Can i have out of-state car insurance in texas – Can I have out-of-state car insurance in Texas? It’s a question many people ask, especially those who recently moved to the Lone Star State or have family connections elsewhere. The answer isn’t always straightforward, as Texas has specific laws regarding car insurance for both residents and non-residents. This guide will explore the intricacies of out-of-state car insurance in Texas, covering everything from coverage requirements to the advantages and disadvantages.

Navigating the world of car insurance can be confusing, particularly when dealing with out-of-state policies. This guide will shed light on the factors influencing the availability of out-of-state insurance in Texas, including the coverage options offered by different companies. We’ll also delve into the process of transferring an existing policy to Texas and discuss the potential benefits and drawbacks of using out-of-state insurance.

Texas Car Insurance Laws

Texas law requires all drivers to carry certain types of car insurance. This includes out-of-state residents who drive in Texas. These laws are designed to protect drivers, passengers, and others on the road in case of an accident.

Mandatory Coverage Requirements for Out-of-State Drivers in Texas

Out-of-state drivers in Texas must have the same minimum insurance coverage as Texas residents. This includes:

- Liability Coverage: This covers bodily injury and property damage to others in case you cause an accident. Texas law requires a minimum of $30,000 per person and $60,000 per accident for bodily injury, and $25,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. Texas law requires a minimum of $30,000 per person and $60,000 per accident for bodily injury.

Penalties for Driving Without Proper Insurance in Texas

Driving without the required minimum insurance in Texas can result in serious penalties, including:

- Fines: Drivers caught without insurance face a fine of up to $350 for a first offense and up to $1,000 for subsequent offenses.

- License Suspension: Your driver’s license may be suspended until you provide proof of insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: If you are involved in an accident without insurance, you could be responsible for the other driver’s medical expenses, property damage, and legal fees.

Out-of-State Insurance Coverage in Texas: Can I Have Out Of-state Car Insurance In Texas

The availability of out-of-state insurance in Texas is subject to several factors, primarily determined by the state’s regulatory framework and the specific insurance company’s operations. Texas law requires all drivers to have liability insurance, but it doesn’t explicitly prohibit out-of-state insurance companies from offering coverage within the state. However, certain aspects of the state’s insurance laws might impact the availability and scope of coverage offered by out-of-state insurers.

Availability of Out-of-State Insurance in Texas

The availability of out-of-state insurance in Texas depends on several factors:

- State Regulations: Texas has specific requirements for insurance companies operating within its borders, including licensing and financial stability. Out-of-state insurers must comply with these regulations to offer coverage in Texas.

- Company Operations: Some insurance companies might choose to operate in specific states or regions based on factors like market demand, profitability, and regulatory environment. If an out-of-state insurer doesn’t have a presence in Texas, it might not be able to offer coverage.

- Policy Coverage: Out-of-state insurers might offer different coverage options or limitations compared to Texas-based insurers. It’s crucial to review the policy details and compare them to Texas’s minimum coverage requirements.

Coverage Options Offered by Out-of-State Insurers in Texas

Out-of-state insurance companies offering coverage in Texas might provide various coverage options, including:

- Liability Coverage: This is the most basic type of insurance, covering damages to other people’s property and injuries in case of an accident. Texas requires minimum liability coverage, which might vary based on the out-of-state insurer’s policy.

- Collision Coverage: This covers damage to your vehicle in case of an accident, regardless of fault. Some out-of-state insurers might offer collision coverage, but the availability and terms might differ.

- Comprehensive Coverage: This covers damage to your vehicle due to non-collision events like theft, vandalism, or natural disasters. Out-of-state insurers might offer comprehensive coverage, but the availability and terms might vary.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. Some out-of-state insurers might offer this coverage, but the availability and terms might differ.

Transferring an Existing Out-of-State Policy to Texas

Transferring an existing out-of-state policy to Texas involves several steps:

- Contact the Insurance Company: Inform your current insurance company about your move to Texas and inquire about the possibility of transferring your policy.

- Review Policy Details: Carefully review the policy details, including coverage options, limitations, and premium costs, to ensure they meet Texas requirements.

- Provide Necessary Documentation: The insurance company might require you to provide documentation like proof of residency, driver’s license, and vehicle registration to complete the transfer process.

- Obtain Confirmation: Once the transfer process is complete, receive confirmation from the insurance company regarding the policy’s effective date and coverage details.

