Navigating the world of insurance can feel like deciphering a complex code. Understanding average insurance costs is crucial for making informed financial decisions, whether you’re securing your car, home, or health. This guide unravels the mysteries behind these costs, exploring the myriad factors that influence premiums and empowering you to find the best coverage at the most competitive price.

From age and driving history to location and credit score, numerous variables impact your insurance premiums. We’ll delve into the specifics of different insurance types – auto, homeowners, health, and life – providing average cost comparisons and highlighting key factors contributing to price variations. Armed with this knowledge, you can confidently compare quotes, understand policy details, and ultimately, secure the insurance protection you need without overspending.

Factors Influencing Average Insurance Costs

Several key factors interact to determine the average cost of insurance. Understanding these factors can help individuals make informed decisions about their insurance choices and potentially reduce their premiums. These factors are not mutually exclusive; they often work in combination to influence the final cost.

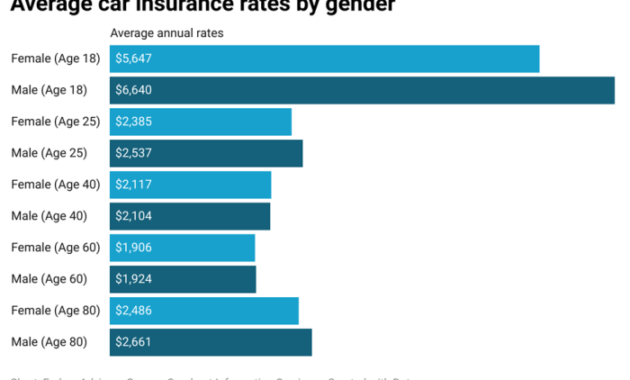

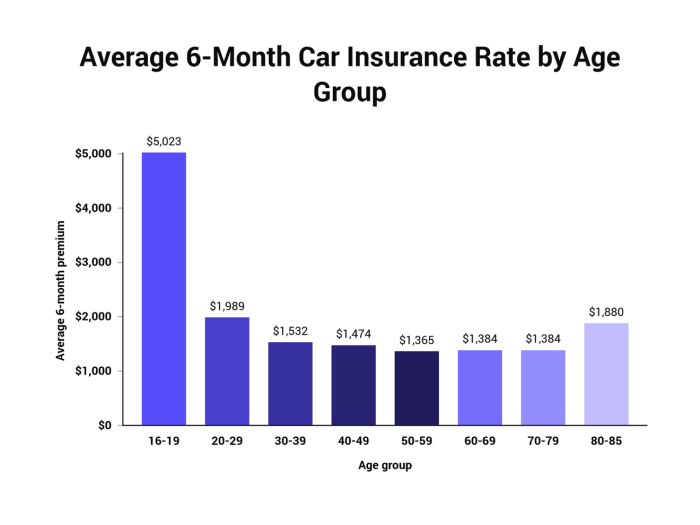

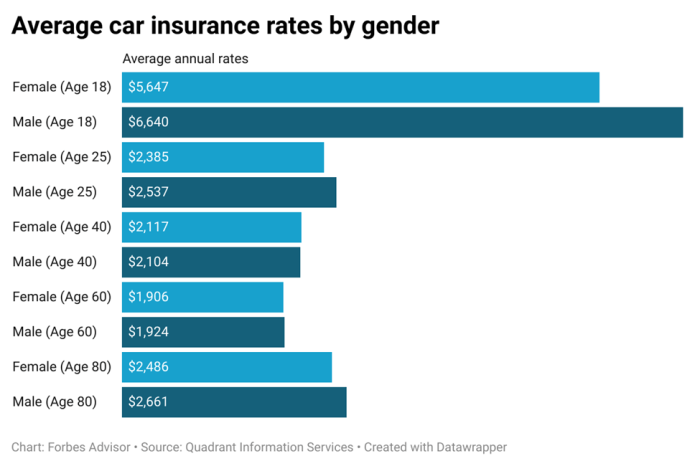

Age and Insurance Premiums

Younger drivers generally pay higher insurance premiums than older drivers. This is primarily due to statistically higher accident rates among younger drivers. Insurance companies assess risk based on historical data, and younger drivers, especially those with less driving experience, are considered higher risk. As drivers age and accumulate years of safe driving, their premiums tend to decrease. This trend often reverses in later years as reaction times and physical abilities may decline, again increasing the perceived risk.

Driving History and Insurance Costs

A clean driving record significantly impacts insurance premiums. Drivers with multiple accidents, speeding tickets, or other moving violations will typically face higher premiums. Insurance companies view these incidents as indicators of higher risk and adjust premiums accordingly. Conversely, a driver with a long history of accident-free driving will often qualify for lower premiums, reflecting their reduced risk profile. Some companies even offer discounts for completing defensive driving courses.

