Imagine this: a single incident, a misplaced step, a customer’s fall – events that can swiftly transform a thriving business into a financial battlefield. The unexpected can strike at any moment, and without the proper safeguards, the consequences can be devastating. This is where business liabilities insurance steps in, acting as a crucial shield against the unforeseen financial burdens that can arise from various liabilities.

This guide delves into the multifaceted world of business liabilities insurance, offering a clear and concise understanding of its importance, coverage options, and the crucial role it plays in protecting your business’s financial well-being. We’ll explore various policy types, factors influencing premiums, the claims process, and provide practical advice to help you choose the right policy to match your specific business needs. By the end, you’ll be equipped with the knowledge to make informed decisions and secure your business’s future.

Defining Business Liabilities Insurance

Business liabilities insurance is a crucial aspect of risk management for any business, regardless of size or industry. It provides financial protection against claims of bodily injury, property damage, or other losses caused by your business’s operations. Essentially, it acts as a safety net, shielding your company from potentially devastating financial consequences arising from legal liabilities.

Types of Business Liabilities Insurance Coverage

Several types of business liability insurance policies exist, each designed to address specific risks. Understanding these different types allows businesses to tailor their coverage to their unique needs and potential exposures. Choosing the right coverage is paramount for mitigating financial risks and ensuring business continuity.

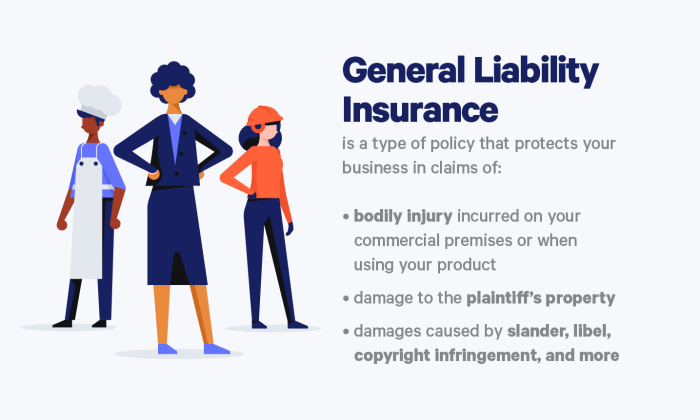

General Liability Insurance

General liability insurance is the most common type of business liability insurance. It covers bodily injury or property damage caused by your business operations or your employees. This includes things like a customer slipping and falling on your premises, or damage to a client’s property caused by your employee. For example, a coffee shop could be covered if a customer spills hot coffee on themselves and sues for damages. The policy would cover the legal fees and any settlements or judgments.

Professional Liability Insurance (Errors and Omissions Insurance)

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals from claims of negligence or mistakes in their professional services. This is particularly important for businesses offering services like consulting, accounting, or legal advice. A software developer, for example, might be covered if a client claims their software contained errors that caused financial losses. The policy would cover the cost of defending the claim and any resulting settlements.

Product Liability Insurance

Product liability insurance covers claims arising from injuries or damages caused by your products. This is vital for businesses that manufacture, distribute, or sell products. A toy manufacturer, for instance, might be covered if a child is injured by a faulty toy. The policy would cover the costs associated with defending the claim and compensating the injured party.

Commercial Auto Insurance

Commercial auto insurance covers accidents involving company vehicles. This is essential for businesses that use vehicles for deliveries, sales calls, or other business purposes. A delivery company, for instance, would be covered if one of their drivers causes an accident that results in injuries or property damage. The policy would cover the costs of repairs, medical bills, and legal fees.

Workers’ Compensation Insurance

Workers’ compensation insurance covers medical expenses and lost wages for employees injured on the job. This is a legally mandated insurance in many jurisdictions. A construction company, for instance, would be covered if a worker is injured on a construction site. The policy would cover medical expenses, lost wages, and rehabilitation costs.

