Best car insurance in Ontario Canada is a crucial aspect of responsible driving, ensuring you have adequate protection in case of accidents or unforeseen events. Navigating the complex landscape of Ontario’s car insurance market can be overwhelming, with numerous factors influencing premiums and coverage options. This guide aims to provide comprehensive insights into understanding the key elements of car insurance in Ontario, empowering you to make informed decisions and find the best policy for your needs.

From understanding mandatory coverage requirements and exploring different types of insurance to identifying factors affecting rates and finding reputable providers, we delve into the intricacies of car insurance in Ontario. We also provide valuable tips for saving money on premiums and navigating the claims process effectively.

Understanding Ontario’s Car Insurance Landscape

Ontario’s car insurance system is complex, with a unique blend of factors that determine your premiums. This complexity stems from a combination of mandatory coverage requirements, a variety of insurance options, and the regulatory oversight of the Financial Services Commission of Ontario (FSCO).

Factors Influencing Car Insurance Rates

Several factors contribute to the cost of car insurance in Ontario. Understanding these factors can help you make informed decisions to potentially lower your premiums.

- Driving Record: This is arguably the most significant factor. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, and other infractions can significantly increase your rates.

- Vehicle Type: The make, model, and year of your vehicle play a role. High-performance cars, luxury vehicles, and those with a history of theft or accidents tend to have higher insurance premiums.

- Location: Where you live influences your rates. Areas with higher crime rates or a greater frequency of accidents generally have higher premiums. Urban areas often have higher premiums than rural areas.

- Driving History: Your driving history, including the number of years you’ve been driving, your age, and your driving experience, all factor into your premiums. Younger and inexperienced drivers often face higher premiums.

- Coverage Levels: The amount of coverage you choose, such as liability limits and optional add-ons, will affect your premium. Higher coverage levels generally mean higher premiums.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles typically lead to lower premiums.

- Discounts: Several discounts are available, such as safe driver discounts, multi-car discounts, and anti-theft device discounts. Taking advantage of these discounts can help you save money.

Mandatory Coverage Requirements

Ontario law mandates specific insurance coverages for all drivers. These coverages protect you and others in case of an accident.

- Third-Party Liability: This coverage protects you financially if you cause an accident that injures or damages someone else. It covers their medical expenses, lost wages, and property damage. Minimum coverage is $200,000, but you can choose higher limits for greater protection.

- Accident Benefits (AB): This coverage provides benefits for you and your passengers if you are injured in an accident. It covers medical expenses, lost income, and rehabilitation costs. It’s important to note that AB benefits are not dependent on fault. You are entitled to these benefits regardless of who caused the accident.

- Direct Compensation Property Damage (DCPD): This coverage protects your vehicle in case of an accident. It allows you to claim directly from your own insurer, regardless of who caused the accident.

Types of Car Insurance in Ontario, Best car insurance in ontario canada

Ontario offers various types of car insurance to meet different needs and budgets.

- Standard Coverage: This is the most basic type of car insurance, providing the mandatory coverages mentioned above. It’s suitable for drivers who want basic protection at a lower cost.

- Comprehensive Coverage: This coverage goes beyond the standard policy, offering protection against damage caused by events other than accidents, such as theft, vandalism, and natural disasters. It provides peace of mind for drivers who want broader protection for their vehicle.

- Collision Coverage: This coverage protects your vehicle from damage caused by collisions, regardless of fault. It’s a valuable option for drivers who want protection for their vehicle in case of an accident, even if they are not at fault.

- Optional Coverage: Many optional coverages are available, such as:

- Roadside Assistance: Provides assistance in case of a breakdown or other roadside emergencies.

- Rental Car Coverage: Covers the cost of a rental car if your vehicle is damaged in an accident.

- Uninsured Motorist Coverage: Protects you in case of an accident with an uninsured or hit-and-run driver.

- Increased Third-Party Liability Limits: Offers higher financial protection in case of an accident.

Role of the Financial Services Commission of Ontario (FSCO)

FSCO plays a crucial role in regulating the car insurance industry in Ontario.

- Licensing and Supervision: FSCO licenses and supervises insurance companies operating in Ontario, ensuring they meet specific standards and comply with regulations.

