Navigating the world of insurance can feel like traversing a dense jungle, filled with complex policies and confusing jargon. Fortunately, a clearing exists in the form of online insurance comparison sites. These powerful tools streamline the process of finding the best coverage at the most competitive prices, saving you time, money, and a considerable amount of stress. This guide explores the landscape of these sites, helping you make informed decisions about your insurance needs.

From auto and home insurance to health and life coverage, these platforms aggregate quotes from multiple insurers, allowing you to compare options side-by-side. Understanding how these sites function, their key features, and potential limitations is crucial to leveraging their benefits effectively. We’ll delve into the factors to consider when choosing a site, highlight best practices for using them, and address common pitfalls to avoid.

Introduction to Insurance Comparison Sites

Finding the right insurance can feel overwhelming, a maze of policies, premiums, and fine print. Insurance comparison websites simplify this process, offering a centralized platform to compare quotes from multiple insurers. This saves consumers valuable time and effort, allowing them to make informed decisions based on their specific needs and budget.

The primary benefit of using these sites lies in their ability to streamline the research process. Instead of contacting numerous insurance companies individually, users can input their requirements into a single website and receive a range of quotes within minutes. This competitive landscape empowers consumers to negotiate better rates and select the policy that best suits their circumstances.

Types of Insurance Compared

Insurance comparison websites typically cover a broad spectrum of insurance types. This often includes auto insurance, protecting vehicles from accidents and damages; home insurance, safeguarding properties from various risks like fire, theft, and natural disasters; health insurance, providing coverage for medical expenses; and life insurance, offering financial security to beneficiaries upon the policyholder’s death. Many sites also include comparisons for renters insurance, travel insurance, pet insurance, and even specialized insurance products like umbrella liability coverage.

A Brief History of Online Insurance Comparison Tools

The evolution of online insurance comparison tools reflects the broader shift towards digitalization in the financial services sector. Early iterations were basic websites displaying limited information from a small number of insurers. However, with advancements in technology and increased internet penetration, these platforms have become increasingly sophisticated. The integration of advanced algorithms and data analytics allows for more accurate and personalized quote comparisons. Furthermore, the incorporation of user reviews and ratings provides additional transparency and assists consumers in making informed choices. The rise of mobile-friendly interfaces has further enhanced accessibility, making insurance comparisons convenient from anywhere, at any time. The competitive landscape has also driven innovation, leading to features such as personalized recommendations and policy management tools.

Key Features of Top Comparison Sites

Choosing the right insurance can be a daunting task, but insurance comparison websites aim to simplify the process. Their effectiveness hinges on several key features that help consumers navigate the complex world of insurance policies and find the best fit for their needs and budget. A robust comparison site should provide a seamless and informative experience, empowering users to make informed decisions.

Several factors contribute to a superior user experience. These features go beyond simply listing policies; they involve presenting information clearly, offering robust search and filtering options, and ensuring data accuracy and security. A user-friendly interface is crucial, allowing even those unfamiliar with insurance jargon to easily understand and compare options. Comprehensive coverage, encompassing various insurance types and providers, is also essential. Finally, reliable customer reviews and robust customer support mechanisms build trust and confidence in the platform’s offerings.

Comparison of User Interfaces

The user interface (UI) significantly impacts the user experience. Three popular comparison sites—let’s call them Site A, Site B, and Site C (to avoid endorsing specific brands)—offer varying approaches. Site A boasts a clean, minimalist design with intuitive navigation. Site B utilizes a more visually rich interface with interactive elements, potentially overwhelming some users. Site C adopts a more traditional, tabular format, which may be preferred by those who value straightforward presentation. The optimal UI is subjective and depends on individual preferences, but each site prioritizes different aspects of user experience.

| Site Name | Ease of Use | Data Accuracy | Customer Support |

|---|---|---|---|

| Site A | High – Simple, intuitive navigation | High – Regularly updated data, clear policy details | Medium – Email and FAQ section, limited phone support |

| Site B | Medium – Visually engaging but potentially overwhelming | High – Comprehensive data, but requires careful review | High – Multiple contact options including phone, chat, and email |

| Site C | Medium – Straightforward, tabular format, may lack visual appeal | High – Clear and concise data presentation | Low – Primarily email support, limited FAQs |

Importance of Security and Data Privacy

Security and data privacy are paramount when using insurance comparison websites. These platforms handle sensitive personal and financial information, making robust security measures critical. Users should look for sites that employ encryption protocols (like HTTPS) to protect data transmitted between the user’s device and the website’s servers. Furthermore, a transparent privacy policy outlining how personal data is collected, used, and protected is essential. Reputable sites will adhere to industry best practices and relevant data protection regulations, providing users with peace of mind.

