Car insurance cost is a significant expense for most drivers, and understanding the factors that influence premiums is crucial for making informed decisions. From your driving history and location to the type of vehicle you own and the coverage options you choose, numerous factors play a role in determining your car insurance cost.

This comprehensive guide explores the key elements that impact car insurance premiums, providing insights into how to minimize costs and maximize coverage. We’ll delve into different coverage options, explore effective strategies for reducing premiums, and examine the influence of technology on the industry.

Factors Influencing Car Insurance Costs

Car insurance premiums are calculated based on various factors that assess your risk as a driver. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Age

Age is a significant factor in determining car insurance costs. Younger drivers, especially those under 25, generally pay higher premiums due to their lack of experience and higher risk of accidents. Conversely, older drivers, typically those over 65, often pay lower premiums because they have more driving experience and a lower accident rate.

Driving History

Your driving history plays a crucial role in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, having a history of accidents, speeding tickets, or DUI convictions will significantly increase your premiums. For example, a driver with two speeding tickets in the past year might face a 20-30% increase in their premium compared to a driver with a clean record.

Location

The location where you live can significantly impact your car insurance costs. Areas with higher population density, traffic congestion, and crime rates tend to have higher accident rates, leading to higher premiums. For example, drivers residing in major metropolitan areas might pay more than those living in rural areas.

Vehicle Type, Car insurance cost

The type of vehicle you drive also influences your car insurance premiums. Sports cars, luxury vehicles, and high-performance cars are often associated with higher risks and therefore higher premiums. Conversely, older, less expensive vehicles typically have lower premiums. Additionally, the safety features of your vehicle, such as anti-lock brakes and airbags, can impact your premium. For instance, a car with advanced safety features might qualify for a discount.

Coverage Options

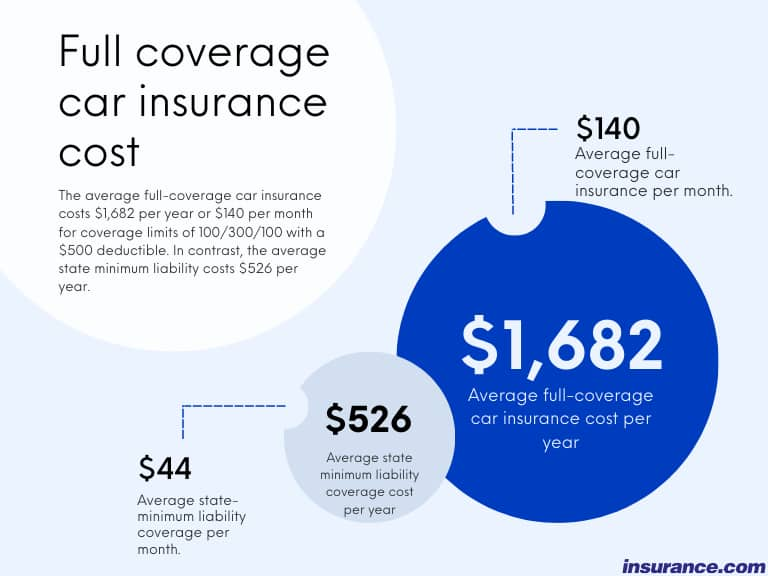

The type and amount of coverage you choose for your car insurance policy will directly impact your premiums. Higher coverage limits, such as comprehensive and collision coverage, will generally result in higher premiums. However, they provide greater financial protection in case of an accident or damage to your vehicle. Conversely, choosing lower coverage limits or opting for basic liability coverage will typically lead to lower premiums but offer less financial protection.

Understanding Different Coverage Options

Choosing the right car insurance coverage is crucial to protect yourself financially in case of an accident or other unforeseen events. Understanding the different coverage options available and their benefits can help you make informed decisions.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It covers the costs of:

- Medical expenses for the injured party

- Property damage to the other vehicle or property

- Legal fees and court costs

Liability coverage is usually required by law in most states, and the minimum amount of coverage varies from state to state. It’s important to have sufficient liability coverage to protect yourself from potentially devastating financial consequences.

Collision Coverage

Collision coverage covers the cost of repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it can be beneficial if you have a newer car or a car with a high value.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than accidents, such as:

- Theft

- Vandalism

- Natural disasters

- Fire

This coverage is also optional, but it can be valuable if you have a newer car or a car that is financed or leased.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. This coverage can help pay for your medical expenses, lost wages, and property damage.

Comparing Coverage Options

| Coverage Type | Purpose | Benefits | Cost |

|---|---|---|---|

| Liability | Protects you financially if you are at fault in an accident | Covers medical expenses, property damage, and legal fees for the other party | Varies based on factors like your driving record, age, and location |

| Collision | Covers repairs or replacement of your vehicle in an accident, regardless of fault | Protects you from financial loss if your vehicle is damaged | Higher cost than liability coverage, but can be valuable if you have a newer or high-value car |

| Comprehensive | Protects your vehicle against damage from events other than accidents | Covers damage from theft, vandalism, natural disasters, and fire | Optional coverage, but can be valuable if you have a newer or financed/leased car |

| UM/UIM | Protects you if you are involved in an accident with an uninsured or underinsured driver | Covers your medical expenses, lost wages, and property damage | Optional coverage, but can be important for added protection |

Final Review

Navigating the complexities of car insurance can be challenging, but with a thorough understanding of the factors involved and the strategies available, you can make informed choices that protect you financially while ensuring adequate coverage. By carefully considering your individual needs, exploring different coverage options, and implementing cost-saving strategies, you can secure affordable car insurance that provides peace of mind on the road.

Essential FAQs: Car Insurance Cost

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there’s a significant life change, such as a new car, a change in your driving record, or a move to a new location.

What is a deductible, and how does it affect my insurance cost?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums.

What are some ways to get discounts on car insurance?

Discounts are often available for good driving records, safety features in your car, bundling insurance policies, and taking defensive driving courses.