Navigating the complexities of auto insurance can be daunting. While standard policies offer crucial coverage, they often fall short in addressing the financial gap between your vehicle’s actual cash value and the outstanding loan balance after an accident. This is where an auto insurance gap policy steps in, offering a crucial safety net for car owners. This comprehensive guide will explore the intricacies of gap policies, outlining their benefits, costs, and how they can protect you from significant financial losses.

We’ll delve into the mechanics of a gap policy claim, compare it to standard coverage, and analyze various scenarios to illustrate its practical application. We’ll also explore alternative financial strategies to help you make informed decisions about protecting your vehicle investment. By the end, you’ll possess a clear understanding of whether a gap policy is the right choice for your specific circumstances.

What is an Auto Insurance Gap Policy?

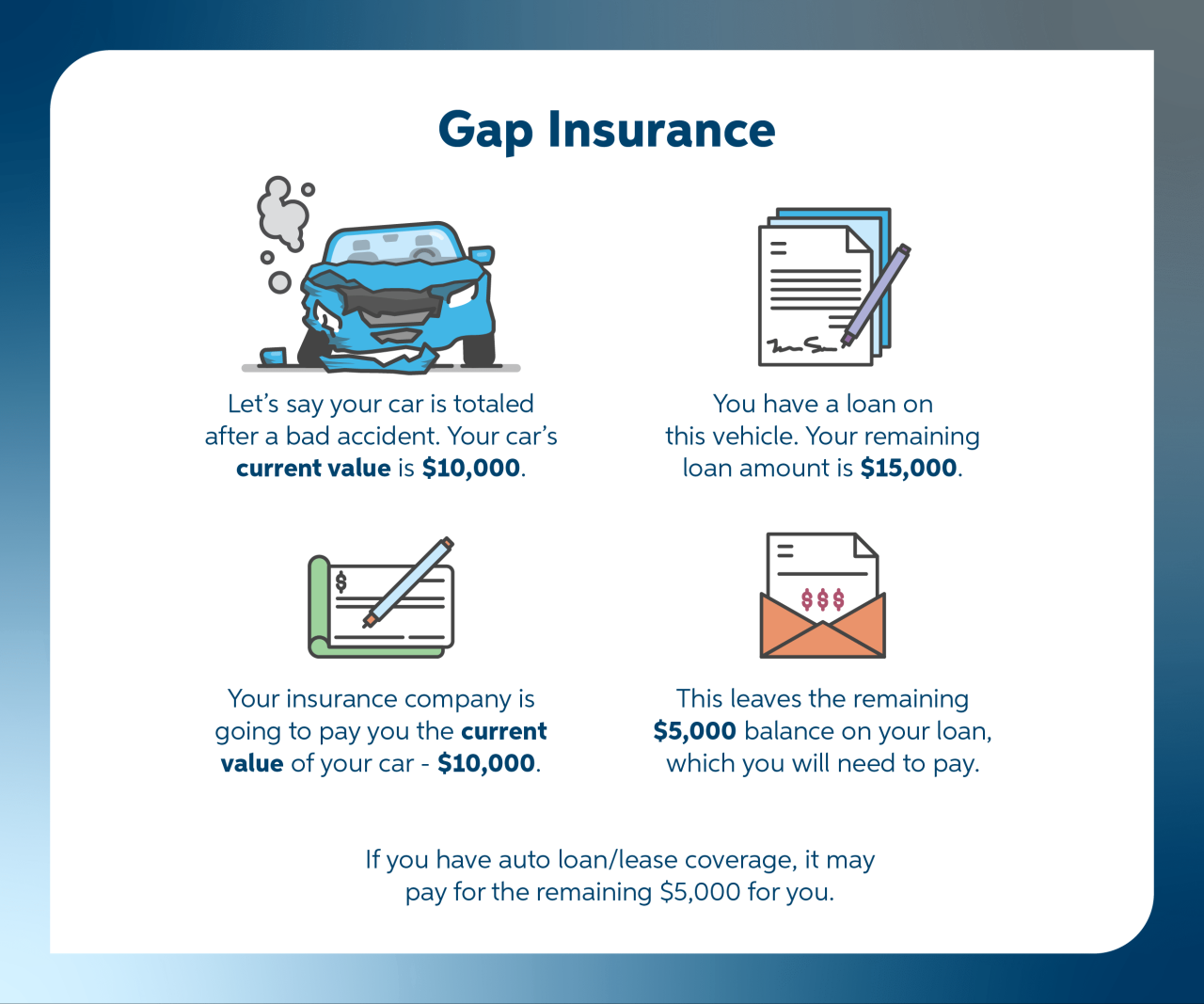

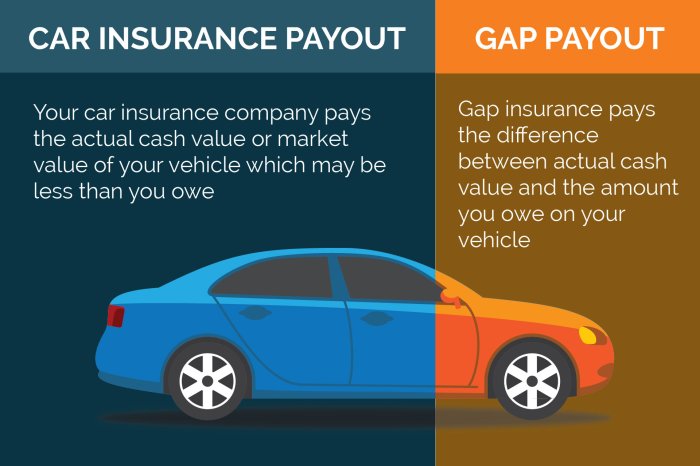

An auto insurance gap policy is a supplemental insurance product designed to protect you from significant financial losses in the event of a total vehicle loss. Standard auto insurance typically covers the actual cash value (ACV) of your vehicle, which depreciates over time. A gap policy bridges the difference between the amount your standard insurance pays and the amount you still owe on your auto loan or lease.

A gap policy’s purpose is to safeguard you from being left with a substantial debt after a total loss. This is particularly crucial during the early years of a loan when the vehicle’s value depreciates rapidly, leaving you owing more than the car is worth.

Beneficial Circumstances for a Gap Policy

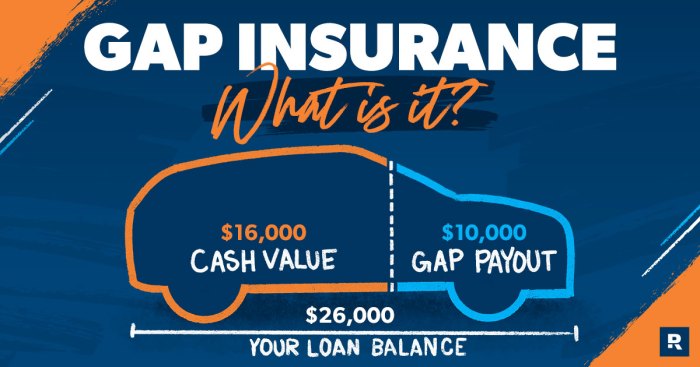

A gap policy offers the most significant benefits when you finance or lease a new vehicle. The larger the loan amount and the newer the vehicle, the greater the potential for a substantial gap between the ACV and the loan balance. This is because newer cars depreciate quickly. For example, a car purchased with a large loan might depreciate by 20% or more in its first year. If totaled in that first year, the insurance payout may only cover a portion of the loan, leaving you responsible for the remaining balance. A gap policy would cover this difference.

