Navigating the world of car insurance in New York can feel overwhelming. With a complex regulatory environment and a wide array of providers offering diverse coverage options, finding the best policy to fit your individual needs and budget requires careful consideration. This guide delves into the intricacies of the New York car insurance market, providing you with the knowledge and tools to make an informed decision.

We’ll explore the various types of coverage available, the factors that influence premium costs, and the key features to look for in a comprehensive policy. We’ll also compare major insurance providers, offering practical tips for securing the best possible deal and navigating the claims process. Whether you’re a young driver, a senior citizen, or simply looking to optimize your existing coverage, this guide is designed to empower you with the information you need to make the right choice.

Understanding New York’s Insurance Market

Navigating the New York car insurance market requires understanding its unique regulatory landscape and the various factors influencing premiums. This section provides a clear overview of the key aspects to help you make informed decisions.

New York’s Car Insurance Regulatory Environment

New York State’s Department of Financial Services (NYDFS) regulates the car insurance industry. This regulation aims to ensure fair pricing, consumer protection, and the financial stability of insurance companies operating within the state. The NYDFS sets minimum coverage requirements, approves insurance rates, and investigates consumer complaints. These regulations are designed to protect drivers and maintain a competitive marketplace. Strict adherence to these regulations is mandatory for all insurance providers operating in the state. Failure to comply can result in significant penalties.

Types of Car Insurance Coverage in New York

New York offers various car insurance coverages. The most common are liability coverage (which covers injuries or damages to others), collision coverage (which covers damage to your vehicle in an accident regardless of fault), comprehensive coverage (which covers damage to your vehicle from non-collision events like theft or vandalism), uninsured/underinsured motorist coverage (which protects you if you’re hit by an uninsured or underinsured driver), and personal injury protection (PIP) which covers medical expenses and lost wages regardless of fault. The specific coverage options and limits are customizable to meet individual needs and budgets. Understanding these different types is crucial in selecting the right policy.

Factors Influencing Car Insurance Premiums in New York

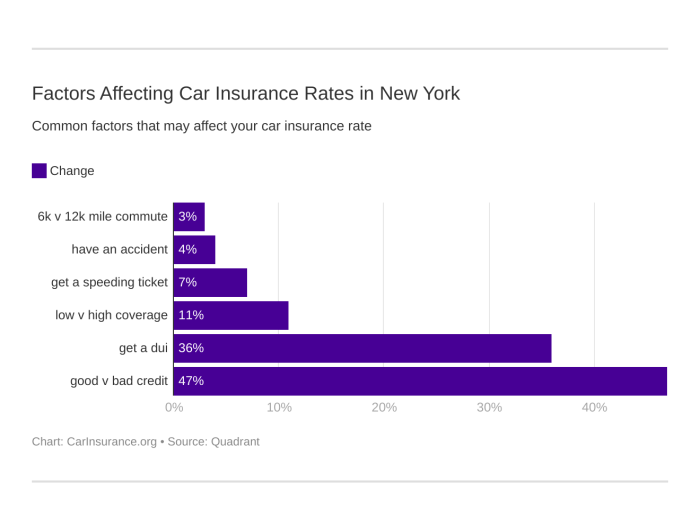

Several factors significantly impact car insurance premiums in New York. These include your driving record (accidents and traffic violations increase premiums), the type of vehicle you drive (sports cars and luxury vehicles often command higher premiums due to repair costs and theft risk), your location (premiums vary based on accident rates and crime statistics in different areas), your age and driving experience (younger and less experienced drivers generally pay more), and your credit score (in some cases, credit history can be a factor in determining premiums). A clean driving record and a safe vehicle choice in a lower-risk area can help keep premiums lower.

