Securing the right automobile insurance coverage is crucial for responsible drivers. Understanding the nuances of liability, collision, comprehensive, and other coverage types can significantly impact your financial well-being in the event of an accident. This guide delves into the intricacies of automobile insurance, providing a comprehensive overview to help you make informed decisions and protect yourself on the road.

From understanding policy documents and filing claims to comparing insurance providers and navigating specific situations like driving a classic car or using a rideshare service, we’ll explore all aspects of securing adequate protection. We’ll also offer strategies to help you obtain the best possible rates and ensure you have the coverage you need.

Insurance Coverage for Specific Situations

Standard auto insurance policies often don’t fully address the unique needs of all drivers. Understanding the nuances of coverage for specific situations is crucial to ensure adequate protection. This section details coverage options for various driving scenarios and vehicle types.

Insurance for Non-Standard Vehicles

Insuring non-standard vehicles like classic cars or motorcycles requires specialized policies. Classic car insurance, for example, often focuses on agreed value coverage, meaning the insurer agrees to pay a predetermined amount in case of a total loss, regardless of the car’s market value at the time of the accident. This protects the owner from depreciation. Motorcycle insurance, on the other hand, might offer different levels of liability and collision coverage, reflecting the higher risk associated with two-wheeled vehicles. Policy premiums are usually influenced by factors such as the vehicle’s age, make, model, and the driver’s experience. Some insurers specialize in these niche markets, offering tailored coverage options and competitive rates.

Insurance Requirements for Rideshare Drivers

Rideshare drivers face unique insurance needs due to the nature of their work. Standard personal auto insurance typically doesn’t cover periods when a driver is actively using their vehicle for rideshare services. Most rideshare companies offer supplemental insurance to bridge this gap, providing liability coverage while a driver is logged into the app and waiting for a ride request, and additional coverage while transporting passengers. However, it’s crucial to understand the gaps in coverage that might still exist, and drivers should carefully review their personal auto policy and the rideshare company’s insurance program to ensure complete protection. This may include considering a commercial auto policy for more comprehensive coverage.

Insurance Coverage for International Travel

Driving internationally requires specific insurance considerations. Standard domestic auto insurance policies generally do not provide coverage outside the country of issuance. International driving permits are often required, but these don’t replace the need for appropriate insurance. Drivers should investigate obtaining international driving insurance, which can provide liability and collision coverage in foreign countries. The specific requirements and coverage levels vary significantly by country, and it’s essential to research the insurance needs of the specific countries you plan to visit before embarking on your trip. Failing to have adequate insurance could result in significant financial liability in the event of an accident.

Insurance Coverage for Leased versus Owned Vehicles

Insurance coverage for leased vehicles often differs from that for owned vehicles. Lease agreements typically require the lessee to carry comprehensive and collision coverage, protecting the leasing company’s financial interest in the vehicle. This is because the leasing company retains ownership of the vehicle throughout the lease term. While the coverage requirements might be similar, the financial responsibility for damages could be different. For example, in the case of an accident with an owned vehicle, the owner is responsible for the deductible, while with a leased vehicle, the lessee might be responsible for the deductible, and potentially additional charges depending on the terms of the lease agreement. Understanding these distinctions is crucial to avoid unexpected financial burdens.

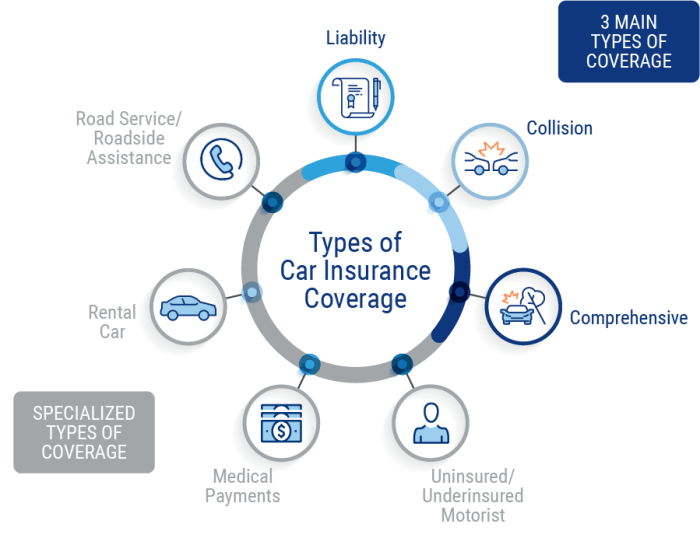

Visual Representation of Coverage Types

Understanding the different types of auto insurance coverage can be challenging. Visualizing these coverages, however, can significantly aid comprehension. The following descriptions aim to paint a picture of each coverage type and the scenarios in which they apply.

