Navigating the world of auto insurance can feel like driving through a fog – confusing and potentially costly. This guide aims to illuminate the path, providing a clear understanding of the different types of auto insurance coverage available, the factors influencing premiums, and how to choose the right policy for your needs. We’ll explore everything from liability and collision coverage to the often-overlooked uninsured/underinsured motorist protection, empowering you to make informed decisions about your financial safety on the road.

From understanding policy documents and filing claims to recognizing common exclusions, this guide offers a practical and accessible approach to managing your auto insurance. We’ll delve into real-world scenarios to illustrate how different coverage types work in practice, equipping you with the knowledge to confidently handle any situation.

Types of Auto Insurance Coverage

Choosing the right auto insurance coverage can seem daunting, but understanding the different types available is key to protecting yourself and your vehicle financially. This section will detail the main types of coverage, helping you make informed decisions about your insurance needs.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It’s typically divided into two parts: bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers the cost of repairing or replacing the other person’s vehicle or property. The amounts of coverage are expressed as limits, such as 25/50/25, meaning $25,000 per person for bodily injury, $50,000 total for bodily injury in an accident, and $25,000 for property damage. These limits are crucial; if your liability exceeds these amounts, you’ll be personally responsible for the difference.

Collision Coverage

Collision coverage pays for damage to your vehicle regardless of who is at fault. This means if you hit another car, a tree, or even a deer, collision coverage will help pay for repairs or replacement, minus your deductible. For example, if you’re involved in a single-car accident and your vehicle sustains $5,000 in damage, and your deductible is $500, your insurance company would pay $4,500. It’s important to note that collision coverage doesn’t cover damage caused by things like hail or floods; those are covered under comprehensive coverage.

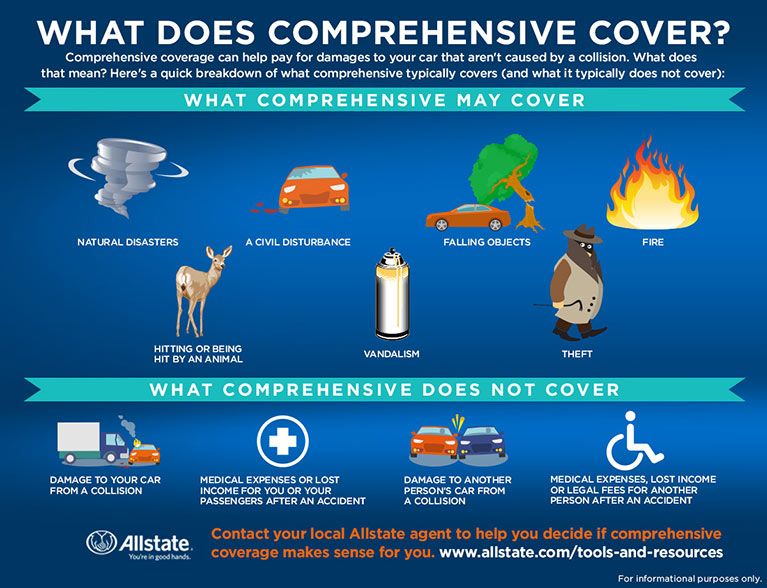

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail, flood, and even damage from animals. Imagine a scenario where a tree falls on your car during a storm; comprehensive coverage would help pay for the repairs. Like collision coverage, a deductible applies. The cost of comprehensive coverage can vary based on factors like your vehicle’s value and your location.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. This is particularly important because many drivers operate without adequate insurance. If an uninsured driver causes an accident resulting in significant injuries or property damage, UM/UIM coverage will help cover your medical bills, lost wages, and vehicle repairs, up to your policy limits. Having sufficient UM/UIM coverage is a vital safety net.

| Coverage Type | What it Covers | Typical Cost Factors |

|---|---|---|

| Liability | Bodily injury and property damage to others caused by you. | Driving record, location, coverage limits. |

| Collision | Damage to your vehicle in an accident, regardless of fault. | Vehicle’s value, age, and your deductible. |

| Comprehensive | Damage to your vehicle from non-collision events (theft, fire, hail, etc.). | Vehicle’s value, age, location, and your deductible. |

| Uninsured/Underinsured Motorist | Injuries and damages caused by an uninsured or underinsured driver. | Coverage limits, location, and driving record. |

Factors Affecting Auto Insurance Premiums

Auto insurance premiums are not a one-size-fits-all cost. Several factors contribute to the final price you pay, and understanding these elements can help you make informed decisions about your coverage and potentially save money. These factors are carefully assessed by insurance companies to determine your risk profile and the associated cost of insuring you.

