Protecting your business from unforeseen liabilities is crucial for its long-term success. Business liability insurance provides a vital safety net, shielding you from potentially devastating financial consequences arising from accidents, lawsuits, or professional errors. Understanding the different types of coverage available and finding the right policy for your specific needs is key to mitigating risk and ensuring peace of mind.

This guide explores the landscape of business liability insurance, helping you navigate the process of finding reliable coverage tailored to your business’s unique circumstances. We will delve into various policy types, factors influencing cost, and the claims process, empowering you to make informed decisions to protect your investment.

Finding Local Insurance Providers

Securing the right business liability insurance is crucial for protecting your company. Finding the best provider, however, requires a strategic approach. This section Artikels effective methods for locating and evaluating local insurance providers, ensuring you receive the coverage you need at a competitive price.

Finding suitable business liability insurance providers in your area involves leveraging various resources. Each method offers unique advantages and disadvantages, impacting your search efficiency and the potential quality of the insurance offered.

Locating Insurance Providers Through Different Channels

Several avenues exist for identifying local business liability insurance providers. Online search engines provide a broad initial overview, while insurance brokers offer personalized guidance and access to multiple insurers. Direct contact with insurance companies allows for a more focused approach, but might limit your options.

Online search engines like Google, Bing, or DuckDuckGo offer a quick and convenient way to find local insurance providers. Simply searching “business liability insurance [your city/state]” will yield a list of companies and brokers in your area. The advantage is the breadth of results and ease of access. However, the disadvantage is the lack of personalized service and the potential for less reputable companies to appear in search results. Thorough vetting of any provider found this way is crucial.

Insurance brokers act as intermediaries, connecting businesses with multiple insurance companies. This offers a significant advantage: access to a wider range of policies and potential cost savings through comparison shopping. The broker’s expertise can be invaluable in navigating the complexities of insurance policies and finding the best fit for your business needs. However, brokers typically charge a commission, which might slightly increase the overall cost. Furthermore, the level of service can vary between brokers.

Directly contacting insurance companies offers a more focused approach, allowing you to engage directly with the insurer and potentially build a long-term relationship. This method allows for a deeper understanding of the company’s policies and customer service. The disadvantage is the limited number of options explored and the potential for missing out on better deals offered by other companies.

Evaluating Insurance Providers and Comparing Quotes

Once you’ve identified potential providers, careful evaluation is necessary. This involves comparing quotes, assessing coverage options, and verifying the insurer’s financial stability and reputation. Don’t solely focus on price; thorough assessment is key.

When comparing quotes, ensure you are comparing apples to apples. Pay close attention to the coverage limits, deductibles, and exclusions of each policy. Consider factors like the insurer’s claims handling process and customer service reputation. Independent ratings agencies like A.M. Best provide financial strength ratings for insurance companies, offering an objective assessment of their stability. Online reviews can also provide insights into customer experiences.

Questions to Ask Potential Insurance Providers

Before committing to a policy, prepare a list of questions to clarify details and ensure the provider meets your needs. These questions will help you make an informed decision.

A list of essential questions includes: What types of business liability coverage do you offer? What are the coverage limits and deductibles for each policy? What is your claims handling process? What is your financial strength rating? What is the cost of the policy, and what factors influence the premium? What are your customer service policies? What are the policy cancellation terms? Can you provide references from other businesses you insure? Do you offer any discounts?

Factors Affecting Insurance Costs

Several key factors influence the cost of business liability insurance. Understanding these factors can help businesses make informed decisions about their coverage and potentially reduce their premiums. The price you pay isn’t arbitrary; it’s a reflection of the insurer’s assessment of your risk.

Several interconnected factors determine the final premium. These include the inherent risks associated with your industry, the size and structure of your business, your past claims history, and even your geographical location.

Industry Type

Different industries present varying levels of risk. High-risk industries, such as construction or healthcare, typically face higher insurance costs due to the increased likelihood of accidents and lawsuits. Conversely, lower-risk industries, like administrative services, may qualify for lower premiums. For example, a construction company will likely pay significantly more for liability insurance than a bookstore, reflecting the higher probability of workplace accidents and resulting legal claims in the construction sector.