Liability Coverage

Imagine a Venn diagram. One circle represents you, your car, and your actions behind the wheel. The other circle represents another person, their car, and their potential involvement in an accident with you. Liability coverage is the area where these circles overlap. It protects you financially if you cause an accident that injures someone or damages their property. If you’re found at fault, your liability coverage pays for the other person’s medical bills, lost wages, and property repairs. The size of this overlapping area represents the amount of your liability coverage – the larger the area, the more financial protection you have.

Collision Coverage

Picture your car. Now, imagine various scenarios: a fender bender in a parking lot, a collision with a deer, or damage sustained during a hailstorm. Collision coverage is like a shield protecting your vehicle from damage regardless of who is at fault. It pays for repairs or replacement of your car, even if you caused the accident. The visual representation would be a car surrounded by a protective bubble representing the financial protection afforded by this coverage. The bubble’s size represents the policy limits.

Comprehensive Coverage

This coverage is broader than collision. Imagine your car again, but now consider damage from events outside of collisions. Think of a tree falling on your car, vandalism, fire, theft, or damage from natural disasters like hail or flooding. Comprehensive coverage acts as an all-encompassing umbrella protecting your vehicle from these non-collision-related incidents. Visually, it’s similar to collision coverage, but the protective bubble is larger and includes various external hazards depicted around the car.

Uninsured/Underinsured Motorist Coverage

Visualize a road with various vehicles. Some vehicles are clearly marked with insurance stickers, representing drivers with adequate coverage. Others are unmarked, representing uninsured or underinsured drivers. This coverage acts as a safety net if you are involved in an accident caused by an uninsured or underinsured driver. It’s like a separate shield protecting you from the financial burden of their negligence. The size of this shield reflects the policy limits, providing protection against medical bills, lost wages, and property damage even if the at-fault driver lacks sufficient insurance.

Medical Payments Coverage (Med-Pay)

Imagine a medical bill after an accident. Med-Pay coverage is like a smaller, readily available first-aid kit. It helps cover medical expenses for you and your passengers, regardless of fault. It’s a supplementary coverage, often smaller than liability, and provides quick access to funds for immediate medical needs. Visually, it can be represented as a small, easily accessible box next to the car, containing medical supplies representing financial aid for immediate medical expenses.

Personal Injury Protection (PIP)

Similar to Med-Pay, PIP coverage is a smaller, but more comprehensive kit. It covers medical expenses, lost wages, and other related expenses for you and your passengers, regardless of fault. Unlike Med-Pay, it can also cover expenses for others in your vehicle. It’s a more robust version of the medical first-aid kit, offering broader protection. It can be visualized as a larger, more detailed first-aid kit with various compartments representing the different types of expenses it covers.

Concluding Remarks

Ultimately, choosing the right automobile insurance coverage is a personal decision based on individual needs and risk tolerance. By understanding the various coverage options, factors affecting premiums, and the claims process, you can confidently navigate the complexities of insurance and secure the best possible protection for yourself and your vehicle. Remember to regularly review your policy and compare providers to ensure you maintain optimal coverage at a competitive price.

Quick FAQs

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others, while collision coverage pays for damage to your own vehicle, regardless of fault.

How does my driving record affect my insurance premiums?

A history of accidents and traffic violations typically leads to higher premiums. Insurers consider the severity and frequency of incidents.

What is uninsured/underinsured motorist coverage?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs.

Can I get a discount on my car insurance?

Yes, many insurers offer discounts for good driving records, bundling policies, safety features in your car, and completing defensive driving courses.

What should I do immediately after a car accident?

Ensure everyone is safe, call emergency services if needed, exchange information with the other driver(s), take photos of the damage, and contact your insurance company.