Navigating the complexities of auto insurance can be daunting. While comprehensive coverage is essential, standard insurance policies may leave a significant gap in protection, especially when dealing with a totaled vehicle. This is where car gap insurance steps in, offering a crucial safety net for borrowers facing substantial financial losses. This guide explores the intricacies of car gap insurance, providing clarity on its benefits, costs, and suitability for various drivers.

We’ll delve into how car gap insurance functions, comparing it to other auto insurance options and outlining the process of filing a claim. We’ll also examine factors influencing its cost, highlighting scenarios where it proves invaluable and demonstrating its potential financial impact. Finally, we’ll provide practical advice on selecting a reputable provider and understanding policy details to ensure you make an informed decision.

What is Car Gap Insurance?

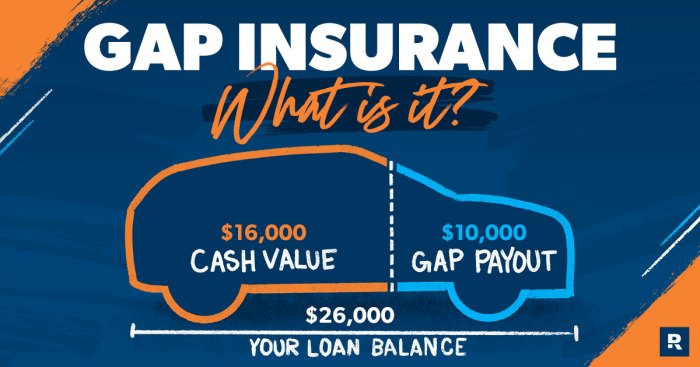

Car gap insurance is a supplemental insurance policy designed to protect you from financial loss if your vehicle is totaled or stolen. It bridges the gap between the actual cash value (ACV) of your car and the amount you still owe on your auto loan or lease. Essentially, it covers the difference, preventing you from being stuck with a significant debt even after your insurance company has paid out.

Car gap insurance is particularly beneficial in situations where your car depreciates quickly, meaning its value decreases substantially over a short period. This is common with new cars. If you’re involved in an accident or your vehicle is stolen, your standard insurance policy will typically only reimburse you for the ACV of your car at the time of the incident. This ACV is often considerably lower than the amount you still owe on your loan, leaving you responsible for the remaining balance. Gap insurance protects you from this potential financial burden.

Situations Where Car Gap Insurance is Beneficial

Gap insurance proves invaluable in several scenarios where standard auto insurance falls short. For instance, if you finance a new car and total it within the first year or two, the depreciation will be substantial. Your standard insurance payout, based on the diminished ACV, may be significantly less than your loan balance. Gap insurance steps in to cover this difference, preventing you from being left with a substantial debt. Similarly, if your car is stolen and not recovered, the same principle applies; the ACV may be far lower than the loan amount, and gap insurance helps alleviate this financial burden.

Examples of Uncovered Losses Covered by Gap Insurance

Let’s consider a specific example: Imagine you purchase a new car for $30,000 with a $25,000 loan. After one year, the car’s ACV drops to $20,000 due to depreciation. If the car is totaled, your standard insurance pays out $20,000. However, you still owe $25,000 on the loan. This leaves you with a $5,000 shortfall. Gap insurance would cover this $5,000 difference, protecting you from additional financial strain. Another example could involve leasing a vehicle. If the vehicle is totaled before the lease term ends, and the lease buyout amount exceeds the ACV, gap insurance can help cover the excess. Finally, consider a scenario where a vehicle is stolen and never recovered; standard insurance would typically only pay the ACV, leaving the driver responsible for any remaining loan amount. Gap insurance would offset this loss.

How Car Gap Insurance Works

Car gap insurance bridges the gap between what your car is worth at the time of a total loss and the amount you still owe on your auto loan or lease. It protects you from potentially significant financial losses if your vehicle is deemed a total loss early in its lifespan, before depreciation significantly reduces its value. This is particularly relevant for new cars which depreciate rapidly.

The process of filing a claim is generally straightforward. After reporting the total loss to your primary auto insurer, you’ll then file a separate claim with your gap insurance provider. You’ll need to provide documentation such as the police report, the appraisal from your primary insurer, your loan or lease agreement, and proof of insurance. The gap insurer will then review your claim and, if approved, pay the difference between the actual cash value (ACV) of your vehicle and the outstanding loan or lease balance. This payment directly goes towards settling your loan or lease, preventing you from being left with a substantial debt on a non-existent vehicle.

Coverage Limits and Exclusions

Gap insurance policies typically cover the difference between the ACV of your vehicle and the outstanding loan or lease amount, up to a specified limit. This limit is usually the original purchase price of the vehicle, less any deductible. However, some policies may have lower limits. Exclusions commonly include situations where the loss is due to normal wear and tear, intentional damage, or if the vehicle was modified without the insurer’s consent. Policies may also exclude losses resulting from certain types of accidents or specific driver actions. Carefully reviewing the policy’s fine print is essential to understanding what is and isn’t covered.