Comparison of Major Car Insurance Providers in New York

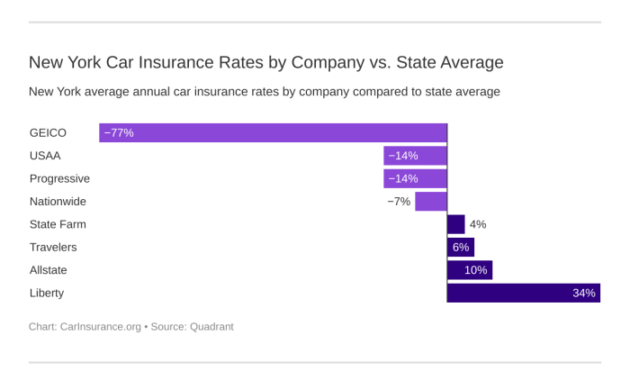

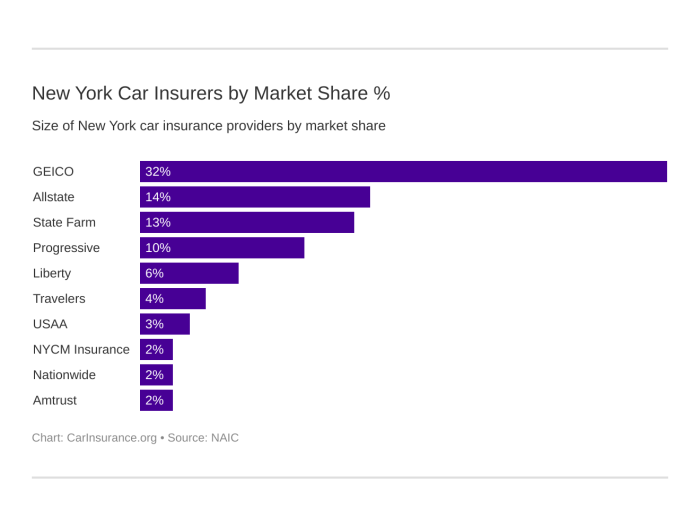

Numerous car insurance companies operate in New York, each offering different coverage options and pricing structures. A direct comparison requires reviewing individual quotes from multiple providers. Factors such as customer service ratings, claims processing speed, and financial stability of the company should also be considered. Major providers often include Geico, State Farm, Allstate, Progressive, and Liberty Mutual. However, the best provider for you will depend on your individual circumstances and needs. It is advisable to obtain quotes from several companies before making a decision to ensure you find the most competitive and suitable policy.

Specific Coverage Needs and Scenarios

Choosing the right car insurance in New York depends heavily on your individual circumstances. Factors like age, driving history, the type of vehicle you own, and your personal risk tolerance all play a significant role in determining your specific coverage needs. Understanding these nuances is key to securing adequate protection without overspending.

Understanding the various coverage options available and how they apply to different situations is crucial for making informed decisions. This section will explore the unique insurance needs of various driver profiles and common scenarios, highlighting the importance of tailored coverage.

Coverage Needs for Different Driver Profiles

New York’s diverse population necessitates a range of insurance options. Young drivers, for example, often face higher premiums due to statistically higher accident rates. Conversely, senior drivers might require adjustments to their coverage based on potential physical limitations. Individuals with multiple vehicles need to consider how their coverage extends across their fleet.

Young Drivers (Under 25): Young drivers typically pay more for insurance due to their higher accident risk. They may benefit from exploring options like driver’s education discounts or opting for higher deductibles to lower premiums, while ensuring sufficient liability coverage to protect themselves and others. Consider adding additional coverage such as comprehensive and collision, to protect your vehicle investment.

Senior Drivers (Over 65): Senior drivers might require adjustments to their coverage based on their driving habits and potential health concerns. They might benefit from reviewing their liability limits to ensure adequate protection, considering the potential for accidents. Comprehensive and collision coverage may be adjusted based on the vehicle’s value and the driver’s driving habits.

Drivers with Multiple Vehicles: Insuring multiple vehicles often allows for discounts, but it’s vital to ensure each vehicle has appropriate coverage. A family with multiple drivers and vehicles should carefully consider the coverage limits and deductibles for each car, ensuring that the overall coverage meets their needs while optimizing cost-effectiveness.

Coverage Options for Specific Situations

Accidents, theft, and natural disasters are just some of the events that can impact drivers. Understanding the coverage options available for each scenario is crucial for mitigating financial losses.

Accidents: Liability coverage is mandatory in New York and covers damages to other people’s property or injuries sustained by others in an accident you cause. Collision coverage protects your vehicle in an accident, regardless of fault, while comprehensive coverage covers damage from non-collision events like theft or vandalism. Uninsured/Underinsured motorist coverage is crucial, protecting you if you’re involved in an accident with a driver who lacks sufficient insurance.

Theft: Comprehensive insurance covers theft, reimbursing you for the value of your stolen vehicle, less your deductible. This is separate from liability insurance which only addresses injuries or damages to other parties.

Natural Disasters: Comprehensive coverage typically extends to damage caused by natural disasters like floods, hurricanes, or hail. However, specific exclusions may apply depending on the policy and the nature of the disaster. It is important to review your policy details to understand the extent of your coverage in such situations.

Examples of Beneficial Coverage Types

Several scenarios illustrate the benefits of specific coverage types.

Scenario 1: A young driver, Sarah, is involved in an accident that damages another driver’s car and causes injuries. Her liability coverage pays for the repairs and medical expenses, preventing a potentially devastating financial burden.

Scenario 2: Mark’s car is stolen. Because he has comprehensive coverage, his insurance company replaces his vehicle, minus his deductible. Without this coverage, he would bear the entire cost of replacing his car.

