Navigating the world of car insurance can feel like driving through a fog – premiums vary wildly, and understanding the factors at play is crucial. This guide cuts through the confusion, offering a clear and concise look at what influences your car insurance costs, how to find affordable coverage, and how to make informed decisions about your policy.

From the impact of your driving history and credit score to the type of vehicle you drive and where you live, numerous factors contribute to the final price. We’ll explore these influences, providing practical strategies for securing the best possible rates and understanding the intricacies of your insurance policy. This guide aims to empower you to become a savvy consumer of car insurance, allowing you to make choices that best suit your individual needs and budget.

Factors Influencing Car Insurance Premiums

Several interconnected factors determine the cost of your car insurance. Understanding these elements can help you make informed decisions and potentially lower your premiums. Insurance companies use complex algorithms to assess risk, and the factors below are key components of that assessment.

Age and Driving History

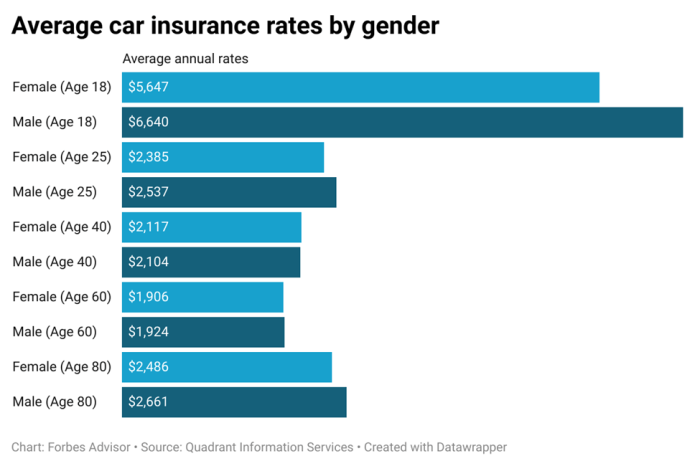

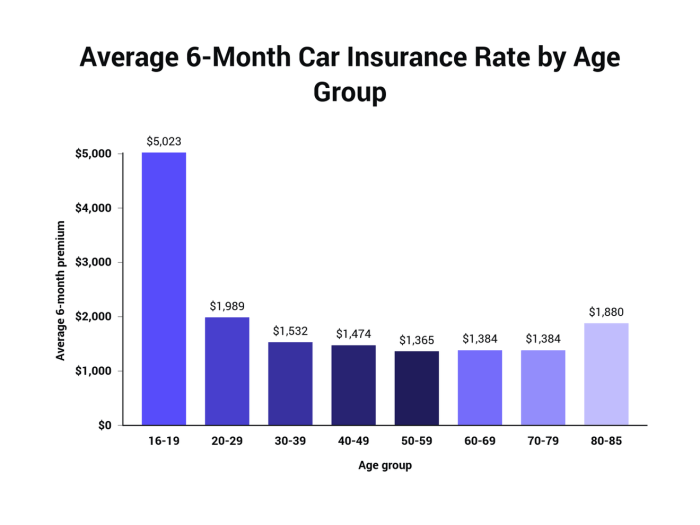

Your age significantly impacts your insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. This is due to factors like inexperience and a higher propensity for risk-taking. Conversely, older drivers, generally over 65, may see lower rates due to a statistically lower accident rate, although certain health conditions could affect this. Driving history is equally crucial. A clean driving record with no accidents or traffic violations results in lower premiums. Conversely, accidents, speeding tickets, or DUI convictions will substantially increase your rates. The severity and frequency of incidents heavily influence the increase. For example, a single minor fender bender will impact premiums less than a serious accident resulting in injury or significant property damage.

Vehicle Type and Features

The type of vehicle you drive is a major factor in determining your insurance cost. Sports cars, luxury vehicles, and high-performance models generally command higher premiums due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive cars typically have lower insurance rates. Vehicle features also play a role. Safety features like anti-lock brakes (ABS), airbags, and electronic stability control (ESC) can lower your premiums as they reduce the likelihood of accidents and the severity of injuries. Conversely, vehicles with expensive aftermarket modifications may lead to higher premiums due to increased repair costs.