Comparison with Other Auto Insurance

Gap insurance is distinct from other types of auto insurance. While comprehensive and collision coverage from your primary auto insurer will pay for repairs or replacement, they only cover the ACV of your vehicle. If you owe more than the ACV, you’re still responsible for the difference. Uninsured/underinsured motorist coverage protects you from damages caused by drivers without sufficient insurance, while liability coverage protects you from claims against you for damages you cause to others. Gap insurance, however, focuses solely on the financial gap left by a total loss when your loan or lease balance exceeds the vehicle’s ACV.

Gap Insurance Provider Comparison

The following table provides a comparison of several hypothetical gap insurance providers. Remember that actual premiums and customer ratings can vary depending on your location, driving history, and the specific details of your policy. It is crucial to obtain quotes from multiple providers before making a decision.

| Provider | Coverage Details | Premium Range (Annual) | Customer Rating (out of 5 stars) |

|---|---|---|---|

| Insurer A | Covers up to original purchase price; excludes wear and tear | $100 – $250 | 4.2 |

| Insurer B | Covers up to 110% of ACV; excludes modifications without consent | $150 – $300 | 4.0 |

| Insurer C | Covers difference between ACV and loan balance, up to $10,000 | $80 – $200 | 3.8 |

| Insurer D | Covers loan/lease balance, regardless of ACV; higher deductible | $200 – $400 | 4.5 |

Cost and Benefits of Car Gap Insurance

Car gap insurance, while offering valuable protection, comes with a cost. Understanding both the expense and the potential financial advantages is crucial to making an informed decision about whether this type of coverage is right for you. The decision hinges on weighing the premium against the potential for significant financial loss in the event of a total loss accident.

Factors Influencing the Cost of Car Gap Insurance

Several factors influence the premium you’ll pay for car gap insurance. These factors are often intertwined and considered by insurers when assessing risk.

Factors Determining Car Gap Insurance Premiums

The cost of car gap insurance is determined by a combination of factors related to both the vehicle and the policyholder. Higher-value vehicles, for example, will typically have higher premiums because the potential gap between the loan amount and the vehicle’s actual cash value (ACV) is larger. Similarly, policyholders with a history of accidents or poor credit scores might face higher premiums, reflecting a perceived higher risk to the insurer.

- Vehicle Value: The initial purchase price and the vehicle’s depreciation rate significantly impact the premium. Newer, more expensive vehicles generally have higher premiums due to the larger potential gap.

- Loan Amount: A larger loan amount leads to a larger potential gap and, consequently, a higher premium. This is because the insurance covers the difference between the loan and the vehicle’s ACV.

- Credit Score: Insurers often use credit scores as an indicator of risk. A lower credit score may result in higher premiums.

- Driving History: A history of accidents or traffic violations can increase the perceived risk, leading to higher premiums.

- Policy Term: The length of the insurance policy can influence the cost; longer terms might have slightly lower per-month costs.

Potential Financial Benefits of Car Gap Insurance

The primary benefit of car gap insurance is the protection it offers against significant financial losses following a total loss accident. Without this coverage, you might be left with a substantial debt on your loan even after receiving the insurance payout for the vehicle’s actual cash value.

Consider a scenario where you finance a new car for $30,000. After two years, the car is totaled in an accident. The insurance company assesses the car’s actual cash value at $20,000, due to depreciation. You still owe $25,000 on the loan. Without gap insurance, you are responsible for the remaining $5,000.

Hypothetical Scenario: Impact of Gap Insurance

Let’s illustrate the financial impact with a hypothetical scenario:

| Scenario | With Gap Insurance | Without Gap Insurance |

|---|---|---|

| Loan Amount | $30,000 | $30,000 |

| Vehicle Actual Cash Value (ACV) after 2 years | $20,000 | $20,000 |

| Insurance Payout | $20,000 | $20,000 |

| Remaining Loan Balance | $10,000 | $10,000 |

| Gap Insurance Payout | $10,000 | $0 |

| Amount Owed After Accident | $0 | $10,000 |

In this example, gap insurance completely covers the difference between the loan amount and the ACV, preventing you from incurring a significant financial burden after a total loss accident. Without gap insurance, you would be personally responsible for the remaining $10,000.

Who Needs Car Gap Insurance?

Car gap insurance isn’t a necessity for everyone, but it offers valuable protection for specific drivers and situations. Understanding your personal risk profile and financial circumstances is key to determining if this type of insurance is right for you. Generally, those who finance a significant portion of their vehicle’s purchase price and/or are concerned about potential rapid depreciation will find it most beneficial.

The primary beneficiaries of gap insurance are individuals who finance a substantial portion of their car’s purchase price. This is because gap insurance covers the difference between what you owe on your loan and the actual cash value of your vehicle in the event of a total loss. This difference can be substantial, particularly in the early years of a loan when depreciation is most significant. For example, imagine financing a new car for five years; in a total loss scenario within the first year, the car’s value might have already depreciated considerably. The gap insurance would bridge that financial gap, preventing you from being left with a significant debt.