Factors Influencing Site Selection

Choosing the right insurance comparison site is crucial for finding the best policy at the best price. Several factors influence this decision, primarily revolving around individual needs and preferences. Understanding these factors ensures a smoother and more effective insurance search.

The selection of an insurance comparison website is highly personalized. Your specific requirements, budget constraints, and geographical location all play a significant role in determining which platform will best serve your needs. Failing to consider these factors can lead to a less efficient search, potentially resulting in overlooked policies or higher premiums.

Individual Needs and Preferences Impacting Site Selection

Individual needs and preferences significantly shape the selection of an insurance comparison site. Budget limitations, desired coverage levels, and location are key considerations. For instance, a budget-conscious individual might prioritize sites known for showcasing affordable options, while someone requiring comprehensive coverage might favor sites that list a wider range of policies. Similarly, location is crucial because insurance rates and available providers vary geographically.

Examples of Insurance Needs and Corresponding Site Selection

A young driver seeking car insurance might prefer a site specializing in young driver policies, emphasizing competitive pricing and potentially offering additional features like driver training discounts. Conversely, a homeowner looking for comprehensive home insurance might choose a site known for its detailed policy comparisons and focus on features like flood or earthquake coverage. A small business owner seeking business liability insurance would likely utilize a site catering to commercial insurance, providing specialized options and detailed policy information relevant to their industry.

Decision-Making Flowchart for Choosing an Insurance Comparison Site

Imagine a flowchart starting with a central box labeled “Insurance Needs Assessment”. Branching from this are three paths: “Budget,” “Coverage Requirements,” and “Location.” Each path leads to a series of decision boxes. For “Budget,” the options might be “Limited Budget,” “Moderate Budget,” and “High Budget,” each leading to a recommendation of specific comparison sites known for their affordability or premium options. “Coverage Requirements” could branch into “Basic Coverage,” “Comprehensive Coverage,” and “Specialized Coverage,” again directing users towards sites that offer those specific types of policies. Finally, “Location” would lead to options based on state or region, guiding users to sites that feature insurers operating in their area. The flowchart would conclude with a box suggesting the most appropriate comparison site(s) based on the user’s choices. The entire flowchart visually guides users through a logical decision-making process, resulting in a more informed site selection.

Potential Drawbacks and Limitations

While insurance comparison websites offer a valuable service, relying solely on them for insurance selection can have drawbacks. It’s crucial to understand these limitations and supplement website results with independent research to ensure you’re making an informed decision that best suits your individual needs. Failing to do so could lead to choosing a policy that appears cheaper initially but ultimately proves inadequate or expensive in the long run.

Comparison sites primarily focus on price, often presenting a limited view of the broader policy details. This can lead to overlooking crucial aspects like coverage limits, exclusions, and customer service quality. Therefore, independent verification is essential to ensure the policy aligns with your specific requirements and risk profile. Don’t just choose the cheapest option without carefully examining the fine print.

Hidden Fees and Policy Limitations

Understanding the potential for hidden costs and policy limitations is critical when using comparison websites. These often-overlooked aspects can significantly impact the overall cost and effectiveness of your insurance.

- Administrative Fees: Some insurers may charge administrative fees that aren’t always clearly displayed on comparison websites. These fees can add up over time, negating the initial cost savings.

- Policy Exclusions: Comparison sites may not highlight all policy exclusions. Certain events or circumstances may not be covered, even if the policy appears comprehensive at first glance. Carefully reviewing the policy document is essential to understand what is and isn’t covered.

