Navigating the world of auto insurance can feel like deciphering a complex code. Premiums vary wildly, leaving many drivers wondering what factors truly influence the cost of their coverage. This guide unravels the mysteries behind auto insurance rates, exploring the key elements that determine how much you pay and offering strategies to potentially lower your costs.

From driving history and vehicle type to location and credit score, numerous variables contribute to your final premium. Understanding these factors empowers you to make informed decisions about your insurance coverage and potentially save money. We’ll delve into the different types of coverage available, explain how to compare quotes effectively, and discuss strategies for securing the best possible rates.

Factors Influencing Auto Insurance Rates

Auto insurance premiums are determined by a complex interplay of factors, all designed to assess the risk an individual poses to the insurance company. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History’s Impact on Insurance Premiums

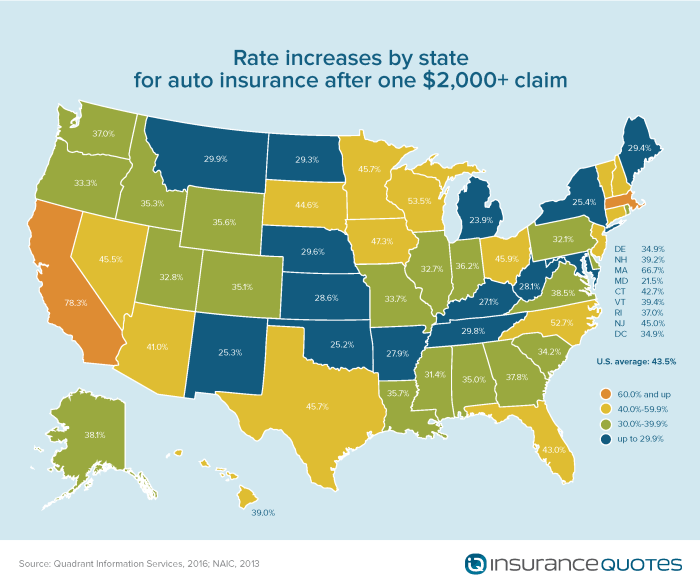

Your driving record significantly influences your insurance rates. A clean record translates to lower premiums, reflecting your demonstrated safe driving behavior. Conversely, violations like speeding tickets, accidents, and DUI convictions dramatically increase your premiums. The severity and frequency of incidents directly impact the increase. For example, a single speeding ticket might result in a modest rate increase, while a DUI conviction could lead to a substantial surge, or even policy cancellation. Insurance companies use a points system; more points mean higher premiums.

Age and Gender Influence on Auto Insurance Costs

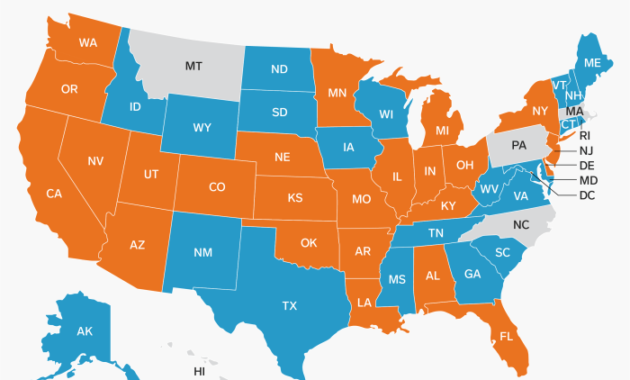

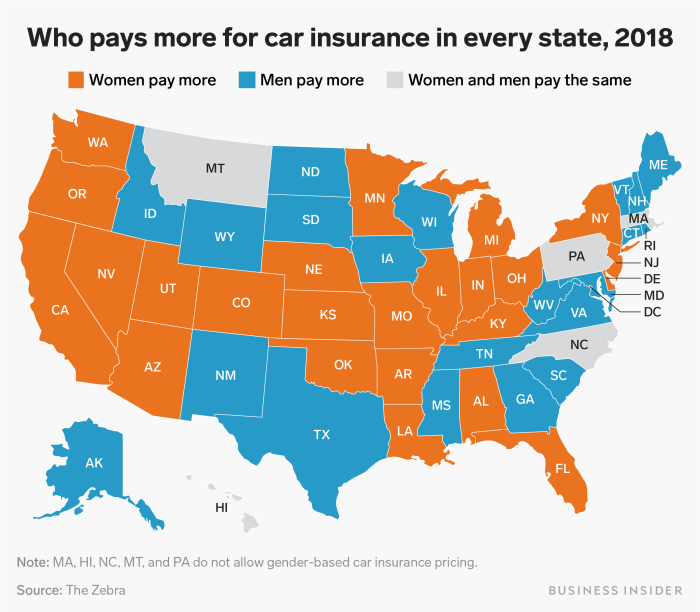

Statistically, younger drivers (typically under 25) are involved in more accidents than older drivers. This higher risk translates to higher premiums for younger drivers. This is because younger drivers often have less experience and are more prone to risky behaviors. Gender also plays a role, though the reasons are complex and debated. Historically, insurance data showed men having a higher accident rate than women, leading to higher premiums for men. However, this gap is narrowing in many regions. The rationale behind these differences is based on statistical analysis of accident data and claims history.