Driving History

Your driving record significantly impacts your insurance premium. A clean driving record, characterized by no accidents or traffic violations, typically results in lower premiums. Conversely, a history of accidents or violations leads to higher premiums. The severity and frequency of incidents play a crucial role. For example, a single speeding ticket might result in a modest premium increase, while a DUI conviction or an at-fault accident causing significant damage could lead to a substantial increase, or even policy cancellation in some cases. Insurance companies view these events as indicators of higher risk.

Age and Gender

Statistically, age and gender correlate with accident rates. Younger drivers, particularly those under 25, generally pay higher premiums due to their increased likelihood of being involved in accidents. This is often attributed to a lack of experience and a higher propensity for risk-taking behavior. Similarly, gender can also play a role, although this varies by region and insurance company. Historically, male drivers, especially young males, have been associated with higher accident rates than female drivers. However, this trend is becoming less pronounced in recent years.

Vehicle Type, Location, and Credit Score

The type of vehicle you drive influences your premium. Sports cars and high-performance vehicles typically cost more to insure than sedans or economy cars due to their higher repair costs and greater potential for theft. Your location also matters; premiums tend to be higher in urban areas with higher accident rates and traffic congestion compared to rural areas. Finally, your credit score can surprisingly impact your insurance rates. Insurance companies often use credit scores as an indicator of financial responsibility, believing that individuals with good credit are less likely to file fraudulent claims.

Comparison of Insurance Rates for Different Driver Profiles

The following illustrates how different driver profiles can lead to varying insurance premiums:

- Young Driver (20 years old, city dweller, sports car, one speeding ticket): Expect significantly higher premiums due to age, vehicle type, location, and driving record.

- Experienced Driver (45 years old, rural resident, sedan, clean driving record): Likely to receive lower premiums due to age, vehicle type, location, and clean driving record.

- City Driver (30 years old, sedan, multiple minor accidents): Premiums will be higher than a similar driver with a clean record, reflecting the increased risk associated with city driving and accident history.

- Rural Driver (30 years old, truck, clean driving record): Premiums will generally be lower than a city driver with a similar profile, reflecting the lower accident rates in rural areas.

Hypothetical Premium Calculation

Let’s imagine Sarah, a 28-year-old living in a city, drives a mid-size sedan and has one at-fault accident on her record. Her good credit score partially mitigates the impact of the accident. Compared to John, a 50-year-old with a clean driving record, living in a rural area and driving an economical car, Sarah’s premium would be considerably higher. The combination of her age, location, accident history (even with a good credit score), and vehicle type contributes to a higher risk profile and consequently, a higher premium. The exact difference would depend on the specific insurance company and their rating algorithms.

Choosing the Right Coverage

Selecting the right auto insurance coverage involves carefully considering your individual needs and risk profile. The goal is to find a balance between adequate protection and affordable premiums. This process requires understanding your liability exposure, the potential for damage to your vehicle, and the additional benefits that optional coverages can provide.

Determining Appropriate Liability Limits

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. The limits are expressed as three numbers: bodily injury per person, bodily injury per accident, and property damage per accident (e.g., 100/300/100). Determining appropriate limits depends on several factors, including your assets, income, and the potential severity of accidents in your area. Higher limits offer greater protection but come with higher premiums. Consider the potential costs of serious injuries or extensive property damage; a higher limit can prevent financial ruin in the event of a significant accident. For example, a policy with limits of 250/500/250 offers significantly more protection than a 25/50/25 policy, although the premium will be higher. It’s advisable to consult with an insurance professional to determine the appropriate liability limits based on your specific circumstances.

Collision and Comprehensive Coverage: Necessity Assessment

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, or hail. The decision of whether to carry these coverages depends on several factors. If you have an older vehicle with a low market value, the cost of collision and comprehensive coverage may outweigh the potential benefits. Conversely, if you have a newer vehicle with a significant loan or lease, these coverages are crucial to protect your financial investment. The decision also depends on your financial ability to self-insure for potential repairs or replacement costs. For example, if you can comfortably afford to pay for repairs or a replacement vehicle out of pocket, you might choose to forgo these coverages to reduce premiums.

Optional Coverages: Benefits and Drawbacks

Several optional coverages can enhance your auto insurance protection. Roadside assistance covers costs associated with towing, flat tire changes, and lockouts. Rental car reimbursement can help cover the cost of a rental car while your vehicle is being repaired after an accident. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks adequate insurance. These optional coverages offer valuable peace of mind, but they increase your premiums. Weigh the potential benefits against the added cost to determine if they are worth the investment for your individual situation. For instance, if you frequently travel long distances or live in an area with a high rate of uninsured drivers, uninsured/underinsured motorist coverage may be a worthwhile addition.