Advantages and Disadvantages of Out-of-State Insurance

Deciding whether to stick with your existing out-of-state car insurance or switch to a Texas-based insurer involves weighing the potential benefits and drawbacks. Here’s a breakdown of the key considerations:

Potential Benefits of Out-of-State Insurance

The decision to keep your out-of-state car insurance in Texas may be driven by a number of factors. Here are some of the potential benefits:

- Lower Premiums: You might find that your current insurer offers more competitive rates compared to Texas insurers, especially if you have a good driving record and have been with the insurer for a while. This is particularly true if you live in a state with lower insurance costs overall.

- Existing Coverage: Maintaining your current policy can offer continuity and familiarity. You’ll already be familiar with your insurer’s claims process, customer service, and coverage details. This can be beneficial if you’ve had a positive experience with your insurer in the past.

- Specialized Coverage: If your current insurer offers specialized coverage options that aren’t readily available in Texas, it might be worthwhile to keep your existing policy. This could include coverage for unique situations like antique cars or high-value vehicles.

Potential Drawbacks of Out-of-State Insurance, Can i have out of-state car insurance in texas

While there are advantages to keeping your existing policy, there are also some potential drawbacks to consider:

- Limited Access to Local Services: You might have limited access to local services like roadside assistance or claims adjusters if you need to file a claim in Texas. This can lead to delays in getting help.

- Compliance Issues: Your out-of-state insurer might not fully comply with all Texas insurance regulations, potentially leaving you with gaps in coverage or legal challenges in case of an accident.

- Potential for Higher Costs: While your current insurer might offer lower premiums now, Texas insurers may offer more competitive rates in the long run, especially if your driving record changes or you add new drivers to your policy.

Comparing Costs and Coverage

It’s crucial to compare the costs and coverage options between your out-of-state insurer and Texas-based insurers to make an informed decision. Here’s what to consider:

- Premiums: Get quotes from multiple Texas insurers and compare them to your current premium. Factor in any discounts you might be eligible for in Texas, such as good driver discounts or discounts for safety features in your vehicle.

- Coverage: Carefully review the coverage offered by both your current insurer and Texas insurers. Ensure you have adequate liability coverage, collision and comprehensive coverage, and any other necessary coverage options, such as uninsured/underinsured motorist coverage.

- Deductibles: Compare the deductibles offered by both insurers. Higher deductibles typically result in lower premiums, but you’ll have to pay more out of pocket if you need to file a claim.

- Customer Service: Consider the customer service experience offered by both insurers. Research their reputation, read reviews, and consider factors like accessibility, response times, and overall customer satisfaction.

Finding Out-of-State Insurance in Texas

Finding out-of-state car insurance in Texas can be a bit tricky, but it’s not impossible. There are several reputable insurance companies that operate across state lines, and you might find better rates or coverage options than what’s available locally.

Researching and Locating Out-of-State Insurance Providers

To find out-of-state insurance providers in Texas, you can follow these steps:

- Start with Online Research: Begin by searching online for “out-of-state car insurance in Texas.” This will lead you to websites of national insurance companies that operate in Texas, as well as articles and forums where other Texans share their experiences.

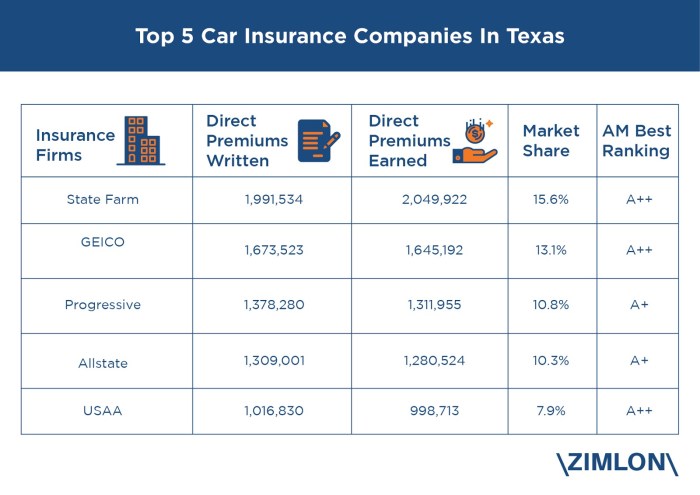

- Check Insurance Company Websites: Visit the websites of major national insurance companies like Geico, Progressive, USAA, and Nationwide. Many of these companies have a “Get a Quote” feature on their websites, allowing you to compare rates without providing personal information.