Scenario 3: A hailstorm damages several cars in a neighborhood. Those with comprehensive coverage receive compensation for the repairs, while those without are left to cover the costs themselves.

Frequently Asked Questions about NY Car Insurance

Understanding the intricacies of New York car insurance can be challenging. Here are answers to some common questions.

Q: What is the minimum liability coverage required in New York?

A: New York requires a minimum of 25/50/10 liability coverage. This means $25,000 for injuries per person, $50,000 for total injuries per accident, and $10,000 for property damage.

Q: What is a deductible?

A: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

Q: What is uninsured/underinsured motorist coverage?

A: This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It helps cover your medical bills and vehicle repairs.

Q: How can I lower my car insurance premiums?

A: Several factors can affect your premiums. Maintaining a good driving record, taking a defensive driving course, bundling insurance policies, and choosing a higher deductible can all help lower your costs.

Illustrative Examples of Policy Features

Understanding the specifics of a car insurance policy in New York can be complex. This section provides illustrative examples to clarify common policy features, coverage details, and cost implications. These examples are for illustrative purposes only and should not be considered a substitute for professional advice or a specific policy quote.

Sample Car Insurance Policy with Detailed Coverage and Premium Breakdown

Let’s consider a hypothetical 30-year-old driver, Sarah, living in suburban New York, driving a 2020 Honda Civic. She opts for a standard policy with the following coverages: Liability ($100,000/$300,000 bodily injury, $50,000 property damage), Collision, Comprehensive, Uninsured/Underinsured Motorist (UM/UIM) coverage, and Personal Injury Protection (PIP) with a $50,000 limit. Her annual premium, based on her driving record (clean), credit score (good), and location, comes to approximately $1,200. This premium is broken down as follows: Liability ($400), Collision ($400), Comprehensive ($200), UM/UIM ($100), and PIP ($100). These figures are estimates and can vary significantly based on individual circumstances.

Coverage for a Hypothetical Accident Scenario

Imagine Sarah is involved in an accident where she is at fault. Another driver sustains $25,000 in medical bills and $10,000 in vehicle damage. Sarah’s vehicle sustains $5,000 in damage. Her liability coverage would cover the other driver’s medical bills and vehicle damage. Her collision coverage would cover the $5,000 damage to her vehicle, less her deductible (let’s assume $500). The claim process would involve filing a report with her insurance company, providing documentation of the accident, and cooperating with the adjuster. The payout would be processed according to the terms of her policy. If Sarah had chosen lower liability limits, she might have faced significant personal financial responsibility.

Example Policy Document: Key Sections and Implications

A typical New York car insurance policy document includes several key sections. The Declarations page summarizes the policyholder’s information, coverage details, premium, and effective dates. The Definitions section clarifies the meaning of key terms used throughout the policy. The Coverages section details the specific types of protection provided, outlining limits and exclusions. The Exclusions section lists events or circumstances not covered by the policy. Understanding these sections is crucial for navigating a claim and knowing the extent of your coverage. For example, damage caused by driving under the influence of alcohol is typically excluded.

Impact of Different Coverage Options on Insurance Cost

Choosing different coverage levels significantly impacts the overall cost. Opting for higher liability limits, for instance, increases the premium but offers greater protection against substantial financial responsibility in the event of a serious accident. Dropping collision or comprehensive coverage can reduce the premium, but leaves the policyholder responsible for vehicle repair costs after an accident or damage from non-collision events. Similarly, adding optional coverages like roadside assistance or rental car reimbursement increases the premium but provides additional benefits. The decision regarding coverage levels involves balancing cost and risk tolerance.

Final Review

Securing the best car insurance in New York involves understanding your specific needs, comparing various providers, and carefully reviewing policy details. By understanding the factors influencing premiums, leveraging comparison tools, and negotiating effectively, you can find a policy that provides adequate protection without breaking the bank. Remember to regularly review your coverage to ensure it continues to meet your evolving needs. Armed with the right information, you can confidently navigate the New York car insurance landscape and find the optimal coverage for your circumstances.

Helpful Answers

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility required by the New York DMV for drivers with certain driving violations, such as DUI or multiple accidents. It’s not a type of insurance itself, but a certificate filed by your insurance company.

How often can I change my car insurance provider?

You can generally switch car insurance providers at any time. However, there might be penalties or cancellation fees depending on your existing policy terms. It’s advisable to check your policy details before switching.

What is the difference between collision and comprehensive coverage?

Collision coverage pays for damage to your vehicle caused by an accident, regardless of fault. Comprehensive coverage covers damage from events other than accidents, such as theft, vandalism, or natural disasters.

Can I get a discount for having multiple vehicles insured with the same company?

Yes, many insurance companies offer multi-vehicle discounts. The exact discount will vary by provider and policy.