Navigating the world of auto insurance can feel like driving through a dense fog. Numerous providers, varying coverage options, and fluctuating premiums make finding the best deal a daunting task. This is where the power of auto insurance comparison quotes comes into play, offering a streamlined approach to securing the most suitable and affordable policy for your individual needs. By comparing quotes from multiple insurers, you gain valuable insights into the market, enabling informed decisions and potential significant savings.

This comprehensive guide delves into the intricacies of auto insurance comparison quotes, exploring the search intent behind this crucial process, analyzing leading comparison websites, and providing actionable strategies for making the most of your search. We’ll uncover the key factors influencing quote variations, helping you understand how your driving history, credit score, and coverage choices impact the final price. Ultimately, our aim is to empower you with the knowledge and tools necessary to confidently navigate the insurance landscape and secure the best possible auto insurance policy.

Understanding the Search Intent

Understanding the search intent behind “auto insurance comparison quote” is crucial for effectively reaching potential customers. This seemingly simple phrase masks a variety of underlying needs and motivations, reflecting different stages in the customer’s journey towards purchasing a policy.

The search term indicates a user actively seeking to compare prices and potentially purchase auto insurance. However, the specific needs and information requirements vary considerably.

User Needs Behind the Search

Users searching for “auto insurance comparison quote” have diverse needs. Some are actively shopping for a new policy, while others may be comparing their current coverage to explore potential savings. Some might be reacting to a specific event, such as a recent accident or a change in their driving situation (e.g., new car, new address). Others might simply be proactively seeking better rates. This diversity requires a nuanced approach to providing relevant information.

Stages of the Customer Journey

The search term can reflect different stages in the customer journey. The awareness stage might involve a user simply researching options. The consideration stage involves actively comparing quotes from different providers. The decision stage represents the point where the user is ready to purchase a policy. Understanding these stages helps tailor content to resonate with the user’s current level of engagement.

Information Sought by Users

Users employing this search phrase seek a range of information. This includes price comparisons, coverage options (liability, collision, comprehensive, etc.), policy details (deductibles, premiums, discounts), company reputations (ratings and reviews), and ease of claims processing. The specific information prioritised varies depending on the individual user and their stage in the customer journey.

User Personas and Information Needs

Several user personas can be identified, each with unique information requirements:

- The Price-Conscious Shopper: This persona prioritizes the lowest price above all else. Their primary need is a quick and easy comparison of quotes, focusing on premium costs and any potential discounts.

- The Safety-Focused Driver: This individual is less concerned with price and more interested in comprehensive coverage and high-quality claims service. They seek information on coverage limits, policy features, and company ratings related to claims processing.

- The Newly Licensed Driver: This persona needs guidance on selecting appropriate coverage and understanding the complexities of auto insurance. They may require more educational content alongside price comparisons.

- The Experienced Driver Switching Providers: This user has existing auto insurance but seeks a better deal or improved coverage. They’ll focus on comparing their current policy with available alternatives, looking for features and benefits not currently included.

Competitor Analysis

This section analyzes five leading auto insurance comparison websites, evaluating their features, strengths, weaknesses, and user experience to understand the competitive landscape and identify best practices. The analysis focuses on functionality, design, and the overall effectiveness of each platform in helping users find suitable insurance options.

Top 5 Auto Insurance Comparison Websites

The following table compares five prominent auto insurance comparison websites across key features, strengths, and weaknesses. Note that the specific features and performance of these websites can change over time. This analysis is based on observations made at the time of writing.

| Website | Features | Strengths | Weaknesses |

|---|---|---|---|

| Website A (Example: The Zebra) | Comprehensive quote comparison, detailed policy information, multiple filter options, customer reviews, user-friendly interface. | Excellent user experience, wide range of insurers, clear and concise information presentation. | Limited customization options for certain search parameters, some insurers may not be included in all regions. |

| Website B (Example: NerdWallet) | Quote comparison, articles and guides on auto insurance, personalized recommendations, financial tools integration. | Strong educational content, helpful resources beyond just quotes, good personalization features. | Quote comparison may not be as extensive as some competitors, reliance on third-party data. |

| Website C (Example: Insurify) | Quote comparison, AI-powered analysis of insurance options, personalized recommendations, map-based visualization of coverage options. | Innovative use of technology, visually appealing presentation of data, unique map feature for coverage comparison. | Some features may be overwhelming for less tech-savvy users, potential for inaccuracies in AI-driven recommendations. |

| Website D (Example: Policygenius) | Quote comparison, licensed agents assistance, personalized guidance, diverse insurance product offerings. | Human assistance adds a personal touch, good for users who prefer direct interaction, wider range of insurance products beyond auto. | May not be as cost-effective as purely online comparison platforms, agent availability may vary. |

| Website E (Example: Compare.com) | Quote comparison, various filter options, detailed policy information, customer reviews. | Straightforward and easy-to-use interface, comprehensive filter options for refined searches. | May lack some advanced features found in competitors, design might feel less modern compared to others. |

Key Differentiators Among Websites

Each website differentiates itself through unique features and approaches. Website A excels in user experience and breadth of insurer coverage. Website B leverages educational content and personalized recommendations. Website C utilizes AI for advanced analysis and visualization. Website D offers the advantage of human agent assistance, and Website E focuses on simplicity and comprehensive filtering options. These differences cater to diverse user needs and preferences.

