Navigating the world of auto insurance can feel like deciphering a complex code, and understanding your deductible is a crucial first step. This seemingly small number significantly impacts your out-of-pocket expenses after an accident and your overall premium cost. Choosing the right deductible involves weighing the risk of higher upfront costs against the potential for lower monthly payments. This guide will unravel the mysteries of auto insurance deductibles, empowering you to make informed decisions.

We’ll explore various deductible types, the factors influencing your choice, and the crucial role it plays in the claims process. We’ll also examine the relationship between deductibles and premiums, and discuss the possibility of deductible waivers. By the end, you’ll have a clear understanding of how to choose a deductible that best suits your individual needs and financial situation.

Defining Auto Insurance Deductibles

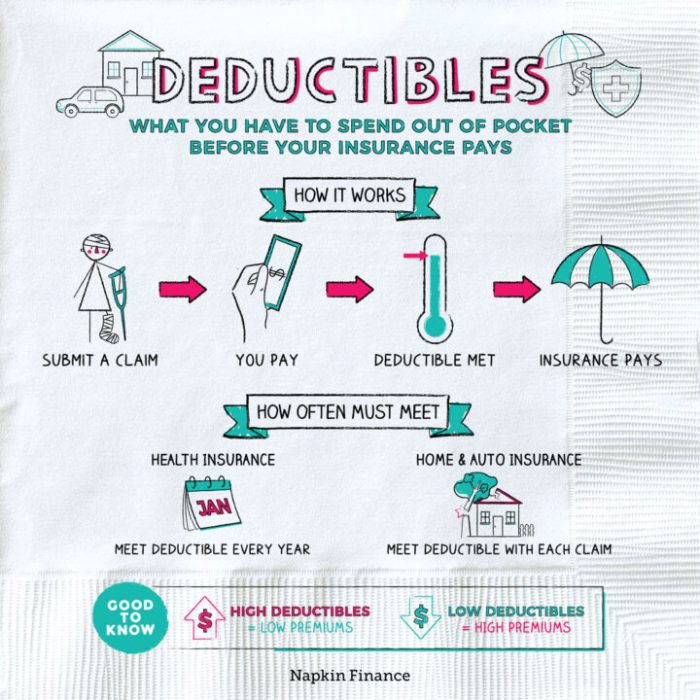

Understanding your auto insurance deductible is crucial for managing your insurance costs and knowing what you’ll pay out-of-pocket in the event of an accident. Simply put, your deductible is the amount of money you agree to pay yourself before your insurance company starts covering the costs of repairs or replacement. It’s essentially your share of the responsibility in case of a claim.

Your deductible amount directly impacts your insurance premium, the amount you pay regularly for your coverage. Choosing a higher deductible generally leads to lower premiums, while a lower deductible means higher premiums. This is because a higher deductible signifies less risk for the insurance company; they’ll pay out less frequently.

Deductible Amounts and Premium Impact

The amount of your deductible is a key decision when purchasing auto insurance. Common deductible amounts range from $250 to $2,000 or more. For example, a policy with a $500 deductible will typically have a higher monthly premium than a policy with a $1,000 deductible. The difference in premiums can be significant, depending on your location, coverage type, and other factors. A person might find that choosing a $1000 deductible instead of a $500 deductible saves them $50 per month on their premium. Over a year, this would represent a savings of $600, which might be offset by the higher deductible if they have a claim. However, if no claim is filed, the savings remain entirely in the policyholder’s pocket.

High vs. Low Deductibles: A Trade-off

Choosing between a high and low deductible involves a careful consideration of risk tolerance and financial capability. A high deductible ($1,000 or more) translates to lower monthly premiums. This is beneficial for drivers who are confident in their driving abilities and have sufficient savings to cover a larger out-of-pocket expense if an accident occurs. Conversely, a low deductible ($250 or less) results in higher monthly premiums but provides greater financial protection in case of an accident. This is a better option for drivers who prioritize financial security and prefer smaller out-of-pocket expenses, even if it means paying more each month. The best choice depends entirely on individual circumstances and risk assessment. For instance, a driver with a history of accidents might opt for a lower deductible to mitigate potential financial burdens, whereas a driver with an impeccable record and substantial savings might prefer a higher deductible to lower their monthly payments.