Vehicle Type and Value’s Role in Determining Insurance Rates

The type and value of your vehicle are key factors in determining your insurance premiums. Luxury cars and high-performance vehicles are generally more expensive to insure because of their higher repair costs and greater potential for theft. Conversely, insuring a smaller, less expensive car usually results in lower premiums. Insurance companies categorize vehicles into different classes based on factors like safety features, repair costs, and theft rates. For example, a sports car will fall into a higher insurance risk category than a compact sedan.

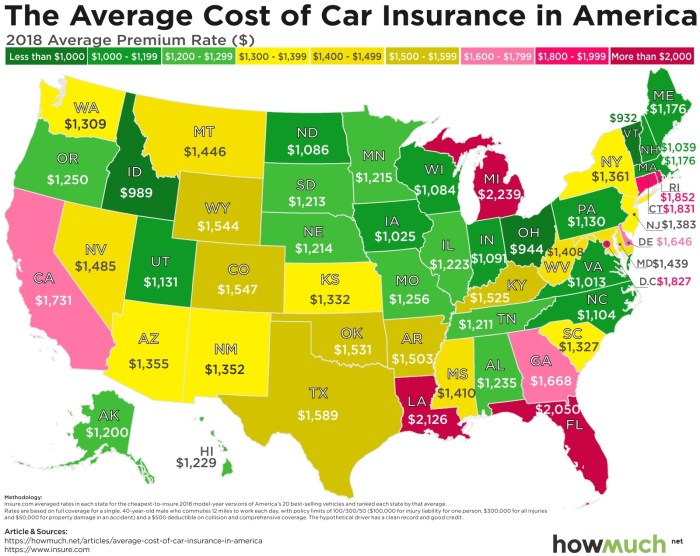

Location’s Impact on Auto Insurance Premiums

Your location significantly impacts your auto insurance rates. Areas with high crime rates, frequent accidents, and higher vehicle theft rates tend to have higher insurance premiums. This is because insurance companies face a greater risk of paying out claims in these areas. Factors such as population density, traffic congestion, and the availability of emergency services also play a role. For instance, living in a densely populated urban area with heavy traffic might lead to higher premiums compared to a rural area with less traffic and lower crime rates.

Impact of Different Driving Habits on Insurance Rates

The following table illustrates the potential impact of various driving habits on your insurance premiums. Note that these are illustrative examples, and the actual impact can vary depending on your insurer and specific circumstances.

| Driving Habit | Potential Impact on Premiums | Example | Illustrative Rate Increase (%) |

|---|---|---|---|

| Speeding Tickets | Moderate to Significant Increase | Two speeding tickets in one year | 10-20% |

| Accidents (at fault) | Significant Increase | One at-fault accident resulting in property damage | 25-40% |

| Long Commuting Distance | Moderate Increase | Daily commute exceeding 50 miles | 5-15% |

| Safe Driving Record (no violations) | Lower Premiums | No accidents or violations for 5 years | Potential discount of 15-25% |

Understanding Insurance Coverage Options

Choosing the right auto insurance coverage can feel overwhelming, but understanding the different options available is key to protecting yourself financially in the event of an accident. This section clarifies the core coverage types and optional add-ons, helping you make informed decisions about your policy.

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. It covers the costs of medical bills, property repairs, and legal fees for the other party involved. The limits of your liability coverage are typically expressed as three numbers, such as 25/50/25, representing $25,000 for injury per person, $50,000 for total injury per accident, and $25,000 for property damage. Higher limits provide greater protection but also result in higher premiums. The drawback is that liability coverage does *not* cover your own vehicle’s damage or your medical expenses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is beneficial if you’re involved in a collision, even if you are not at fault. The drawback is that you’ll typically have to pay your deductible before the insurance company covers the rest of the repair costs.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or weather-related damage. It’s crucial for protecting your investment in your vehicle against unforeseen circumstances. The drawback, similar to collision coverage, is the deductible you must pay before the insurance company covers the remaining costs.

Deductible Options and Their Impact on Premiums

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums because you’re accepting more financial responsibility. For example, a $500 deductible will likely result in a lower premium than a $1000 deductible, but you’ll pay more out-of-pocket if you make a claim. Choosing a deductible involves balancing your risk tolerance with your budget. A lower deductible means less out-of-pocket expense in case of an accident, but a higher premium. A higher deductible means lower premiums but greater out-of-pocket expense. Consider your financial situation and the likelihood of filing a claim when making this decision.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. This is vital because it covers your medical bills and vehicle repairs even if the at-fault driver doesn’t have sufficient insurance to cover your losses. For example, if an uninsured driver causes an accident resulting in $10,000 in medical bills and $5,000 in vehicle damage, your UM/UIM coverage would help pay for these expenses.

Optional Coverage Options

Several optional coverage add-ons can enhance your insurance protection.