- Use Comparison Websites: Websites like Insurance.com, Policygenius, and The Zebra allow you to compare quotes from multiple insurance companies simultaneously. This can save you time and effort in researching individual providers.

- Ask for Recommendations: Reach out to friends, family, and colleagues who have experience with out-of-state insurance in Texas. Their recommendations can be invaluable in narrowing down your options.

Obtaining Quotes for Out-of-State Car Insurance

Once you’ve identified a few potential providers, you can start obtaining quotes:

- Provide Accurate Information: When requesting a quote, ensure you provide accurate information about your vehicle, driving history, and desired coverage levels. This will help you receive the most accurate and relevant quotes.

- Compare Quotes Carefully: Don’t just focus on the lowest price. Compare the coverage offered by each provider and ensure it meets your needs. Factors like deductibles, liability limits, and optional coverage should be considered.

- Ask Questions: If you have any questions or concerns about the quotes you receive, don’t hesitate to contact the insurance companies directly. They can clarify details and help you understand the terms of their policies.

Comparing and Selecting the Best Option

After gathering quotes from several providers, you can compare and choose the best option for your needs:

- Consider Your Coverage Needs: Determine the minimum coverage required by Texas law and consider additional coverage options like collision, comprehensive, and uninsured/underinsured motorist coverage. Balance your coverage needs with your budget and risk tolerance.

- Review Customer Reviews and Ratings: Check online reviews and ratings of insurance companies to gain insights into their customer service, claims handling processes, and overall reputation. Look for companies with positive reviews and high ratings.

- Compare Prices and Discounts: Analyze the prices offered by different providers and see if they offer any discounts for good driving records, safety features, or bundling multiple policies.

- Choose the Best Value: Ultimately, the best out-of-state insurance option for you is the one that provides the most comprehensive coverage at the most affordable price, while also offering reliable customer service and a strong reputation.

Important Considerations

While having out-of-state car insurance in Texas can offer some benefits, it’s crucial to consider several factors before making a decision. Failing to do so could lead to complications and unexpected consequences.

Insurance Company’s License and Reputation

It’s essential to verify that the insurance company you’re considering is licensed to operate in Texas. This ensures they meet the state’s minimum requirements and can legally provide coverage. You can check the Texas Department of Insurance website for a list of licensed companies.

Additionally, researching the company’s reputation is crucial. Look for customer reviews and ratings from reputable sources to assess their financial stability, claims handling practices, and customer service.

Impact on Claims Processing and Customer Service

Having out-of-state insurance may complicate the claims process, particularly in case of an accident. The insurer might have limited resources in Texas, making it challenging to access immediate assistance or handle claims efficiently.

Customer service could also be affected. You might encounter longer wait times for assistance, difficulties communicating with representatives familiar with Texas laws, and potential challenges in navigating the claims process.

Implications for Driving Record and Future Insurance Rates

Using out-of-state insurance might not directly affect your driving record. However, if you’re involved in an accident and your insurer deems you at fault, it could impact your future insurance rates.

Insurers use various factors to determine premiums, including driving history, claims history, and location. If you’re involved in an accident in Texas while insured with an out-of-state company, your claims history might be reported to Texas insurance databases. This could potentially lead to higher premiums when you switch to a Texas-based insurer in the future.

Last Word

While out-of-state car insurance in Texas can be a viable option for some, it’s crucial to carefully consider the implications. Before making a decision, thoroughly research the insurance company’s license, reputation, and customer service record in Texas. Understanding the potential impact on claims processing and future insurance rates is also essential. By taking the time to weigh the pros and cons, you can make an informed decision that aligns with your specific needs and circumstances.

Questions Often Asked

What are the mandatory coverage requirements for out-of-state drivers in Texas?

Out-of-state drivers in Texas must have the minimum liability coverage required by the state, which includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

Can I use my out-of-state insurance for a car I bought in Texas?

You may be able to use your out-of-state insurance for a car purchased in Texas, but it’s essential to check with your insurance company to ensure coverage is valid in Texas. They may require you to update your policy or transfer it to a Texas-based insurer.

What are the potential consequences of driving without proper insurance in Texas?

Driving without the required car insurance in Texas can result in hefty fines, license suspension, and even vehicle impoundment. You could also face significant financial liability in the event of an accident.