The auto insurance industry is a complex landscape, a vast network of companies vying for your business. Understanding the intricacies of this market is crucial for securing the best coverage at the most competitive price. This guide delves into the key players, the various types of coverage available, and the factors that influence your premium, equipping you with the knowledge to make informed decisions about your auto insurance.

From choosing the right company to understanding your policy and filing a claim effectively, we’ll cover all the essential aspects. We’ll explore how technology is transforming the industry and offer practical strategies for securing the most favorable rates. This comprehensive overview aims to demystify the process, empowering you to navigate the world of auto insurance with confidence.

Top Auto Insurance Companies

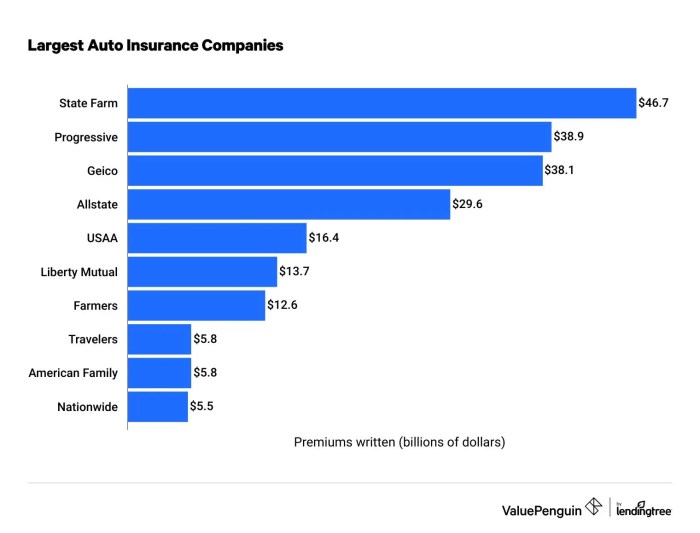

The automotive insurance market in the United States is a vast and competitive landscape, dominated by a handful of major players. Understanding these companies, their market share, and their financial stability is crucial for consumers seeking reliable and affordable coverage. This section will examine the ten largest auto insurers in the US, providing an overview of their history, services, and financial strength.

Top Ten Auto Insurance Companies by Market Share

The following table presents the ten largest auto insurance companies in the United States, ranked by market share. Note that market share data can fluctuate slightly depending on the source and reporting period. The year listed represents the most recent year for which comprehensive data is readily available. (Data source should be cited here – e.g., A.M. Best, National Association of Insurance Commissioners, etc. This is crucial for verification and accuracy. Please replace with actual source).

| Rank | Company Name | Market Share (Approximate) | Year |

|---|---|---|---|

| 1 | State Farm | 16% | 2023 (Example – Replace with accurate data) |

| 2 | GEICO | 14% | 2023 (Example – Replace with accurate data) |

| 3 | Progressive | 12% | 2023 (Example – Replace with accurate data) |

| 4 | Allstate | 9% | 2023 (Example – Replace with accurate data) |

| 5 | Liberty Mutual | 8% | 2023 (Example – Replace with accurate data) |

| 6 | USAA | 7% | 2023 (Example – Replace with accurate data) |

| 7 | Farmers Insurance | 6% | 2023 (Example – Replace with accurate data) |

| 8 | Nationwide | 5% | 2023 (Example – Replace with accurate data) |

| 9 | Auto-Owners Insurance | 4% | 2023 (Example – Replace with accurate data) |

| 10 | American Family Insurance | 3% | 2023 (Example – Replace with accurate data) |

Company Overviews and Services

This section provides a brief description of each company’s history and principal services. Remember that the specific services offered can vary by state and individual policy. (Replace the following with accurate and detailed information from reliable sources for each company. Include founding dates, key milestones, and a concise summary of their main product offerings beyond auto insurance if applicable.)

