Finding the right car insurance in Oklahoma City can feel like navigating a complex maze. With numerous providers, varying coverage options, and fluctuating premiums, understanding the landscape is crucial for securing both affordable and comprehensive protection. This guide delves into the specifics of the OKC car insurance market, equipping you with the knowledge to make informed decisions and find the best policy to fit your needs and budget.

From understanding the demographics that influence premiums to comparing top providers and exploring effective negotiation strategies, we’ll cover everything you need to know. We’ll also address specific OKC challenges, such as navigating the impact of weather patterns on claims and understanding insurance requirements for drivers with less-than-perfect driving records. Ultimately, our aim is to empower you to confidently secure the car insurance that best protects you and your vehicle.

Understanding the Oklahoma City Car Insurance Market

Oklahoma City’s car insurance market is shaped by a complex interplay of demographic factors, coverage options, and pricing influences. Understanding these elements is crucial for residents seeking the best and most affordable insurance solutions. This section will delve into the key aspects of the OKC car insurance landscape.

Oklahoma City Driver Demographics and Insurance Needs

Oklahoma City’s population is diverse, with varying age groups, income levels, and driving experiences. A significant portion of the population falls within the younger driver demographic, statistically associated with higher accident rates and, consequently, higher insurance premiums. Conversely, a substantial older population may benefit from lower rates due to their generally safer driving records. Income levels also play a role; lower-income individuals might opt for minimum coverage due to budget constraints, while higher-income individuals may choose more comprehensive policies. The city’s mix of urban and suburban areas also influences risk assessments, with urban areas often presenting higher accident probabilities than suburban counterparts. These diverse demographic factors contribute to a wide range of insurance needs across the city.

Types of Car Insurance Coverage in Oklahoma City

Oklahoma, like other states, mandates minimum liability coverage. This typically includes bodily injury liability and property damage liability, protecting drivers in case they cause an accident resulting in injuries or property damage to others. Beyond minimum coverage, many drivers opt for additional protection. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage covers damage from events like theft, vandalism, or hail. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver lacking sufficient insurance. Medical payments coverage helps pay for medical bills regardless of fault. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. The availability and cost of these additional coverages vary among insurance providers.

Comparison of Average Car Insurance Premiums in OKC versus Other Major US Cities

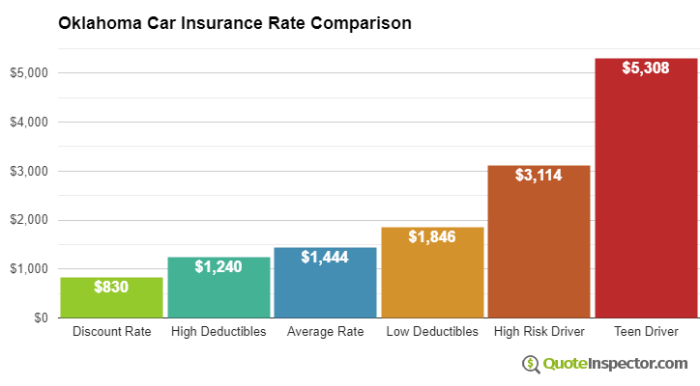

Precise comparisons require referencing current data from reputable insurance comparison websites. However, generally speaking, Oklahoma City’s average car insurance premiums tend to fall within the national average or slightly below, depending on the specific coverage chosen and individual driver profiles. Major coastal cities, particularly those in California and New York, often report significantly higher premiums due to factors such as higher population density, higher accident rates, and more expensive vehicle repair costs. Cities with lower population densities and lower accident rates tend to have lower premiums. It is crucial to conduct personalized comparisons using online tools to accurately assess premiums in relation to your specific circumstances and location within OKC.

Factors Influencing Car Insurance Rates in Oklahoma City

Several factors contribute to the variability of car insurance rates within Oklahoma City. A driver’s history is paramount; a clean driving record with no accidents or traffic violations typically results in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions can significantly increase rates. The type of vehicle is also a key determinant; sports cars and luxury vehicles generally command higher premiums due to their higher repair costs and perceived higher risk. The location of residence within Oklahoma City itself plays a role; areas with higher crime rates and more frequent accidents will likely have higher insurance rates. Age and gender are also considered, with younger drivers and males often facing higher premiums. Finally, credit history can sometimes be a factor, though this is subject to state regulations and varies among insurance companies.

Top Car Insurance Providers in OKC

Choosing the right car insurance provider in Oklahoma City can significantly impact your budget and peace of mind. Several factors influence the best choice, including price, coverage options, customer service, and the company’s financial stability. This section examines some of the leading car insurance companies operating in OKC, providing a comparative overview to assist in your decision-making process.