- Excesses and Deductibles: While comparison sites often display the premium, they may not emphasize the excess or deductible amounts. These are the amounts you’ll have to pay out-of-pocket before the insurer covers the remaining costs. A high excess or deductible can significantly reduce the value of the policy.

- Renewal Premiums: The initial premium displayed on a comparison site may be significantly lower than subsequent renewal premiums. Insurers often adjust premiums based on various factors, and this change might not be immediately apparent.

- Add-ons and Optional Coverages: Comparison sites often showcase basic policies. Adding essential optional coverages, such as roadside assistance or legal protection, can dramatically increase the overall cost. These additional costs aren’t always transparent.

Best Practices for Using Comparison Sites

Effectively utilizing insurance comparison websites requires a strategic approach. By following best practices, consumers can navigate the complexities of insurance options and secure the most suitable and cost-effective coverage. This involves understanding how these sites operate, interpreting the information presented, and making informed comparisons.

Comparison sites streamline the process of obtaining multiple insurance quotes, saving time and effort. However, their effectiveness depends on the user’s ability to leverage their features and interpret the data accurately. A methodical approach, coupled with critical thinking, is crucial for making well-informed decisions.

Step-by-Step Guide to Using Comparison Websites

Finding the best insurance coverage involves a structured approach. The following steps provide a framework for effectively using comparison websites:

- Input Accurate Information: Provide complete and accurate details about yourself and your needs. Inaccuracies can lead to inaccurate quotes or even policy rejection later.

- Specify Coverage Needs: Clearly define the type and level of coverage required. For example, if you’re comparing car insurance, specify the make, model, and year of your vehicle. For health insurance, indicate your age, location, and pre-existing conditions (if any).

- Review Multiple Quotes: Don’t settle for the first quote you see. Compare quotes from several insurers to identify the best options available. Pay close attention to the details of each policy, not just the premium amount.

- Understand Policy Details: Carefully examine the policy documents of the top contenders. Look beyond the premium price and consider factors like deductibles, co-pays, and coverage limits. A lower premium may come with higher out-of-pocket expenses.

- Check Insurer Ratings and Reviews: Research the financial stability and customer satisfaction ratings of the insurers offering quotes. Independent rating agencies like A.M. Best provide valuable insights into insurers’ financial strength. Online reviews can also offer valuable perspectives on customer experiences.

- Contact Insurers Directly: If you have questions or need clarification on any policy details, contact the insurers directly. This allows you to discuss specific needs and negotiate terms.

Interpreting Information and Avoiding Misleading Claims

Insurance comparison websites often present information in a simplified format. It’s essential to understand how this information is presented and to avoid potential biases or misleading claims.

For instance, some sites might highlight the lowest premium without providing sufficient context about coverage limits or deductibles. Always read the fine print and compare policies based on the overall value, not just the initial price.

Be wary of overly simplified comparisons. Some sites might use proprietary rating systems that are not transparent or easily comparable across different insurers. Focus on understanding the key features and coverage details of each policy rather than relying solely on a site’s ranking system.

Comparing Quotes and Identifying Best Value

Comparing insurance quotes requires a systematic approach. Don’t just focus on the premium; consider the overall value proposition.

Create a table to compare key features: This could include premium amount, deductible, coverage limits, policy exclusions, and customer service ratings. This structured approach facilitates a clear comparison of different policies.

| Insurer | Premium | Deductible | Coverage Limits | Customer Rating |

|---|---|---|---|---|

| Insurer A | $500 | $500 | $100,000 | 4.5 stars |

| Insurer B | $450 | $1000 | $75,000 | 4 stars |

| Insurer C | $550 | $250 | $125,000 | 4.2 stars |

For example, Insurer B offers the lowest premium but has a higher deductible and lower coverage limits than Insurer A or C. The best value depends on your risk tolerance and financial situation. A higher deductible might be acceptable if you are comfortable with a larger out-of-pocket expense in case of a claim.

Illustrative Examples of Comparison Site Usage

Using insurance comparison websites simplifies the process of finding the best coverage at the most competitive price. This section provides examples of how these sites can be used effectively, highlighting the user experience and potential benefits.