Types of Auto Insurance Deductibles

Understanding the different types of auto insurance deductibles is crucial for making informed decisions about your coverage. The deductible you choose significantly impacts your premiums and your out-of-pocket expenses in the event of an accident. Choosing the right deductible involves balancing the cost of your premiums with your willingness to absorb potential repair costs.

Deductible Types and Their Impact

Several types of auto insurance deductibles exist, each affecting your financial responsibility differently. The most common types are per-accident deductibles, per-claim deductibles, and deductibles specific to coverage types like comprehensive and collision.

| Deductible Type | Description | Impact on Premium | Example Scenario |

|---|---|---|---|

| Per Accident Deductible | You pay your chosen deductible amount once per accident, regardless of the number of claims filed. | Generally lower premiums than per-claim deductibles. | You’re involved in a single accident causing damage to your car and another vehicle. You file two claims (one for your car, one for the other vehicle). You pay your deductible only once. |

| Per Claim Deductible | You pay your chosen deductible amount for each separate claim filed, even if they stem from the same accident. | Generally higher premiums than per-accident deductibles. | You’re in an accident causing damage to your car and another vehicle. You file two claims (one for your car, one for the other vehicle). You pay your deductible twice. |

| Comprehensive Deductible | This deductible applies to claims related to non-collision damage, such as theft, vandalism, or weather damage. | Affects comprehensive coverage premium; a higher deductible usually means a lower premium. | Your car is damaged by a hailstorm. You file a comprehensive claim and pay your comprehensive deductible. |

| Collision Deductible | This deductible applies to claims related to accidents involving collisions with another vehicle or object. | Affects collision coverage premium; a higher deductible usually means a lower premium. | You hit a deer, causing damage to your vehicle. You file a collision claim and pay your collision deductible. |

Deductible Types and Out-of-Pocket Expenses

The type of deductible you choose directly influences your out-of-pocket expenses after an accident. For instance, a per-accident deductible is more cost-effective in scenarios with multiple claims arising from a single incident. Conversely, a per-claim deductible will lead to higher out-of-pocket expenses in such situations. Having separate deductibles for comprehensive and collision coverage allows for more flexibility, potentially reducing costs if the damage is covered under only one type of coverage. Consider your risk tolerance and financial capacity when selecting a deductible type. A higher deductible typically results in lower premiums, but also means you’ll pay more out-of-pocket if you file a claim. A lower deductible means higher premiums but lower out-of-pocket expenses in the event of an accident.

Factors Influencing Deductible Choices

Choosing the right auto insurance deductible is a crucial decision that significantly impacts your premiums and out-of-pocket expenses in case of an accident. Several factors interplay to determine the most suitable deductible for your individual circumstances. Understanding these factors empowers you to make an informed choice that aligns with your financial situation and risk tolerance.

Your driving history, age, and location are key elements influencing your deductible selection. Insurance companies assess risk based on these factors, ultimately affecting the premiums and deductible options available to you. A clean driving record typically allows for lower premiums and potentially a wider range of deductible choices, while a history of accidents or violations may necessitate higher premiums and potentially limit your deductible options to higher amounts.

Driving History’s Impact on Deductible Selection

A driver’s history significantly influences the available deductible options and the associated premiums. Individuals with a clean driving record, characterized by the absence of accidents or traffic violations, are generally considered lower risk by insurance companies. This lower-risk profile often translates to access to lower premiums and a wider range of deductible choices, including lower deductibles. Conversely, drivers with a history of accidents or traffic violations are viewed as higher risk. This higher-risk assessment may result in higher premiums and a more limited selection of deductibles, often favoring higher deductible options. For example, a driver with multiple at-fault accidents might only be offered higher deductible options to offset the increased risk.

Age and Deductible Selection

Age is another significant factor influencing deductible choices. Younger drivers, particularly those with less driving experience, are often considered higher risk due to increased likelihood of accidents. Insurance companies may offer fewer deductible options to these drivers, typically favoring higher deductibles to mitigate the perceived risk. Conversely, older drivers with extensive driving experience and a clean record may qualify for lower premiums and a wider range of deductible options, potentially including lower deductibles. This reflects the statistical observation that accident rates tend to be higher among younger drivers and decrease with age and experience.

