles due to higher repair costs and a greater likelihood of theft. Safety features, such as anti-lock brakes, airbags, and advanced driver-assistance systems (ADAS), can influence your rates. Vehicles equipped with these features often receive discounts as they demonstrate a reduced risk of accidents and injuries. For instance, a high-performance sports car will generally command a higher premium than a fuel-efficient compact car, even if both vehicles are new.

Location and its Impact on Rates

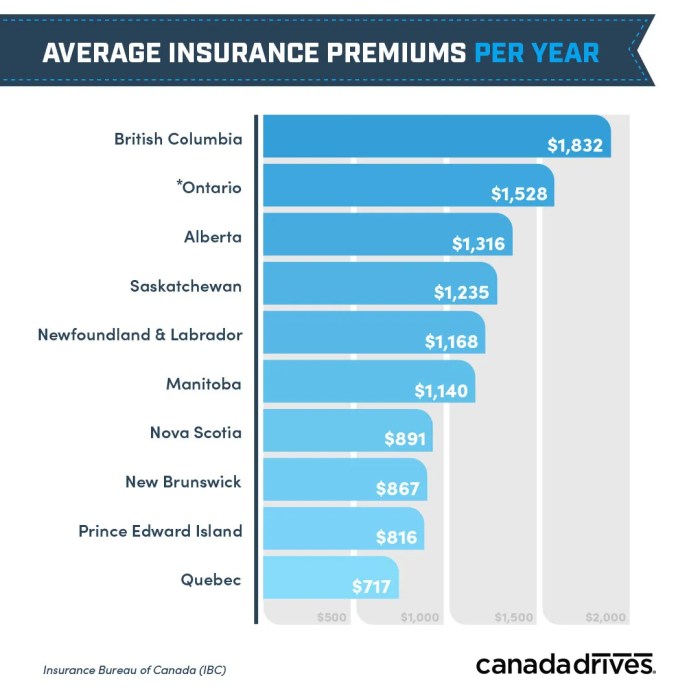

Your location is another significant factor influencing your insurance rates. Insurance companies consider the crime rate, accident frequency, and the cost of vehicle repairs in your area. Urban areas with high traffic density and higher crime rates typically have higher insurance premiums than rural areas with lower accident rates. For example, a driver in a large metropolitan city might pay substantially more than a driver in a small, rural town, even if all other factors are the same.

Coverage Options and Premium Costs

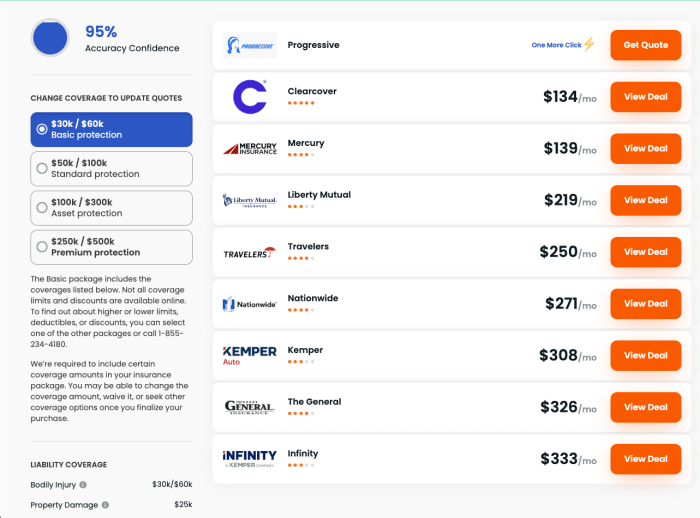

The level of coverage you choose directly impacts your premium. Comprehensive and collision coverage, while offering more protection, typically results in higher premiums than liability-only coverage. Higher liability limits also increase premiums, but provide greater financial protection in case of an accident. Similarly, adding optional coverages such as uninsured/underinsured motorist protection or roadside assistance will affect your overall premium. Choosing a higher deductible can help lower your premium, but it also means you’ll pay more out-of-pocket in the event of a claim.

