Navigating the world of car insurance can feel like driving through a maze. Numerous providers, varying coverage options, and fluctuating prices make finding the best deal a significant challenge. This is where car insurance comparison quotes become invaluable. By leveraging online comparison tools, drivers can efficiently compare multiple insurance offers, ensuring they secure the most suitable and cost-effective coverage for their needs.

This exploration delves into the intricacies of using car insurance comparison websites, examining their features, highlighting influencing factors on quote generation, and ultimately guiding you toward making informed decisions. We’ll cover everything from understanding your search intent to avoiding potential pitfalls, ensuring you’re equipped to confidently navigate the process.

Key Features of Comparison Websites

Car insurance comparison websites have revolutionized the way consumers shop for insurance, offering a convenient and efficient way to compare quotes from multiple providers. These platforms streamline the process, saving users valuable time and potentially money by highlighting the best deals available. Understanding the key features and user experiences offered by different websites is crucial for making an informed decision.

Comparison Website Features: A Comparative Analysis

Leading car insurance comparison websites offer a range of features designed to simplify the insurance-buying process. While many share core functionalities, differences in user experience, data presentation, and available coverage options exist. For instance, some platforms excel in their user-friendly interfaces, while others prioritize comprehensive coverage details. The following analysis contrasts the features of three prominent websites: Compare.com (fictional example for illustrative purposes), Insurify (real-world example), and The Zebra (real-world example).

User Experience on Three Platforms

Compare.com (fictional): This website boasts a clean, intuitive interface. Users can easily input their details, and the results are presented clearly, with a focus on price comparison. However, detailed policy information may require navigating to individual insurer websites. The customer support is accessible through a chatbot and email, but phone support is absent.

Insurify: Insurify prioritizes a streamlined quote comparison process. Its user interface is straightforward, making it easy for users to input their information and receive multiple quotes quickly. The platform excels in its user-friendly design and clear presentation of results. However, the depth of coverage details provided directly on the site might be considered less comprehensive than some competitors. Customer support is primarily online-based.

The Zebra: The Zebra offers a robust comparison tool with a focus on comprehensive policy details. The website’s interface is well-organized, but might feel slightly less intuitive than Insurify for first-time users. Its strength lies in its detailed coverage information, allowing users to thoroughly compare policy features beyond just price. The Zebra offers multiple customer support channels, including phone, email, and chat.

Ideal Car Insurance Comparison Website UI Design

An ideal car insurance comparison website should prioritize ease of use and clear presentation of information. The design should be intuitive, with a clear path to obtaining quotes and comparing policies. Key features should be prominently displayed, and the website should be responsive across various devices. A clean and uncluttered layout is essential to avoid overwhelming users with excessive information. Detailed policy information should be easily accessible, and customer support should be readily available through multiple channels.

| Feature | Compare.com (Fictional) | Insurify | The Zebra |

|---|---|---|---|

| Ease of Use | Excellent | Excellent | Good |

| Coverage Options | Good | Good | Excellent |

| Customer Support | Fair | Good | Excellent |

| Price Transparency | Excellent | Excellent | Excellent |

Factors Influencing Insurance Quotes

Getting the best car insurance rate involves understanding the many factors that insurance companies consider. Your premium isn’t just a random number; it’s a calculation based on your individual risk profile and the perceived likelihood of you filing a claim. Several key elements contribute to this calculation, influencing the final cost you pay.

Driver Age and Experience

Age significantly impacts insurance premiums. Younger drivers, typically under 25, are statistically more likely to be involved in accidents due to inexperience and risk-taking behavior. Insurance companies reflect this higher risk with higher premiums. Conversely, older drivers, particularly those in their 50s and 60s, often receive lower rates due to their established driving records and generally more cautious driving habits. This trend often reverses in very advanced age, as reaction times and physical capabilities may decline. For example, a 20-year-old driver with a clean record might pay significantly more than a 45-year-old with a similar driving history.

Driving History

Your driving history is arguably the most critical factor. Accidents, speeding tickets, and DUI convictions all significantly increase your premiums. Insurance companies view these as indicators of higher risk. A single at-fault accident can lead to a substantial premium increase for several years, while multiple incidents can result in even higher costs or policy cancellations. Conversely, maintaining a clean driving record for several years demonstrates responsible driving behavior and can earn you discounts. A driver with a history of five years without any accidents or violations will likely receive a better rate than a driver with several infractions on their record.

Location

Where you live significantly impacts your insurance rates. Areas with high crime rates, a greater number of accidents, or higher vehicle theft rates typically have higher insurance premiums. This is because insurance companies face a greater risk of paying out claims in these areas. For instance, a driver living in a densely populated urban area with high traffic congestion might pay more than a driver residing in a rural area with lower traffic volume and fewer accidents.