User Experience Analysis

Website A offers a clean, intuitive interface with clear navigation. Website B provides a wealth of information but might feel slightly cluttered. Website C’s innovative features can be both engaging and overwhelming. Website D prioritizes personalized support, potentially at the cost of speed. Website E balances simplicity and functionality effectively. Each platform’s user experience is tailored to its specific value proposition.

Hypothetical User Flow for a Comparison Website

A streamlined user flow should begin with a simple form requesting basic information (zip code, driving history, vehicle details). This is followed by presenting a curated list of quotes, allowing users to filter and sort results based on price, coverage, and other preferences. Detailed policy information should be easily accessible for each quote. Finally, users should be able to seamlessly connect with insurers or agents to finalize their purchase. This flow prioritizes ease of use and efficient information delivery.

Visual Elements & Design

A visually appealing and user-friendly design is crucial for an auto insurance comparison website. The goal is to create a clean, trustworthy, and efficient experience that encourages users to complete the comparison process and obtain quotes. The design should prioritize clarity and ease of navigation, minimizing distractions and maximizing conversion.

The visual design should inspire confidence and trust, essential factors when dealing with financial matters like insurance. A well-structured layout, coupled with clear visual cues, will guide users seamlessly through the process, increasing the likelihood of obtaining quotes.

Color Palette, Imagery, and Typography

The color palette should reflect trustworthiness and professionalism. Consider using a combination of calming blues and greens, perhaps accented with a more vibrant color for calls to action. Avoid overly bright or jarring colors that could distract users or create a sense of unease. Imagery should be high-quality and relevant, possibly showcasing happy families or safe driving scenes. Avoid clichés and opt for images that subtly convey the benefits of insurance, such as security and peace of mind. Typography should be clean, legible, and consistent. Choose fonts that are easy to read, even on smaller screens. A clear hierarchy of headings and subheadings is important to guide the user’s eye and improve readability.

Visual Elements Improving User Understanding and Engagement

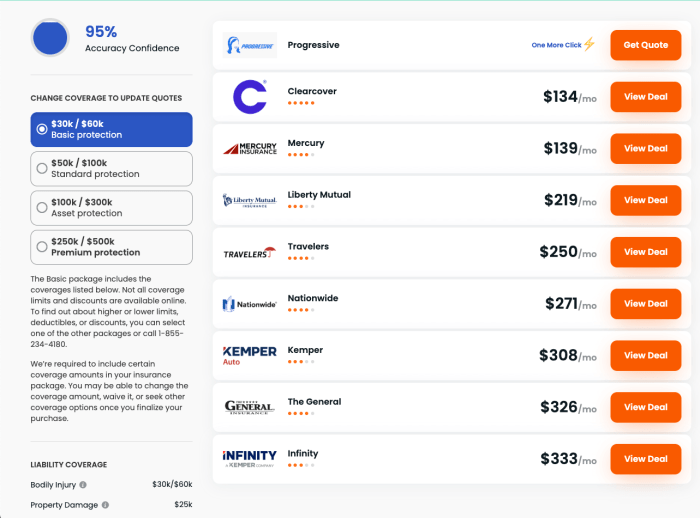

High-quality visuals significantly improve user understanding and engagement. Interactive elements, such as progress bars, clearly illustrate the stages of the comparison process. Data visualization, such as charts comparing prices from different insurers, can effectively present complex information in an easily digestible format. The use of icons and symbols to represent key features of different insurance plans can reduce the need for lengthy text descriptions, improving overall comprehension. A clean, uncluttered layout will improve the overall user experience and minimize cognitive load.

Guiding Users Through the Comparison Process with Visual Cues

A well-designed website should guide users intuitively through the quote comparison process. Visual cues are essential for achieving this.

- Step 1: Initial Information Entry: A clear and concise form with prominent labels and helpful instructions should be used for gathering initial information from the user. A progress bar could show that the user is at the first step.

- Step 2: Quote Generation: A loading animation or progress indicator can maintain user engagement during the quote generation phase. A clear message should be displayed, explaining what is happening.

- Step 3: Comparison Table: A well-structured comparison table with clear headings, visually distinct pricing, and color-coded features will allow users to easily compare quotes. Sorting and filtering options can further enhance usability.

