Navigating the world of auto insurance can feel like deciphering a complex code. Premiums vary wildly, leaving many drivers unsure of what they should be paying. Fortunately, powerful tools exist to help you understand and control your costs: auto insurance cost estimators. These digital assistants provide a glimpse into the factors influencing your premiums, allowing you to make informed decisions before committing to a policy.

This guide delves into the intricacies of auto insurance cost estimators, exploring their functionality, limitations, and the key factors they consider. We’ll examine how these tools can empower you to find the best coverage at the most competitive price, ultimately helping you save money and drive with confidence.

Understanding Auto Insurance Cost Estimator Tools

Auto insurance cost estimator tools are valuable resources for understanding the potential cost of car insurance. These tools, available online and through insurance agents, provide estimates based on various factors, allowing individuals to compare prices and make informed decisions. However, it’s crucial to understand their functionality and limitations to avoid misinterpretations.

Different types of auto insurance cost estimator tools operate with varying degrees of complexity and data input requirements. Some are simple online calculators requiring basic information like vehicle details and driving history, while others are more sophisticated, incorporating detailed risk assessments. These sophisticated tools might request information about your credit score, claims history, and even your location.

Factors Considered in Premium Calculations

Auto insurance cost estimator tools consider a wide range of factors to calculate premiums. These factors contribute to the overall risk assessment associated with insuring a particular driver and vehicle. For example, a younger driver with a less-than-perfect driving record will likely face higher premiums compared to an older driver with a clean record.

- Vehicle Information: Make, model, year, and safety features of the vehicle significantly influence premiums. A high-performance sports car will generally cost more to insure than a family sedan due to higher repair costs and a greater risk of accidents.

- Driver Information: Age, driving history (accidents, tickets), driving experience, and even credit score are key factors. A driver with multiple accidents or traffic violations will typically pay more.

- Location: Geographic location plays a crucial role. Areas with higher accident rates or theft rates usually have higher insurance premiums.

- Coverage Options: The type and level of coverage selected (liability, collision, comprehensive, etc.) directly impact the cost. Higher coverage limits result in higher premiums.

- Deductibles: The amount the policyholder pays out-of-pocket before the insurance coverage kicks in. Higher deductibles generally result in lower premiums.

Online Estimators versus Insurance Agent Estimators

Online auto insurance cost estimators offer quick and convenient estimates, allowing for easy comparison shopping among different insurers. However, they typically provide only a general estimate, as they may not consider all the nuances of an individual’s situation. In contrast, insurance agents can provide more personalized estimates, considering specific details and potentially securing better rates through their established relationships with insurance companies. An agent can also explain coverage options in detail and help navigate the complexities of insurance policies.

Limitations of Online Auto Insurance Cost Estimators

Online estimators, while convenient, have inherent limitations. They often rely on simplified algorithms and may not fully capture the complexities of individual risk profiles. For example, they might not accurately reflect the impact of specific driving infractions or the nuances of certain coverage options. The estimates generated are not binding quotes and should be considered preliminary. The final premium offered by an insurer may differ from the online estimate. Furthermore, online estimators may not always present all available discounts or options, leading to potentially higher estimated costs than could be obtained through direct contact with an insurance company or agent. Finally, the data privacy aspects of using online estimators should be carefully considered.

Factors Influencing Auto Insurance Costs

Several interconnected factors determine the cost of your auto insurance premium. Understanding these elements can help you make informed decisions and potentially save money. This section will explore the key influences, categorized for clarity.

Driver-Related Factors

Your driving record significantly impacts your insurance cost. Insurers assess risk based on your history. A clean record with no accidents or violations leads to lower premiums, while accidents, speeding tickets, or DUI convictions increase them substantially. The severity of incidents also matters; a minor fender bender will affect your rates less than a serious accident resulting in injuries or significant property damage. Age also plays a role; younger drivers, statistically, have higher accident rates, hence higher premiums. Experience, demonstrated through a long, clean driving history, generally translates to lower costs.

Vehicle-Related Factors

The type of vehicle you drive is a major factor in determining your insurance cost. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less powerful vehicles tend to have lower insurance premiums. Vehicle features also play a role; safety features like anti-lock brakes, airbags, and advanced driver-assistance systems (ADAS) can lower your premiums as they reduce the likelihood of accidents and severity of injuries. The vehicle’s age and its value also influence the cost; newer, more expensive cars typically have higher premiums due to higher repair costs and replacement value.

