Finding the best car insurance company can feel overwhelming, but it doesn’t have to be. Understanding your needs and comparing different companies is key to getting the best coverage at the right price.

First, you’ll need to understand the different types of car insurance coverage available, such as liability, collision, and comprehensive. Then, you can factor in your driving history, age, vehicle type, and location to get a personalized estimate. Remember, your individual needs should guide your decision, taking into account your driving habits, vehicle value, and financial situation.

Understanding Car Insurance Needs

Car insurance is a crucial aspect of responsible vehicle ownership, providing financial protection against potential risks associated with driving. It is essential to understand the various types of coverage available and how they can safeguard you and your vehicle.

Types of Car Insurance Coverage

Car insurance policies typically offer a range of coverage options, each designed to address specific risks. Here’s a breakdown of some common types:

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries. It covers medical expenses, property damage, and legal costs. Liability coverage is typically required by law and is essential to protect yourself from significant financial losses.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. Collision coverage is optional but highly recommended, especially if you have a newer or more expensive vehicle. It provides peace of mind knowing that your vehicle will be repaired or replaced in case of an accident.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, natural disasters, and animal collisions. Comprehensive coverage is optional, but it is beneficial for vehicles with high value or those that are more susceptible to these types of risks.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It helps cover your medical expenses and property damage if the other driver cannot afford to pay for the damages.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. PIP is typically required in certain states and can provide essential financial support during your recovery.

Factors Influencing Car Insurance Premiums

Several factors influence the cost of your car insurance premiums. Understanding these factors can help you make informed decisions to potentially reduce your premiums:

- Driving History: Your driving record is a significant factor in determining your insurance premiums. A clean driving record with no accidents or violations will generally result in lower premiums. However, having accidents, speeding tickets, or DUI convictions can significantly increase your premiums.

- Age: Younger drivers are statistically more likely to be involved in accidents, which leads to higher insurance premiums. As drivers gain experience and age, their premiums typically decrease. This is because insurance companies recognize that older drivers have a lower risk profile.

- Vehicle Type: The type of vehicle you drive plays a significant role in your insurance premiums. Vehicles with high performance, luxury, or expensive parts are generally more expensive to insure. This is because these vehicles are more likely to be stolen, damaged, or involved in accidents, leading to higher repair costs.

- Location: Your location can also affect your insurance premiums. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents may have higher insurance rates. Insurance companies assess the risk associated with different locations and adjust premiums accordingly.

- Credit Score: In some states, your credit score can be used to determine your insurance premiums. Insurance companies believe that individuals with good credit scores are more likely to be responsible and pay their premiums on time. A higher credit score can potentially lead to lower premiums.

- Coverage Levels: The amount of coverage you choose can also influence your premiums. Higher coverage limits, such as for liability or collision, will generally result in higher premiums. However, it is essential to choose coverage levels that adequately protect you and your vehicle in case of an accident.

Understanding Your Individual Needs

It is crucial to assess your individual insurance needs based on your specific circumstances. Consider the following factors:

- Driving Habits: Do you drive frequently? Do you drive in high-traffic areas or under challenging conditions? Your driving habits can influence the likelihood of an accident and impact your insurance premiums.

- Vehicle Value: What is the value of your vehicle? If you have a newer or more expensive vehicle, you may want to consider comprehensive and collision coverage to protect your investment. Older or less expensive vehicles may not require these coverages.

- Financial Situation: What is your financial situation? Can you afford to pay for significant expenses out of pocket in case of an accident? If not, you may need higher coverage limits to ensure adequate protection.

Key Factors to Consider When Choosing a Company

Choosing the right car insurance company can be a daunting task, especially with so many options available. It’s crucial to go beyond simply comparing prices and consider other factors that directly impact your overall experience and financial well-being.

Financial Stability and Claims Handling Processes

Financial stability is a crucial factor in choosing a car insurance company. It ensures that your insurance provider will be able to pay your claims in the event of an accident or other covered event. You can evaluate a company’s financial stability by looking at its credit ratings, which are assigned by independent agencies like A.M. Best and Standard & Poor’s. Higher credit ratings indicate a stronger financial position.