Examples of Gap Policy Coverage

Imagine you financed a new car for $30,000. After one year, the car’s ACV drops to $22,000 due to depreciation. If the car is totaled, your standard insurance would only pay out $22,000. However, you still owe $28,000 on your loan. A gap policy would cover the $6,000 difference, preventing you from being personally liable for that amount. Another example involves leasing a vehicle. If the vehicle is totaled and you owe money on the lease, the gap policy would cover that remaining balance. Gap policies can also cover situations where you have additional add-ons on your loan, like gap insurance or extended warranties, that are not typically covered by standard auto insurance.

Gap Policy vs. Standard Auto Insurance

Standard auto insurance primarily covers liability, collision, and comprehensive damages. It typically pays out the ACV of your vehicle in the event of a total loss. A gap policy, on the other hand, is designed to address the shortfall between the ACV and the outstanding loan or lease balance. Standard insurance focuses on the value of the vehicle at the time of the accident, while a gap policy focuses on protecting the borrower from financial responsibility beyond the vehicle’s value. It’s a supplementary policy, not a replacement for standard coverage. Both are important for comprehensive financial protection.

How Does a Gap Policy Work?

A gap insurance policy bridges the difference between what your car is worth at the time of a total loss and what you still owe on your auto loan or lease. It essentially protects you from being financially responsible for this shortfall, often referred to as “negative equity.” This is particularly helpful in situations where your vehicle depreciates quickly, leaving you owing more than the car’s actual market value.