Driving History and its Influence

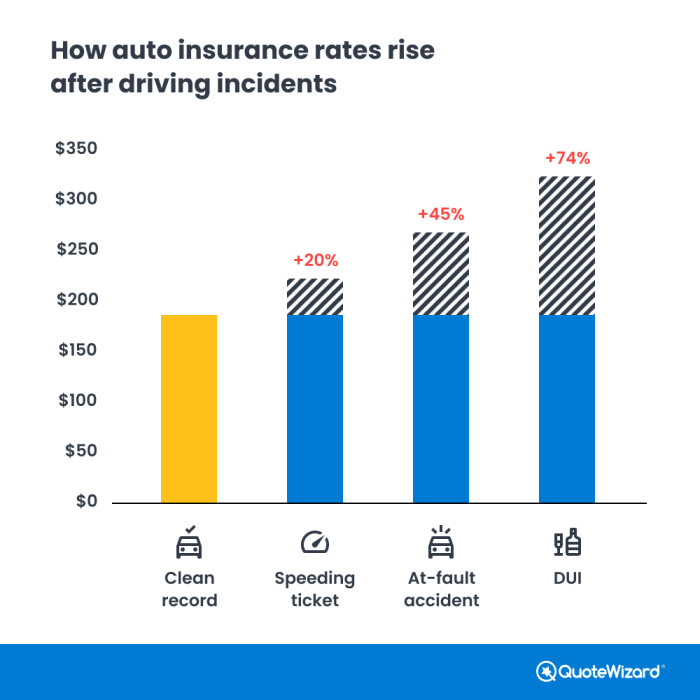

Your driving history is a critical factor in determining your auto insurance rates. A clean driving record, free of accidents and violations, will generally result in lower premiums. Conversely, accidents, speeding tickets, and other moving violations can significantly increase your rates. The severity of the violation also matters; a DUI conviction will likely have a much more substantial impact on your premiums than a minor speeding ticket. Insurance companies use a points system to track driving infractions, with more points leading to higher premiums.

Methods for Comparing Auto Insurance Rates

Comparing auto insurance rates can feel overwhelming, but with a systematic approach, you can find the best coverage at the most competitive price. This section details effective methods for comparing rates online, utilizing comparison tools, understanding policy details, and making informed decisions. Understanding the process will empower you to secure the right insurance protection without overspending.

Effectively comparing auto insurance quotes requires a multi-step process that balances convenience with thoroughness. A streamlined approach ensures you’re not only comparing prices but also the quality and comprehensiveness of the coverage offered.

Online Quote Comparison: A Step-by-Step Guide

Gathering quotes online is the most efficient method for comparing auto insurance rates. This process should be methodical to ensure you obtain accurate and complete information from multiple providers.

- Gather Necessary Information: Before starting, collect all relevant details about your vehicle (year, make, model, VIN), driving history (accidents, tickets, violations), and personal information (address, age, occupation).

- Visit Multiple Insurance Websites: Use several comparison websites and directly visit the websites of individual insurers. Don’t rely on just one source; insurers may offer different discounts and coverage options.

- Complete the Quote Forms Accurately: Provide precise information to ensure you receive accurate quotes. Inaccurate information can lead to higher premiums or policy discrepancies.

- Compare Quotes Side-by-Side: Once you’ve received several quotes, create a spreadsheet or use a comparison tool to organize them. This allows for easy comparison of premiums, deductibles, coverage limits, and other policy features.

- Review Policy Details Carefully: Don’t just focus on price; examine the coverage details. Understand what each policy covers and what exclusions apply. Pay close attention to liability limits, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Contact Insurers for Clarification: If you have any questions or need clarification on specific policy details, contact the insurance providers directly. Don’t hesitate to ask for further explanation of coverage aspects or terms.

Best Practices for Using Online Comparison Tools and Websites

Online comparison tools and websites can significantly simplify the process of comparing auto insurance rates. However, effective use requires understanding their limitations and employing best practices.

- Use Reputable Websites: Choose well-established comparison websites with a strong reputation and transparent privacy policies.

- Be Aware of Potential Biases: Some comparison websites may prioritize certain insurers, potentially influencing the results. Consider visiting individual insurer websites as well.

- Read Reviews and Ratings: Before using any comparison tool, check online reviews and ratings to gauge user experience and reliability.

- Verify Information: Always verify the information provided by comparison websites with the insurers directly, as errors can occur.

- Avoid Clicking on Suspicious Links: Be cautious of unsolicited emails or links promising exceptionally low rates; these could be phishing scams.

Understanding Policy Details and Coverage Options

Choosing the right auto insurance policy involves more than just comparing prices. A thorough understanding of coverage options and policy details is crucial for making an informed decision.

Consider factors such as liability coverage (protecting you in case you cause an accident), collision coverage (repairing your vehicle after an accident regardless of fault), comprehensive coverage (covering damage from events other than collisions), uninsured/underinsured motorist coverage (protecting you if you’re hit by an uninsured driver), and medical payments coverage (covering medical expenses for you and your passengers). Each coverage type has different limits and deductibles that significantly impact the overall cost and protection level. Carefully evaluate your needs and risk tolerance when making your selection.

Flowchart for Comparing and Selecting an Auto Insurance Policy

The following flowchart visually represents the process of comparing and selecting an auto insurance policy. It highlights the key decision points and actions involved in finding the best coverage for your needs.

(Note: A visual flowchart would be included here. It would start with “Gather Information,” branch to “Obtain Quotes from Multiple Insurers,” then to “Compare Quotes and Coverage,” leading to “Review Policy Details,” and finally culminating in “Select Policy and Purchase.”)

Illustrative Examples of Rate Comparisons

Understanding the differences in auto insurance rates can be challenging. This section provides concrete examples to illustrate how rates vary between insurers and how policy details impact the final premium. By examining these examples, you can better understand the importance of comparing quotes before selecting a policy.

