The independent consulting world offers incredible freedom and flexibility, but it also presents unique risks. Navigating the complexities of liability and protecting your hard-earned business requires a clear understanding of business insurance. This guide explores the various types of insurance crucial for consultants, helping you choose the right coverage to safeguard your future and peace of mind.

From professional liability to general liability and commercial auto insurance, we’ll delve into the specifics of each policy, examining coverage, costs, and how different factors influence premiums. We’ll also equip you with strategies for finding reputable providers, understanding policy documents, and implementing proactive risk management techniques to minimize potential liabilities. Ultimately, our goal is to empower you to make informed decisions that protect your business and ensure its long-term success.

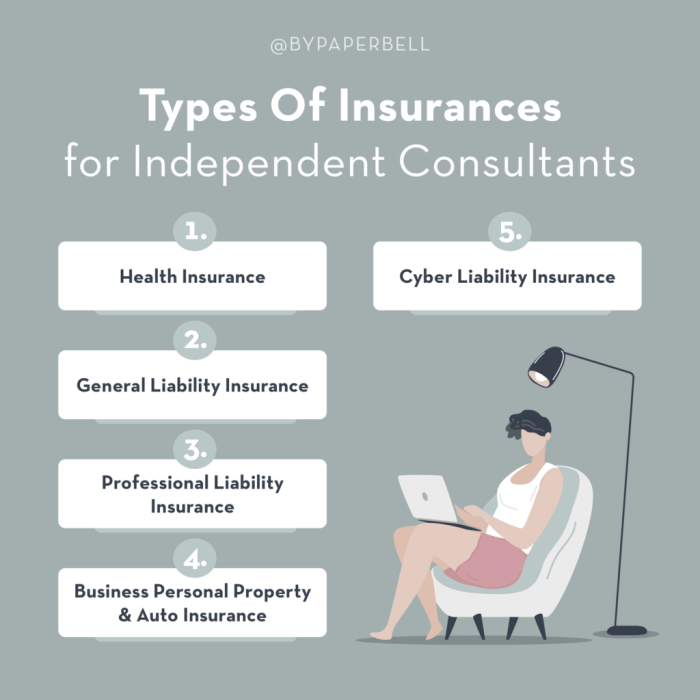

Types of Business Insurance for Consultants

Choosing the right business insurance is crucial for consultants to protect their professional reputation and financial stability. A comprehensive insurance strategy mitigates risks associated with potential errors, omissions, accidents, and property damage, ensuring peace of mind while operating your consulting business. This section Artikels key insurance types relevant to consultants and their specific coverage.

Professional Liability Insurance (Errors and Omissions Insurance)

Professional liability insurance, often called errors and omissions (E&O) insurance, protects consultants against claims of negligence, mistakes, or omissions in their professional services. This coverage is vital, as a single error could lead to significant financial losses or legal battles. For example, if a consultant provides faulty financial advice that results in a client’s financial loss, E&O insurance would cover the costs of legal defense and potential settlements. The policy typically covers claims arising from professional services rendered, but exclusions may apply for intentional acts or criminal behavior. The cost varies depending on the consultant’s specialty, experience, and revenue.

General Liability Insurance

General liability insurance protects consultants from financial losses resulting from bodily injury or property damage caused to third parties on their premises or during their work. This coverage is essential even for consultants who primarily work remotely. For instance, if a client is injured during a consultation at the consultant’s office, general liability insurance would cover medical expenses and legal fees. Similarly, if a consultant accidentally damages a client’s property, the insurance would help cover the repair or replacement costs. This type of insurance does not typically cover professional errors or omissions, which fall under professional liability insurance. Premiums are influenced by factors such as the consultant’s location, business activities, and the number of employees (if any).

Commercial Auto Insurance

If a consultant uses their personal vehicle for business purposes – such as traveling to client meetings or transporting equipment – they need commercial auto insurance. This policy provides coverage for accidents or damages that occur while using the vehicle for business-related activities. Standard personal auto insurance policies typically exclude business use, leaving the consultant personally liable for any accidents or damages. Commercial auto insurance protects the consultant’s assets and provides liability coverage for injuries or damages caused to others. The cost depends on factors like the vehicle’s type, the consultant’s driving record, and the extent of business use.

