Navigating the world of car insurance can feel overwhelming. With numerous providers offering a vast array of coverage options and price points, finding the best deal requires careful consideration and comparison. This guide delves into the process of comparing car insurance quotes, empowering you to make informed decisions and secure the most suitable coverage at a competitive price.

Understanding your individual needs and preferences is crucial before you begin comparing quotes. Factors like your driving history, vehicle type, location, and desired coverage levels all significantly influence the final price. By understanding these factors, you can effectively narrow your search and focus on quotes that truly align with your requirements. This guide will help you understand these factors and effectively navigate the comparison process.

Understanding “Car Insurance Compare Quote” User Intent

Users searching for “car insurance compare quote” are actively engaged in the process of finding the best car insurance policy for their needs. Their search reflects a desire for value, convenience, and potentially, a sense of urgency. Understanding their motivations is crucial for effectively presenting insurance options.

Understanding the motivations behind this search reveals a multi-faceted user intent. It’s not simply a request for information; it’s a reflection of a user’s stage in the car insurance buying journey. This search indicates a proactive approach to securing coverage, driven by a variety of factors including cost, coverage options, and personal circumstances.

User Motivations and Goals

The primary motivation for searching “car insurance compare quote” is to find the most affordable and suitable car insurance policy. This involves comparing prices from different providers, understanding the coverage options offered, and ensuring the policy aligns with their individual needs and risk profile. For example, a new driver might prioritize comprehensive coverage, while an experienced driver with a clean record might focus on finding the lowest premium. Another example is a driver recently involved in an accident who may be seeking better coverage than their current policy provides. A user might also be motivated by a need to switch providers due to dissatisfaction with their current insurer’s customer service or claim handling.

Stages of the Car Insurance Buying Journey

The search “car insurance compare quote” typically reflects users in the consideration and decision-making stages of the car insurance buying journey. Some may be in the initial research phase, simply exploring their options. Others might be further along, actively comparing specific quotes received from various providers. The search indicates a move beyond passive awareness; users are actively seeking solutions and are likely ready to make a purchase decision soon. This contrasts with users who may simply be researching car insurance generally, without an immediate intent to buy.

User Persona: Sarah Miller

Sarah Miller, a 32-year-old marketing professional, recently purchased a new car. She’s currently insured with a national provider but feels she’s overpaying. Sarah is tech-savvy, using comparison websites and online tools extensively. Her primary needs are affordable premiums without sacrificing essential coverage. She values convenience and transparency, preferring online interactions and clear, concise information. Sarah’s online behavior includes using search engines, comparing prices on aggregator websites, and checking reviews of different insurance providers before making a decision. She is likely to engage with websites offering detailed policy comparisons and online chat support. Sarah represents a typical user who utilizes “car insurance compare quote” as a starting point in her search for a better car insurance deal.

Competitor Analysis of “Car Insurance Compare Quote” Websites

The car insurance comparison website market is fiercely competitive, with numerous platforms vying for consumer attention. Understanding the strengths and weaknesses of leading competitors is crucial for developing a successful strategy. This analysis examines three major players, comparing their features, user interfaces, and overall user experience to identify opportunities for differentiation and improvement.

Comparison of Leading Car Insurance Comparison Websites

The following table summarizes the key features, user interface characteristics, and overall user experience of three prominent car insurance comparison websites. These observations are based on recent user experiences and publicly available information.

| Website Name | Key Features | User Interface | Overall User Experience |

|---|---|---|---|

| Compare.com (Example) | Wide range of insurers, detailed quote breakdowns, add-on options, customer reviews, mobile app. | Clean and intuitive design, easy navigation, clear presentation of information. Uses a primarily visual approach with color-coded options. | Generally positive; users appreciate the breadth of coverage and ease of comparison. Some users find the sheer volume of information overwhelming. |

| Insurify (Example) | Focus on personalized recommendations, AI-powered features, quick quote generation, social media integration. | Modern and visually appealing, but could be perceived as less intuitive for less tech-savvy users. Relies heavily on interactive elements. | Mixed reviews; some praise the innovative features and personalized experience, while others find the interface slightly cluttered. |

| The Zebra (Example) | Strong emphasis on transparency, detailed policy explanations, customer support tools, robust search filters. | Straightforward and functional, prioritizes ease of use and clear communication. A more text-based approach compared to the others. | Generally positive; users value the clear and concise information provided. Some users may find the design less visually engaging. |

Strengths and Weaknesses of Quote Presentation

Each website employs a unique approach to presenting insurance quotes. Compare.com excels in providing comprehensive, detailed breakdowns of each quote, allowing users to thoroughly understand the coverage offered. However, this level of detail can be overwhelming for some. Insurify’s AI-powered recommendations offer a personalized approach, streamlining the process, but this might sacrifice some control for the user. The Zebra prioritizes transparency and clear explanations, making it easy for users to compare policies, but lacks some of the advanced features found in its competitors.

