Securing the right car insurance in Georgia is crucial for responsible drivers. This guide unravels the complexities of Georgia’s car insurance landscape, providing clear explanations of coverage options, cost factors, and the claims process. Whether you’re a seasoned driver or a new resident, understanding your insurance needs is paramount for peace of mind on Georgia’s roads.

From understanding minimum liability requirements and penalties for driving uninsured to exploring various coverage types and finding the best provider, we aim to equip you with the knowledge to make informed decisions. We’ll also delve into strategies for saving money on premiums and navigating the challenges faced by high-risk drivers.

Understanding Georgia’s Car Insurance Requirements

Driving in Georgia requires understanding the state’s car insurance regulations to ensure compliance and avoid potential penalties. This section Artikels the minimum coverage requirements, penalties for non-compliance, and a comparison of different insurance options available to Georgia drivers.

Minimum Liability Coverage Requirements in Georgia

Georgia law mandates minimum liability coverage for bodily injury and property damage. This means drivers must carry insurance that will cover costs associated with injuries or damages they cause to others in an accident. The minimum requirement is $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $25,000 for property damage. This is often expressed as 25/50/25 coverage. It’s crucial to understand that this minimum coverage may not be sufficient to cover all potential costs in a serious accident.

Penalties for Driving Without Insurance in Georgia

Driving without insurance in Georgia is illegal and carries significant penalties. These penalties can include fines, license suspension, and even vehicle impoundment. The exact penalties can vary depending on the circumstances and the number of offenses. Furthermore, if you are involved in an accident without insurance, you could face significant financial responsibility for the damages, even if you weren’t at fault. It is strongly recommended to maintain continuous insurance coverage to avoid these consequences.

Comparison of Different Types of Car Insurance Coverage in Georgia

Georgia offers several types of car insurance coverage beyond the minimum liability requirements. These options provide varying levels of protection and come with different costs. Understanding the differences between these coverages is vital in choosing a policy that meets your individual needs and budget.

Summary of Common Coverage Options

| Coverage Type | Description | Key Features | Approximate Cost Range (Annual) |

|---|---|---|---|

| Liability | Covers injuries and damages to others caused by you. | Required by law; minimum limits are 25/50/25. | $300 – $800 |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Helps pay for repairs or replacement of your car. | $300 – $1000 |

| Comprehensive | Covers damage to your vehicle from events other than accidents, such as theft, vandalism, or weather damage. | Protects against a wider range of risks. | $200 – $600 |

| Uninsured/Underinsured Motorist | Covers injuries and damages caused by a driver without insurance or with insufficient coverage. | Provides crucial protection in accidents with uninsured drivers. | $100 – $300 |

Note: Cost ranges are estimates and can vary based on factors like driving history, age, vehicle type, and location.

Factors Affecting Car Insurance Premiums in GA

Several factors influence the cost of car insurance in Georgia. Insurance companies use a complex formula considering various aspects of your profile and driving habits to determine your premium. Understanding these factors can help you make informed decisions to potentially lower your costs.

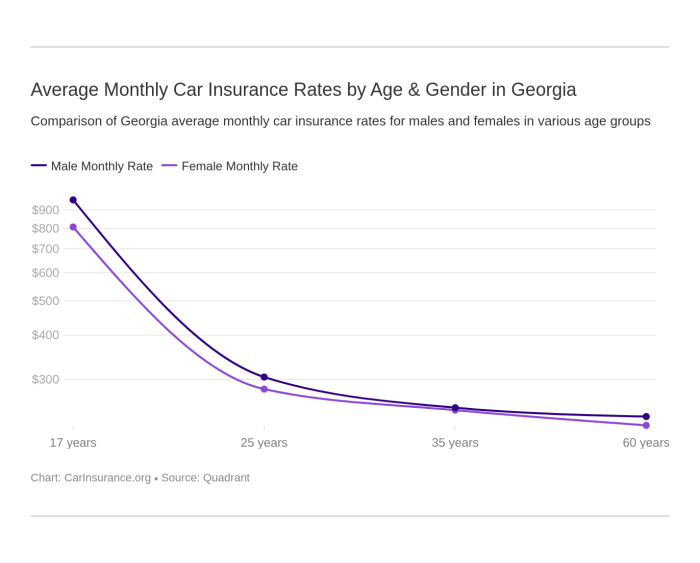

Driver’s Age

Insurance rates in Georgia, like most states, significantly correlate with age. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates within this demographic. Conversely, older drivers, particularly those in their 50s and 60s, often receive lower rates as they tend to have more experience and a better driving record. This is because insurance companies assess risk based on statistical data.