Comparison of Liability Insurance Policies

| Type of Insurance | Coverage | Typical Insured Businesses | Examples of Covered Claims |

|---|---|---|---|

| General Liability | Bodily injury or property damage caused by business operations | Retailers, restaurants, offices | Customer slipping and falling, damage to client’s property |

| Professional Liability (E&O) | Negligence or mistakes in professional services | Consultants, accountants, lawyers | Software errors causing financial losses, incorrect financial advice |

| Product Liability | Injuries or damages caused by products | Manufacturers, distributors, retailers | Faulty toy injuring a child, defective product causing property damage |

| Commercial Auto | Accidents involving company vehicles | Delivery services, sales teams | Driver causing an accident resulting in injuries or property damage |

Understanding Policy Coverage

A business liability insurance policy provides crucial protection against financial losses arising from various incidents. Understanding the scope of this coverage is vital for effective risk management and ensuring your business is adequately protected. This section details the common aspects covered, highlights important exclusions and limitations, and provides illustrative examples.

Covered Aspects of a Typical Policy

A typical business liability insurance policy covers a range of potential liabilities. These commonly include bodily injury or property damage caused by your business operations, advertising injury (like libel or slander), and personal injury (like wrongful eviction or invasion of privacy). The specific coverage will vary depending on the policy and chosen endorsements. For instance, some policies might include coverage for professional liability (errors and omissions), while others may offer additional protection for specific activities like product liability. The policy will specify the limits of liability, which represents the maximum amount the insurer will pay for covered claims.

Policy Exclusions and Limitations

It is equally crucial to understand what is *not* covered by your policy. These exclusions often involve intentional acts, employee dishonesty, pollution, and certain types of professional services. Furthermore, policies usually have limitations on coverage, such as deductibles (the amount you pay before the insurance kicks in) and policy limits (the maximum amount the insurer will pay out). Understanding these limitations allows businesses to plan for potential out-of-pocket expenses and to determine if supplemental coverage is necessary.

Examples of Covered and Excluded Claims

Consider a coffee shop where a customer slips on a wet floor and suffers injuries. This would likely be covered under bodily injury liability, assuming the shop was negligent in maintaining a safe environment. Conversely, if a disgruntled employee intentionally damages company property, this would typically be excluded due to the intentional nature of the act. Another example of a covered claim could be a false advertising lawsuit against a company, falling under advertising injury. An example of an excluded claim could be environmental damage caused by improper waste disposal, which is often excluded unless specifically covered by an endorsement.

Sample Policy Summary

| Feature | Description | Exclusion |

|---|---|---|

| Bodily Injury Liability | Covers injuries to third parties caused by your business operations. | Intentional acts, employee injuries covered by workers’ compensation. |

| Property Damage Liability | Covers damage to third-party property caused by your business operations. | Damage to your own property, intentional acts. |

| Advertising Injury | Covers claims arising from libel, slander, or copyright infringement in your advertising. | Claims arising from actual malice or knowingly false statements. |

| Personal Injury | Covers claims arising from wrongful eviction, invasion of privacy, or other similar offenses. | Claims arising from intentional acts or breach of contract. |

| Policy Limit | $1,000,000 per occurrence | N/A |

| Deductible | $1,000 per occurrence | N/A |

The Claims Process

Filing a claim under your business liabilities insurance policy might seem daunting, but understanding the process can significantly ease the burden. This section Artikels the steps involved, necessary documentation, and the role of the insurance adjuster. Knowing what to expect can help you navigate this crucial stage effectively and efficiently.

Steps Involved in Filing a Claim

The claims process generally follows a structured sequence. Prompt action is key to a smoother resolution. Delaying the reporting of an incident can negatively impact the claim’s outcome.

- Report the Incident: Immediately contact your insurance provider to report the incident that triggered the potential claim. Provide as much detail as possible, including date, time, location, and a brief description of what happened.

- Complete a Claim Form: Your insurer will provide a claim form. Complete it accurately and thoroughly, providing all requested information.

- Gather Supporting Documentation: Collect all relevant documentation to support your claim. This may include police reports, medical records, witness statements, and invoices for damages or losses.

- Cooperate with the Adjuster: The insurance adjuster will contact you to investigate the claim. Cooperate fully, providing any requested information or documentation promptly.