Unique Selling Propositions (USPs)

Compare.com’s USP is its broad insurer coverage and detailed quote comparison. Insurify leverages AI and personalized recommendations as its unique selling point. The Zebra focuses on transparency and user-friendly policy explanations as its differentiator. Each website caters to a slightly different segment of the market based on its USP.

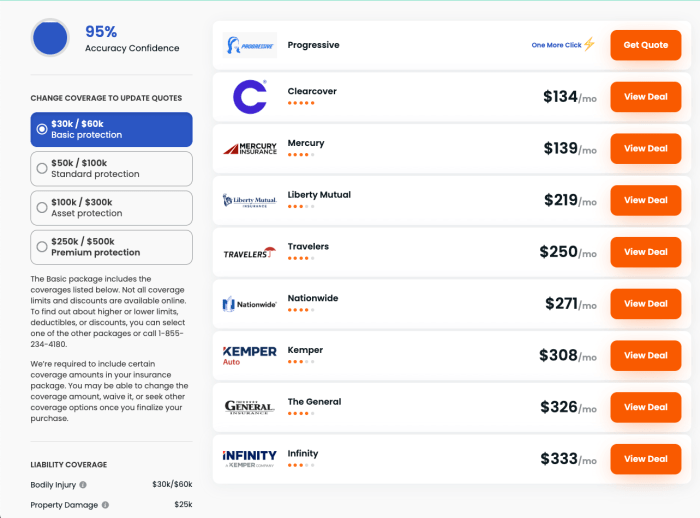

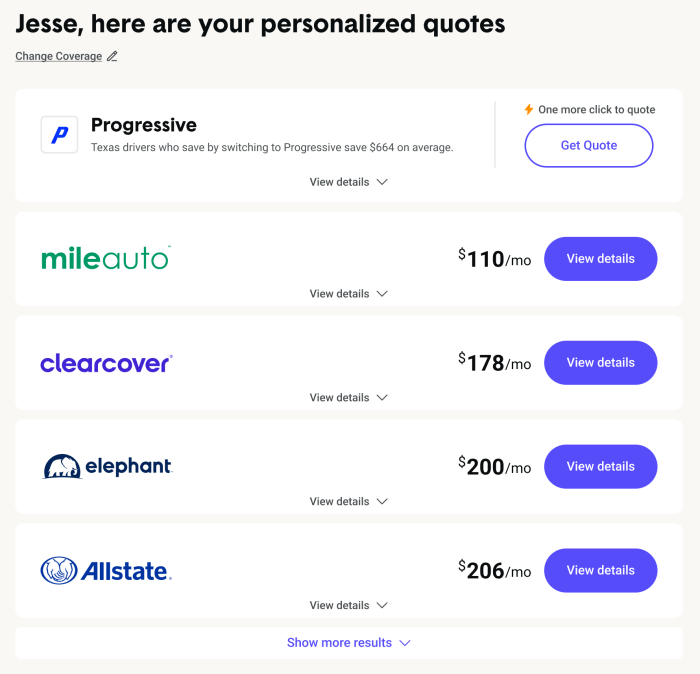

Visual Representation of Insurance Quote Comparison

Presenting insurance quote comparisons effectively is crucial for helping users make informed decisions. A clear and concise visual representation can significantly improve understanding and reduce the cognitive load associated with comparing multiple policies. This involves using appropriate infographics and tables to highlight key differences and crucial information.

Infographic Illustrating Factors Influencing Car Insurance Costs

This infographic would use a circular design, visually representing the interconnectedness of factors. The central circle would be labeled “Final Insurance Premium,” radiating outwards to several segmented sections representing key influencing factors. Each segment would be color-coded for better visual distinction. For example, a large segment might represent “Driving History,” further subdivided into smaller sections representing accidents, speeding tickets, and DUI convictions. The size of each smaller section would be proportional to its impact on the final premium. Similarly, other segments could represent “Vehicle Type” (showing different car types with varying premium implications), “Location” (with geographic areas shaded to reflect risk levels), “Age and Gender” (using age ranges and gender-specific colors), and “Coverage Level” (illustrating the premium differences between liability-only, comprehensive, and collision coverage). The size of each segment would directly reflect its contribution to the overall premium cost. A key would clearly define the color-coding and size-to-impact relationship. The overall visual would emphasize that the final premium is a composite result of several interacting factors.