Vehicle Type and Insurance Costs

The type of vehicle insured significantly affects insurance costs. Sports cars, luxury vehicles, and high-performance cars generally have higher insurance premiums than sedans or economy cars. This is because these vehicles are often more expensive to repair or replace, and they are sometimes associated with a higher risk of accidents or theft. Factors such as safety ratings and the vehicle’s theft rate also contribute to the premium calculation. For example, a new Tesla Model S will likely have a higher premium than a used Honda Civic.

Location and Insurance Rates

Geographic location plays a substantial role in determining insurance rates. Areas with high crime rates, frequent accidents, or higher repair costs typically have higher insurance premiums. Urban areas often have higher rates than rural areas due to increased traffic congestion and the higher likelihood of collisions. Insurance companies analyze claims data for specific zip codes and adjust premiums accordingly to reflect the risk profile of each area. For instance, insurance in a densely populated city like New York City will likely be more expensive than in a rural town in Montana.

Credit Score and Insurance Premiums

In many states, credit score is a factor considered by insurance companies when determining premiums. A higher credit score is generally associated with lower insurance premiums, while a lower credit score can result in higher premiums. The rationale behind this is that individuals with good credit are considered less risky, implying greater financial responsibility which can translate to a lower likelihood of filing claims. However, the use of credit scores in insurance pricing is a subject of ongoing debate and varies by state.

Comparison of Insurance Costs for Different Coverage Levels

| Coverage Level | Liability Only | Liability + Collision | Liability + Collision + Comprehensive |

|---|---|---|---|

| Estimated Monthly Premium (Example) | $50 | $80 | $100 |

*Note: These are example premiums and actual costs will vary significantly based on all the factors discussed above. This table illustrates the general trend of increasing cost with increasing coverage.

Types of Insurance and Their Average Costs

Understanding the average costs associated with different types of insurance is crucial for effective financial planning. This section will explore the average costs for several common insurance types, highlighting factors contributing to cost variations. Remember that these are averages and your individual costs may vary significantly based on numerous personal factors.

Auto Insurance Average Costs

Auto insurance premiums vary considerably across states, influenced by factors such as traffic density, accident rates, and the cost of vehicle repairs. The following data represents average annual premiums, but individual rates can differ greatly based on driving history, vehicle type, and coverage levels. These figures are estimates and should be considered as such.

- State A: $1,200 (Average annual premium. This state has a relatively high rate of accidents, leading to higher premiums.)

- State B: $850 (Average annual premium. This state boasts a lower accident rate and lower vehicle repair costs.)

- State C: $1,500 (Average annual premium. This state has high insurance costs due to a combination of factors, including high population density and expensive car repair services.)

Homeowners Insurance Average Premiums

The cost of homeowners insurance is heavily dependent on the value of the property. Higher property values typically translate to higher premiums due to the increased risk and potential payout in case of damage or loss. Other factors, such as location and coverage levels, also influence premiums.

- Property Value $200,000: $1,000 (Average annual premium. This represents a modest home in a relatively low-risk area.)

- Property Value $500,000: $2,500 (Average annual premium. This reflects a more expensive home, potentially located in a higher-risk area, demanding greater coverage.)

- Property Value $1,000,000: $5,000 (Average annual premium. This represents a high-value property requiring extensive coverage and therefore higher premiums.)

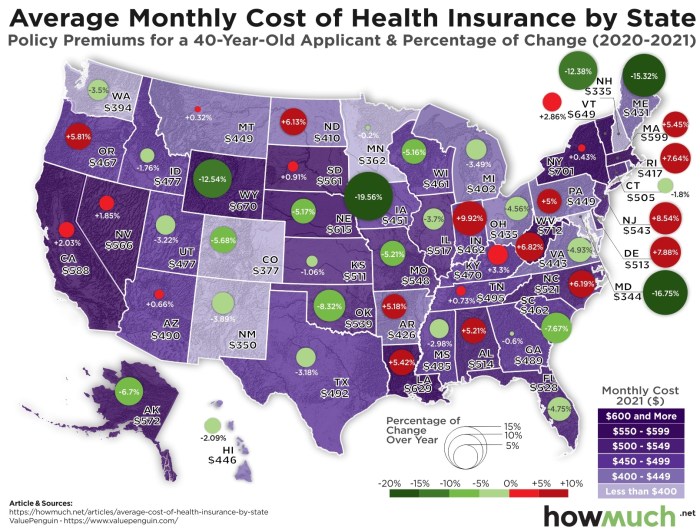

Health Insurance Cost Variability

Health insurance costs are notoriously complex and variable. Several factors contribute to the wide range of premiums individuals pay.

- Age: Older individuals generally pay more due to higher healthcare utilization.

- Location: The cost of healthcare varies geographically, impacting premiums.

