Securing affordable car insurance is a significant financial consideration for most drivers. However, navigating the complexities of premiums and coverage can feel overwhelming. This guide aims to demystify the concept of “average car insurance,” exploring the factors that contribute to varying costs and providing practical strategies to find the best coverage at a price that suits your budget. We’ll delve into the nuances of policy types, explore how your personal circumstances influence premiums, and equip you with the knowledge to make informed decisions.

Understanding your car insurance needs is crucial for financial protection and peace of mind. From geographical location and driving history to the type of vehicle you drive and the coverage you choose, numerous factors play a pivotal role in determining your premium. This guide will break down these elements, offering insights into how you can control your costs and secure the most appropriate level of insurance.

Defining “Average Car Insurance”

Defining a truly “average” cost for car insurance proves surprisingly challenging. The price you pay is highly personalized, a complex calculation based on numerous individual factors, making a single, universally applicable “average” misleading. While industry reports often cite average premiums, these figures represent broad averages that may not reflect the reality for any single individual.

Factors Influencing Car Insurance Premiums

Several key factors contribute to the significant variation in car insurance premiums. These factors are carefully weighed by insurance companies to assess risk and determine appropriate pricing. Understanding these factors is crucial for consumers to better understand their own insurance costs.

For example, your driving history plays a significant role. A clean driving record with no accidents or traffic violations will generally result in lower premiums compared to someone with multiple incidents. The type of vehicle you drive is another major factor; sports cars and luxury vehicles often command higher premiums due to their higher repair costs and increased risk of theft. Your age and gender also influence premiums, as statistical data shows certain demographics are associated with higher accident rates. Credit history can also surprisingly impact your insurance rates, with good credit often correlating with lower premiums. Finally, your location significantly impacts your insurance costs due to varying accident rates and crime statistics in different areas.

Geographical Location’s Impact on Average Premiums

Geographical location significantly impacts car insurance premiums due to variations in factors such as accident rates, crime statistics, the cost of repairs, and the prevalence of specific types of weather events (e.g., hurricanes, hailstorms). Areas with higher accident rates and more vehicle thefts tend to have higher insurance premiums to cover the increased risk. Similarly, regions with high costs of car repairs will also reflect those costs in insurance rates.

Average Premiums Across Different States

The following table illustrates the variation in average annual car insurance premiums across several states. It is important to remember that these are broad averages and individual premiums will vary based on the factors previously discussed. The data presented here is for illustrative purposes and should not be considered definitive or all-inclusive. Actual premiums can vary significantly depending on the specific insurer and individual circumstances.

| State | Average Annual Premium | State | Average Annual Premium |

|---|---|---|---|

| California | $1500 | Texas | $1200 |

| Florida | $1650 | New York | $1400 |

| Illinois | $1350 | Pennsylvania | $1150 |

Factors Affecting Car Insurance Costs

Several key factors interact to determine the cost of car insurance. Understanding these influences can help you make informed decisions to potentially lower your premiums. This section will explore the most significant elements impacting your insurance rate.

Driving History

Your driving record significantly impacts your insurance premiums. A clean driving history, free of accidents and traffic violations, typically results in lower rates. Conversely, accidents and tickets, especially those involving significant damage or injury, can substantially increase your premiums. Insurance companies view a history of at-fault accidents as a higher risk, leading to increased costs to cover potential future claims. The severity of the offense also matters; a speeding ticket will generally have less impact than a DUI conviction. For example, a driver with two at-fault accidents in the past three years will likely pay significantly more than a driver with a spotless record.