A high credit rating suggests a company is financially sound and less likely to face difficulties in paying out claims.

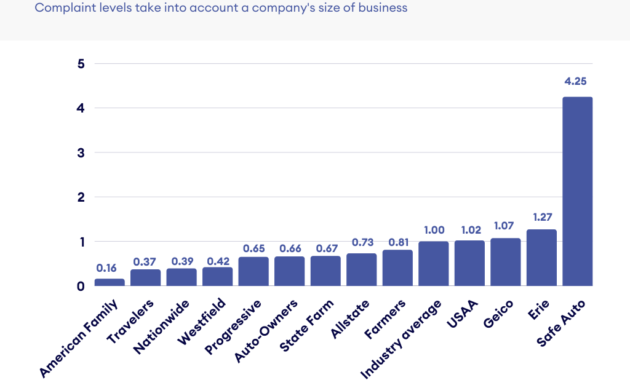

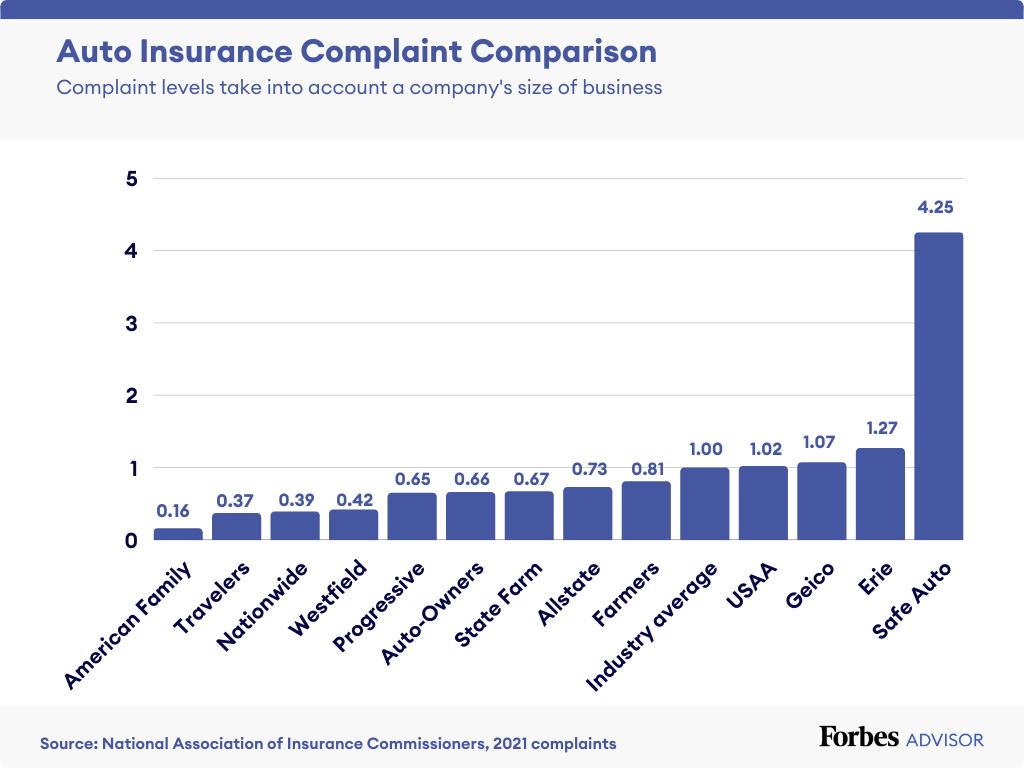

Beyond financial stability, the claims handling process is equally important. A streamlined and efficient claims process can make a significant difference during a stressful time. Look for companies with a reputation for prompt and fair claim settlements. You can research customer reviews and complaints online to get insights into a company’s claims handling process.

Customer Service and Ease of Communication

Effective customer service is crucial when dealing with an insurance company. You want to be able to easily reach a representative who can answer your questions, address concerns, and provide assistance when needed. Look for companies with multiple communication channels, such as phone, email, and online chat, to ensure convenient and accessible customer support.

Companies that offer 24/7 customer service and have a dedicated claims hotline are particularly beneficial.