- Consumer Protection: FSCO protects consumers by investigating complaints, resolving disputes, and educating the public about insurance matters. It ensures that insurance companies operate fairly and transparently.

- Rate Regulation: FSCO monitors insurance rates and intervenes if they are deemed excessive or unreasonable. It aims to ensure that rates are fair and reflect the actual risks involved.

Key Factors Affecting Car Insurance Rates: Best Car Insurance In Ontario Canada

Car insurance premiums are calculated based on various factors that assess your risk as a driver. Insurance companies use a complex system to determine how much you pay for coverage, taking into account your driving history, the type of vehicle you drive, your age, and your location.

Driving History

Your driving history plays a significant role in determining your car insurance rates. Insurance companies analyze your driving record to assess your risk. A clean driving record with no accidents or violations will generally result in lower premiums.

- Accidents: Even a single accident can significantly increase your insurance premiums. The severity of the accident and who was at fault are major factors.

- Traffic Violations: Speeding tickets, driving under the influence (DUI), and other traffic violations can also lead to higher premiums.

- Driving Record Improvement: Maintaining a clean driving record is crucial for reducing your insurance costs.

Vehicle Type

The type of vehicle you drive is another key factor in determining your insurance rates. Insurance companies consider the vehicle’s make, model, year, safety features, and theft risk.

- Vehicle Value: More expensive vehicles typically have higher insurance premiums because they cost more to repair or replace in case of an accident.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for lower premiums.

- Theft Risk: Certain vehicle models are more prone to theft, which can result in higher insurance premiums.

Age

Your age is also a factor in determining your car insurance rates. Insurance companies consider your age and driving experience.

- Young Drivers: Younger drivers, particularly those under 25, are generally considered higher risk due to their lack of experience.

- Mature Drivers: Mature drivers, often over 65, may benefit from lower premiums as they have more driving experience and are statistically less likely to be involved in accidents.

Location

Where you live can also affect your car insurance rates. Insurance companies consider factors such as population density, traffic volume, and crime rates in your area.

- Urban Areas: Insurance premiums tend to be higher in urban areas with higher population density and traffic congestion.

- Rural Areas: Premiums may be lower in rural areas with lower population density and less traffic.

Optional Coverage Choices

The optional coverage choices you select can also impact your insurance premiums.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of fault.

Finding the Best Car Insurance Providers in Ontario

Navigating the Ontario car insurance market can feel overwhelming, with numerous providers offering a wide range of coverage options and prices. To make an informed decision, it’s essential to research and compare various providers to find the best fit for your needs.

Reputable Car Insurance Providers in Ontario

This section explores some of the most reputable car insurance providers in Ontario, providing insights into their coverage options, pricing, and customer service.

- Desjardins Insurance: Known for its competitive rates and comprehensive coverage options, Desjardins Insurance offers a wide range of discounts, including safe driving bonuses and multi-policy discounts. They also have a strong reputation for customer service, with 24/7 access to support through various channels.

- TD Insurance: A popular choice for its user-friendly online platform and mobile app, TD Insurance offers personalized quotes and flexible payment options. They provide various coverage options, including accident forgiveness and roadside assistance. While known for its convenience, some customers have reported challenges with customer service responsiveness.

- Intact Insurance: One of the largest insurance providers in Canada, Intact Insurance offers a comprehensive range of coverage options and competitive rates. They are known for their strong financial stability and innovative insurance products. However, some customers have reported difficulties in resolving claims efficiently.

- RBC Insurance: A trusted provider with a strong reputation for customer service, RBC Insurance offers various coverage options and competitive rates. They are known for their personalized service and commitment to customer satisfaction. However, some customers have reported limited flexibility in policy customization.

- Economical Insurance: Economical Insurance is a popular choice for its competitive rates and various discounts, including safe driving bonuses and group discounts. They offer a wide range of coverage options and are known for their efficient claims processing. However, some customers have reported limited options for online service access.