Age and Gender

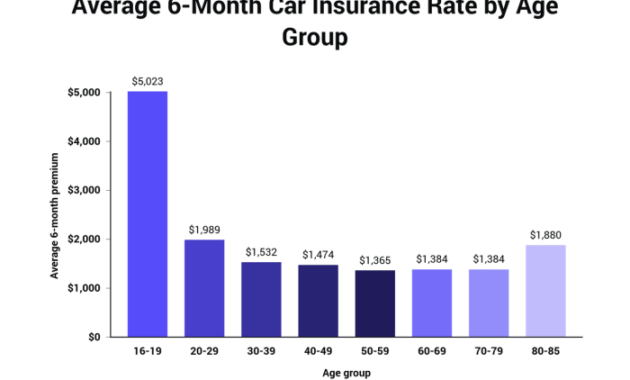

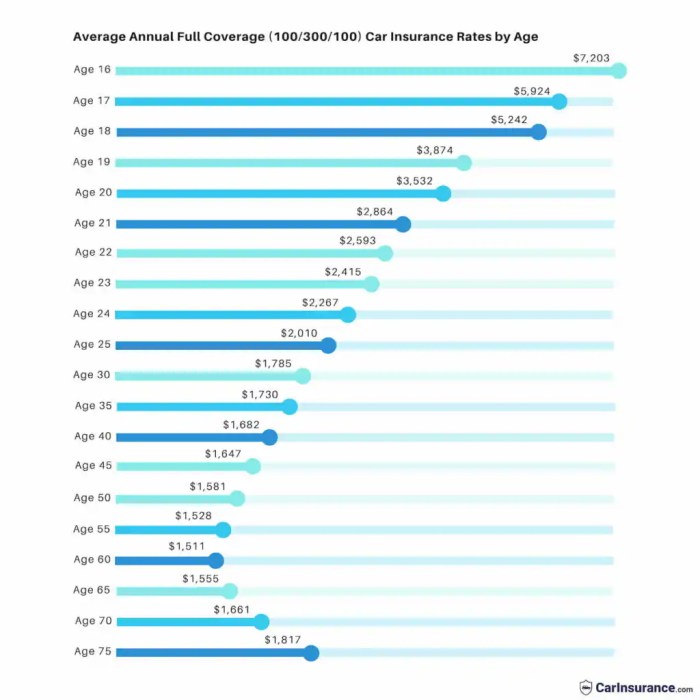

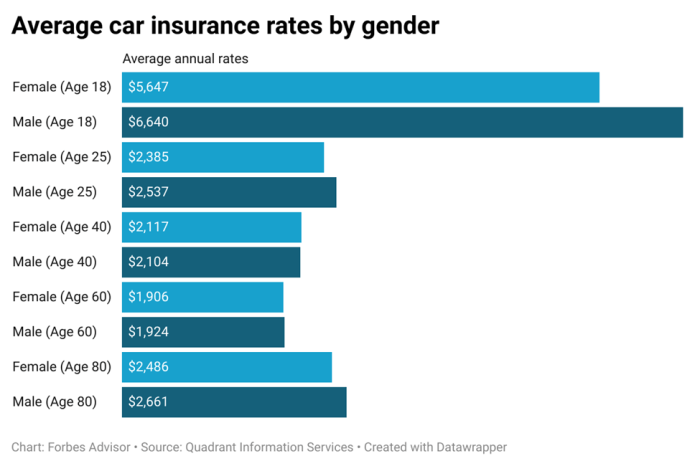

Statistically, age and gender correlate with accident risk. Younger drivers, particularly those in their late teens and early twenties, generally pay higher premiums due to their increased likelihood of being involved in accidents. This is often attributed to a lack of experience and a higher propensity for risk-taking behaviors. Insurance companies use actuarial data to assess risk based on these demographics. Gender also plays a role, with historical data suggesting that males tend to have higher accident rates than females in certain age groups, resulting in potentially higher premiums for male drivers. These differences, however, are becoming less pronounced as more data is collected and analyzed.

Vehicle Type

The type of vehicle you drive is a major factor in determining insurance costs. Sports cars and luxury vehicles often command higher premiums due to their higher repair costs and increased potential for theft. Conversely, sedans and smaller, more economical vehicles typically have lower insurance rates. The vehicle’s safety features also influence premiums; cars with advanced safety technologies like automatic emergency braking or lane departure warnings may qualify for discounts. For instance, insuring a high-performance sports car will be considerably more expensive than insuring a compact sedan, reflecting the higher risk and repair costs associated with the former.

Location

Where you live plays a crucial role in your insurance costs. Areas with high crime rates, higher accident frequencies, and more expensive car repairs tend to have higher insurance premiums. Urban areas often have higher rates than rural areas due to increased traffic congestion and the greater likelihood of theft or vandalism. Insurance companies use geographical data to assess the risk profile of different locations, leading to variations in premiums across regions. A driver in a high-crime, densely populated city will likely pay more than a driver in a rural area with low crime rates.

Credit Score

In many jurisdictions, your credit score can influence your car insurance rates. Insurers often use credit scores as an indicator of risk, with individuals who have poor credit scores sometimes paying higher premiums. The rationale is that individuals with poor credit may be more likely to file fraudulent claims or fail to pay their premiums on time. This practice is controversial and varies by state, but it’s a factor that can significantly impact your insurance costs in many regions. Improving your credit score can potentially lead to lower insurance premiums.

Types of Car Insurance Coverage

Choosing the right car insurance coverage can seem daunting, but understanding the different types available is key to protecting yourself and your vehicle. This section will Artikel the common types of coverage, their features, and the crucial differences between key options. Making informed decisions about your insurance needs will help ensure you have the appropriate protection at a price that fits your budget.