Coverage Levels

Car insurance coverage comes in various levels, each impacting the premium differently. Liability coverage pays for damages you cause to others. Collision coverage pays for repairs to your vehicle in an accident, regardless of fault. Comprehensive coverage covers damage to your vehicle from non-collision events like theft, vandalism, or weather damage. Liability-only policies are the cheapest but offer minimal protection. Adding collision and comprehensive coverage increases your premiums but provides more comprehensive protection. The specific coverage limits chosen also affect the cost; higher limits mean higher premiums. For instance, a $100,000 liability limit will cost more than a $50,000 limit.

Location

Your location plays a significant role in determining your insurance rates. Areas with high accident rates, crime rates, and higher average vehicle repair costs will generally have higher insurance premiums. Urban areas often have higher rates than rural areas due to increased traffic congestion and higher risk of theft. For example, a driver in a large metropolitan area like New York City might pay significantly more than a driver in a rural town in Montana, even with identical driving records and vehicles.

Credit Score

In many states, your credit score is a factor in determining your car insurance premiums. Insurers often use credit scores as an indicator of risk. A good credit score generally translates to lower premiums, while a poor credit score can lead to higher premiums. The reasoning behind this is that individuals with poor credit history may be considered higher risk. However, the use of credit scores in insurance is a controversial topic and regulations vary by state. It is important to note that this is not a direct measure of driving ability, but rather a factor considered alongside other risk assessments.

Finding Affordable Car Insurance

Securing affordable car insurance requires a proactive approach and a thorough understanding of the market. By strategically comparing quotes, leveraging potential discounts, and making informed decisions about your coverage, you can significantly reduce your premiums without compromising essential protection.

Comparing Car Insurance Quotes

Effectively comparing car insurance quotes involves more than just looking at the bottom line price. Consider factors beyond the initial premium, such as the level of coverage, deductibles, and the insurer’s claims handling reputation. Obtain quotes from at least three to five different providers to ensure a comprehensive comparison. Utilize online comparison tools, but also contact insurers directly to discuss your specific needs and potentially uncover additional discounts. Remember to provide consistent information across all quotes to ensure an accurate comparison.

Bundling Car Insurance with Other Insurance Types

Bundling car insurance with other types of insurance, such as homeowners or renters insurance, often results in significant savings. Many insurers offer discounts for bundling policies, as it simplifies their administration and reduces risk. However, the benefits of bundling should be weighed against the potential drawbacks. For instance, if you are highly satisfied with your current homeowners insurer but find a better deal on car insurance elsewhere, bundling might not be the most cost-effective option. Carefully compare the total cost of separate policies versus a bundled package to make an informed decision.

Comparison of Major Car Insurance Companies

| Company | Average Annual Premium (Estimate) | Key Features | Discounts Offered |

|---|---|---|---|

| Progressive | $1200 (This is an example and varies greatly by location and driver profile) | Name Your Price® Tool, 24/7 roadside assistance, accident forgiveness | Safe driver, good student, multi-car, bundling |

| Geico | $1100 (This is an example and varies greatly by location and driver profile) | Easy online management, 24/7 claims service, extensive coverage options | Good driver, multi-vehicle, military, federal employee |

| State Farm | $1300 (This is an example and varies greatly by location and driver profile) | Strong customer service reputation, various coverage options, extensive agent network | Good driver, safe driver, defensive driving course, bundling |

*Note: These are estimated average annual premiums and can vary significantly based on individual factors such as location, driving history, age, and vehicle type.

Lowering Car Insurance Premiums Through Safe Driving and Discounts

Maintaining a clean driving record is the most significant factor in determining your car insurance premium. Avoid accidents and traffic violations to qualify for good driver discounts. Consider taking a defensive driving course, which can often lead to premium reductions. Many insurers offer discounts for various factors, including good students, military personnel, and those who install anti-theft devices in their vehicles. Exploring all available discounts and maintaining a safe driving record are crucial steps in lowering your car insurance costs.