* State Farm: (Insert detailed description of State Farm’s history and services here)

* GEICO: (Insert detailed description of GEICO’s history and services here)

* Progressive: (Insert detailed description of Progressive’s history and services here)

* Allstate: (Insert detailed description of Allstate’s history and services here)

* Liberty Mutual: (Insert detailed description of Liberty Mutual’s history and services here)

* USAA: (Insert detailed description of USAA’s history and services here)

* Farmers Insurance: (Insert detailed description of Farmers Insurance’s history and services here)

* Nationwide: (Insert detailed description of Nationwide’s history and services here)

* Auto-Owners Insurance: (Insert detailed description of Auto-Owners Insurance’s history and services here)

* American Family Insurance: (Insert detailed description of American Family Insurance’s history and services here)

Financial Stability Ratings of Top Three Companies

Financial strength ratings, typically provided by agencies like A.M. Best, Moody’s, and Standard & Poor’s, are crucial indicators of an insurance company’s ability to meet its obligations. These ratings assess factors such as underwriting performance, investment portfolio strength, and overall financial health. A comparison of the top three companies (State Farm, GEICO, and Progressive) would reveal differences in their financial stability ratings and provide insights into their relative financial strength. (Insert a comparison of the financial stability ratings of State Farm, GEICO, and Progressive here, citing the rating agencies and the dates of the ratings. Explain what the ratings mean in simple terms and how they might affect consumer confidence.)

Types of Auto Insurance Coverage

Choosing the right auto insurance coverage can seem daunting, but understanding the different types available empowers you to make informed decisions that protect you and your vehicle. This section details the key types of coverage, their benefits, and situations where they’re most valuable.

Auto insurance policies typically offer a combination of coverages to address various potential risks. The specific coverages and their limits are customizable based on individual needs and risk assessments.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, property repairs, and legal defense.

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering of others injured in an accident you caused.

- Property Damage Liability: Covers the cost of repairing or replacing the other person’s vehicle or property damaged in an accident you caused.

Example: You rear-end another car, causing injuries and damage. Your liability coverage would pay for the other driver’s medical bills and vehicle repairs.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle regardless of fault. This means it covers damages even if the accident was your fault or if the other driver is uninsured.

- Covers damage to your vehicle resulting from a collision with another vehicle or object.

Example: You hit a deer, causing significant damage to your car. Your collision coverage would pay for the repairs, even though the deer was not at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions. This broader protection covers a wide range of incidents.

- Covers damage caused by events such as theft, vandalism, fire, hail, floods, and falling objects.

Example: Your car is damaged in a hailstorm. Comprehensive coverage would pay for the repairs.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident caused by a driver who is uninsured or whose insurance coverage is insufficient to cover your losses.

- Uninsured Motorist Bodily Injury: Pays for your medical bills and other expenses if you’re injured by an uninsured driver.

- Uninsured Motorist Property Damage: Covers the cost of repairing your vehicle if it’s damaged by an uninsured driver.

- Underinsured Motorist Bodily Injury: Supplements the other driver’s liability coverage if it’s not enough to cover your medical expenses and other losses.

- Underinsured Motorist Property Damage: Supplements the other driver’s liability coverage if it’s not enough to cover the damage to your vehicle.

Example: You are hit by a driver who has no insurance. Your uninsured motorist coverage would pay for your medical bills and vehicle repairs.

Factors Affecting Auto Insurance Premiums

Understanding the factors that influence your auto insurance premium is crucial for securing the best possible coverage at a manageable cost. Several key elements contribute to the final price you pay, and awareness of these can help you make informed decisions about your policy.

Several major factors significantly impact the cost of auto insurance. These factors are considered by insurance companies when assessing risk and setting premiums. A comprehensive understanding of these factors can empower consumers to make choices that may lead to lower premiums.

Driving History

Your driving record is a primary determinant of your insurance premium. A clean driving record, free of accidents and traffic violations, generally translates to lower premiums. Conversely, accidents, especially those deemed your fault, and traffic violations like speeding tickets or DUIs, significantly increase your premiums. Insurance companies view these incidents as indicators of higher risk, thus justifying a higher premium to offset the potential for future claims. The severity of the accident or violation also plays a role; a serious accident resulting in significant damage or injury will impact your premiums more than a minor fender bender.