Decision-Making Flowchart for Auto Insurance Coverage Selection

A flowchart visualizing the decision-making process would begin with assessing your risk tolerance and financial situation. This would branch into evaluating the necessity of liability coverage, with a decision point determining the appropriate liability limits based on individual circumstances and asset protection needs. Next, the flowchart would branch into a decision point concerning the need for collision and comprehensive coverage, based on the vehicle’s age, value, and loan status. Finally, the flowchart would consider the need for optional coverages, such as roadside assistance or rental car reimbursement, based on individual driving habits and needs, leading to the final selection of a comprehensive auto insurance policy. The flowchart’s visual nature would help guide individuals through a logical and systematic process of selecting the right coverage, ensuring a personalized and suitable policy tailored to their specific requirements.

Understanding Policy Documents and Exclusions

Your auto insurance policy is a legally binding contract. Understanding its terms, particularly the exclusions, is crucial to ensure you’re adequately protected and avoid unexpected denial of claims. This section will clarify common exclusions and guide you through effectively reviewing your policy documents.

Common Exclusions in Auto Insurance Policies

Standard auto insurance policies typically exclude coverage for certain situations. These exclusions are often designed to limit liability in high-risk scenarios or to prevent abuse of the system. Failing to understand these exclusions could lead to significant financial burdens in the event of an accident.

- Damage caused by intentional acts: If you intentionally damage your car or someone else’s, your insurance will likely not cover the costs.

- Driving under the influence of alcohol or drugs: Most policies exclude coverage if the driver is intoxicated at the time of the accident.

- Racing or other illegal activities: Participating in illegal racing or other high-risk activities typically voids coverage.

- Damage from wear and tear: Normal wear and tear on your vehicle, such as tire punctures or brake pad wear, is not covered.

- Damage caused by acts of God: While comprehensive coverage often protects against certain weather-related damage, events like earthquakes or floods may have specific exclusions.

- Using a vehicle without permission: If you’re driving a car you don’t own without the owner’s permission and are involved in an accident, your insurance may not cover the damages.

Understanding Policy Declarations and Coverage Limits

The declarations page of your policy summarizes key information, including your coverage limits, premiums, and policy period. Coverage limits define the maximum amount your insurance company will pay for a specific type of claim. For example, a $100,000 bodily injury liability limit means the insurer will pay a maximum of $100,000 for injuries caused to others in an accident. Understanding these limits is vital in determining your level of protection. Insufficient coverage limits can leave you personally liable for significant expenses beyond the policy’s payout.

Effectively Reviewing Policy Documents

Carefully reviewing your policy is essential. Don’t just skim it; take the time to understand each section. Start with the declarations page to grasp the basics. Then, thoroughly read the sections describing your coverage types and their limitations. Pay close attention to any exclusions. If anything is unclear, contact your insurance provider for clarification. Consider keeping a copy of your policy in a safe place and noting key dates, such as renewal dates.

Examples of Coverage Denial Due to Policy Exclusions

Scenario 1: A driver, under the influence of alcohol, causes an accident resulting in significant property damage and injuries. The insurance company will likely deny coverage due to the exclusion for driving under the influence.

Scenario 2: A policyholder uses their vehicle for an unsanctioned race, resulting in an accident. The claim will likely be denied due to the exclusion for participation in illegal activities.

Scenario 3: A car suffers damage from a tree falling during a severe storm. If the policy excludes damage from falling trees, or specifically excludes damage caused by certain weather events, the claim might be denied. However, comprehensive coverage may cover such events if the policy clearly specifies it.

Concluding Remarks

Securing adequate auto insurance coverage is a crucial step in responsible driving. By understanding the various types of coverage, the factors affecting premiums, and the claims process, you can protect yourself financially and legally. Remember, the right policy is a personalized choice based on your individual circumstances and risk tolerance. This guide serves as a foundation for informed decision-making, allowing you to confidently navigate the complexities of auto insurance and drive with peace of mind.

Query Resolution

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident, paying for the other person’s damages. Collision coverage protects your vehicle in an accident, regardless of fault.

How often can I expect my auto insurance rates to change?

Rates can change periodically, often annually, based on factors like your driving record, claims history, and changes in the insurance market.

What should I do if I’m involved in a hit-and-run accident?

Report the accident to the police immediately, then contact your insurance company as soon as possible. Document the incident with photos and witness information if available.

Can I get my insurance premiums lowered?

Yes, maintaining a clean driving record, taking defensive driving courses, and bundling insurance policies can often lead to lower premiums.