A gap policy functions as supplemental coverage to your standard auto insurance. It doesn’t replace your comprehensive or collision coverage; instead, it works in conjunction with it to ensure you’re fully compensated after a total loss. The gap policy only pays out if your vehicle is deemed a total loss by your primary auto insurer.

The Gap Policy Claims Process

Filing a claim with your gap insurance provider typically involves several steps. First, you must report the total loss to your primary auto insurer and obtain their official determination of the total loss and the actual cash value (ACV) of your vehicle. This is crucial because the gap insurer uses this information to calculate the amount they owe.

Required Documentation for a Gap Claim

To successfully file a gap insurance claim, you will need to provide several key documents to your gap insurer. This typically includes: a copy of your auto loan or lease agreement demonstrating the outstanding balance; the claim settlement documentation from your primary auto insurer, including the ACV determination and any payout received; proof of ownership of the vehicle; and a copy of the gap insurance policy itself. Accurate and complete documentation is essential for a smooth and timely claim processing.

Examples of Approved and Denied Gap Claims

A claim would be approved if your vehicle is declared a total loss by your primary insurer, you have an outstanding loan or lease balance exceeding the ACV of your vehicle, and you have provided all the necessary documentation as Artikeld in your policy. For example, imagine you owe $25,000 on your car loan, but the insurer only values the car at $20,000 due to damage. The gap policy would cover the $5,000 difference. Conversely, a claim would be denied if the vehicle is not considered a total loss by your primary insurer, if the outstanding loan or lease is less than or equal to the ACV, if the policy has lapsed, or if required documentation is missing or incomplete. For instance, if you only have collision coverage and the damage is not a total loss, the gap policy wouldn’t apply.

Gap Policy Claim Flowchart

The following flowchart visually represents the steps involved in filing a gap insurance claim:

[Imagine a flowchart here. The flowchart would start with “Total Loss Accident,” branch to “Report to Primary Insurer,” then to “Receive ACV Determination,” followed by “File Gap Claim with Documentation,” then to “Gap Insurer Review,” then to “Claim Approval/Denial,” and finally to “Payment (if approved).”] The flowchart would clearly illustrate the sequential steps and decision points in the claims process.

Cost and Benefits of a Gap Policy

The decision of whether or not to purchase an auto insurance gap policy involves carefully weighing the associated costs against the potential financial benefits. Several factors influence the premium, and understanding these can help you make an informed choice. The financial protection offered can be substantial, particularly in situations involving total vehicle loss shortly after purchase.

Factors Influencing Gap Policy Cost

Several key factors determine the cost of a gap policy. These include the vehicle’s make and model, its age, the amount of coverage desired, your driving history (affecting your insurance risk profile), and the insurer you choose. Newer vehicles with higher initial values typically command higher premiums due to the larger potential gap in coverage. Similarly, drivers with poor driving records may face higher premiums, reflecting the increased risk to the insurer.

Gap Policy Premium Comparisons

The following table presents a sample comparison of gap policy premiums from different hypothetical insurers. Remember that actual premiums will vary based on the factors discussed above. These figures are for illustrative purposes only and should not be considered actual quotes.

| Insurer | Coverage Amount | Premium (Annual) | Deductible |

|---|---|---|---|

| Insurer A | $10,000 | $150 | $0 |

| Insurer B | $10,000 | $175 | $100 |

| Insurer C | $15,000 | $225 | $0 |

| Insurer D | $15,000 | $200 | $250 |

Financial Benefits of a Gap Policy

A gap policy’s primary benefit is protection against significant financial loss in the event of a total vehicle loss. If your vehicle is totaled and its actual cash value (ACV) is less than the outstanding loan balance, the gap policy covers the difference. This prevents you from being personally liable for this shortfall, a potentially substantial amount, especially for new vehicles that depreciate rapidly. For example, imagine purchasing a new car with a $30,000 loan. If the car is totaled within the first year, its ACV might only be $20,000. Your standard insurance would only cover $20,000 leaving you $10,000 in debt. A gap policy would cover this $10,000 difference.

Cost-Benefit Analysis of a Gap Policy

Consider a scenario where a new car loan is $30,000, and the annual gap policy premium is $200. If the vehicle is totaled within the first year and the ACV is $20,000, the gap policy would cover the $10,000 difference. The net benefit is $10,000 minus the $200 premium, resulting in a net savings of $9,800. While the cost-benefit analysis depends on the probability of a total loss, the potential for significant savings makes the gap policy attractive for those with new vehicles and substantial loan balances. The probability of a total loss within the first few years of owning a vehicle, though not easily quantified, is higher than in later years.