- Step 4: Selection and Next Steps: Once a preferred quote is selected, clear call-to-action buttons, such as “Get this quote,” will guide users to the next step. The button should be visually prominent.

Illustrative Image Description

The illustrative image could depict a family happily driving down a scenic highway, their car gleaming in the sunlight. In the background, a subtle graphic could show multiple insurance quote options, all neatly organized and presented within a user-friendly interface. The overall message is one of peace of mind and security, highlighting the benefits of comparing quotes before making a decision. The image should convey a sense of confidence and control, emphasizing the ease and simplicity of the comparison process.

Factors Influencing Quote Comparisons

Getting the best auto insurance quote involves understanding the various factors that influence pricing. These factors are complex and intertwined, impacting your premium significantly. This section will illuminate the key elements driving quote variations, allowing you to make informed decisions.

Key Factors Influencing Auto Insurance Prices

Several critical factors determine the cost of your auto insurance. These include your driving history, vehicle characteristics, location, and coverage choices. A clean driving record generally results in lower premiums, while factors like vehicle make, model, and age, along with your location’s accident rate and theft statistics, also play a substantial role. Your chosen coverage level, naturally, significantly impacts the overall cost.

Impact of Driver Profiles on Insurance Quotes

Different driver profiles lead to vastly different insurance premiums. Younger drivers, for instance, typically pay more due to higher accident statistics. Drivers with multiple accidents or traffic violations face higher premiums reflecting a greater perceived risk. Conversely, experienced drivers with clean records often qualify for lower rates, demonstrating a history of responsible driving. Factors like marital status and occupation can also influence premiums, though their impact varies among insurers. For example, a married driver might receive a slightly lower rate than a single driver of the same age and driving history. This is because insurers often associate marriage with increased responsibility and stability.

Comparison of Auto Insurance Coverage Types

Understanding the different types of auto insurance coverage is crucial for making informed decisions. The following table Artikels common coverage types, their benefits, and considerations.

| Coverage Type | Description | Benefits | Considerations |

|---|---|---|---|

| Liability Coverage | Covers bodily injury and property damage to others caused by an accident you’re at fault for. | Protects you financially if you injure someone or damage their property. State minimums exist, but higher limits offer greater protection. | Consider your assets and potential liability; higher limits cost more but offer better protection against substantial claims. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Pays for repairs or replacement of your vehicle after a collision, even if you caused the accident. | Often optional; consider your vehicle’s value and deductible. May be dropped if the vehicle is older or has low value. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. | Protects against a wider range of risks beyond accidents. | Optional; consider the value of your vehicle and your risk tolerance. |

| Uninsured/Underinsured Motorist Coverage | Covers injuries and damages caused by an uninsured or underinsured driver. | Protects you in situations where the at-fault driver lacks sufficient insurance. | Highly recommended; offers crucial protection in high-risk areas or when dealing with uninsured drivers. |

Role of Credit Scores and Driving History in Determining Premiums

Insurance companies often use credit scores as an indicator of risk. A higher credit score generally correlates with lower premiums, reflecting a perceived lower risk of claims. This is because individuals with good credit often demonstrate responsible financial behavior, which insurers associate with responsible driving habits. Conversely, a poor credit score can lead to higher premiums. Driving history plays an even more direct role. Accidents and traffic violations increase premiums due to the higher likelihood of future claims. The severity and frequency of incidents significantly impact the premium increase. For instance, a single minor accident might result in a modest increase, while multiple serious accidents could lead to a substantial premium hike.

Final Conclusion

Securing the most advantageous auto insurance policy involves more than simply selecting the cheapest option. A thorough understanding of your needs, a careful analysis of coverage options, and a strategic comparison of quotes are essential steps in this process. By leveraging the insights and strategies Artikeld in this guide, you can confidently navigate the complexities of auto insurance, ultimately saving money and securing comprehensive protection. Remember, taking the time to compare quotes empowers you to make informed decisions, ensuring you find the perfect balance between cost and coverage tailored to your specific circumstances.

Questions Often Asked

What factors affect my auto insurance quote?

Several factors influence your quote, including your driving history, age, location, credit score, the type of vehicle you drive, and the coverage you select.

How often should I compare auto insurance quotes?

It’s advisable to compare quotes annually, or even more frequently if your circumstances change significantly (e.g., new car, address change, driving record alteration).

Are online comparison tools accurate?

Online tools provide a good starting point, but it’s crucial to verify the information with individual insurers, as rates can vary slightly based on specific underwriting criteria.

What does “uninsured/underinsured motorist” coverage mean?

This coverage protects you and your passengers if you’re involved in an accident caused by an uninsured or underinsured driver.

Can I bundle my auto and home insurance?

Yes, many insurers offer discounts for bundling auto and home insurance policies.