Car insurance policies typically bundle various coverages, offering different levels of protection. The specific types and their availability can vary slightly by state and insurance provider. However, the core types of coverage remain consistent across most providers.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, legal fees, and property repairs for the other party involved. Liability coverage is typically broken down into bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and other damages resulting from injuries you cause, while property damage liability covers the cost of repairing or replacing the other person’s damaged vehicle or property. The limits are expressed as numbers, such as 25/50/25, representing $25,000 per person for bodily injury, $50,000 total for all bodily injuries in an accident, and $25,000 for property damage.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. This means that even if you cause the accident, your insurance will cover the cost of repairing or replacing your car. The deductible, the amount you pay out-of-pocket before your insurance kicks in, will be subtracted from the payout. For example, if you have a $500 deductible and your repairs cost $2,000, your insurance will pay $1,500.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or damage from animals. Similar to collision coverage, a deductible applies. For example, if your car is stolen and the replacement value is $10,000, and you have a $1,000 deductible, the insurance company would pay $9,000.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. This is particularly important because accidents involving uninsured drivers are unfortunately common. This coverage can pay for your medical bills, lost wages, and vehicle repairs, even if the at-fault driver is uninsured or underinsured. It’s often advisable to purchase this coverage with limits that match or exceed your liability coverage.

Summary of Car Insurance Coverages

| Coverage Type | What it Covers | Who it Protects | Deductible? |

|---|---|---|---|

| Liability | Damages to others (property and injuries) | Other drivers and passengers | No |

| Collision | Damage to your vehicle in an accident, regardless of fault | You | Yes |

| Comprehensive | Damage to your vehicle from non-collision events (theft, fire, etc.) | You | Yes |

| Uninsured/Underinsured Motorist | Damages caused by an uninsured or underinsured driver | You | May vary |

Liability vs. Collision Coverage

The key difference between liability and collision coverage lies in who they protect. Liability coverage protects other people and their property from your mistakes, while collision coverage protects you and your vehicle from damage, regardless of fault. Liability is usually required by law, while collision is optional but highly recommended.

The Importance of Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is crucial because it bridges the gap when an at-fault driver lacks sufficient insurance to cover your damages. Without this coverage, you could be left responsible for significant medical bills or vehicle repairs, even if you were not at fault. Given the prevalence of uninsured drivers, this coverage offers essential protection against significant financial hardship.

Finding Affordable Car Insurance

Securing affordable car insurance requires a proactive approach involving careful comparison shopping, effective negotiation, and strategic cost-reduction measures. Understanding the market and your own driving habits are key to finding the best coverage at the most competitive price.

Finding the right car insurance policy can feel overwhelming, but with a systematic approach, you can significantly reduce your premiums. This section Artikels steps to effectively compare quotes, negotiate with insurers, and implement strategies to lower your overall costs.

Comparing Car Insurance Quotes

To find the most competitive rates, it’s crucial to compare quotes from multiple insurers. Start by using online comparison tools that allow you to input your information once and receive quotes from several companies simultaneously. This saves significant time and effort. Remember to provide accurate information to ensure the quotes you receive are truly reflective of your risk profile. After receiving several quotes, carefully review the coverage details and premiums to identify the best fit for your needs and budget. Don’t solely focus on the lowest price; ensure the coverage adequately protects you.

Negotiating Lower Premiums

Once you’ve identified a few promising quotes, don’t hesitate to negotiate. Insurance companies often have some flexibility in their pricing. Highlight any positive aspects of your driving record, such as a clean history or completion of a defensive driving course. Inquire about discounts for bundling policies (home and auto), paying in full, or opting for higher deductibles. Be polite but firm in your negotiation, and remember that insurers are more likely to negotiate with customers who demonstrate they are willing to shop around. If one insurer is unwilling to negotiate, don’t hesitate to take your business elsewhere.

Advantages and Disadvantages of Different Insurance Providers

Different insurance providers offer varying levels of customer service, coverage options, and pricing structures. Large national insurers often offer broad coverage and established claims processes but may have less personalized service. Smaller, regional insurers might provide more personalized attention but potentially have fewer resources in the event of a large claim. Direct-to-consumer insurers typically offer lower premiums through streamlined operations but may have less flexibility in terms of coverage customization. The best provider for you depends on your individual needs and priorities. Consider factors such as claims handling reputation, financial stability, and customer service ratings when making your decision.

Strategies to Reduce Insurance Costs

Several strategies can help reduce your car insurance costs. Implementing even a few of these can lead to significant savings over time.