Side-by-Side Comparison of Insurance Quotes Using an HTML Table

A responsive HTML table is an effective way to present multiple insurance quotes side-by-side for easy comparison. The table would have four columns: Insurer, Price, Coverage, and Deductible. Each row would represent a different insurance quote.

| Insurer | Price (Annual) | Coverage | Deductible |

|---|---|---|---|

| Company A | $1200 | Comprehensive + Collision | $500 |

| Company B | $1000 | Liability Only | $1000 |

| Company C | $1500 | Comprehensive + Collision | $250 |

| Company D | $1150 | Liability + Collision | $750 |

This table allows for quick visual scanning and comparison of key aspects of different insurance plans. The use of clear headings and consistent formatting enhances readability.

Use of Color and Visual Hierarchy in Quote Comparison Charts

Color and visual hierarchy are essential for directing the user’s attention to critical information. In the table above, the “Price” column could be highlighted using a bold font and a contrasting color (e.g., green for the lowest price, red for the highest). Different coverage levels could be represented by distinct colors (e.g., green for comprehensive, yellow for liability + collision, red for liability only). This color-coding provides immediate visual cues, enabling users to quickly identify the best value proposition. Using a slightly larger font size for the “Price” column would further enhance its visual prominence. Furthermore, the table could be designed with responsive properties, adapting its layout to different screen sizes to maintain readability on various devices.

Addressing User Concerns and Objections

Comparing car insurance quotes can feel overwhelming, and it’s natural for users to have concerns and objections throughout the process. Understanding these anxieties and providing clear, concise solutions is crucial for building trust and encouraging users to complete their comparisons. Addressing these concerns proactively leads to higher conversion rates and a more positive user experience.

Understanding and addressing user concerns is paramount to building trust and converting potential customers. By acknowledging and directly addressing common anxieties, we can transform a potentially stressful experience into a confident and informed decision-making process.

Concerns Regarding Data Privacy and Security

Users often worry about the security of their personal information when providing details for insurance quotes. This is a valid concern, and transparency is key. We must clearly state how data is used, protected, and with whom it’s shared. This should include mentioning encryption methods, data protection policies compliant with relevant regulations (e.g., GDPR, CCPA), and the absence of selling user data to third parties. Providing links to privacy policies and security certifications will further bolster user confidence.

Concerns About Hidden Fees and Charges

Many users fear hidden fees or unexpected charges that inflate the final premium. To alleviate this concern, we need to clearly display all fees and charges upfront. This includes outlining any additional costs associated with optional add-ons or coverage choices. Transparency ensures users understand the complete cost of their chosen policy before committing. Providing detailed breakdowns of the premium components (e.g., liability, collision, comprehensive) further enhances clarity.

Concerns About Policy Complexity and Jargon

Insurance policies are notoriously complex, filled with technical jargon that can be difficult for the average user to understand. We can address this by providing clear, concise explanations of key policy terms and features in simple language. Using visual aids like infographics or short videos can also help to simplify complex information and improve comprehension. Offering a glossary of common insurance terms is another valuable resource.

Concerns About Finding the Best Deal

Users often worry about whether they’re finding the best possible deal. To build confidence, we should highlight the breadth and depth of our comparison engine. Emphasize the number of insurers included, the range of coverage options compared, and the accuracy of our quote calculations. Showing a variety of options, not just the cheapest, can also demonstrate a commitment to providing comprehensive results. For example, we can highlight policies with strong customer service ratings or those offering specific benefits, even if they are slightly more expensive than the absolute cheapest option.

Building Trust and Credibility

Building trust is essential for success. This can be achieved through several key strategies:

- Transparency: Clearly communicate our methodology, data sources, and any limitations of our comparison tool.

- Security Measures: Display security badges and certifications to demonstrate our commitment to data protection.

- User Reviews and Testimonials: Showcase positive user feedback to build social proof.

- Contact Information: Provide readily accessible customer support channels for users to address any questions or concerns.

- Industry Recognition and Awards: If applicable, highlight any awards or recognitions received from reputable industry bodies.

Final Conclusion

Ultimately, comparing car insurance quotes is a crucial step in securing affordable and comprehensive coverage. By utilizing online comparison tools, understanding the factors influencing premiums, and carefully reviewing policy details, you can confidently choose a policy that provides the necessary protection while fitting within your budget. Remember to regularly review your coverage needs and compare quotes to ensure you maintain optimal protection at the best possible price.

Frequently Asked Questions

What information do I need to get a car insurance quote?

Typically, you’ll need your driver’s license information, vehicle details (make, model, year), address, and driving history.

How often should I compare car insurance quotes?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change (e.g., new car, change of address, improved driving record).

What does “deductible” mean in car insurance?

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident.

Can I compare quotes without providing my personal information?

Some comparison websites offer initial estimates without requiring full personal details, but you’ll generally need to provide more information to receive a precise quote.