Location-Related Factors

Where you live significantly affects your insurance rates. Insurers consider the crime rate, accident frequency, and the cost of repairs in your area. Areas with high accident rates or theft rates will generally have higher insurance premiums. The density of the population also plays a role; densely populated areas often have more accidents and therefore higher insurance costs.

Table Summarizing Factor Influence

| Factor | Impact Level | Explanation |

|---|---|---|

| Driving History (Accidents, Tickets) | High | More accidents and violations lead to significantly higher premiums. |

| Age and Driving Experience | High | Younger drivers and those with less experience typically pay more. |

| Vehicle Type (e.g., Sports Car vs. Sedan) | High | Higher-performance vehicles are more expensive to insure. |

| Vehicle Safety Features | Medium | Safety features can lower premiums by reducing risk. |

| Vehicle Age and Value | Medium | Newer, more expensive vehicles generally have higher premiums. |

| Location (Crime Rate, Accident Frequency) | Medium | High-risk areas result in higher premiums. |

| Credit Score (in some states) | Medium | Credit score can be a factor in some states, though regulations vary. |

| Coverage Levels | High | Higher coverage limits (liability, collision, comprehensive) result in higher premiums. |

Using an Auto Insurance Cost Estimator

Online auto insurance cost estimators are valuable tools for quickly comparing rates from different insurers and understanding the factors that influence your premium. They streamline the process of obtaining insurance quotes, allowing you to make informed decisions before contacting companies directly. Using these tools effectively requires understanding the process and providing accurate information.

Step-by-Step Process of Using an Online Auto Insurance Cost Estimator

Most online estimators follow a similar process. Typically, you’ll begin by entering basic information about yourself and your vehicle. The estimator then uses this data to generate a preliminary cost estimate. This estimate isn’t a firm quote, but it provides a good starting point for comparison shopping. The final step usually involves reviewing the results and potentially refining your input to explore different scenarios.

Information Required by Auto Insurance Cost Estimators

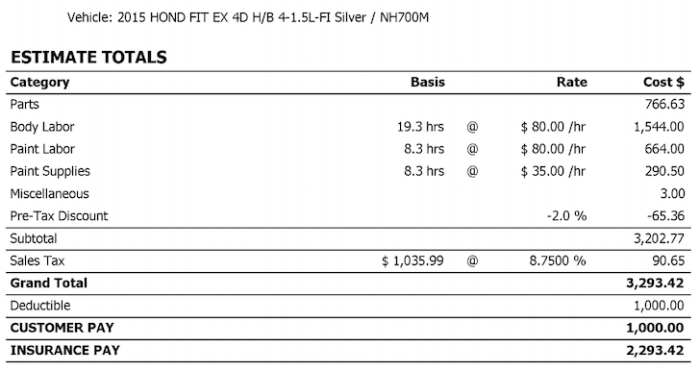

Auto insurance cost estimators require a range of information to calculate a personalized estimate. This information falls into several categories. Firstly, personal details such as your age, address, driving history (including accidents and violations), and credit score (in some states) are crucial. Secondly, details about your vehicle, including the make, model, year, and vehicle identification number (VIN), are necessary. Finally, details about your coverage preferences, such as liability limits, collision and comprehensive coverage, and deductible amounts, will also be required. For example, a tool might ask for your date of birth, your current address, the number of years you’ve held a driver’s license, and whether you’ve had any accidents or traffic violations in the past three years. Regarding your vehicle, the estimator will need information such as the year, make, and model, and the VIN to verify its details. You’ll also need to specify the type of coverage you’re interested in and your preferred deductible amount.

Best Practices for Obtaining Accurate Cost Estimates

To ensure the accuracy of your estimates, provide complete and accurate information. Any omissions or inaccuracies could lead to an estimate that is significantly different from your actual premium. Double-check all entries before submitting the information. It is also important to understand that estimates are just that – estimates. They are not binding quotes. Comparing estimates from multiple estimators can help you gain a broader perspective on pricing. Finally, remember that factors beyond your control, such as your location and the insurer’s current risk assessment models, can influence the final cost. For instance, living in a high-crime area or having a history of claims may lead to higher premiums.

Improved Auto Insurance Cost Estimator User Interface Flow

An improved user interface could utilize a progressive disclosure approach. The initial screen would only request essential information, such as zip code and vehicle year. Subsequent screens would progressively request more detailed information, contingent on the user’s responses. This approach would improve the user experience by minimizing upfront information overload. The use of clear and concise language, avoiding insurance jargon, would further enhance usability. A visual progress bar indicating the completion of each step could also be incorporated. Finally, incorporating interactive elements, such as a vehicle selection tool with image previews, could enhance engagement and accuracy. For instance, the initial screen could show a map to select a location, and the vehicle selection could use a dropdown menu with image thumbnails for easier identification. Subsequent screens would request driving history, coverage preferences, and other details.