Roadside Assistance: This coverage provides help with things like flat tires, lockouts, and jump starts. It’s particularly beneficial for those who frequently drive long distances or live in areas with limited roadside assistance services.

Rental Car Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident or covered claim. This is helpful to maintain mobility while your vehicle is unavailable.

Key Features of Different Insurance Policy Types

The following Artikels the typical features of different policy types. Remember that specific coverage details vary by insurer and state.

- Basic Policy: Typically includes only the state-mandated minimum liability coverage. Offers the lowest premium but minimal protection.

- Comprehensive Policy: Includes liability, collision, and comprehensive coverage, offering more extensive protection. Premiums are higher than basic policies.

- Premium Policy: Includes all standard coverages plus additional optional add-ons such as roadside assistance, rental car reimbursement, and potentially higher liability limits. This provides the most comprehensive protection but comes with the highest premium.

Strategies for Lowering Auto Insurance Costs

Reducing your auto insurance premiums can significantly impact your budget. Several effective strategies can help you achieve lower rates, from improving your driving habits to strategically shopping for insurance. By understanding these methods, you can save money and maintain adequate coverage.

Good Driving Habits and Defensive Driving Courses

Safe driving practices are paramount in lowering your insurance costs. Insurance companies reward drivers with clean records, fewer accidents, and minimal traffic violations. Maintaining a good driving record demonstrably reduces your risk profile, leading to lower premiums. Completing a defensive driving course can further enhance your savings. These courses teach accident avoidance techniques and safe driving strategies, often resulting in discounts from insurance providers. For example, a driver with a clean record for five years might receive a 15-20% discount compared to a driver with multiple accidents or violations within the same period. The completion certificate from a certified defensive driving course often provides immediate discounts, typically ranging from 5% to 10% depending on the insurer and the course.

Comparing and Negotiating Insurance Quotes

Obtaining quotes from multiple insurance providers is crucial for securing the best rates. Don’t settle for the first quote you receive. Compare policies carefully, paying attention to coverage limits, deductibles, and any additional fees. Use online comparison tools or contact insurers directly to obtain personalized quotes. Once you have several quotes, you can leverage them to negotiate lower rates with your current provider or a new one. For example, if you find a competitor offering a significantly lower rate, you can use this information to negotiate a better deal with your existing insurer. They may be willing to match or even undercut the competitor’s price to retain your business.

Bundling Insurance Policies

Bundling your home and auto insurance policies with the same provider often leads to substantial savings. Insurance companies frequently offer discounts for bundling, recognizing the reduced administrative costs and increased customer loyalty. The discount amount varies depending on the insurer and the specific policies bundled, but it can range from 10% to 25% or even more. For instance, a family bundling their home and auto insurance could save hundreds of dollars annually compared to purchasing separate policies from different providers. This represents a significant long-term cost saving.

Discounts for Specific Groups

Several insurance companies offer discounts to specific demographics, recognizing lower risk profiles associated with certain groups. Students with good grades, seniors with clean driving records, and military personnel often qualify for these discounts. Eligibility requirements vary by insurer, but generally involve providing proof of student status, age verification, or military identification. For example, a student with a GPA above 3.0 might qualify for a 10% discount, while a senior driver with 25 years of accident-free driving might receive a 15% discount. Military personnel often receive discounts as a show of appreciation for their service.

Strategies to Lower Auto Insurance Costs

| Strategy | Estimated Premium Impact | Example | Notes |

|---|---|---|---|

| Maintain a clean driving record | 10-25% reduction | Avoid accidents and traffic violations. | Significant long-term savings. |

| Complete a defensive driving course | 5-10% reduction | Many online and in-person courses available. | Proof of completion required. |

| Bundle home and auto insurance | 10-25% reduction | Consolidate policies with one insurer. | Savings vary by insurer and policies. |

| Explore available discounts | 5-15% reduction (or more) | Good student, senior, military discounts. | Eligibility requirements vary. |

Outcome Summary

Securing affordable auto insurance requires a proactive approach. By understanding the factors influencing rates, comparing quotes diligently, and adopting safe driving habits, you can significantly impact your premiums. Remember, insurance is a crucial financial safeguard, and taking the time to understand the nuances of pricing can lead to significant long-term savings and peace of mind. This guide provides a solid foundation for navigating the complexities of auto insurance and making informed choices to protect yourself and your vehicle.

Helpful Answers

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for repairs to your vehicle regardless of fault.

How often can I expect my auto insurance rates to change?

Rates can change annually, or even more frequently depending on your insurer and any changes in your driving record or risk profile.

Can I get my auto insurance cancelled?

Yes, insurers can cancel policies for various reasons, such as non-payment, fraudulent claims, or repeated violations.

What is a SR-22 form?

An SR-22 is a certificate of insurance that proves you have the minimum required auto insurance coverage, often mandated after serious driving offenses.

Does my marital status affect my auto insurance rates?

In some states, marital status might be a factor considered by insurers, but it’s not as significant as other factors like driving record and age.