Can you use gap insurance when trading in a car? This question often arises for car owners who are considering trading in their vehicle. Gap insurance, designed to cover the difference between what you owe on your car loan and its actual market value, is a valuable tool for some, but its applicability in a trade-in scenario can be unclear. This article explores the intricacies of gap insurance and its potential benefits during a trade-in, shedding light on its workings and the key factors to consider.

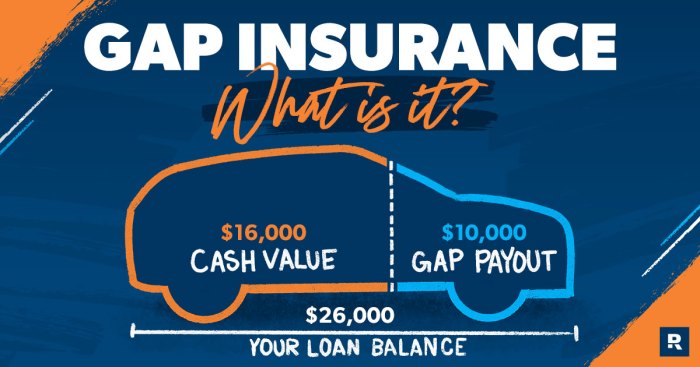

Gap insurance essentially acts as a safety net for those who face the unfortunate situation of owing more on their car loan than its current market value. This gap can arise due to depreciation, particularly in the early years of ownership. If you’re in an accident and your car is totaled or stolen, gap insurance can help cover the remaining balance on your loan, potentially preventing financial strain.

Gap Insurance Basics

Gap insurance is a type of coverage that helps to bridge the difference between what you owe on your car loan and the actual market value of your vehicle if it’s totaled or stolen. This can be particularly beneficial if you financed your car for a longer term, as your loan balance may be higher than the car’s value, even if it’s relatively new.

Scenarios Where Gap Insurance is Most Beneficial

Gap insurance is most beneficial in situations where the car’s market value depreciates faster than the loan balance. This can occur in several scenarios:

- New cars: New cars depreciate rapidly in the first few years. If you finance a new car for a longer term, the loan balance might be significantly higher than the car’s value after an accident or theft.

- Cars with high financing amounts: If you have a large loan amount, especially for a used car, the gap between your loan balance and the car’s value might be substantial.

- Cars with lower-than-average market value: Certain car models might depreciate faster than others, leaving you with a significant gap between the loan balance and the car’s value.

- Cars with customized features: If you have added aftermarket modifications to your car, these might not be factored into the car’s market value, creating a larger gap.

Factors Influencing the Cost of Gap Insurance

Several factors influence the cost of gap insurance:

- Vehicle type and model: The make, model, and year of your car can impact the cost of gap insurance. Newer cars, luxury vehicles, and cars with higher depreciation rates typically have higher premiums.

- Loan amount: The amount you borrowed to finance your car is a major factor in determining the cost of gap insurance. Higher loan amounts usually mean higher premiums.

- Loan term: Longer loan terms often lead to higher gap insurance premiums, as the gap between the loan balance and the car’s value is likely to be larger over a longer period.

- Driving history: Your driving history and insurance claims can influence the cost of gap insurance. Drivers with a history of accidents or violations might face higher premiums.

- Insurance company: Different insurance companies offer varying rates for gap insurance. It’s essential to compare quotes from multiple providers to find the best deal.

Trading in a Car: Can You Use Gap Insurance When Trading In A Car

Trading in your old car is a common practice when purchasing a new vehicle. It simplifies the buying process, allowing you to use the equity from your current car towards the purchase of a new one. Dealerships often offer trade-in values, which can be a convenient option for many sellers.

Trade-in Process

The trade-in process typically involves bringing your vehicle to the dealership for an inspection. The dealership appraises the car’s condition, mileage, and market value to determine a trade-in offer. You can then use this offer as a credit towards the purchase of your new vehicle.