Accuracy and Reliability of Estimates

Auto insurance cost estimators provide a valuable tool for understanding potential premiums, but it’s crucial to remember that these are estimates, not guaranteed quotes. Several factors can influence the accuracy of the prediction, leading to variations between the estimated cost and the final price offered by an insurer. Understanding these limitations is key to using these tools effectively.

While these online tools offer a convenient way to get a general idea of costs, it’s important to recognize their inherent limitations. The estimates generated are based on the information you provide, and inaccuracies or omissions in this data can significantly impact the final result. Furthermore, different insurers utilize different algorithms and rating factors, leading to variations in the estimates provided.

Sources of Error in Auto Insurance Cost Estimates

Several factors contribute to potential inaccuracies in online auto insurance cost estimates. These range from the limitations of the data you input to the complexities of insurance rating systems themselves. For example, a minor oversight in providing details about your driving history, such as a past accident, could significantly alter the estimated premium. Similarly, failing to accurately reflect your vehicle’s features or your location can lead to inaccuracies. The estimator may not account for all the nuanced factors considered by an insurer during the underwriting process. These could include credit score, claims history (beyond what’s explicitly asked for), and specific details about your coverage preferences.

Comparison of Estimates from Different Providers

Different insurance providers utilize varying algorithms and rating factors, resulting in different estimates for the same individual. Consider a hypothetical scenario: A 30-year-old driver with a clean driving record in a medium-sized city seeks coverage for a 2020 Honda Civic. One estimator might predict an annual premium of $1200, while another might estimate $1500, reflecting the different weight given to factors like age, vehicle type, and location in their respective models. This highlights the importance of obtaining estimates from multiple providers to gain a broader perspective on potential costs. These differences aren’t necessarily indicative of a lack of accuracy in any single estimator; rather, they reflect the inherent variability in insurance pricing models.

Impact of Input Data Variations on Cost Estimates

The accuracy of an auto insurance cost estimate is directly tied to the accuracy of the input data. Small changes in the information provided can lead to significant variations in the final estimate. For example, altering the reported annual mileage from 10,000 to 15,000 miles might result in a higher estimated premium due to the increased risk associated with more frequent driving. Similarly, selecting a different coverage level (e.g., increasing liability limits) will directly impact the estimate. Providing inaccurate information about your driving history, such as omitting a past accident, could lead to a significantly underestimated premium. The impact of these variations underscores the importance of providing complete and accurate information when using these tools.

Difference Between an Estimate and a Final Quote

An auto insurance cost estimate is simply a prediction based on the information provided. It is not a binding offer. A final quote, on the other hand, is a formal offer from an insurance company after a full underwriting review. This review involves a more comprehensive assessment of your risk profile, considering factors that might not be included in an online estimator. Therefore, while an estimate provides a helpful starting point, the final quote may differ, potentially being higher or lower depending on the insurer’s underwriting criteria. It is essential to remember that only a formal quote from an insurance company constitutes a guaranteed price.

Visualizing Cost Estimates

Understanding how different factors influence your auto insurance costs can be easier with visual aids. Charts and graphs can clearly illustrate the relationships between these factors and the resulting premium. This section explores how visualizations can help you interpret your estimated insurance costs.

Visualizing the impact of various factors on insurance costs allows for a more intuitive understanding than simply looking at numbers in a table. This improved comprehension can lead to better decision-making regarding your insurance choices.

Chart Illustrating the Impact of Factors on Insurance Costs

A bar chart effectively displays the impact of driver age and vehicle value on insurance premiums. The horizontal axis (x-axis) represents the independent variables: age groups (e.g., 16-25, 26-35, 36-45, 46-55, 55+) and vehicle value ranges (e.g., $0-$10,000, $10,001-$20,000, $20,001-$30,000, etc.). The vertical axis (y-axis) represents the dependent variable: the average annual insurance premium. Each bar’s height corresponds to the average premium for a specific age group and vehicle value combination. For example, a taller bar for the 16-25 age group and the $20,001-$30,000 vehicle value range would indicate a higher average premium for that demographic and vehicle type. The chart would clearly show the general trend: higher premiums for younger drivers and more expensive vehicles. Data points could be derived from publicly available insurance rate data or from a sample of insurance quotes. For instance, data could show that the average premium for a 20-year-old driving a $30,000 car is $2,000 higher than that for a 40-year-old driving a $10,000 car.