Eligibility and Requirements for a Gap Policy

Securing an auto insurance gap policy hinges on meeting specific criteria set by insurance providers. These criteria vary slightly depending on the insurer, but generally revolve around the vehicle’s characteristics, your financial situation, and the loan or lease agreement. Understanding these eligibility requirements is crucial before applying.

Eligibility for a gap policy isn’t a guarantee; several factors determine approval. The primary focus is on mitigating the risk for the insurance company. They need to assess the likelihood of a total loss and the subsequent financial impact. This means certain situations might lead to ineligibility.

Vehicle Eligibility

Gap insurance typically covers newer vehicles with significant loan balances. Older vehicles or those with substantially depreciated values may not be eligible because the potential financial loss is lower. For instance, a five-year-old car with a low loan balance may not be considered a suitable candidate for gap coverage. Similarly, vehicles with extensive prior damage or a history of accidents might be excluded, as their risk profile is higher. The insurer assesses the vehicle’s value using various methods, including assessing market data and comparing to similar models.

Financial Situation and Loan Details

The presence of a loan or lease is a fundamental requirement. Gap insurance is designed to cover the difference between the insurance payout and the outstanding loan amount after a total loss. Therefore, individuals who own their vehicles outright or have minimal loan balances would typically not need, and thus, are unlikely to qualify for, a gap policy. Furthermore, the terms of the loan itself, such as the loan-to-value ratio, might influence eligibility. A higher loan-to-value ratio, indicating a larger outstanding balance relative to the vehicle’s value, would generally increase the likelihood of approval.

Situations Leading to Ineligibility

Several scenarios can lead to ineligibility. For example, having a history of numerous insurance claims might raise concerns about risk and lead to rejection. Similarly, if the vehicle has been modified extensively, it may not meet the insurer’s underwriting guidelines, resulting in ineligibility. Lastly, some insurers may have specific restrictions based on the vehicle’s make, model, or year. It’s crucial to review the specific terms and conditions of each insurer’s gap policy.

Requirements for Applying for a Gap Policy

To apply for a gap policy, you’ll generally need to provide the following:

- Proof of vehicle ownership (title or lease agreement)

- Current auto insurance policy information

- Loan or lease agreement details, including the outstanding balance

- Vehicle identification number (VIN)

- Driver’s license and personal information

- Completed application form

The specific requirements might vary depending on the insurance provider, so it’s essential to confirm the necessary documentation with your chosen insurer.

Alternatives to a Gap Policy

While a gap insurance policy offers a valuable solution for covering the difference between your car’s actual cash value and the outstanding loan balance after an accident, several alternatives exist. Understanding these alternatives allows you to make an informed decision based on your individual financial situation and risk tolerance. Choosing the right approach depends on factors like your vehicle’s value, loan terms, and personal savings capacity.

Comparison of Gap Policies with Other Auto Insurance Coverages

Gap insurance is distinct from other standard auto insurance coverages. Comprehensive and collision coverage reimburse you for damage to your vehicle, but only up to its actual cash value (ACV). This ACV often falls short of the amount you still owe on your loan, leaving you with a significant shortfall. Uninsured/underinsured motorist coverage protects you if an at-fault driver lacks sufficient insurance, but it doesn’t directly address the gap between ACV and loan balance. Gap insurance specifically bridges this gap, while other coverages address different aspects of vehicle damage or liability.

Alternative Financial Strategies for Managing Depreciation Risk

Several financial strategies can mitigate the risk of vehicle depreciation. These strategies don’t directly replace gap insurance, but they can help reduce the financial burden if your vehicle is totaled. These include increasing your down payment, opting for a shorter loan term, and building an emergency fund specifically designated for unexpected vehicle expenses.

Advantages and Disadvantages of Alternative Strategies

Increasing your down payment: A larger down payment reduces the loan amount, thus shrinking the potential gap between ACV and loan balance in the event of a total loss. Advantage: Lower monthly payments and a smaller potential gap. Disadvantage: Requires a larger upfront investment.

Opting for a shorter loan term: A shorter loan term leads to quicker loan payoff, reducing the risk of owing more than the vehicle’s worth. Advantage: Less interest paid overall and reduced risk of owing more than the car’s value. Disadvantage: Higher monthly payments.