Vehicle Features

The type of car you drive also influences your insurance premiums. Factors such as the car’s make, model, year, safety features, and repair costs all play a role. Generally, newer cars with advanced safety features like anti-lock brakes, airbags, and electronic stability control command lower rates due to their reduced accident risk and lower repair costs. Conversely, high-performance sports cars or vehicles with a history of theft or frequent repairs typically attract higher premiums. For example, a fuel-efficient hybrid car might have a lower premium than a high-powered sports car of similar age.

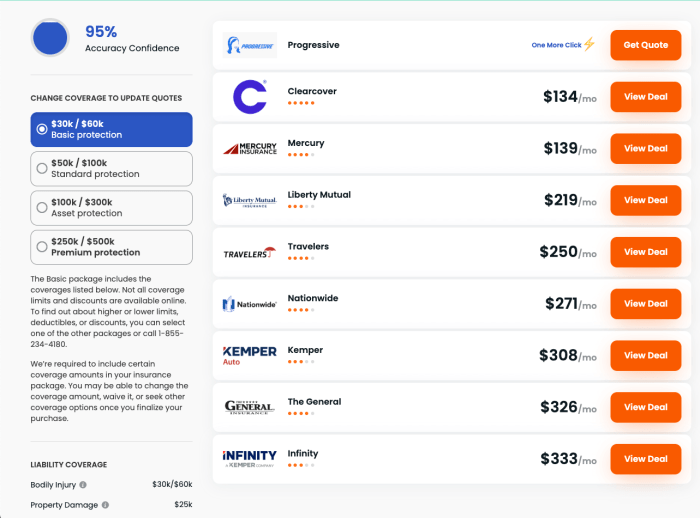

Data Presentation and Visualization

Understanding how insurance quote data is presented is crucial for making informed decisions. Effective visualization techniques allow for quick comparisons and identification of the best options, transforming complex data into easily digestible information. This section will explore different ways to present insurance quote data clearly and concisely.

Visualizing the distribution of insurance quotes across different providers can be achieved through various methods. A clear and concise way to present this information is essential for quick comparison shopping.

Insurance Quote Distribution Across Providers

Imagine a bar chart. The horizontal axis represents different insurance providers (e.g., Provider A, Provider B, Provider C, etc.). The vertical axis represents the number of quotes received from each provider within a specific search range (e.g., the number of quotes for a 2020 Honda Civic driven by a 30-year-old male with a clean driving record). The height of each bar corresponds to the number of quotes received from that particular provider. This visual instantly highlights which providers offer the most competitive rates, showing a clear picture of market competition at a glance. For example, if Provider A’s bar is significantly taller than others, it indicates a higher frequency of quotes from that provider within that specific search criteria.

Average Insurance Costs by Car Type and Driver Profile

Presenting average insurance costs requires a well-structured table. The table below illustrates how to organize this information effectively. Remember, these are illustrative examples and actual costs vary significantly based on numerous factors.

| Car Type | Driver Age (Years) | Driving History | Average Annual Premium ($) |

|---|---|---|---|

| Sedan (2018 Honda Civic) | 30 | Clean | 1200 |

| SUV (2020 Toyota RAV4) | 30 | Clean | 1500 |

| Sports Car (2022 Ford Mustang) | 25 | Clean | 1800 |

| Sedan (2018 Honda Civic) | 25 | One at-fault accident | 1500 |

| SUV (2020 Toyota RAV4) | 45 | Clean | 1700 |

Presenting Complex Insurance Information Concisely

To effectively present complex information, prioritize clarity and simplicity. Use plain language, avoiding jargon. Break down complex concepts into smaller, easily understandable chunks. Use visual aids like charts and tables whenever possible. For example, instead of stating “Your premium is subject to actuarial calculations based on risk assessment models,” say “Your price depends on factors like your age, driving record, and car type.” Concise explanations and clear visuals significantly improve user comprehension.

End of Discussion

Ultimately, securing the right car insurance involves more than simply finding the cheapest quote. A thorough understanding of your needs, careful consideration of coverage options, and a critical evaluation of the provider’s reputation are crucial. By utilizing car insurance comparison websites strategically and thoughtfully analyzing the presented information, you can confidently choose a policy that provides comprehensive protection without breaking the bank. Remember, informed choices lead to better outcomes, and in the world of car insurance, that translates to peace of mind.

FAQ Explained

What information do I need to provide when using a car insurance comparison website?

Typically, you’ll need your driving history, vehicle information (make, model, year), location, and desired coverage levels. Some sites may also request personal details like age and occupation.

Are comparison website quotes binding?

No, comparison website quotes are generally not binding. They serve as estimates to help you compare options. You’ll need to contact the individual insurance provider to finalize your policy.

How often should I compare car insurance quotes?

It’s advisable to compare quotes annually, or even more frequently if your circumstances change significantly (e.g., moving, changing vehicles, adding a driver).

What if I have a poor driving record? Will I still find affordable options?

Even with a poor driving record, comparison websites can still be helpful. They allow you to see quotes from multiple providers, some of whom may specialize in high-risk drivers. Be prepared for potentially higher premiums.