Comparison of Business Insurance Policies for Consultants

The following table summarizes the key features of these insurance types:

| Policy Type | Coverage | Benefits | Typical Annual Cost (USD) |

|---|---|---|---|

| Professional Liability (E&O) | Negligence, errors, omissions in professional services | Protects against lawsuits, settlements, legal fees related to professional mistakes. | $500 – $5,000+ |

| General Liability | Bodily injury or property damage to third parties | Protects against lawsuits, settlements, medical expenses, property damage costs. | $300 – $1,500+ |

| Commercial Auto | Accidents and damages while using a vehicle for business purposes | Protects against liability for accidents, vehicle damage, and injuries to others. | $500 – $2,000+ |

Note: The cost ranges provided are estimates and can vary significantly based on individual circumstances and the specific policy details. It is crucial to obtain quotes from multiple insurers to find the most suitable and cost-effective coverage.

Factors Influencing Insurance Costs for Consultants

Securing the right business insurance is crucial for consultants, but understanding the factors that influence premiums is equally important. This allows for informed decision-making and potentially significant cost savings. Several key elements determine the cost of your insurance policy.

Several factors contribute to the final premium a consultant will pay for business insurance. These factors are interconnected and insurance companies use sophisticated algorithms to assess risk and calculate premiums accordingly.

Industry and Specialization

The industry in which a consultant operates significantly impacts insurance costs. High-risk industries, such as those involving significant liability exposure (e.g., engineering, construction consulting) will typically command higher premiums than lower-risk sectors (e.g., marketing or writing). Similarly, specialization within an industry can influence costs. A consultant specializing in complex financial modeling will likely face higher premiums than one offering basic bookkeeping services due to the potential for greater financial liability. For example, a consultant specializing in environmental remediation will likely pay more than one offering general business advice due to the potential for higher environmental liability claims.

Experience and Professional Qualifications

Insurance providers view experience and professional qualifications as indicators of risk. Consultants with extensive experience and relevant certifications (e.g., CPA, PMP) often qualify for lower premiums. This reflects a lower perceived risk of errors or negligence. A newly established consultancy with limited experience will typically pay higher premiums to compensate for the increased uncertainty surrounding their risk profile. A seasoned consultant with a proven track record and professional designations might negotiate a lower premium because their risk profile is considered lower.

Location

Geographic location plays a role in determining insurance premiums. Areas with higher operating costs, higher litigation rates, or a higher frequency of natural disasters will generally lead to higher insurance costs. A consultant based in a major metropolitan area with high legal costs may face higher premiums than one operating in a smaller, rural town. For example, a consultant located in a region prone to hurricanes will likely pay more for property insurance than one in a less disaster-prone area.

Claims History

A consultant’s claims history is a major factor in determining future premiums. A history of claims, especially large or frequent ones, will significantly increase future premiums. Insurance companies view a clean claims history as a strong indicator of responsible business practices and lower risk. Conversely, a history of claims indicates higher risk and justifies higher premiums. For instance, a consultant with a past claim for professional negligence will see their premium increase substantially compared to a consultant with a clean record.

Ways to Reduce Insurance Premiums

Consultants can take proactive steps to reduce their insurance premiums. This might involve improving risk management practices, implementing robust safety protocols, and maintaining thorough documentation. Bundling insurance policies (e.g., general liability and professional liability) with the same provider can also lead to discounts. Shopping around and comparing quotes from different insurers is crucial to securing the most competitive rates. Negotiating with insurers based on your experience and risk profile can also be beneficial. Regularly reviewing your insurance needs and coverage ensures you only pay for what you need, preventing unnecessary costs.

Finding and Choosing the Right Insurance Provider

Selecting the right business insurance provider is crucial for consultants. A thorough search and careful comparison are essential to ensure you secure adequate coverage at a competitive price. The process involves more than simply finding the cheapest option; it requires understanding the nuances of different providers and their offerings to find the best fit for your specific needs and risk profile.

Finding reputable insurance providers specializing in consultant insurance requires a multi-pronged approach. Online directories dedicated to insurance providers can be a valuable starting point. These directories often allow you to filter by specialty, location, and customer ratings, helping you narrow down your options to those with experience insuring consultants. Networking within your professional circles can also yield valuable recommendations. Consultants often share experiences and insights about their insurance providers, providing firsthand accounts of service quality and claim handling. Finally, seeking recommendations from trusted business advisors, such as accountants or financial planners, can provide additional insights and perspectives.