Location and Deductible Selection

Your location plays a crucial role in determining your insurance premiums and, consequently, your deductible options. Areas with high crime rates, frequent accidents, or severe weather conditions are considered higher risk. Insurance companies reflect this increased risk in higher premiums and may limit the availability of lower deductibles in such locations. For instance, drivers residing in areas prone to hailstorms or theft might find fewer options for lower deductibles due to the increased likelihood of claims. Conversely, drivers in areas with lower accident rates and less severe weather may have access to a wider range of deductible options, including lower ones, reflecting the reduced risk associated with their location.

Key Considerations When Choosing a Deductible Amount

Choosing a deductible involves weighing the trade-off between lower premiums and higher out-of-pocket expenses in case of a claim. A higher deductible means lower premiums, but you’ll pay more if you need to file a claim. Conversely, a lower deductible means higher premiums but lower out-of-pocket costs in the event of an accident. This decision requires careful consideration of your financial situation and risk tolerance.

Factors to Weigh When Deciding on a Deductible

Before selecting a deductible, consumers should carefully consider several key factors. These include:

- Your emergency fund: A larger emergency fund allows for greater flexibility in choosing a higher deductible and lower premiums.

- Your risk tolerance: A higher risk tolerance may favor a higher deductible and lower premiums.

- Your driving history: A clean driving record often allows for more deductible options, including lower ones.

- Your vehicle’s value: The value of your vehicle should be considered in relation to the deductible amount.

- Your budget: Your monthly budget will influence your ability to manage higher premiums associated with lower deductibles.

Deductible and Claim Process

Understanding how your deductible works within the claims process is crucial for navigating auto insurance effectively. This section details the steps involved in filing a claim and explains how your deductible affects the final cost of repairs.

Filing a claim typically begins with reporting the accident to your insurance company. This often involves providing details about the accident, including the date, time, location, and parties involved. You’ll likely need to provide information about the damage to your vehicle and any injuries sustained. The insurance company will then investigate the claim, potentially requiring you to provide additional documentation, such as police reports or photos of the damage.

Claim Process Steps

After reporting the accident, your insurance company will guide you through the necessary steps. This might include arranging for vehicle inspections, securing estimates for repairs, and negotiating settlements with other involved parties. Once the liability is determined and the repair costs are assessed, the claims adjuster will determine the amount your insurance company will cover. This is where your deductible comes into play. Your deductible is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

Deductible Payment

Following the assessment of the damage and determination of liability, you will be informed of the amount you owe as your deductible. Payment is usually required before the repair process begins. You can typically pay your deductible through various methods, including check, money order, or credit card. Some insurance companies may offer payment plans, especially for larger deductibles. It is important to confirm the payment options with your insurance company before the repairs start.

Calculating Total Repair Costs

The total cost of the repair is the sum of your deductible and the amount your insurance company covers. For example, if your repair estimate is $2,000 and your deductible is $500, your insurance company will pay $1,500, and you will be responsible for the remaining $500.

Total Repair Cost = Repair Estimate – Insurance Coverage + Deductible

Total Repair Cost = $2000 – $1500 + $500 = $2000

This formula illustrates how your deductible impacts your overall expenses. Choosing a higher deductible will generally lower your premium, but it will increase your out-of-pocket expenses in the event of a claim. Conversely, a lower deductible means higher premiums but lower out-of-pocket costs when filing a claim. Understanding this trade-off is key to selecting a deductible that best suits your financial situation and risk tolerance.

Impact of Deductibles on Premiums

Choosing your auto insurance deductible significantly impacts your premium cost. Essentially, a higher deductible means a lower premium, and vice-versa. This is because a higher deductible signifies you’re willing to shoulder more of the financial burden in the event of an accident, reducing the insurer’s risk and, consequently, their payout.

The relationship between deductible and premium is inverse. This means that as one increases, the other decreases. Insurance companies base their premiums on risk assessment; a higher deductible lowers their potential payout, thus lowering your premium. Conversely, a lower deductible increases their potential payout, resulting in a higher premium.