Business Size

The size of your business significantly impacts your insurance costs. Larger businesses with more employees and greater operational complexity generally face higher premiums due to the increased potential for incidents and the greater potential for financial losses. A small bakery with a handful of employees will likely have a lower premium than a large manufacturing plant with hundreds of workers. The greater number of employees and the more complex operations increase the potential for liability claims.

Claims History

Your business’s past claims history is a critical factor. A history of numerous or significant claims will lead to higher premiums, as insurers view this as an indicator of higher risk. Conversely, a clean claims history can result in lower premiums and even potential discounts. For example, a business with three liability claims in the past five years will almost certainly pay more than a business with no claims in the same period. Insurers use statistical models to assess this risk.

Location

Geographical location plays a role in determining insurance costs. Areas with higher crime rates, more frequent natural disasters, or stricter regulations may result in higher premiums. A business operating in a high-crime area might pay more than an identical business in a safer neighborhood, reflecting the increased risk of theft, vandalism, or other incidents that could lead to liability claims. Similarly, businesses located in areas prone to hurricanes or earthquakes will face higher premiums to account for the increased risk of property damage and associated liability.

Hypothetical Scenario

Let’s consider two hypothetical businesses: “Acme Construction,” a large construction firm with a history of several significant liability claims located in a high-risk earthquake zone, and “Beta Books,” a small bookstore with a clean claims history located in a safe, low-risk area. Acme Construction will undoubtedly pay significantly higher premiums than Beta Books due to the combined impact of industry type, business size, claims history, and location.

Strategies to Reduce Insurance Costs

Implementing effective risk management strategies can significantly reduce your insurance costs.

- Implement robust safety programs and training for employees to minimize accidents and injuries.

- Maintain detailed records of all safety measures and incident reports.

- Invest in preventative maintenance to reduce the likelihood of equipment failures.

- Review and update your business policies and procedures regularly to ensure compliance with all relevant regulations.

- Shop around and compare quotes from multiple insurers to find the best rates.

- Consider increasing your deductible to lower your premiums (while ensuring you can afford the higher out-of-pocket cost).

Policy Coverage and Exclusions

Understanding the specifics of your business liability insurance policy is crucial. While it protects your business from various financial risks, it’s essential to be aware of what isn’t covered to avoid unpleasant surprises. This section details common exclusions and how to ensure your policy adequately protects your business.

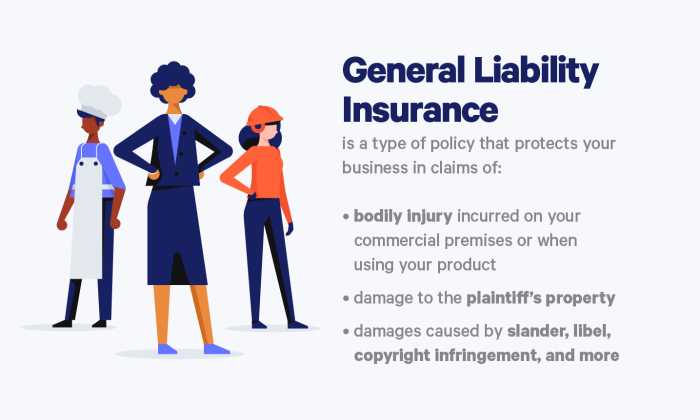

Policy coverage in business liability insurance typically revolves around protecting your business from claims of bodily injury or property damage caused by your business operations. However, numerous exclusions limit this protection. It’s vital to carefully review your policy wording to understand these limitations fully.

Common Exclusions in Business Liability Insurance Policies

Many standard business liability insurance policies exclude coverage for specific types of claims or circumstances. These exclusions are designed to manage risk and prevent the insurer from covering losses that are difficult to predict or control. Understanding these exclusions is key to securing appropriate coverage.

- Intentional Acts: Most policies won’t cover injuries or damages resulting from intentional acts by you or your employees. For example, if an employee intentionally assaults a customer, the resulting liability would likely be excluded.

- Employee-Related Claims (Workers’ Compensation): Business liability insurance typically doesn’t cover injuries to your employees. This is usually covered under a separate workers’ compensation policy, which is often mandated by law.

- Pollution or Environmental Damage: Unless you have specific pollution liability coverage, environmental damage caused by your business operations is usually excluded. This could include contamination of soil or water sources.

