Navigating the world of automobile insurance can feel like deciphering a complex code. Premiums vary wildly, influenced by a multitude of factors that often seem arbitrary. This guide unravels the mysteries behind automobile insurance cost, providing a clear understanding of the key elements that determine your premium and offering practical strategies to potentially lower your expenses. From your driving record to your geographic location, we’ll explore the intricate web of influences shaping your insurance bill.

Understanding automobile insurance cost is crucial for responsible financial planning. This guide will empower you with the knowledge to make informed decisions, compare insurance providers effectively, and ultimately secure the best possible coverage at a price that fits your budget. We’ll delve into the specifics of how different factors interact to determine your premium, offering actionable insights and practical tips to help you save money.

Illustrative Examples of Insurance Cost Scenarios

Understanding the factors that influence car insurance premiums is crucial for making informed decisions. Two contrasting scenarios illustrate how seemingly small choices can significantly impact your overall cost.

High Insurance Costs: A Case Study

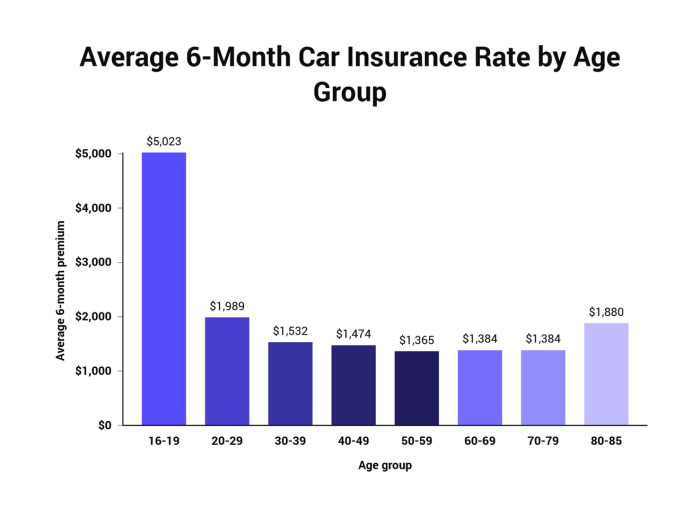

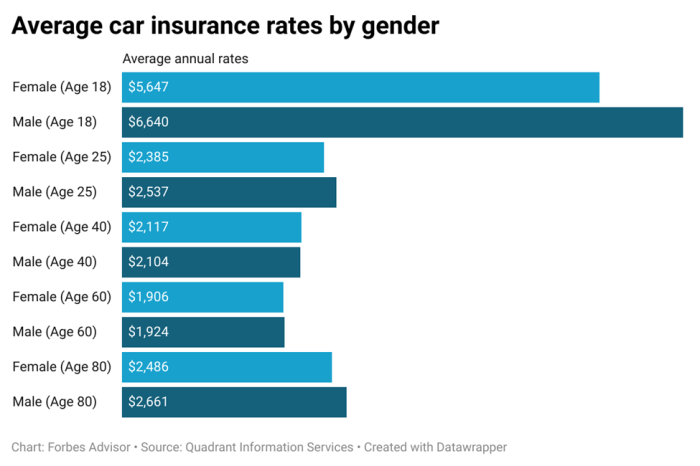

Let’s consider a young, inexperienced driver, Alex, aged 20, living in a high-crime urban area. Alex drives a high-performance sports car, a model known for its high repair costs and propensity for accidents. He has a history of traffic violations, including speeding tickets and a reckless driving citation. His insurance company assesses him as a high-risk driver. His premium reflects this assessment. Several factors contribute to Alex’s high insurance costs. His age and lack of driving experience are significant risk factors. Statistics consistently show that young drivers are involved in more accidents than older, more experienced drivers. The location where he resides increases his risk of theft and collisions. His choice of vehicle, a high-performance sports car, inherently increases the likelihood of accidents and significantly increases repair costs should an accident occur. Finally, his driving record, marked by violations, further elevates his risk profile in the eyes of the insurance company. The combination of these factors results in a substantially higher insurance premium than a driver with a different profile might pay.

Alex’s high insurance costs are a direct result of his age, driving history, vehicle choice, and location.

Low Insurance Costs: A Responsible Driver

In contrast, consider Sarah, a 35-year-old with a clean driving record. Sarah drives a fuel-efficient sedan and lives in a suburban area with a low crime rate. She has maintained a spotless driving record for over 15 years, with no accidents or violations. Sarah proactively engages in safe driving practices, such as maintaining her vehicle’s regular maintenance, avoiding aggressive driving, and adhering to all traffic laws. She also opted for higher deductibles to reduce her monthly premium, demonstrating a willingness to share more of the risk. These responsible choices have resulted in significantly lower insurance premiums compared to Alex.

Sarah’s low insurance premiums are a direct result of her responsible driving habits, vehicle choice, location, and proactive risk management.

Closure

Ultimately, understanding your automobile insurance cost is about more than just saving money; it’s about making informed choices that protect your financial well-being and ensure you have adequate coverage. By carefully considering the factors Artikeld in this guide, from your driving history to your chosen coverage levels, you can navigate the insurance landscape with confidence. Remember that proactive steps, such as maintaining a clean driving record and shopping around for the best rates, can significantly impact your bottom line. Take control of your insurance costs and drive with peace of mind.

Frequently Asked Questions

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others, while collision coverage pays for damage to your own vehicle, regardless of fault.

How often should I shop around for car insurance?

It’s advisable to compare rates from different insurers at least annually, as rates can fluctuate.

Can I get my insurance cancelled for minor infractions?

While a single minor infraction is unlikely to lead to cancellation, multiple violations or serious offenses can.

Does paying my insurance annually save me money?

Often, yes, as many insurers offer discounts for annual payments. However, check with your provider.