Comparing Insurance Provider Services and Offerings

Different insurance companies offer varying levels of service and a range of policy options. A key aspect of comparison involves examining the breadth of coverage offered. Some providers might specialize in specific types of consultant liability, such as professional liability or errors and omissions insurance, while others offer more comprehensive packages. Beyond coverage, the claims process is another crucial factor. Investigate the provider’s reputation for timely and efficient claims handling. Look for reviews and testimonials that detail their experience with the claims process. Customer service responsiveness and accessibility are also vital; consider whether the provider offers multiple communication channels (phone, email, online portal) and the speed and quality of their responses. Finally, consider the provider’s financial stability and ratings. Independent rating agencies provide assessments of insurance companies’ financial strength, indicating their ability to pay out claims.

Obtaining Quotes and Selecting a Policy

The process of obtaining quotes typically involves completing an application form that details your business operations, including the types of consulting services you provide, your client base, and your revenue. Be accurate and thorough in completing this application, as inaccuracies can lead to coverage issues or higher premiums. Once submitted, you’ll receive quotes from different providers. These quotes should clearly Artikel the coverage offered, the premium amount, and any exclusions or limitations. Compare these quotes side-by-side, paying close attention to the details of coverage, not just the price. A slightly more expensive policy with broader coverage might be more cost-effective in the long run than a cheaper policy with significant limitations. Once you’ve chosen a policy, review the policy documents carefully before signing. Ensure you understand all terms and conditions, especially exclusions and limitations.

Checklist for Evaluating Insurance Providers and Policies

Before committing to a policy, it’s beneficial to use a checklist to ensure you’ve considered all essential factors. This structured approach helps avoid overlooking critical aspects.

- Provider Reputation: Check online reviews and ratings from independent sources.

- Financial Stability: Review the provider’s financial strength rating from a reputable rating agency.

- Coverage Breadth: Ensure the policy covers all relevant risks, including professional liability, general liability, and potentially cyber liability.

- Claims Process: Inquire about the provider’s claims handling procedures and review customer testimonials regarding their experience.

- Customer Service: Assess the provider’s responsiveness and accessibility through various communication channels.

- Policy Exclusions: Carefully review the policy document to understand any exclusions or limitations.

- Premium Cost: Compare premiums from multiple providers, keeping in mind that the cheapest option isn’t always the best.

- Policy Renewals: Understand the terms and conditions for policy renewal, including potential premium increases.

Risk Management Strategies for Consultants

Proactive risk management is crucial for consultants to protect their business and reputation. By implementing robust strategies, consultants can significantly reduce their exposure to potential liabilities and maintain a successful practice. This involves a multi-faceted approach encompassing contract negotiation, client communication, record-keeping, and preventative measures.

Contract Negotiation and Client Communication

Clear and comprehensive contracts are the cornerstone of risk mitigation. These documents should explicitly define the scope of work, deliverables, payment terms, intellectual property rights, and liability limitations. Ambiguity in contracts can lead to disputes and costly legal battles. Similarly, open and consistent communication with clients is vital. Regular updates, prompt responses to inquiries, and proactive problem-solving can prevent misunderstandings and build trust, reducing the likelihood of disputes. For example, a consultant might include a clause specifying the client’s responsibility for providing necessary data on time, preventing delays and associated costs for the consultant.

Record Keeping and Documentation

Meticulous record-keeping is essential for demonstrating compliance, justifying charges, and defending against potential claims. This includes maintaining detailed records of all client interactions, project milestones, expenses, contracts, and communications. A well-organized system ensures easy access to crucial information should a dispute arise. Consider using a cloud-based system for secure storage and easy access from multiple devices. For example, a consultant might maintain a project folder with all relevant documents, including signed contracts, emails, meeting minutes, and invoices.

Preventative Measures for Consultants

Implementing preventative measures can significantly reduce the likelihood of incidents leading to liabilities. These steps are crucial for proactive risk management and should be considered a cornerstone of any consultant’s operations.