Factors Influencing Trade-in Value

Several factors influence the trade-in value of your car, including:

- Year, Make, and Model: Newer vehicles with popular models generally command higher trade-in values.

- Mileage: Lower mileage vehicles are typically more desirable and fetch higher prices.

- Condition: Vehicles in excellent condition, with minimal wear and tear, are valued more highly.

- Market Demand: Certain car models may be in high demand, leading to increased trade-in values.

- Vehicle History: A clean vehicle history report, free from accidents or major repairs, can enhance the trade-in value.

Trade-in vs. Selling Privately

Trading in your car offers convenience and speed, but it may not result in the highest possible price. Selling your car privately allows you to potentially receive a higher price, but it requires more effort and time.

- Trade-in: Convenient and quick, but you may receive a lower price than selling privately.

- Selling Privately: Potentially higher price, but requires more effort and time, including advertising, showing the car, and handling negotiations.

Gap Insurance and Trade-ins

Gap insurance can be a valuable tool for car owners, but its applicability when trading in a car is a nuanced matter. While it’s not typically used directly during a trade-in, there are specific situations where it might come into play, and its payoff amount can be calculated based on the trade-in value.

Calculating the Payoff Amount

The payoff amount from gap insurance in a trade-in situation is determined by the difference between the vehicle’s outstanding loan balance and its actual trade-in value.

Here’s how it works:

– Outstanding Loan Balance: This is the remaining amount owed on your car loan.

– Trade-in Value: This is the amount the dealership offers for your car as a trade-in towards a new vehicle.

– Gap Insurance Payoff: If the outstanding loan balance exceeds the trade-in value, the gap insurance policy will cover the difference.

Gap insurance payoff = Outstanding Loan Balance – Trade-in Value

For example, if your car loan balance is $15,000 and the dealership offers you $10,000 for your car as a trade-in, the gap insurance payoff would be $5,000.

Scenarios Where Gap Insurance Might Be Beneficial

Gap insurance can be beneficial in several trade-in scenarios:

– Depreciating Vehicles: If your car has depreciated significantly since you purchased it, the trade-in value might be lower than the outstanding loan balance. Gap insurance can help cover the difference.

– High-Interest Loans: If you have a high-interest loan, your outstanding balance may be higher than the actual value of the car. Gap insurance can help you avoid owing money even after trading in the vehicle.

– Accidents or Damage: If your car has been in an accident or has sustained significant damage, the trade-in value might be significantly reduced. Gap insurance can help cover the difference.

– Total Loss: If your car is totaled in an accident, gap insurance can help you cover the difference between the insurance payout and the outstanding loan balance.

Scenarios Where Gap Insurance Might Not Be Beneficial

In some cases, gap insurance may not be beneficial during a trade-in:

– Low Loan Balance: If your loan balance is relatively low compared to the trade-in value, you might not need gap insurance.

– Low-Interest Loans: If you have a low-interest loan, your outstanding balance may be lower than the actual value of the car. Gap insurance might not be necessary in this situation.

– Trading in a Newer Vehicle: If you are trading in a relatively new car, the trade-in value is likely to be closer to the loan balance, making gap insurance less relevant.

It’s crucial to remember that gap insurance policies can vary depending on the insurance provider and your individual circumstances. Always review your policy details and consult with your insurance agent to understand the specific terms and conditions of your coverage.

Alternatives to Gap Insurance

Gap insurance can be a valuable tool to protect yourself from financial losses in case of a total vehicle loss, but it’s not the only option available. Exploring alternatives can help you make an informed decision that aligns with your specific needs and budget.