Building an emergency fund: Having savings specifically allocated for unexpected car expenses provides a financial cushion to cover potential shortfalls. Advantage: Offers flexibility to handle various unexpected costs. Disadvantage: Requires disciplined saving and may not cover the entire gap in a significant loss.

Leasing instead of financing: Leasing transfers the risk of depreciation to the leasing company. Advantage: No risk of owing more than the vehicle’s worth at the end of the lease term. Disadvantage: Higher monthly payments and mileage restrictions.

Comparison of Gap Policies and Other Financial Solutions

| Feature | Gap Policy | Larger Down Payment | Shorter Loan Term | Emergency Fund | Leasing |

|---|---|---|---|---|---|

| Cost | Additional premium | Higher initial cost | Higher monthly payments | Requires consistent saving | Higher monthly payments |

| Gap Coverage | Covers the gap | Reduces the gap | Reduces the gap | May partially cover the gap | No gap; depreciation risk transferred |

| Flexibility | Covers total loss | Limited flexibility | Limited flexibility | Flexible use of funds | Limited flexibility, mileage restrictions |

| Risk Mitigation | High | Moderate | Moderate | Low to Moderate | High (for depreciation) |

Illustrative Scenarios

Let’s examine several scenarios to illustrate how an auto insurance gap policy can impact your finances after a car accident. Understanding these examples will help you determine if a gap policy is right for your situation.

Totaled Vehicle Scenario: Financial Impact With and Without Gap Coverage

Imagine Sarah, who financed her $30,000 car with a $5,000 down payment, resulting in a $25,000 loan. After two years of payments, her loan balance is $20,000. Unfortunately, her car is totaled in an accident. Her insurance company assesses the actual cash value (ACV) of the vehicle at $15,000, reflecting depreciation.

Without a gap policy, Sarah would receive $15,000 from her insurance. However, she still owes $20,000 on her loan, leaving her with a $5,000 shortfall. She would be responsible for covering this difference out-of-pocket.

With a gap policy, Sarah’s insurance payout would be supplemented by the gap policy, covering the $5,000 difference between the ACV and the loan balance. She would receive the full $20,000 needed to pay off her loan, leaving her financially whole (aside from her deductible, if applicable).

Scenario Where a Gap Policy Would Not Provide Coverage

John’s car is damaged in an accident, but it’s not totaled. The repairs cost $4,000, which is fully covered by his comprehensive insurance policy. In this instance, a gap policy wouldn’t provide any additional coverage because there’s no gap between the insurance payout and the loan balance. Gap insurance is specifically designed to cover the difference between the ACV and the loan amount when a vehicle is deemed a total loss.

Scenario Demonstrating Significant Policyholder Benefit

Consider Maria, a recent college graduate who financed a new car for $28,000 with a $3,000 down payment. After only six months, she was involved in a serious accident. The car was totaled, and its ACV was determined to be only $20,000 due to rapid depreciation of new vehicles. She still owed $25,000 on the loan. Without a gap policy, Maria would have faced a significant $5,000 debt. However, because she had a gap policy, her insurance company paid out the full $25,000 owed on the loan, eliminating her financial burden and allowing her to move forward without the added stress of a substantial debt. This scenario highlights the peace of mind and significant financial protection a gap policy can provide, especially in the early years of a car loan when depreciation is most rapid.

Last Recap

Securing adequate auto insurance is a critical aspect of responsible vehicle ownership. While a standard policy provides essential protection, understanding the nuances of an auto insurance gap policy can be instrumental in mitigating potential financial risks associated with vehicle loss or damage. By carefully weighing the costs and benefits, and considering your individual circumstances, you can determine if a gap policy provides the necessary financial safeguard for your vehicle investment. Remember to consult with an insurance professional to personalize your coverage and ensure you have the right protection in place.

Question Bank

What happens if I total my car and still owe money on the loan?

Without a gap policy, you’d be responsible for the difference between your insurance payout (based on the car’s depreciated value) and the remaining loan amount. A gap policy covers this difference.

Can I get a gap policy after I’ve already bought my car?

Generally, yes, but it’s often more affordable to purchase it at the time of buying the vehicle. Check with your insurer about availability and cost.

Does a gap policy cover all types of accidents?

Typically, yes, but specific policy terms and conditions will apply. Review your policy document carefully.

How long does a gap policy typically last?

The duration varies depending on the insurer and your loan term, usually coinciding with the length of your auto loan.

Is a gap policy worth the extra cost?

This depends on your individual financial situation and risk tolerance. If you have a significant loan balance and a high risk of total loss, it might be a worthwhile investment.