Individuals Who Benefit Most from Gap Insurance

This type of insurance is particularly relevant for individuals purchasing new or nearly-new vehicles. The higher the loan amount relative to the vehicle’s value, the greater the potential benefit. Consider these scenarios: A young driver financing a new car with a long loan term is at greater risk of a total loss and significant depreciation; a driver leasing a vehicle, where the lease gap insurance can cover excess wear and tear charges above what is covered by the lease agreement; and a driver who has experienced a total loss in the past and wishes to avoid a similar financial burden in the future. These individuals would all greatly benefit from the financial protection offered by gap insurance.

Reasons for Purchasing Car Gap Insurance

Purchasing gap insurance is a strategic decision to mitigate financial risk. The following reasons illustrate why many choose to purchase it:

- Protection against significant financial loss in case of a total loss accident. The insurance pays the difference between what you owe on the loan and the actual cash value of the vehicle.

- Mitigation of depreciation risk, especially in the early years of vehicle ownership when depreciation is highest.

- Peace of mind knowing that you are protected from potentially substantial debt in the event of a total loss.

- Reduced financial burden following a major accident, allowing focus on recovery and not debt management.

- Enhanced financial stability and protection against unexpected financial hardship.

Finding and Choosing a Car Gap Insurance Provider

Securing the right car gap insurance involves more than just finding the cheapest option. A thorough search and careful comparison are crucial to ensuring you receive adequate coverage at a fair price. This process requires understanding your needs and knowing where to look for reputable providers.

Finding a suitable car gap insurance provider involves a systematic approach. This process minimizes the risk of choosing an unreliable provider and maximizes the chances of securing comprehensive and cost-effective coverage.

Steps to Finding a Reputable Provider

Several steps can help you find a trustworthy car gap insurance provider. Begin by utilizing a variety of resources and conducting thorough research on each potential provider before making a decision.

- Check with your existing car insurer: Many auto insurance companies offer gap insurance as an add-on to your existing policy. This can streamline the process and potentially offer bundled discounts.

- Use online comparison tools: Several websites allow you to compare quotes from multiple gap insurance providers simultaneously. This facilitates a side-by-side comparison of coverage and pricing.

- Seek recommendations: Ask friends, family, and colleagues for recommendations on reliable gap insurance providers. Personal experiences can offer valuable insights.

- Verify licensing and accreditation: Ensure the provider is properly licensed and accredited in your state. This helps confirm their legitimacy and adherence to industry standards.

- Read online reviews and ratings: Check online review platforms like Yelp or the Better Business Bureau to gauge customer satisfaction and identify any potential red flags.

Key Factors to Consider When Comparing Policies

Comparing different car gap insurance policies requires attention to several crucial factors to ensure you select the most appropriate coverage for your needs. A simple price comparison isn’t sufficient; the extent of coverage and policy terms must also be considered.

- Coverage amount: Ensure the coverage amount is sufficient to cover the gap between your car’s actual cash value and the outstanding loan balance.

- Deductibles: Understand the deductible amount you’ll be responsible for in the event of a claim.

- Policy term: Determine the length of the policy term and whether it aligns with your loan repayment schedule.

- Claim process: Investigate the provider’s claim process to ensure it’s straightforward and efficient.

- Customer service: Look for a provider with a responsive and helpful customer service team.

- Price: While price is a factor, it shouldn’t be the sole determinant. Balance cost with coverage and service quality.

Importance of Reading the Fine Print

Before committing to a car gap insurance policy, meticulously review the fine print. Overlooking crucial details in the policy documents can lead to unexpected costs or coverage limitations.

Thoroughly reading the policy ensures you understand the terms and conditions, exclusions, and limitations. This proactive approach prevents future misunderstandings and disputes. Pay close attention to sections regarding claim procedures, exclusions (e.g., specific types of accidents or damage not covered), and cancellation policies. For example, some policies might exclude coverage for certain types of accidents or if the vehicle is modified. Understanding these limitations beforehand is crucial.

Epilogue

In conclusion, car gap insurance serves as a vital financial safeguard for many drivers, bridging the gap between the actual cash value of a vehicle and the outstanding loan amount after a total loss. By understanding its mechanics, benefits, and limitations, you can make a well-informed decision about whether this additional coverage aligns with your individual needs and financial circumstances. Remember to carefully compare policies and providers before making a commitment to ensure you secure the best protection for your investment.

Query Resolution

What happens if my car is stolen and I have gap insurance?

Gap insurance will typically cover the difference between the actual cash value of your stolen vehicle and the outstanding loan balance, just as it would with a total loss due to an accident.

Is car gap insurance worth it if I have a low down payment?

Yes, car gap insurance is particularly beneficial if you have a low down payment, as the difference between your loan amount and the car’s depreciated value is likely to be larger.

Can I get car gap insurance after I’ve already purchased my car?

Sometimes, yes. The availability of gap insurance after purchase depends on your lender and insurer. Contact them directly to inquire about options.

How long does car gap insurance typically last?

The duration of car gap insurance coverage is usually tied to the length of your auto loan. It typically ends when the loan is paid off.

Does car gap insurance cover damage beyond a total loss?

No, car gap insurance specifically addresses the difference between the loan amount and the insurance payout in the event of a total loss (theft or damage beyond repair). It does not cover minor repairs or partial damage.