The search for the perfect car and home insurance quote often feels like navigating a maze. Understanding the nuances of bundled policies, comparing providers, and deciphering the jargon can be overwhelming. This guide aims to illuminate the process, providing you with the knowledge and tools to make informed decisions and secure the best coverage for your needs.

From understanding the various stages of the customer journey to identifying key factors influencing premium costs, we’ll explore the complexities of car and home insurance quotes. We’ll analyze competitive landscapes, delve into policy features, and offer practical tips for obtaining accurate quotes online. Ultimately, our goal is to empower you to confidently navigate the insurance market and find the ideal policy that safeguards your valuable assets.

Competitive Landscape Analysis

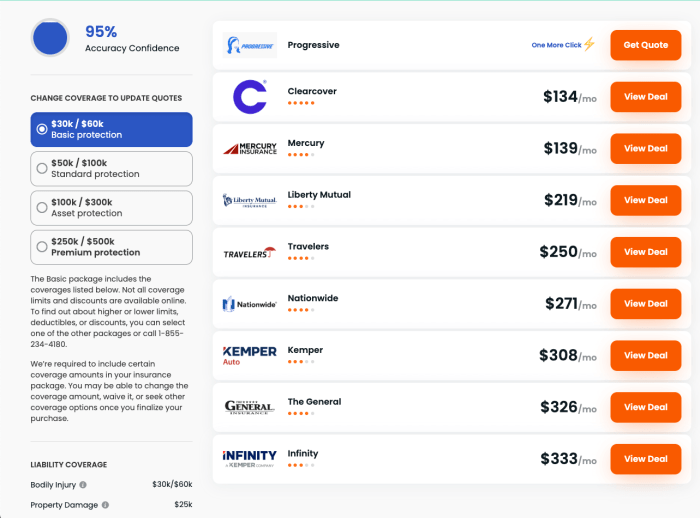

The market for bundled car and home insurance is fiercely competitive, with a range of providers vying for customers through diverse pricing strategies and policy features. Understanding this landscape is crucial for consumers seeking the best value and coverage. This analysis compares prominent insurers, examining their pricing models and the key benefits included in their bundled packages.

Comparison of Insurance Providers

Several major insurance companies offer bundled car and home insurance policies. These providers often compete on price, coverage options, and the convenience of managing both policies under a single provider. Direct comparison is difficult without specific location and individual risk profile data, as premiums vary significantly. However, general observations can be made about common pricing strategies and offered benefits.

Pricing Strategies of Major Insurance Companies

Major insurers typically employ a tiered pricing system for bundled policies. This often involves discounts for bundling, but the overall price remains dependent on several factors including credit score, driving history, home location, and the value of the property and vehicle. Some insurers may offer discounts based on security features in the home (e.g., alarm systems) or safety features in the vehicle (e.g., anti-theft devices). Companies also use sophisticated actuarial models to assess risk, leading to individualized premiums. For example, a customer with a pristine driving record and a home in a low-risk area will likely receive a lower premium than someone with multiple accidents and a home in a high-crime area. Aggressive competition sometimes results in introductory offers or limited-time discounts.

Key Features and Benefits Offered by Competitors

The following table provides a general comparison of features. Note that specific benefits and pricing will vary depending on individual circumstances and location. This is not an exhaustive list of all providers and features.

| Insurer | Bundled Discount | Coverage Options | Additional Benefits |

|---|---|---|---|

| Company A | Up to 25% | Comprehensive car, homeowners, and liability coverage | 24/7 claims service, online account management, roadside assistance |

| Company B | Up to 20% | Similar to Company A, may offer specialized coverage for high-value items | Discounts for multiple policies, flexible payment options, loyalty programs |

| Company C | Up to 15% | Focuses on basic coverage, options for add-ons | Simple online quote process, strong customer service reputation |

| Company D | Variable, based on risk assessment | Wide range of coverage options, including specialized policies | Personalized risk management advice, extensive online resources |

Factors Influencing Premium Costs

Several interconnected factors determine the cost of bundled car and home insurance. Understanding these elements allows consumers to make informed decisions and potentially secure more favorable rates. This involves considering both individual risk assessments and broader market influences.

Insurance companies utilize sophisticated algorithms to assess risk and calculate premiums. This process considers a wide range of variables, combining statistical data with individual characteristics to arrive at a personalized price. Essentially, the higher the perceived risk, the higher the premium.

Individual Risk Profile Impact on Premiums

Individual risk profiles are central to premium calculations. Factors such as driving history (accidents, tickets), age, credit score, and the specifics of the home and car significantly influence the insurer’s assessment of potential claims. A clean driving record and a high credit score generally translate to lower premiums, while factors like a history of claims or a property located in a high-risk area can increase costs.

Variables Influencing Insurance Pricing

The following table illustrates how different variables impact insurance pricing. Note that these are illustrative examples and actual pricing will vary based on the specific insurer and a multitude of other factors.

| Variable | Low Risk Profile | Medium Risk Profile | High Risk Profile |

|---|---|---|---|

| Location (Home & Car) | Quiet, low-crime suburban area | Urban area with moderate crime rates | High-crime urban area, prone to natural disasters |

| Credit Score | 750+ (Excellent) | 680-749 (Good) | Below 680 (Fair/Poor) |

| Claims History (Past 5 years) | No claims | One minor claim | Multiple claims, including at-fault accidents |

| Vehicle Type (Car Insurance) | Small, fuel-efficient car with safety features | Mid-size sedan | High-performance sports car or older vehicle with poor safety ratings |

Last Recap

Obtaining a car and home insurance quote shouldn’t be a daunting task. By understanding your needs, comparing providers, and carefully considering the factors that influence pricing, you can secure comprehensive coverage at a competitive rate. Remember to thoroughly review policy details, compare quotes from multiple insurers, and don’t hesitate to ask questions. With the right information and a strategic approach, you can confidently protect your home and vehicle with a policy that perfectly suits your lifestyle and budget.

FAQ Insights

What is a bundled car and home insurance policy?

A bundled policy combines your car and home insurance coverage into a single policy with one provider, often offering discounts.

How long does it take to get a quote?

Online quotes are typically generated instantly, while phone quotes may take a few minutes.

Can I bundle my insurance if I rent my home?

Yes, many insurers offer bundled policies even if you rent your home, although the specifics may vary.

What happens if I make a claim?

The claims process will be Artikeld in your policy documents. Generally, you’ll need to report the claim to your insurer and follow their instructions.

Can I change my coverage after getting a quote?

Yes, you can typically adjust your coverage levels before finalizing your policy.