Age and Gender

Statistically, certain age groups and genders are associated with higher accident rates. Younger drivers, particularly those under 25, typically pay higher premiums due to their increased risk of accidents. This is largely due to inexperience and a higher propensity for risky driving behaviors. Similarly, gender can be a factor, although the impact varies by insurer and region. Historically, young male drivers have been associated with higher accident rates than young female drivers, leading to potentially higher premiums for young men. However, this is becoming less of a determining factor in many jurisdictions due to regulatory changes and shifting societal trends.

Vehicle Type and Value

The type and value of the vehicle you insure directly influence your premium. Sports cars and other high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. The vehicle’s safety features also play a role; cars with advanced safety technologies, such as anti-lock brakes and airbags, may qualify for discounts. Older vehicles, while potentially less expensive to insure than newer models, may have higher repair costs relative to their value, potentially offsetting any age-related discount. The vehicle’s make and model are also considered; some makes and models have statistically higher rates of accidents or theft, leading to higher premiums.

Location

Where you live significantly impacts your insurance premium. Areas with high crime rates, frequent accidents, or severe weather conditions typically have higher insurance rates. Insurance companies assess the risk associated with your location by analyzing claims data and crime statistics in your area. Living in a densely populated urban area, for example, often leads to higher premiums than living in a rural area with lower traffic density.

Credit Score

In many jurisdictions, your credit score can be a factor in determining your auto insurance premium. Insurers often use credit-based insurance scores to assess risk. The rationale behind this is that individuals with poor credit may be more likely to file claims or have difficulty paying premiums. However, the use of credit scores in insurance is controversial, and regulations vary by state. A higher credit score generally leads to lower premiums, while a lower credit score can result in significantly higher premiums.

Hypothetical Scenario

Consider two individuals: Sarah, a 35-year-old woman with a clean driving record, drives a mid-sized sedan and lives in a suburban area with a good credit score. John, a 22-year-old man with a speeding ticket and a minor accident on his record, drives a sports car and lives in a high-crime urban area, also with a lower credit score. All other factors being equal, John is likely to pay significantly more for auto insurance than Sarah due to the cumulative effect of his age, driving history, vehicle type, location, and credit score. The differences in their premiums would reflect the higher risk associated with John’s profile compared to Sarah’s.

Understanding Insurance Policies

Choosing the right auto insurance policy is a significant financial decision. A thorough understanding of your policy’s terms and conditions is crucial to ensure you’re adequately protected and avoid unexpected costs in the event of an accident or other covered incident. Failing to review your policy carefully could leave you vulnerable to financial hardship.

Before signing any auto insurance policy, take the time to read it thoroughly. Don’t just skim it; understand the details. This proactive approach will prevent future misunderstandings and disputes with your insurance provider. Consider seeking clarification from your insurer if anything is unclear.

Key Sections of an Auto Insurance Policy

It’s essential to familiarize yourself with several key sections within your policy document. These sections contain vital information about your coverage, limitations, and responsibilities. Understanding these sections empowers you to make informed decisions and utilize your insurance effectively.

- Declarations Page: This page summarizes your policy’s key details, including your name, address, vehicle information, policy number, coverage types, and premium amounts. It’s your policy’s “summary sheet”.

- Coverage Sections: This section Artikels the specific types of coverage you’ve purchased, such as liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments. Each coverage type will have its own limits of liability clearly stated.

- Exclusions: This critical section details situations or events that are specifically not covered by your policy. Understanding exclusions prevents unrealistic expectations about what your insurance will and will not cover. For example, damage caused by wear and tear is typically excluded.

- Conditions: This section Artikels your responsibilities as a policyholder, such as notifying the insurer promptly of an accident or cooperating with investigations. Failure to meet these conditions could affect your claim.

- Definitions: This section clarifies the meaning of specific terms used throughout the policy, ensuring consistent interpretation. Understanding these definitions is crucial for accurate comprehension of your policy’s scope.

Interpreting Common Policy Terms and Conditions

Insurance policies often use specialized terminology. Familiarizing yourself with these terms will help you understand your policy’s scope and limitations.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. For example, a $500 deductible means you pay the first $500 of repair costs in an accident before your insurance covers the rest.