The Role of Technology in Car Insurance

Technology is rapidly transforming the car insurance industry, impacting how premiums are calculated, policies are managed, and even how we drive. This shift is driven by advancements in data collection, analysis, and the development of sophisticated risk assessment models. The result is a more personalized and, in some cases, more affordable insurance experience for consumers.

Telematics and Usage-Based Insurance

Telematics uses technology to monitor driving behavior. Usage-based insurance (UBI) programs leverage this data to adjust premiums based on individual driving habits. Devices, either embedded in the car or as smartphone apps, track factors like speed, acceleration, braking, mileage, and even time of day driving occurs. Safe drivers who demonstrate responsible behavior through consistent data collection often receive discounts on their premiums. Conversely, risky driving habits may lead to higher premiums. For example, a driver who frequently accelerates rapidly and brakes hard might see a higher premium compared to a driver with a smoother, more consistent driving style. This system offers a fairer pricing model that rewards safe driving and incentivizes behavioral changes.

Impact of Driver-Assistance Technologies on Insurance Costs

The increasing prevalence of advanced driver-assistance systems (ADAS) is influencing insurance costs. Features like automatic emergency braking (AEB), lane departure warning (LDW), and adaptive cruise control (ACC) can significantly reduce the risk of accidents. Insurance companies recognize this and often offer discounts to drivers who own vehicles equipped with these safety features. The reduction in accident frequency and severity directly translates into lower claim payouts for insurers, leading to lower premiums for consumers. For instance, a car with AEB might receive a discount of 5-10% compared to a similar vehicle without the feature.

Data Analytics in Determining Insurance Rates

Data analytics plays a crucial role in determining insurance rates. Insurers collect vast amounts of data, including driving records, demographics, vehicle information, and telematics data. Sophisticated algorithms analyze this data to identify patterns and predict the likelihood of accidents. This allows insurers to create more accurate risk profiles for individual drivers, resulting in premiums that more closely reflect the actual risk involved. For example, an algorithm might identify that drivers in a particular age group living in a specific area have a higher accident rate, leading to higher premiums for those drivers. However, it is important to note that this data analysis must comply with privacy regulations to protect consumer information.

Traditional vs. Technology-Driven Insurance Models

Traditional insurance models rely heavily on broad actuarial tables and generalized risk assessments. This often leads to less personalized pricing, with drivers paying premiums based on broad categories rather than their individual driving behavior. Technology-driven models, on the other hand, offer a more granular and personalized approach. By incorporating telematics, ADAS data, and sophisticated analytics, these models can provide more accurate risk assessments and more equitable premiums. The shift towards technology-driven models offers the potential for fairer and more efficient insurance pricing.

Mobile App for Managing Car Insurance: Pros and Cons

The use of mobile apps for managing car insurance is becoming increasingly common. This provides a convenient way to access policies, make payments, and contact customer service. However, there are both advantages and disadvantages to consider.

| Pros | Cons |

|---|---|

| Convenient access to policy information | Potential for security breaches |

| Easy payment options | Reliance on technology and internet access |

| Quick and easy claims reporting | Lack of personal interaction |

| 24/7 access to customer support | Potential for app glitches or malfunctions |

Final Summary

Ultimately, understanding car insurance costs is about more than just finding the cheapest policy; it’s about securing the right coverage for your needs and circumstances. By carefully considering the factors influencing your premiums, actively comparing quotes, and understanding the details of your policy, you can gain control over this essential expense. Remember to regularly review your coverage to ensure it aligns with your evolving life circumstances and driving habits. Armed with knowledge, you can navigate the complexities of car insurance with confidence and peace of mind.

FAQ Compilation

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for damage to your own vehicle, regardless of fault.

How often can I expect my car insurance rates to change?

Rates can change periodically, often annually, based on factors like your driving record, claims history, and changes in the insurance market.

Can I get car insurance if I have a poor driving record?

Yes, but you’ll likely pay higher premiums. Consider working with a specialist broker to find options.

What is a SR-22 form?

An SR-22 is a certificate of insurance that proves you have the minimum required liability insurance. It’s often required by states after serious driving offenses.

How does my credit score affect my car insurance?

In many states, insurers use credit-based insurance scores to assess risk. A higher credit score generally leads to lower premiums.