Deductible and Premium Correlation

Imagine a graph with the x-axis representing the deductible amount (increasing from left to right) and the y-axis representing the premium cost (decreasing from top to bottom). The line representing the relationship would slope downwards from left to right, showing a clear negative correlation. A point on the far left, representing a low deductible, would show a high premium cost. A point on the far right, representing a high deductible, would show a significantly lower premium cost. The slope would likely not be perfectly linear; the premium reduction might be more significant for initial increases in the deductible and then level off as the deductible increases further.

Illustrative Examples

Let’s consider two scenarios for a hypothetical driver:

Scenario 1: A driver chooses a $500 deductible. Their annual premium might be $1200.

Scenario 2: The same driver opts for a $1000 deductible. Their annual premium might decrease to $1000.

In this example, doubling the deductible from $500 to $1000 results in a $200 reduction in the annual premium. This demonstrates the financial trade-off involved: a higher deductible means a lower premium, but also a greater out-of-pocket expense in case of a claim. The exact savings will vary based on factors such as your driving history, location, and the type of vehicle you insure. However, the general principle of an inverse relationship between deductible and premium remains consistent across most insurance providers.

Understanding Deductible Waivers

Deductible waivers are a valuable but often misunderstood aspect of auto insurance. Essentially, a deductible waiver means your insurance company agrees to pay your claim without requiring you to pay your deductible upfront. This can significantly reduce the out-of-pocket expense following an accident, making a potentially stressful situation much more manageable. However, it’s crucial to understand the circumstances under which waivers are granted and any limitations that may apply.

Deductible waivers are not a standard feature of most auto insurance policies. They are typically offered as an add-on or are available only under specific circumstances defined by the insurer’s policy. Understanding these conditions is key to determining if a waiver is a worthwhile addition to your coverage.

Situations Where Deductibles Might Be Waived

Several situations might lead an insurance company to waive your deductible. These often involve circumstances beyond your control, where holding you responsible for the deductible would be unfair or impractical. For example, if your car is damaged due to a hit-and-run accident, and the at-fault driver is never identified, your insurer might waive your deductible, recognizing the impossibility of recovering the cost from another party. Similarly, if your vehicle is damaged by a falling tree or other natural disaster (depending on specific policy wording and the nature of the event), the deductible might be waived. Comprehensive coverage, which covers non-collision events, often has a higher chance of a deductible waiver in these circumstances. In some cases, insurance companies may also waive deductibles as a gesture of goodwill, especially for long-term policyholders with a clean claims history.

Conditions and Limitations of Deductible Waivers

It’s important to remember that deductible waivers are not guaranteed. Even in situations where a waiver seems likely, the insurance company retains the right to assess the circumstances and make a final determination. The specific conditions and limitations will vary depending on the insurance company and the individual policy. For instance, a policy might specify that deductibles are waived only for comprehensive claims and not for collision claims. Additionally, some waivers may be limited to a certain dollar amount, or they might be subject to the successful identification and prosecution of the at-fault party in cases like hit-and-run accidents. The policy documents should clearly Artikel the specific conditions under which a deductible waiver might apply. It is always advisable to carefully review your policy wording and contact your insurer directly to clarify any uncertainties regarding deductible waivers.

Final Summary

Ultimately, selecting the right auto insurance deductible is a personal financial decision. By carefully considering your driving history, financial stability, and risk tolerance, you can find the balance between affordable premiums and manageable out-of-pocket expenses in the event of an accident. Remember to review your policy regularly and don’t hesitate to contact your insurer with any questions. Making informed choices about your auto insurance deductible can provide significant peace of mind and financial protection.

User Queries

What happens if I’m at fault for an accident and don’t have enough money to pay my deductible?

Your insurer will likely still process your claim, but you’ll need to arrange payment for the deductible. Options include payment plans or financing. Failure to pay may affect future coverage.

Can I change my deductible after my policy has started?

Generally, yes, but it often involves modifying your existing policy, which might lead to a premium adjustment. Contact your insurer to inquire about the process and any potential changes to your rates.

Does my deductible reset every year?

Your deductible remains the same throughout your policy term unless you actively change it. It does not reset annually unless you renew your policy with a different deductible amount.

What if my repairs cost less than my deductible?

You wouldn’t file a claim in this instance as the repair cost is less than your out-of-pocket responsibility. You would pay for the repairs yourself.