Evaluate a company’s responsiveness to customer inquiries and complaints. You can research online reviews and forums to gauge the general satisfaction level with a company’s customer service. Positive customer experiences indicate a company that prioritizes customer needs and satisfaction.

Discounts and Special Offers

Many insurance companies offer discounts and special offers to attract customers and make their policies more affordable. These discounts can significantly reduce your premiums and make your insurance more cost-effective.

- Good Driver Discounts: These are offered to drivers with a clean driving record, free of accidents or violations.

- Safe Driver Discounts: Companies may offer discounts to drivers who have completed defensive driving courses or have installed safety features in their vehicles.

- Multi-Policy Discounts: Bundling multiple insurance policies, such as car insurance and home insurance, with the same company can often result in significant discounts.

- Loyalty Discounts: Some companies reward long-term customers with loyalty discounts, recognizing their continued business.

- Payment Discounts: Paying your premium in full or setting up automatic payments can sometimes qualify you for discounts.

It’s essential to compare the discounts offered by different companies and ensure you’re taking advantage of all available savings.

Evaluating Company Features and Services

Once you’ve identified your car insurance needs and considered key factors, the next step is to evaluate the features and services offered by different insurance companies. This step helps you determine which company best aligns with your preferences and requirements.

Comparing Company Features and Services

To make an informed decision, it’s helpful to compare the features and services offered by different insurance companies. You can create a table to organize this information. Here’s an example:

| Feature | Company A | Company B | Company C |

|---|---|---|---|

| Online quote availability | Yes | Yes | Yes |

| Mobile app functionality | Yes | Yes | Yes |

| 24/7 customer support | Yes | Yes | Yes |

| Claims reporting process | Online, phone, or app | Online or phone | Online or phone |

Illustrating the Claims Process

A flowchart can be a helpful visual representation of the claims process for a specific insurance company. This visual tool clarifies the steps involved, providing a clear understanding of how a claim is handled.

Example:

Flowchart for Company A’s Claims Process:

1. Incident Occurs: The insured party experiences an incident covered by their policy.

2. Initial Report: The insured party contacts Company A to report the incident. This can be done online, through the mobile app, or by phone.

3. Claim Assessment: Company A assesses the claim, verifying details and determining coverage.

4. Investigation: If necessary, Company A may conduct an investigation to gather additional information.

5. Claim Approval: Once the claim is approved, Company A determines the amount of coverage and payment.

6. Payment Processing: Company A processes the payment to the insured party or the repair facility.

7. Claim Closure: Once the claim is settled, Company A closes the case.

Gathering and Analyzing Customer Reviews and Ratings

Customer reviews and ratings are invaluable resources for understanding customer experiences and making informed decisions about car insurance companies. By analyzing feedback from real policyholders, you can gain insights into a company’s strengths and weaknesses, helping you choose the best option for your needs.

Identifying Reputable Sources for Unbiased Reviews

Finding unbiased customer reviews and ratings is crucial for getting an accurate picture of a car insurance company’s performance. Several reputable sources provide reliable feedback from real customers:

- J.D. Power: A well-known research and data analytics company, J.D. Power conducts annual surveys and provides ratings on various industries, including car insurance. Their rankings are based on customer satisfaction with factors like price, claims handling, and customer service.

- Consumer Reports: This non-profit organization conducts independent testing and provides ratings on a wide range of products and services, including car insurance. Their reviews are based on data collected from surveys and analysis of industry performance.

- NerdWallet: This personal finance website aggregates reviews and ratings from multiple sources, including customer feedback and expert analysis. Their platform allows you to compare car insurance quotes and read reviews from other users.

- Insurance.com: This website offers a comprehensive comparison of car insurance quotes and provides access to customer reviews and ratings from a variety of sources.

- Google Reviews: While not specific to car insurance, Google Reviews can provide valuable insights into customer experiences with local insurance agents and branches. These reviews often reflect customer satisfaction with the overall service and responsiveness of the company.