- Plan Type: Different plans (e.g., HMO, PPO) offer varying levels of coverage and cost-sharing, resulting in different premiums.

- Pre-existing Conditions: Individuals with pre-existing conditions may face higher premiums depending on the insurer and plan.

Life Insurance Average Costs

The cost of life insurance depends primarily on the coverage amount. Larger death benefits necessitate higher premiums to cover the increased risk for the insurance company. Other factors such as age, health, and lifestyle also play a significant role.

- $250,000 Coverage: $500 (Average annual premium. This represents a relatively standard coverage amount for a young, healthy individual.)

- $500,000 Coverage: $1,000 (Average annual premium. This doubles the coverage and, correspondingly, the premium.)

- $1,000,000 Coverage: $2,000 (Average annual premium. This significant coverage amount results in a substantially higher premium.)

Understanding Insurance Policies and Coverage

Insurance policies are complex legal documents, but understanding their key components is crucial for securing adequate protection. This section will clarify the various types of coverage, common exclusions, and the financial aspects of insurance policies.

Types of Insurance Coverage

Insurance policies offer a range of coverage options, tailored to specific needs and risks. Common types include liability coverage (protecting against claims of injury or damage caused to others), property coverage (covering damage or loss to your own property), and medical payments coverage (covering medical expenses for those injured on your property, regardless of fault). Additional coverages, like personal injury protection (PIP) in auto insurance or supplemental coverage for specific events (like floods or earthquakes), can be added depending on individual requirements and location. The specific coverage offered varies widely depending on the type of insurance (homeowners, auto, health, etc.) and the policy itself.

Common Exclusions and Limitations

Every insurance policy contains exclusions, which are specific events or circumstances not covered by the policy. Common exclusions might include damage caused by intentional acts, wear and tear, or events specifically excluded by named perils policies (like flood damage in a standard homeowners policy). Limitations specify the maximum amount the insurer will pay for a specific claim or over the policy period. Understanding these limitations is vital to avoid unexpected financial burdens. For example, a homeowners policy might exclude coverage for damage caused by a war or acts of terrorism. Similarly, an auto insurance policy might limit coverage for rental car expenses after an accident.

Deductibles, Premiums, and Co-pays

Three key financial components of most insurance policies are deductibles, premiums, and co-pays. The premium is the regular payment made to maintain the insurance coverage. The deductible is the amount the policyholder must pay out-of-pocket before the insurance coverage begins. A co-pay is a fixed amount the insured pays for a specific service, such as a doctor’s visit, with the insurer covering the remainder. For example, a $1,000 deductible means the insured pays the first $1,000 of covered expenses before the insurance company starts paying. Higher deductibles often lead to lower premiums, while lower deductibles result in higher premiums. Co-pays vary significantly based on the type of insurance and the specific plan.

Policy Options: Benefits and Drawbacks

Various policy options exist, each with its benefits and drawbacks. For instance, a high-deductible health plan offers lower premiums but requires a larger out-of-pocket payment before coverage begins. Conversely, a low-deductible plan has higher premiums but lower out-of-pocket costs. Similarly, in homeowners insurance, comprehensive policies offer broader coverage but come with higher premiums compared to basic policies with limited coverage. The choice depends on individual risk tolerance and financial capacity. Choosing the right policy involves carefully weighing the potential costs and benefits of each option in relation to personal circumstances.

Typical Homeowners Insurance Coverage Areas

Imagine a house represented by a square. The roof of the square represents coverage for the structure of the house itself (walls, roof, foundation). The interior of the square represents coverage for personal belongings inside the house. An area extending slightly beyond the square represents coverage for detached structures, like a shed or garage. Another area around the house represents liability coverage, protecting against accidents that occur on the property causing injury to others. Finally, a small area representing additional living expenses covers temporary housing if the house becomes uninhabitable due to a covered event. Each of these areas has its own limits and exclusions defined in the policy.

Conclusion

Securing adequate insurance coverage is a cornerstone of responsible financial planning. By understanding the factors that influence average insurance costs and employing the strategies Artikeld in this guide, you can navigate the insurance landscape with confidence. Remember to actively compare quotes, carefully review policy details, and leverage available discounts to optimize your coverage and budget. Making informed decisions about your insurance ensures peace of mind and financial stability for the future.

FAQ Guide

What is the impact of bundling insurance policies?

Bundling your auto and homeowners insurance (or other policies) with the same provider often results in significant discounts due to the combined risk assessment.

How often should I review my insurance coverage?

It’s recommended to review your insurance policies annually, or whenever there’s a significant life change (marriage, new home, new car, etc.), to ensure you maintain adequate coverage.

Can I negotiate my insurance premiums?

While not always successful, it’s worth attempting to negotiate your premiums, particularly if you have a clean driving record or have been a loyal customer for an extended period.

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in for a claim.