Let’s consider a hypothetical scenario involving Sarah, a young professional who needs car insurance for her newly purchased vehicle. Sarah is unsure which insurer offers the best combination of price and coverage for her needs. Instead of contacting multiple insurers individually, she decides to utilize an online comparison website.

Finding Car Insurance Using a Comparison Site

Sarah begins by entering her details into the comparison site, including her vehicle information (make, model, year), driving history (including any accidents or violations), location, and desired coverage levels (liability, collision, comprehensive). The site’s algorithm then searches its database of insurers and presents her with a range of options, each with a detailed breakdown of premiums and coverage features. She can easily filter results by price, coverage type, or insurer, allowing her to compare apples-to-apples.

Sarah carefully reviews the options, noting differences in deductibles, coverage limits, and additional features such as roadside assistance or rental car reimbursement. She also checks the insurer’s ratings and customer reviews to gauge their reputation for claims handling and customer service. This comprehensive comparison enables her to make an informed decision based on her specific needs and budget.

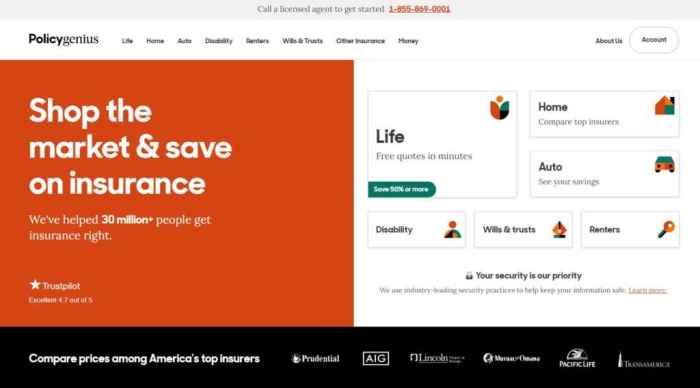

Visual Elements and User Experience on Comparison Websites

Most reputable comparison sites prioritize a clean, intuitive user interface. Information is typically presented in a clear, concise manner, using tables and charts to facilitate easy comparison. Key features like premiums, deductibles, and coverage details are prominently displayed, often using color-coding or highlighting to emphasize differences between options. Navigation is straightforward, with clear search filters and sorting options. The overall design aims for accessibility, with clear font sizes and sufficient contrast to cater to users with varying visual needs.

Imagine a website with a clean, white background. A large, easily understandable search bar sits at the top. Below, the results are presented in a grid format, each insurer represented by a tile containing the company logo, a brief description of the policy, and the monthly premium. Clicking on a tile expands to reveal a detailed breakdown of coverage options, including deductibles and limits. This visual approach simplifies the comparison process and makes it easy for users to understand the key differences between policies.

Case Study: Significant Savings Through Comparison Site Usage

Consider John, a homeowner who had been with the same insurer for over ten years. He assumed he had a good deal on his home insurance. However, curious about potential savings, he decided to use a comparison website. After inputting his home details and coverage requirements, the site revealed several policies with significantly lower premiums than his current plan, offering comparable or even better coverage. By switching through the comparison site, John was able to reduce his annual home insurance premium by $500, representing a substantial saving.

Conclusive Thoughts

Ultimately, utilizing insurance comparison websites empowers consumers to take control of their insurance decisions. By understanding the features, limitations, and best practices associated with these platforms, you can confidently navigate the insurance market and secure the coverage that best suits your individual needs and budget. Remember to always verify information independently and consider your unique circumstances when making your final selection. Armed with the right knowledge, finding the right insurance policy becomes a manageable and even rewarding experience.

Essential FAQs

What information do I need to provide to comparison sites?

Typically, you’ll need basic personal information (age, location), details about your desired coverage (car model, home value, health history), and driving history (for auto insurance).

Are the quotes on comparison sites guaranteed?

No, quotes are estimates and may vary slightly from the final offer from the insurer. Always review the insurer’s policy details before committing.

Can I trust the reviews on comparison sites?

While reviews can be helpful, it’s wise to cross-reference them with other sources like independent review sites to get a balanced perspective.

What if I don’t find a suitable policy on a comparison site?

Comparison sites don’t list every insurer, so you might need to contact insurers directly if you don’t find what you need.