Analyzing Key Themes and Insights from Customer Feedback

Once you’ve gathered reviews from reputable sources, it’s important to analyze the key themes and insights to understand the overall customer experience. Look for recurring patterns and trends in the feedback:

- Customer service: Do customers praise the company’s responsiveness, helpfulness, and efficiency in handling claims and inquiries? Or are there complaints about long wait times, rude staff, or difficulty resolving issues?

- Claims handling: How satisfied are customers with the claims process? Are claims processed quickly and fairly? Are there any complaints about delays, denials, or unreasonable settlement offers?

- Price and value: Do customers feel they are getting good value for their money? Are they happy with the premiums they pay? Are there any complaints about hidden fees or unexpected charges?

- Policy options and coverage: Do customers find the company’s policy options and coverage options suitable for their needs? Are there any complaints about limited coverage or restrictive terms?

- Digital experience: How user-friendly are the company’s online platforms and mobile apps? Do customers find it easy to manage their policies, make payments, or file claims online?

Comparing and Contrasting Ratings and Reviews from Different Sources, Best car insurance company

To gain a comprehensive understanding of customer experiences, it’s important to compare and contrast ratings and reviews from different sources. Look for consistency in the feedback and identify any discrepancies or conflicting opinions:

- Consistency in ratings: Do different sources provide similar ratings for the same company? If there are significant differences, it’s worth investigating further to understand the reasons behind the discrepancies.

- Focus of reviews: Different sources may focus on different aspects of the customer experience. For example, J.D. Power may emphasize customer satisfaction with claims handling, while Consumer Reports may focus on price and value.

- Specific issues raised: Compare the specific issues raised in customer reviews across different sources. Are there any recurring themes or common complaints that appear in multiple reviews?

Exploring Alternative Insurance Options

While traditional insurance companies dominate the market, exploring alternative options can often lead to more competitive rates and tailored coverage. Here’s a look at some key players in the alternative insurance landscape:

Online Insurance Brokers and Comparison Websites

These platforms act as intermediaries, connecting you with multiple insurance providers. They streamline the comparison process by allowing you to input your information once and receive quotes from various companies.

- Advantages:

- Convenience: They eliminate the need to contact multiple insurers individually.

- Time-Saving: The process is often faster than contacting each company directly.

- Transparency: They allow you to compare quotes side-by-side, revealing the best deals.

- Disadvantages:

- Limited Customization: You may not be able to access all the features and coverage options offered by individual companies.

- Potential Bias: Some brokers may prioritize companies that pay them higher commissions.

Specialized Insurance Companies

These companies focus on specific vehicle types or driving groups, offering tailored policies and potentially lower premiums.

- Advantages:

- Specialized Expertise: They have a deep understanding of the unique needs of their target market.

- Competitive Pricing: Their focus on specific groups often allows them to offer more competitive rates.

- Customized Coverage: They can tailor policies to meet the specific requirements of their customers.

- Disadvantages:

- Limited Availability: They may not offer coverage for all types of vehicles or drivers.

- Potential Lack of Flexibility: Their specialized focus might limit the range of coverage options available.

Pricing and Coverage Options

Pricing and coverage options vary widely across insurance providers. Here’s a breakdown of some key factors to consider:

- Type of Vehicle: The make, model, and year of your vehicle significantly impact your premium. Sports cars and luxury vehicles generally cost more to insure.

- Driving History: Your driving record, including accidents and traffic violations, plays a crucial role. A clean record typically leads to lower premiums.

- Location: Your geographic location influences your risk profile. Areas with higher crime rates or traffic congestion may have higher insurance costs.

- Coverage Levels: The amount of coverage you choose, such as liability limits, collision coverage, and comprehensive coverage, will affect your premium.

Epilogue

Finding the best car insurance company requires careful research and consideration. By understanding your needs, comparing companies, and reading reviews, you can make an informed decision that protects you and your vehicle. Remember, insurance is a long-term commitment, so choosing the right company can save you money and provide peace of mind for years to come.

Query Resolution: Best Car Insurance Company

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there are significant life changes, such as a new car, a change in driving habits, or a move to a new location.

What is a deductible and how does it affect my insurance premium?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to a lower premium, while a lower deductible means a higher premium.

What are some common discounts offered by car insurance companies?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining car insurance with other types of insurance, like homeowners or renters insurance.