- Maintain professional liability insurance to cover potential claims arising from errors or omissions.

- Regularly review and update contracts to reflect current industry best practices and evolving client needs.

- Implement robust cybersecurity measures to protect client data and prevent breaches.

- Establish clear protocols for handling confidential information and maintaining client privacy.

- Invest in professional development to stay updated on industry trends and best practices.

- Seek legal counsel when necessary to ensure contracts and operational procedures comply with relevant laws and regulations.

- Develop a crisis management plan to address potential problems quickly and effectively.

Insurance Needs Based on Consulting Specialization

The insurance needs of consultants vary significantly depending on their area of expertise and the nature of their work. Factors such as liability exposure, the type of clients served, and the location of operations all play a crucial role in determining the appropriate level and type of coverage. Understanding these nuances is vital for consultants to secure adequate protection and mitigate potential financial risks.

Different consulting specializations present unique risks. For example, an IT consultant might face liability for data breaches or system failures, while a financial consultant could be exposed to claims related to investment advice. Management consultants, on the other hand, may face reputational damage or legal action stemming from flawed recommendations. This necessitates a tailored approach to insurance planning, ensuring that coverage aligns precisely with the specific risks inherent in each specialization.

Insurance Requirements Across Consulting Niches

The following table summarizes the typical insurance needs for consultants in various industries. It is important to note that this is not exhaustive and individual needs may vary based on specific circumstances. Consultants should always seek professional advice to determine their exact insurance requirements.

| Consulting Specialization | Common Insurance Needs | Unique Risks | Example Scenarios |

|---|---|---|---|

| IT Consulting | Professional Liability (Errors & Omissions), Cyber Liability, Data Breach Insurance | Data breaches, system failures, software malfunctions, intellectual property infringement | A consultant’s faulty code causes a client’s system to crash, resulting in data loss and business interruption. A client’s sensitive data is compromised due to a security vulnerability overlooked by the consultant. |

| Financial Consulting | Professional Liability (Errors & Omissions), Directors & Officers Liability, Fidelity Bond | Mismanagement of client funds, inaccurate financial advice, regulatory violations | A consultant provides flawed investment advice that results in significant financial losses for a client. A consultant embezzles funds from a client’s account. |

| Management Consulting | Professional Liability (Errors & Omissions), General Liability | Reputational damage, flawed recommendations, breach of contract | A consultant’s recommendations lead to a client’s business failure. A consultant fails to deliver on a promised service, resulting in a breach of contract. |

| Healthcare Consulting | Professional Liability (Medical Malpractice if applicable), General Liability, Cyber Liability (for HIPAA compliance) | Medical errors (if providing clinical advice), HIPAA violations, data breaches | A consultant provides incorrect medical advice leading to patient harm. A consultant fails to comply with HIPAA regulations, resulting in a data breach. |

Summary

Protecting your consulting business is not merely a matter of compliance; it’s a strategic investment in your future. By carefully considering the types of insurance discussed here—professional liability, general liability, and commercial auto—and implementing proactive risk management strategies, you can significantly reduce your exposure to potential liabilities. Remember, choosing the right insurance provider and understanding your policy documents are equally crucial steps in securing your business’s stability and growth. Take control of your risk profile today and focus on what you do best: delivering exceptional consulting services.

Key Questions Answered

What is professional liability insurance (errors and omissions insurance) and why do I need it?

Professional liability insurance protects you against claims of negligence or errors in your professional services. It covers legal fees and potential settlements if a client sues you for faulty advice or missed deadlines, for example. It’s essential for mitigating financial risk associated with your professional expertise.

How much does business insurance for consultants typically cost?

The cost varies significantly based on factors like your specialty, location, experience, and the level of coverage you choose. Obtaining quotes from multiple insurers is crucial to compare pricing and coverage options. Expect to invest a portion of your revenue in securing adequate protection.

What if I work from home? Do I still need general liability insurance?

Yes. Even if you operate from home, general liability insurance is important to protect against accidents or injuries that may occur on your property during client meetings or while conducting business activities. It also covers property damage claims.

Can I bundle different types of insurance policies together?

Many insurers offer bundled packages that combine different types of insurance, potentially offering discounts. Inquire about this option when obtaining quotes to see if it’s cost-effective for your specific needs.