| Age Group | Average Premium (Example) | Reasoning |

|---|---|---|

| 16-25 | $2000 | Higher accident risk, less driving experience |

| 26-35 | $1500 | Improved driving record, more experience |

| 36-55 | $1200 | Established driving history, fewer accidents |

| 56+ | $1000 | Lower accident rate, increased driving maturity |

*Note: These are example premiums and actual rates vary widely depending on other factors.*

Driving Record

Your driving history significantly impacts your insurance premium. Accidents and traffic violations increase your risk profile, leading to higher premiums. A clean driving record, on the other hand, usually results in lower rates. The severity of accidents and the number of violations also affect the premium increase. For instance, a DUI conviction will drastically increase your premiums compared to a minor speeding ticket.

Vehicle Type

The type of vehicle you drive also affects your insurance costs. Sports cars and luxury vehicles are often more expensive to insure due to higher repair costs and a higher risk of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. The vehicle’s safety features, such as airbags and anti-lock brakes, also play a role.

Location

Your address in Georgia impacts your insurance rates. Areas with higher crime rates or a greater frequency of accidents generally have higher insurance premiums due to increased risk of theft or collisions. Insurance companies use geographical data to assess risk in different regions of the state.

Credit Score

In Georgia, as in many states, your credit score can influence your car insurance premium. Insurance companies believe that a good credit score correlates with responsible behavior, suggesting a lower risk profile. A poor credit score might lead to higher premiums, though this practice is subject to state regulations and varies among insurers. This is because a poor credit score may suggest a higher likelihood of late payments on insurance premiums.

Finding and Choosing a Car Insurance Provider in GA

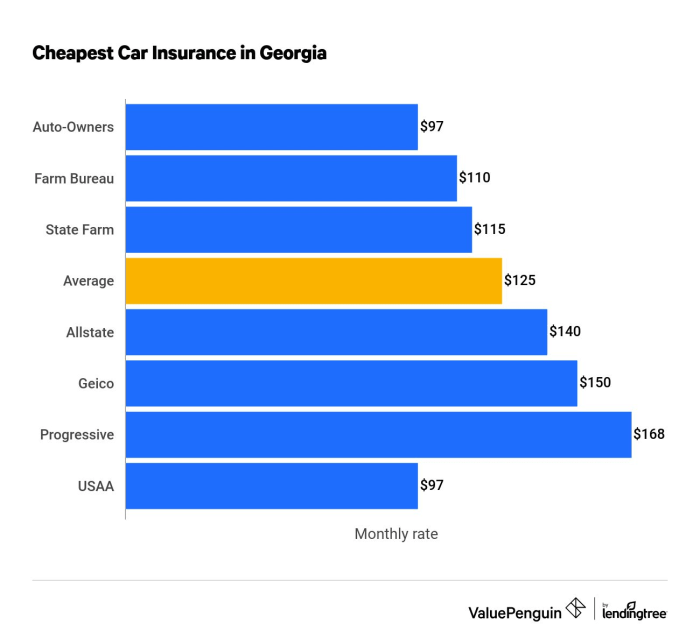

Selecting the right car insurance provider in Georgia is crucial for securing adequate coverage at a competitive price. This involves understanding your needs, researching available options, and comparing quotes to find the best fit for your budget and risk profile. Careful consideration of several factors will ensure you’re adequately protected while managing your expenses effectively.

Finding suitable car insurance in Georgia is simplified through various avenues. Several resources streamline the process, allowing you to compare policies and find the best option for your individual circumstances.

Resources for Finding Car Insurance Providers

Numerous resources exist to help Georgia residents find car insurance providers. Online comparison websites aggregate quotes from multiple insurers, allowing for quick side-by-side comparisons. These websites often include filtering options based on coverage levels, deductibles, and other preferences. Independent insurance agents act as intermediaries, working with multiple insurance companies to find the best policy for their clients. They often have access to a wider range of options than those available directly through individual insurers. Directly contacting insurance companies is also an option; however, this method may be more time-consuming as it requires individual research for each company.