Comparing Top 5 Car Insurance Providers in Ontario

To simplify the comparison process, the following table highlights the strengths and weaknesses of the top 5 car insurance providers in Ontario.

| Provider | Strengths | Weaknesses |

|---|---|---|

| Desjardins Insurance | Competitive rates, comprehensive coverage, strong customer service | Limited online service options |

| TD Insurance | User-friendly online platform, flexible payment options, various coverage options | Challenges with customer service responsiveness |

| Intact Insurance | Comprehensive coverage options, competitive rates, strong financial stability | Difficulties in resolving claims efficiently |

| RBC Insurance | Personalized service, commitment to customer satisfaction, various coverage options | Limited flexibility in policy customization |

| Economical Insurance | Competitive rates, various discounts, efficient claims processing | Limited options for online service access |

Tips for Choosing the Right Insurance Provider

Choosing the right car insurance provider involves considering your individual needs and preferences. Here are some helpful tips:

- Compare Quotes: Obtain quotes from multiple providers to compare rates and coverage options.

- Assess Coverage Needs: Determine the level of coverage required based on your vehicle, driving history, and financial situation.

- Consider Discounts: Explore available discounts, such as safe driving bonuses, multi-policy discounts, and group discounts.

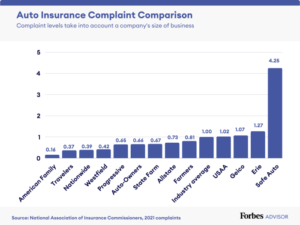

- Read Reviews: Research customer reviews and ratings to gain insights into providers’ customer service and claims handling processes.

- Check Financial Stability: Ensure the provider has a strong financial rating to guarantee claims payment.

Saving Money on Car Insurance

Car insurance is a necessity in Ontario, but it can also be a significant expense. Fortunately, there are several strategies you can employ to save money on your premiums. By understanding these options and taking proactive steps, you can ensure you’re getting the best possible deal on your car insurance.

Discounts for Bundling Policies

Bundling your car insurance with other types of insurance, such as home, condo, or renters insurance, can lead to significant savings. Insurance companies often offer discounts for combining policies, as it simplifies their administration and reduces the risk of multiple claims from the same customer.

Maintaining a Good Driving Record

A clean driving record is crucial for obtaining lower car insurance rates. Driving safely and avoiding traffic violations, accidents, and speeding tickets can significantly reduce your premiums. Insurance companies view drivers with a history of safe driving as less risky, leading to lower rates.

Taking Defensive Driving Courses

Completing a recognized defensive driving course can demonstrate your commitment to safe driving practices. Many insurance companies offer discounts to drivers who have successfully completed these courses, recognizing their enhanced driving skills and reduced risk of accidents.

Pay-As-You-Drive and Usage-Based Insurance

Pay-as-you-drive (PAYD) and usage-based insurance (UBI) programs are becoming increasingly popular. These programs utilize telematics devices or smartphone apps to track your driving habits, such as mileage, time of day, and acceleration. Drivers with safer driving habits and lower mileage typically pay lower premiums.

Negotiating Car Insurance Rates

Don’t be afraid to negotiate your car insurance rates. When you receive a quote, consider asking for a better rate. Highlight your good driving record, any discounts you qualify for, and the potential benefits of bundling policies. Insurance companies are often willing to negotiate, especially if you’re a loyal customer or willing to switch providers.

Final Summary

Securing the best car insurance in Ontario Canada requires a strategic approach, taking into account individual needs, driving history, and budget. By understanding the factors influencing rates, exploring various coverage options, and comparing reputable providers, you can find a policy that offers comprehensive protection while minimizing your out-of-pocket expenses. Remember to regularly review your insurance needs and explore available discounts to ensure you’re always getting the best possible value for your money.

FAQ Overview

What are the mandatory coverages required in Ontario?

Ontario requires all drivers to have liability coverage, accident benefits, and direct compensation property damage (DCPD) coverage. These coverages protect you and others in case of accidents.

What are the different types of car insurance available in Ontario?

Ontario offers various car insurance types, including third-party liability, all-perils, and comprehensive coverage. Each type provides different levels of protection and comes with varying premiums.

How can I get a discount on my car insurance?

Several discounts are available, including bundling policies, maintaining a good driving record, taking defensive driving courses, and installing safety features in your vehicle.

What should I do if I need to file a car insurance claim?

Contact your insurance provider immediately, report the accident, and gather evidence such as photos and witness statements. Follow their instructions for filing a claim.