Fictional Scenario: Rate Comparison Between Two Insurers

Let’s consider Sarah, a 30-year-old with a clean driving record, driving a 2018 Honda Civic. She’s looking for liability coverage with a $500 deductible. Insurer A offers her a policy with a premium of $800 per year. This policy includes $100,000 bodily injury liability per person, $300,000 bodily injury liability per accident, and $50,000 property damage liability. Insurer B, on the other hand, offers a similar policy for $950 per year, but includes $250,000 bodily injury liability per person, $500,000 bodily injury liability per accident, and $100,000 property damage liability. While Insurer B is more expensive, it offers significantly higher liability coverage. Sarah needs to weigh the cost difference against the increased protection.

Comparative Table: Three Hypothetical Insurance Plans

The following table compares three different insurance plans, highlighting the variations in premium, coverage, and deductible.

| Insurer | Premium (Annual) | Coverage Details | Deductible |

|---|---|---|---|

| Insurer X | $750 | $100,000/$300,000 Bodily Injury, $50,000 Property Damage, Collision, Comprehensive | $500 |

| Insurer Y | $900 | $250,000/$500,000 Bodily Injury, $100,000 Property Damage, Collision, Comprehensive, Uninsured Motorist | $1000 |

| Insurer Z | $1100 | $500,000/$1,000,000 Bodily Injury, $250,000 Property Damage, Collision, Comprehensive, Uninsured Motorist, Roadside Assistance | $500 |

Potential Savings from Rate Comparison

By comparing rates from multiple insurers, consumers can often achieve significant savings. For example, if Sarah had only obtained a quote from Insurer B, she would have paid $150 more annually than necessary. In a five-year period, this would represent a $750 difference. This illustrates the potential for substantial savings by taking the time to compare multiple quotes before committing to a policy. The savings can be even more significant for individuals with less-than-perfect driving records or those insuring higher-value vehicles.

Tips for Saving Money on Auto Insurance

Lowering your auto insurance premiums can significantly impact your budget. By implementing a few strategic changes, you can potentially save hundreds of dollars annually. The following tips offer actionable strategies to achieve this goal.

- Bundle Your Insurance Policies: Many insurance companies offer discounts when you bundle multiple insurance policies, such as auto and homeowners or renters insurance, with the same provider. This is because the insurer can streamline administrative processes and reduce risk by insuring multiple aspects of your life. For example, if you bundle your auto and homeowners insurance with Progressive, you might receive a 10-15% discount on your overall premium, depending on your specific coverage and risk profile. This discount translates directly to lower monthly payments.

- Maintain a Good Driving Record: A clean driving record is one of the most significant factors influencing your insurance rates. Avoiding accidents and traffic violations demonstrates lower risk to insurance companies, resulting in lower premiums. For instance, a driver with a spotless record for five years might qualify for a “safe driver” discount, potentially reducing their premium by 20% or more compared to a driver with multiple accidents or speeding tickets. The cumulative effect of avoiding incidents over time leads to substantial savings.

- Increase Your Deductible: Choosing a higher deductible means you pay more out-of-pocket in the event of an accident. However, this significantly lowers your premium. The trade-off is worth considering if you have sufficient savings to cover a higher deductible. For example, increasing your deductible from $500 to $1000 could reduce your premium by 15-25%, depending on your insurer and coverage. Carefully weigh the risk of a larger upfront payment against the long-term savings.

- Shop Around and Compare Rates: Don’t settle for the first quote you receive. Different insurance companies use varying algorithms and risk assessments, resulting in significantly different premiums for the same coverage. Taking the time to compare quotes from multiple insurers ensures you’re getting the best possible rate. For example, comparing quotes from three different insurers – say, Geico, State Farm, and Allstate – might reveal a difference of several hundred dollars annually for identical coverage.

- Consider Anti-theft Devices and Safety Features: Installing anti-theft devices or having vehicles equipped with advanced safety features, such as anti-lock brakes or airbags, can lower your insurance premiums. These features demonstrate a reduced risk of theft or accidents, which insurers factor into their pricing. For example, installing a GPS tracking system or alarm system could reduce your premium by 5-10%, while cars with advanced safety features often receive discounts reflecting their inherent safety. The specific discount depends on the insurer and the features present.

Final Wrap-Up

Ultimately, comparing auto insurance rates isn’t just about finding the cheapest policy; it’s about finding the right balance between cost and comprehensive coverage. By following the strategies Artikeld in this guide, you can confidently navigate the insurance market, secure optimal protection for your vehicle, and achieve significant savings. Remember, taking the time to compare rates and understand your policy details is an investment in your financial well-being and peace of mind.

Frequently Asked Questions

What is the best time of year to compare auto insurance rates?

There’s no single “best” time, but shopping around every 6-12 months is recommended to ensure you’re getting the best rates. Your circumstances (e.g., moving, changing vehicles) may necessitate more frequent comparisons.

How does my credit score affect my auto insurance rates?

In many states, insurers use credit-based insurance scores to assess risk. A higher credit score typically translates to lower premiums, while a lower score may result in higher rates.

Can I compare rates without providing personal information?

Some comparison websites offer preliminary rate estimates without requiring extensive personal data. However, to obtain accurate quotes, you’ll generally need to provide some information.

What if I have a DUI on my record?

A DUI significantly increases your insurance premiums. Be prepared to disclose this information honestly when comparing rates, as omitting it can lead to policy cancellation.