Comparison of Services Offered by Different Insurance Companies

Georgia’s insurance market is diverse, with companies offering varying levels of coverage, services, and pricing. Some insurers may specialize in specific types of coverage, such as high-value vehicles or commercial fleets. Others may focus on specific demographics, such as young drivers or seniors. Consider the types of coverage offered (liability, collision, comprehensive, uninsured/underinsured motorist), customer service reputation (as reflected in online reviews and ratings), and available discounts (good driver, safe vehicle, multiple policy discounts). Factors like claims processing speed and ease of communication also significantly impact the overall customer experience. For example, some insurers may offer digital-first experiences with online claims filing and 24/7 customer support, while others might rely more on traditional methods.

Checklist for Evaluating Car Insurance Quotes

Before committing to a policy, carefully review and compare quotes from multiple providers using a structured checklist. This ensures you make an informed decision.

| Factor | Description |

|---|---|

| Coverage Levels | Liability limits, collision, comprehensive, uninsured/underinsured motorist coverage. |

| Deductibles | Compare deductibles for collision and comprehensive coverage. |

| Premium Costs | Annual, semi-annual, or monthly payment options and total cost. |

| Discounts | Good driver, safe vehicle, multiple policy discounts, etc. |

| Customer Service | Read online reviews and ratings. |

| Claims Process | Understand the insurer’s claims process and customer support availability. |

Step-by-Step Guide to Obtaining Car Insurance in Georgia

Securing car insurance in Georgia is a straightforward process. Follow these steps to ensure you have the necessary coverage.

- Gather necessary information: Driver’s license, vehicle identification number (VIN), driving history, and details about your vehicle.

- Obtain quotes from multiple insurers: Use online comparison tools, independent agents, or contact companies directly.

- Compare quotes: Use the checklist above to evaluate the quotes received, focusing on coverage, cost, and customer service.

- Select a policy: Choose the policy that best meets your needs and budget.

- Provide payment information: Pay the initial premium to activate the policy.

- Receive proof of insurance: Keep a copy of your insurance card and policy documents.

Understanding Insurance Policies and Claims

Navigating the complexities of car insurance claims in Georgia can feel daunting, but understanding the process and your policy’s coverage can significantly ease the burden after an accident. This section will Artikel the steps involved in filing a claim, clarify situations where coverage applies or doesn’t, and provide a visual representation of the claim process.

Filing a Car Insurance Claim in Georgia

Filing a car insurance claim in Georgia typically begins immediately after an accident. It’s crucial to gather as much information as possible at the scene, including contact details of all involved parties, witness information, and photographic evidence of the damage. Contacting your insurance company promptly is vital to initiate the claims process. Your insurer will guide you through the necessary paperwork and may request additional information, such as a police report. The speed of the claim resolution depends on the complexity of the accident and the cooperation of all involved parties.

Resolving a Car Accident Claim

Resolving a car accident claim involves several steps. First, you’ll report the accident to your insurance company. Next, you’ll provide them with all necessary documentation, such as the police report (if applicable), photos of the damage, and details of the other driver’s insurance. Your insurer will then investigate the accident, assessing liability and the extent of the damage. If liability is disputed, negotiations between insurance companies may be necessary. In some cases, a settlement may be reached directly with the other driver’s insurance company. If a settlement cannot be reached, litigation may be required.

Examples of Coverage and Non-Coverage

Understanding your policy’s coverage is essential. For example, collision coverage typically pays for damage to your vehicle regardless of fault, while liability coverage protects you financially if you’re at fault for an accident causing injury or damage to another person’s property. Comprehensive coverage can cover damages from events outside of accidents, like theft or hail damage.

Conversely, your insurance may not cover damages resulting from driving under the influence of alcohol or drugs, or if you violate traffic laws that directly cause the accident. Similarly, if your vehicle is modified without notifying your insurer, coverage might be affected. Also, damage to your vehicle caused by wear and tear or normal aging is generally not covered.

The Car Insurance Claim Process Flowchart

The following illustrates a simplified representation of the claim process:

[Flowchart Description]

The flowchart would begin with a box labeled “Accident Occurs”. This would lead to two branches: “Police Involved” and “Police Not Involved”. Both branches converge at a box labeled “Report Accident to Insurer”. From there, the process continues to “Provide Documentation” (police report, photos, witness statements etc.), followed by “Insurer Investigation”. The investigation leads to either “Claim Approved” or “Claim Denied”. If approved, the process continues to “Repair/Settlement”. If denied, there’s an option to “Appeal Decision”. Finally, the process concludes with a box labeled “Claim Resolved”.

Discounts and Savings on Car Insurance in GA

Securing affordable car insurance in Georgia is achievable through various discounts and strategic planning. Understanding the available discounts and implementing effective cost-saving strategies can significantly reduce your annual premiums. This section Artikels common discounts, strategies for lowering premiums, and methods for maintaining a good driving record.