Comparing Gap Insurance with Other Financial Options

Several financial options offer protection similar to gap insurance. Understanding their coverage details, cost factors, and suitability for trade-ins can help you choose the right option for your situation.

| Insurance Type | Coverage Details | Cost Factors | Suitability for Trade-ins |

|---|---|---|---|

| Gap Insurance | Covers the difference between the outstanding loan balance and the actual cash value of your vehicle in case of a total loss. | Loan amount, vehicle age, and credit score. | Generally not recommended for trade-ins as it doesn’t cover the difference between the trade-in value and the outstanding loan balance. |

| Extended Warranty | Covers repairs and replacements for specific components beyond the manufacturer’s warranty period. | Vehicle make and model, coverage level, and term. | Not directly relevant for trade-ins, but a well-maintained vehicle with extended warranty may fetch a higher trade-in value. |

| Loan Protection Insurance | Covers loan payments in case of death, disability, or unemployment. | Loan amount, borrower’s age and health, and credit score. | Not directly relevant for trade-ins. |

| High Deductible Car Insurance | Offers lower premiums but requires a higher out-of-pocket payment in case of an accident. | Driving history, vehicle type, and location. | Not directly relevant for trade-ins, but a lower premium can offset some of the financial burden if your vehicle is totaled. |

Pros and Cons of Alternatives

-

Extended Warranty

- Pros: Provides peace of mind by covering expensive repairs beyond the manufacturer’s warranty. Can potentially increase the trade-in value if the vehicle is well-maintained and has a comprehensive extended warranty.

- Cons: Can be expensive, especially for high-mileage vehicles or those with a longer coverage term. May not cover all components, and the coverage may not be transferable to a new owner.

-

Loan Protection Insurance

- Pros: Offers financial protection in case of unexpected events like death, disability, or unemployment, ensuring your loan payments are covered.

- Cons: Can be expensive and may not be necessary if you have a strong financial safety net or other insurance policies covering similar situations.

-

High Deductible Car Insurance

- Pros: Offers lower premiums, which can be a significant cost saving over time. Can be a suitable option for drivers with a clean driving record and a comfortable financial buffer to cover the higher deductible.

- Cons: Requires a higher out-of-pocket payment in case of an accident. May not be suitable for drivers who cannot afford a large deductible or who are concerned about the financial burden of an accident.

Practical Considerations

When considering gap insurance, it’s crucial to weigh the potential benefits against the costs. Understanding your specific situation and evaluating the potential financial implications will help you make an informed decision.

Determining if Gap Insurance is Worthwhile, Can you use gap insurance when trading in a car

Gap insurance can be a valuable investment in certain situations, but it’s essential to determine if it aligns with your financial goals. Consider these factors:

- Loan Amount vs. Vehicle Value: Gap insurance is most beneficial when your loan amount significantly exceeds the vehicle’s market value. For example, if you financed a $30,000 car and its market value drops to $20,000 after an accident, gap insurance would cover the $10,000 difference.

- Vehicle Depreciation: Vehicles depreciate rapidly, especially in the first few years. If you’re financing a new car, gap insurance might be more worthwhile, as the depreciation rate is higher during the initial years.

- Financial Situation: Assess your financial ability to cover the difference between the loan amount and the vehicle’s value in case of a total loss. If you have a substantial emergency fund or can afford the potential shortfall, gap insurance might be less necessary.

Last Recap

Navigating the world of gap insurance and trade-ins can be complex, but understanding the nuances can lead to informed decisions. While gap insurance might not always be directly applicable during a trade-in, it can still play a role in protecting your financial interests. By weighing the potential benefits against the costs, you can determine if gap insurance is the right choice for your specific circumstances.

Commonly Asked Questions

Is gap insurance worth it for everyone?

No, gap insurance is not a one-size-fits-all solution. It’s generally more beneficial for those who finance a car for a longer term or those who purchase a new car with a high loan-to-value ratio.

What happens to my gap insurance if I sell my car privately?

If you sell your car privately, your gap insurance policy will typically be terminated. The insurance company may refund a portion of the premium based on the remaining policy term.

Can I get gap insurance after I’ve already purchased my car?

Yes, you can usually purchase gap insurance after buying a car, but it’s often more expensive than if you add it at the time of purchase.