- Review the Claim Settlement: Once the investigation is complete, the insurer will provide a settlement offer. Review the offer carefully and negotiate if necessary.

Required Documentation

Providing comprehensive documentation is crucial for a successful claim. The specific documents needed will vary depending on the nature of the incident, but common examples include:

- Police Report: If the incident involved a crime or accident, a police report is essential.

- Medical Records: If injuries are involved, medical records documenting the extent of the injuries and treatment received are necessary.

- Witness Statements: Statements from anyone who witnessed the incident can provide valuable corroborating evidence.

- Invoices and Receipts: Documentation of expenses incurred as a result of the incident, such as repairs, medical bills, or lost wages, is critical.

- Photographs and Videos: Visual evidence of the damage or injuries can significantly strengthen your claim.

The Role of the Insurance Adjuster

The insurance adjuster plays a vital role in the claims process. Their responsibilities include:

- Investigating the Claim: The adjuster will investigate the circumstances surrounding the incident to determine liability and the extent of damages.

- Evaluating the Claim: The adjuster will assess the validity of the claim and determine the amount of compensation to be paid.

- Negotiating a Settlement: The adjuster will negotiate a fair and reasonable settlement with the claimant.

- Processing the Claim Payment: Once a settlement is reached, the adjuster will process the payment of the claim.

Claims Process Flowchart

A typical claims process can be visualized as follows:

[Imagine a flowchart here. The flowchart would begin with “Incident Occurs,” branching to “Report Incident to Insurer.” This would lead to “Complete Claim Form and Gather Documentation,” then to “Insurance Adjuster Investigation.” The investigation would branch into two paths: “Claim Approved” leading to “Settlement and Payment” and “Claim Denied” leading to “Appeal Process.” The Appeal Process would then potentially lead back to “Insurance Adjuster Investigation” or to a final “Claim Denied” outcome.]

Choosing the Right Policy

Selecting the appropriate business liability insurance policy is crucial for protecting your business from financial ruin. The right policy will depend on several factors, including your business type, size, and the level of risk you face. Understanding your specific needs and carefully evaluating different policy options are key steps in this process.

Determining the Appropriate Coverage Level

The amount of coverage you need will vary significantly based on your business’s operations and potential liabilities. A small, low-risk business might only require a relatively low coverage limit, while a larger business with higher potential liabilities will need substantially more. Consider factors such as the value of your assets, the potential cost of lawsuits, and the nature of your business operations (e.g., a construction company faces inherently higher risks than a consulting firm). For example, a small bakery might need $1 million in coverage, while a large manufacturing plant might require $10 million or more. It’s essential to consult with an insurance professional to determine the appropriate coverage level for your specific circumstances. They can help you assess your risk profile and recommend a suitable policy.

Comparison of Policy Options and Suitability for Various Business Types

Various liability insurance policies cater to different business needs. General liability insurance is a foundational policy covering bodily injury and property damage caused by your business operations. Professional liability insurance (errors and omissions insurance) protects against claims of negligence or mistakes in professional services. Product liability insurance covers claims arising from defects in products you manufacture or sell. Businesses involved in transportation might require commercial auto insurance, while those operating in specific industries (e.g., healthcare) may need specialized policies. A restaurant, for example, might need general liability, product liability (for food-borne illnesses), and potentially workers’ compensation insurance. A software company, on the other hand, would likely prioritize professional liability and potentially cyber liability insurance.

Evaluating Insurers and Their Offerings

Choosing the right insurer is as important as choosing the right policy. Consider the insurer’s financial stability (check ratings from agencies like A.M. Best), customer service reputation (read online reviews), and claims handling process. Compare quotes from multiple insurers to ensure you’re getting competitive pricing. Look beyond the premium cost; consider the breadth and clarity of the coverage offered, the insurer’s history of fair claims settlements, and the ease of contacting their customer service team. A lower premium might not be worth it if the insurer has a poor reputation for handling claims efficiently and fairly.

Checklist of Questions for Potential Insurance Providers

Before committing to a policy, prepare a list of questions to ask potential insurers. This will ensure you understand the terms and conditions fully. The following are examples of pertinent questions:

- What specific types of claims are covered under the policy?