Common Car Insurance Discounts in Georgia

Many insurance companies in Georgia offer a range of discounts to incentivize safe driving and responsible insurance practices. These discounts can significantly reduce your overall premium cost.

Some of the most common discounts include:

- Safe Driver Discount: This is arguably the most prevalent discount, rewarding drivers with clean driving records free of accidents and traffic violations. The discount percentage varies depending on the insurer and the driver’s history.

- Good Student Discount: High school and college students maintaining a certain GPA often qualify for this discount, reflecting the lower risk associated with academically successful individuals.

- Bundling Discount: Insuring multiple vehicles or combining auto insurance with homeowners or renters insurance under one policy often results in a substantial discount.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course demonstrates a commitment to safe driving and can lead to premium reductions.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can reduce your premiums as it lowers the risk of theft.

- Vehicle Safety Feature Discount: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts due to their enhanced safety profile.

- Payment Plan Discount: Paying your insurance premium in full annually may offer a discount compared to paying in installments.

Strategies for Lowering Car Insurance Premiums

Beyond leveraging available discounts, several strategies can help lower your Georgia car insurance premiums.

These strategies include:

- Shop Around and Compare Quotes: Obtaining quotes from multiple insurance providers allows for a comprehensive comparison of prices and coverage options.

- Increase Your Deductible: Opting for a higher deductible (the amount you pay out-of-pocket before insurance coverage begins) can significantly lower your premiums. However, weigh this against your ability to afford a higher deductible in case of an accident.

- Maintain a Good Credit Score: Insurance companies often consider credit scores when determining premiums. A higher credit score generally translates to lower premiums.

- Review Your Coverage Needs: Regularly assess your insurance needs and adjust your coverage accordingly. Dropping unnecessary coverage can reduce your premiums.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits. Safe driving behavior can lead to lower premiums.

Maintaining a Good Driving Record

A clean driving record is crucial for securing significant discounts and maintaining affordable car insurance.

Tips for maintaining a good driving record include:

- Obey Traffic Laws: Strictly adhere to all traffic laws and regulations to avoid accidents and citations.

- Drive Defensively: Practice defensive driving techniques, anticipating potential hazards and reacting appropriately.

- Maintain Your Vehicle: Regularly maintain your vehicle to ensure it’s in optimal working condition, reducing the likelihood of accidents due to mechanical failure.

- Avoid Distracted Driving: Eliminate distractions while driving, such as using mobile phones or eating.

Calculating Potential Savings with Discount Combinations

The savings potential from combining multiple discounts can be substantial. Let’s illustrate with an example:

Assume a base annual premium of $1200. With a safe driver discount (15%), good student discount (10%), and bundling discount (5%), the potential savings are calculated as follows:

| Discount | Discount Percentage | Savings |

|---|---|---|

| Safe Driver | 15% | $180 ($1200 * 0.15) |

| Good Student | 10% | $120 ($1200 * 0.10) |

| Bundling | 5% | $60 ($1200 * 0.05) |

| Total Savings | 30% | $360 |

In this scenario, the total annual premium would be reduced to $840 ($1200 – $360). Note that the exact discount percentages and available discounts will vary depending on the insurance provider and individual circumstances. Always check with your insurer for specific details.

Conclusion

Successfully navigating the world of car insurance in Georgia requires careful consideration of several factors. This guide has provided a framework for understanding your obligations, exploring your options, and securing the best possible coverage at a reasonable price. Remember, proactive planning and a thorough understanding of your policy can significantly reduce the stress associated with unforeseen circumstances.

Key Questions Answered

What is the minimum liability coverage required in Georgia?

Georgia requires a minimum of 25/50/25 liability coverage, meaning $25,000 for injury per person, $50,000 for total injury per accident, and $25,000 for property damage.

How does my credit score affect my car insurance rates?

In Georgia, insurance companies often consider your credit score as a factor in determining your premiums. A good credit score generally translates to lower rates.

What happens if I get into an accident and I’m not at fault?

Even if you’re not at fault, you should still file a claim with your insurance company. They will then pursue recovery from the at-fault driver’s insurance.

Can I bundle my home and auto insurance for a discount?

Yes, many insurance companies offer discounts for bundling your home and auto insurance policies.

What is uninsured/underinsured motorist coverage and why is it important?

This coverage protects you in case you’re involved in an accident with an uninsured or underinsured driver. It helps cover your medical bills and vehicle repairs.