- Maintain a clean driving record: Accidents and traffic violations significantly increase premiums.

- Improve your credit score: In many states, credit history is a factor in determining insurance rates.

- Increase your deductible: A higher deductible lowers your premium, but you’ll pay more out-of-pocket in the event of a claim.

- Bundle your insurance policies: Combining auto and home insurance often results in discounts.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

- Choose a less expensive car: The make, model, and year of your vehicle affect insurance rates. Safer and less expensive cars often have lower premiums.

- Shop around regularly: Insurance rates can change, so comparing quotes annually is advisable.

- Consider usage-based insurance: Some insurers offer programs that track your driving habits and reward safe driving with lower premiums.

Understanding Insurance Policies

Your car insurance policy is a legally binding contract outlining the terms and conditions of your coverage. Understanding its key components is crucial for effectively managing your risk and ensuring you receive the appropriate compensation in the event of an accident or other covered incident. This section will break down the essential elements of a typical policy, highlighting common exclusions and the claims process.

Key Components of a Car Insurance Policy

A standard car insurance policy typically includes several key sections. These sections detail the specifics of your coverage, including the insured vehicle(s), the policyholder’s information, and the coverage limits. Crucially, the policy clearly defines what events are covered and what the insurer’s responsibilities are in those situations. The policy also specifies the premiums due, payment schedule, and conditions under which the policy can be canceled or renewed. A declarations page summarizes all the key details at a glance.

Common Policy Exclusions and Limitations

It’s important to note that car insurance policies don’t cover everything. Many policies exclude coverage for damage caused by certain events, such as wear and tear, intentional acts, or driving under the influence of alcohol or drugs. There are also limitations on coverage amounts. For example, a policy might have a specific limit on liability coverage, meaning the maximum amount the insurer will pay for injuries or damages caused to others. Another common limitation is the deductible, the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. For instance, a $500 deductible means you would pay the first $500 of repair costs after an accident, and the insurance company would cover the rest. Furthermore, some policies might exclude coverage for specific types of vehicles or drivers.

Filing a Claim with Your Insurance Company

The claims process typically begins with immediately reporting the incident to your insurer. This usually involves contacting their claims department by phone or online. You will be required to provide details about the accident, including the date, time, location, and the individuals involved. You’ll likely need to provide police reports, photos of the damage, and contact information for any witnesses. The insurer will then investigate the claim to determine liability and the extent of the damages. Once the investigation is complete, the insurer will either approve or deny the claim, and if approved, will determine the amount of compensation to be paid. This process can vary in length depending on the complexity of the claim. For example, a minor fender bender might be resolved quickly, while a more serious accident involving significant injuries or property damage could take considerably longer.

Understanding and Interpreting Policy Documents

Car insurance policies can be complex legal documents. To fully understand your coverage, take the time to read your policy thoroughly. Pay close attention to the definitions of terms, the description of coverages, and any exclusions or limitations. If you have any questions or are unsure about anything, contact your insurance agent or the insurance company directly for clarification. Don’t hesitate to ask for explanations of specific clauses or sections. Consider keeping a copy of your policy in a safe and easily accessible place, and familiarize yourself with the key sections to ensure you are fully informed about your rights and responsibilities. It’s beneficial to review your policy periodically, especially before renewing, to ensure it still meets your needs.

Final Thoughts

Finding the right car insurance involves careful consideration of your individual needs and risk profile. By understanding the key factors influencing premiums, comparing quotes from different providers, and negotiating effectively, you can secure affordable and comprehensive coverage. Remember, proactive planning and a thorough understanding of your policy are crucial for managing your insurance costs effectively and ensuring adequate protection on the road. This guide provides a solid foundation for making informed decisions about your car insurance needs, leading to greater financial security and peace of mind.

FAQ Compilation

What does “full coverage” car insurance actually mean?

Full coverage typically refers to a combination of liability, collision, and comprehensive coverage, offering broader protection than minimum liability insurance. However, it’s essential to review the specific policy details as “full coverage” can vary between insurers.

Can I get my car insurance rate lowered if I take a defensive driving course?

Yes, many insurance companies offer discounts for completing a state-approved defensive driving course. This demonstrates your commitment to safe driving practices.

How often can I expect my car insurance rates to change?

Rates can change periodically, often annually, due to factors like claims history, driving record updates, and changes in the insurance market. You should review your policy regularly.

What happens if I get into an accident and don’t have enough coverage?

If your coverage limits are insufficient to cover the damages or injuries caused, you could face significant out-of-pocket expenses. This underscores the importance of adequate liability coverage.