Visual Representation of a Sample Insurance Cost Breakdown

A pie chart provides a clear and concise visualization of the cost breakdown for a sample insurance policy. The entire pie represents the total annual premium. Each slice represents a different coverage component, such as liability coverage (bodily injury and property damage), collision coverage, comprehensive coverage (fire, theft, vandalism), uninsured/underinsured motorist coverage, and medical payments coverage. The size of each slice is proportional to its cost relative to the total premium. For example, a larger slice for liability coverage would visually demonstrate that it constitutes a significant portion of the total cost. Numerical values indicating the dollar amount and percentage for each coverage type should be clearly displayed next to each slice. A sample breakdown could show liability at 40% ($800) of a $2000 total premium, collision at 30% ($600), and comprehensive at 20% ($400), with the remaining 10% allocated to other coverages. This visual representation allows for easy comparison of the relative costs of different coverage components.

Beyond the Estimate

Receiving an auto insurance cost estimate is just the first step in securing affordable and comprehensive coverage. Understanding what to do next is crucial to ensuring you find the best policy for your needs and budget. This section Artikels the steps you should take after receiving your estimate, helping you navigate the process of obtaining quotes and comparing your options.

An online estimate provides a valuable starting point, but it’s not a formal quote. To secure actual coverage, you’ll need to move forward with the process of obtaining a formal quote from the insurance provider. This involves providing more detailed information about yourself, your vehicle, and your driving history. This detailed information allows the insurer to accurately assess your risk profile and finalize your premium.

Obtaining a Formal Insurance Quote

After receiving a cost estimate, contact the insurance company directly. They will likely request additional information, such as your driver’s license number, vehicle identification number (VIN), and details about your driving history (including accidents and traffic violations). Be prepared to answer questions about your driving habits, the location where your vehicle is primarily parked, and the intended use of the vehicle (e.g., commuting, personal use). The insurer will use this information to calculate a precise quote reflecting your specific circumstances. This quote will typically include details about coverage options, deductibles, and premium payments. For example, you might find that a higher deductible reduces your monthly premium but increases your out-of-pocket expenses in case of an accident.

Comparing Quotes from Multiple Providers

Once you have a formal quote from one insurer, it’s essential to obtain quotes from several other companies. Different insurers use varying algorithms and risk assessment models, leading to potentially significant differences in pricing. Comparing multiple quotes allows you to identify the most competitive and suitable option for your individual needs. For instance, you might find that a company specializing in drivers with good records offers a lower premium than a company that caters to a broader range of drivers. Remember to compare not only the price but also the coverage offered by each provider. A lower premium might not be worth it if the coverage is significantly less comprehensive. A simple comparison table can be helpful to organize the information. For example:

| Insurer | Annual Premium | Deductible | Coverage Details |

|---|---|---|---|

| Company A | $1200 | $500 | Liability, Collision, Comprehensive |

| Company B | $1000 | $1000 | Liability, Collision |

| Company C | $1300 | $500 | Liability, Collision, Comprehensive, Uninsured Motorist |

Closing Notes

Understanding auto insurance costs is crucial for responsible financial planning. While online estimators offer a valuable starting point, remember that they provide estimates, not final quotes. By carefully considering the factors influencing your premiums and comparing quotes from multiple providers, you can secure the best possible auto insurance coverage at a price that aligns with your budget. Take control of your insurance costs—start exploring the options available to you today.

FAQ Compilation

What information do I need to use an auto insurance cost estimator?

Typically, you’ll need information about your vehicle (year, make, model), driving history (accidents, violations), location, and desired coverage levels.

Are online auto insurance cost estimators completely accurate?

No, online estimators provide estimates, not guaranteed quotes. They rely on the data you provide, and small inaccuracies can significantly impact the result. They also might not account for all possible discounts or surcharges.

How do I compare quotes from different insurance providers?

Use a spreadsheet or comparison website to list the key features (coverage, deductible, premium) of each quote side-by-side. This allows for a clear and easy comparison of different options.

What happens after I get an estimate?

An estimate is just a starting point. Contact the insurance provider directly to get a formal quote and discuss your options. This will involve providing more detailed information and potentially undergoing a more thorough risk assessment.

Can I trust an auto insurance cost estimator from a specific insurance company?

While convenient, company-specific estimators may present a biased view. It’s best to compare estimates from several different, independent providers to get a more holistic picture.