- Premium: The amount you pay regularly to maintain your insurance coverage. Premiums are calculated based on various factors, including your driving record, age, location, and the type of vehicle you insure.

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical bills and property damage up to your policy’s limit.

- Collision Coverage: This covers damage to your vehicle caused by a collision, regardless of who is at fault. This coverage is typically subject to a deductible.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or weather-related damage. This coverage also typically has a deductible.

Auto Insurance and Technology

The auto insurance industry is undergoing a significant transformation driven by technological advancements. These changes are impacting how premiums are calculated, how claims are processed, and how customers interact with their insurers. The integration of technology is leading to greater efficiency, personalized service, and a more data-driven approach to risk assessment.

Telematics and usage-based insurance (UBI) are at the forefront of this technological revolution. These systems utilize data collected from devices installed in vehicles to monitor driving behavior and habits. This data is then used to create more accurate risk profiles and tailor insurance premiums accordingly.

Telematics and Usage-Based Insurance

Telematics systems use various sensors and GPS technology to track driving patterns such as speed, acceleration, braking, mileage, and even time of day. This data provides a detailed picture of a driver’s behavior, allowing insurers to identify safer drivers and reward them with lower premiums. UBI programs typically offer discounts based on the data collected, incentivizing safer driving habits. For example, a driver who consistently maintains a moderate speed and avoids harsh braking might receive a substantial discount compared to a driver with a more aggressive driving style. Some programs even offer feedback to drivers on their performance, allowing them to improve their driving and potentially lower their future premiums.

Impact of Technology on Premiums and Customer Service

The implementation of telematics and UBI has a direct impact on both premiums and customer service. For safer drivers, premiums can be significantly reduced, reflecting the lower risk they pose. Conversely, drivers with riskier driving habits may see their premiums increase. This personalized pricing model creates a more equitable system where drivers are rewarded or penalized based on their individual behavior. Furthermore, technology enhances customer service by providing faster and more efficient claim processing. Real-time data from telematics systems can assist in accident investigation, speeding up the claims process and reducing paperwork. Digital platforms and mobile apps allow customers to access their policies, manage their accounts, and contact customer service with ease.

Future Impact of Technology on the Auto Insurance Market

The future of auto insurance is inextricably linked to technological advancements. We can expect to see an increasing reliance on data-driven insights to assess risk and personalize premiums. The rise of autonomous vehicles will likely lead to significant changes in the industry, as the traditional model of assessing driver risk becomes obsolete. Insurers will need to adapt to this new reality by focusing on other factors, such as vehicle safety features and the potential for accidents caused by software malfunctions. Artificial intelligence and machine learning will play an increasingly important role in fraud detection, risk assessment, and customer service. Predictive analytics could allow insurers to identify potential risks and proactively offer preventative measures to customers, leading to fewer accidents and lower claims costs. For example, insurers might use data to identify drivers at high risk of speeding and offer them personalized safety training or driving assistance programs.

Ultimate Conclusion

Securing adequate auto insurance is a critical aspect of responsible vehicle ownership. By understanding the different companies, coverage options, and factors affecting premiums, you can make informed choices to protect yourself and your assets. Remember to actively compare quotes, negotiate rates, and thoroughly review your policy to ensure it aligns with your needs. Proactive engagement with your insurance provider can significantly enhance your overall experience and peace of mind.

Questions Often Asked

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for repairs to your vehicle, regardless of fault.

How often should I review my auto insurance policy?

It’s advisable to review your policy annually, or whenever there’s a significant life change (e.g., new car, change in driving habits, address change).

Can I get my auto insurance canceled?

Yes, your insurance can be canceled for various reasons, including non-payment of premiums, fraudulent claims, or repeated violations of policy terms. Check your policy for specifics.

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles mean lower monthly premiums but higher out-of-pocket costs in case of a claim.

How do I choose the right level of coverage?

Consider your financial situation, the value of your vehicle, and your risk tolerance. Consult with an insurance agent to determine the appropriate level of coverage for your individual needs.