- Contractual Liability: Liability assumed through contracts is often excluded unless specifically included as an endorsement. For example, if you contractually agree to assume liability for another party’s negligence, that liability may not be covered.

- Professional Services Errors & Omissions: If your business provides professional services (like consulting or design), errors or omissions in those services may require a separate Errors & Omissions (E&O) insurance policy.

Examples of Situations Not Covered by a Standard Policy

Consider these scenarios to illustrate the importance of understanding policy exclusions.

- A restaurant owner intentionally serves spoiled food, causing several customers to become ill. This would likely be excluded due to the intentional nature of the act.

- A construction company employee is injured on the job site. This would typically be covered under workers’ compensation, not general business liability insurance.

- A manufacturing plant accidentally releases hazardous chemicals into a nearby river, causing significant environmental damage. This pollution-related incident might not be covered without specific pollution liability coverage.

The Importance of Understanding Policy Wording and Limitations

Carefully reviewing your policy’s specific wording is paramount. Insurance policies often contain complex legal language, so don’t hesitate to seek clarification from your insurance agent or broker. Misunderstanding policy limitations can lead to significant financial losses if a claim arises and is denied due to an exclusion. Think of it as a contract; understand your obligations and the insurer’s obligations.

Best Practices for Ensuring Adequate Coverage

To ensure your business has sufficient liability protection, consider these best practices:

- Work with a knowledgeable insurance broker: A broker can help you identify your specific risks and recommend appropriate coverage levels and endorsements.

- Regularly review your policy: As your business changes, your insurance needs may change too. Review your policy annually to ensure it still adequately protects your business.

- Consider additional endorsements: If your business involves higher risk activities or has specific needs, consider purchasing endorsements to expand coverage beyond the standard policy.

- Maintain accurate records: Keep detailed records of your business operations and any incidents that could potentially lead to a liability claim.

Illustrative Scenarios

Understanding the practical applications of business liability insurance is crucial. The following scenarios highlight the importance of having adequate coverage in different business contexts. These examples demonstrate how insurance can protect your business from significant financial losses.

General Liability Insurance: A Small Coffee Shop

A small coffee shop, “The Daily Grind,” experienced a customer slipping and falling on a wet floor near the entrance. The customer suffered a broken arm and incurred significant medical expenses. The customer sued “The Daily Grind” for negligence. The coffee shop’s general liability insurance policy covered the legal fees, medical expenses, and the settlement reached with the customer. The claim process involved filing a report with the insurance company, providing documentation of the incident, and cooperating with the insurer’s investigation. The outcome was a successful claim resolution, preventing the coffee shop from facing crippling financial burdens. The insurance company handled all aspects of the legal proceedings and paid the settlement, protecting the business’s financial stability.

Professional Liability Insurance: A Freelance Web Designer

A freelance web designer, Sarah, created a website for a client. Due to a coding error, the website crashed repeatedly, resulting in significant lost revenue for the client. The client sued Sarah for professional negligence, claiming damages for lost sales and business interruption. Sarah’s professional liability insurance policy covered the legal defense costs and the settlement reached with the client. The claim process involved providing the insurance company with a detailed account of the incident, including contracts and documentation of the website’s malfunction. The outcome was a successful claim resolution, safeguarding Sarah’s personal assets and her professional reputation. The insurer negotiated a settlement and paid for Sarah’s legal representation, preventing a potentially devastating financial loss.

Closing Summary

Successfully navigating the world of business liability insurance requires careful consideration of your specific risks and needs. By understanding the various types of coverage, comparing quotes from reputable providers, and thoroughly reviewing policy terms, you can secure the protection necessary for your business’s continued growth and stability. Remember, proactive risk management is an investment in your future success.

Helpful Answers

What is the difference between general liability and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions insurance) covers claims of negligence or mistakes in professional services.

How much does business liability insurance typically cost?

Costs vary greatly depending on factors like industry, business size, location, and claims history. Getting multiple quotes is essential for comparison.

What is not covered by business liability insurance?

Common exclusions include intentional acts, employee injuries (covered by workers’ compensation), and damage to your own property.

How long does it take to get a business liability insurance policy?

The timeframe varies by provider but can often be obtained within a few days to a couple of weeks.

Can I get business liability insurance if my business has a history of claims?

Yes, but it might be more expensive, and you may need to disclose your claims history accurately during the application process.