- What are the policy limits and exclusions?

- What is the claims process, and how long does it typically take to resolve a claim?

- What is the insurer’s financial strength rating?

- What is the insurer’s customer service reputation?

- Are there any discounts available?

- What are the policy renewal terms?

Thoroughly reviewing the policy documents and asking clarifying questions will help you make an informed decision. Remember, choosing the right insurance is a significant decision that can safeguard your business’s future.

Illustrative Scenarios

Real-world examples can powerfully demonstrate the value and potential pitfalls of business liability insurance. Understanding these scenarios helps businesses make informed decisions about their coverage.

Scenario: Liability Insurance Preventing Significant Financial Losses

A small bakery, “Sweet Surrender,” experienced a customer slipping and falling on a wet floor near the entrance. The customer suffered a broken arm and incurred significant medical expenses. Sweet Surrender, however, had comprehensive general liability insurance. The insurance company covered the customer’s medical bills, legal fees associated with the claim, and the settlement amount, preventing the bakery from facing potentially crippling financial losses. The bakery’s proactive insurance coverage protected its assets and allowed it to continue operating without interruption. Without insurance, the bakery could have faced bankruptcy due to the high cost of legal defense and settlement.

Scenario: Inadequate Business Liability Insurance Resulting in Substantial Financial Hardship

A landscaping company, “Green Thumbs,” was involved in an accident where a falling tree branch, while being removed from a client’s property, damaged a neighboring house. Green Thumbs held liability insurance, but the policy’s coverage limit was far too low to cover the extensive damage to the house. The company was forced to pay a significant portion of the repair costs out-of-pocket, resulting in substantial financial hardship and jeopardizing the business’s stability. This case highlights the importance of accurately assessing risk and securing adequate coverage limits to avoid devastating financial consequences.

Scenario: Impact of Business Liability Insurance in a High-Risk Industry

Imagine a graph depicting the financial impact of an incident on a construction company. The X-axis represents the severity of the incident (minor incident, moderate incident, major incident, catastrophic incident). The Y-axis represents the financial impact in dollars. A line representing a company *without* liability insurance shows a steep, almost vertical increase in financial impact as the severity of the incident increases. The line quickly surpasses the company’s total assets, indicating potential bankruptcy. A second line, representing a company *with* adequate liability insurance, shows a much gentler slope. While there is still an increase in financial impact, it remains significantly lower than the uninsured company, largely capped by the insurance policy’s limits. This visual representation clearly demonstrates how liability insurance acts as a crucial buffer, mitigating the financial devastation that high-risk industries like construction often face. The difference between the two lines dramatically illustrates the financial security provided by appropriate coverage.

End of Discussion

Navigating the complexities of business liabilities insurance can feel daunting, but understanding its core principles and the various coverage options available is paramount to protecting your business. By carefully considering your specific risks, selecting an appropriate policy, and understanding the claims process, you can significantly mitigate potential financial losses and ensure the long-term stability and success of your enterprise. Remember, proactive risk management through comprehensive insurance is not just a cost; it’s a strategic investment in your business’s future.

Answers to Common Questions

What types of incidents are typically covered by business liability insurance?

Commonly covered incidents include bodily injury to customers or employees on your premises, property damage caused by your business operations, advertising injury (like libel or slander), and professional liability (for errors or omissions in professional services).

How do I determine the right amount of liability coverage for my business?

The appropriate coverage amount depends on several factors, including your business type, size, location, and the potential for significant liability claims. Consulting with an insurance professional is recommended to determine the optimal coverage level for your specific circumstances.

What is the role of an insurance adjuster in a claim?

An insurance adjuster investigates the claim, assesses the damages, and determines the amount the insurance company will pay. They work to resolve the claim fairly and efficiently, negotiating settlements with claimants and coordinating with other involved parties.

Can my business be denied coverage if I make a claim?

While a single claim usually won’t lead to denial of future coverage, repeated or fraudulent claims could impact your insurability. Maintaining a good claims history is crucial for securing favorable insurance rates in the future.