Comparison of Top Car Insurance Providers in OKC

The following table compares four major car insurance companies operating in Oklahoma City. Note that average premiums and customer ratings can fluctuate based on individual factors like driving history and coverage choices. This data represents a general market overview and should not be considered a definitive quote.

| Company Name | Average Premium (Estimate) | Customer Ratings (Source: J.D. Power, etc. – aggregated) | Coverage Options |

|---|---|---|---|

| State Farm | $1200 – $1800 annually (estimate) | 4.5 out of 5 stars | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments |

| Geico | $1100 – $1700 annually (estimate) | 4.2 out of 5 stars | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments |

| Progressive | $1000 – $1600 annually (estimate) | 4.0 out of 5 stars | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments, Specialty Coverage Options |

| Allstate | $1300 – $1900 annually (estimate) | 4.3 out of 5 stars | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments |

Customer Service Experiences

Customer service experiences vary widely across these providers. State Farm often receives positive feedback for its extensive agent network and personalized service. Geico is known for its easy-to-use online platform and generally efficient claims processing. Progressive is praised for its Name Your Price® tool, allowing customers to customize their coverage and premiums, but some report longer wait times for customer support. Allstate’s customer service reputation is mixed, with some praising their accessibility while others cite difficulties in reaching representatives or resolving claims.

Discounts Offered by Providers in OKC

Each company offers a range of discounts to attract and retain customers. These discounts often include: good driver discounts (for those with clean driving records), multi-policy discounts (bundling auto and home insurance), safe driver discounts (based on telematics programs), and discounts for students, seniors, and military personnel. Specific discount amounts and eligibility criteria vary by company and policy. For example, Geico might offer a larger discount for bundling policies compared to State Farm, while Progressive might offer more aggressive discounts for safe driving habits tracked through their Snapshot program.

Financial Stability and Reputation

All four companies mentioned boast strong financial ratings from major rating agencies, indicating their ability to pay claims. State Farm and Allstate are long-established companies with a substantial market presence and well-known reputations for financial stability. Geico and Progressive, while newer entrants in the market, also maintain strong financial standings and have built a solid reputation through competitive pricing and innovative products. Checking the latest financial ratings from independent agencies like A.M. Best is recommended before making a final decision.

Finding the Best Car Insurance Deal in OKC

Securing affordable car insurance in Oklahoma City requires a strategic approach. By understanding the market, comparing options, and employing effective negotiation tactics, drivers can significantly reduce their insurance costs. This guide provides a step-by-step process to help Oklahoma City residents find the best car insurance deal.

A Step-by-Step Guide to Finding Affordable Car Insurance in OKC

Finding the right car insurance policy involves careful planning and comparison. Begin by gathering necessary information, such as your driving history, vehicle details, and desired coverage levels. Then, systematically explore different options and compare quotes. Finally, negotiate with providers to secure the best possible price. This process, while time-consuming, can save you significant money in the long run.

- Gather Your Information: Compile your driving record (including accidents and violations), vehicle information (make, model, year), and desired coverage levels (liability, collision, comprehensive). Accurate information is crucial for receiving accurate quotes.

- Obtain Quotes from Multiple Providers: Contact at least three to five different insurance companies, both online and offline. This allows for a comprehensive comparison of prices and coverage options. Don’t hesitate to explore both major national providers and smaller, regional companies.

- Compare Quotes Carefully: Don’t just focus on the price. Analyze the coverage details, deductibles, and any additional features offered. A slightly higher premium might be worth it if it offers better protection.

- Negotiate with Providers: Once you’ve identified a few preferred options, don’t be afraid to negotiate. Mention competing quotes and highlight any discounts you qualify for (e.g., good driver discounts, bundling discounts).

- Review Your Policy Regularly: Your insurance needs may change over time. Review your policy annually to ensure it still meets your requirements and consider adjusting coverage or deductibles to optimize your premium.

Benefits and Drawbacks of Online Comparison Tools

Online comparison tools offer convenience and efficiency in gathering car insurance quotes. However, it’s crucial to understand their limitations. While they simplify the process, they may not always present a completely comprehensive picture of the market.

- Benefits: Convenience, speed, ability to compare multiple quotes simultaneously, often unbiased presentation of options.

- Drawbacks: May not include all providers, simplified comparison may overlook crucial policy details, potential for data inaccuracies.

Effective Negotiation Strategies with Insurance Providers

Negotiating your car insurance premium can significantly impact your overall cost. Remember to be polite but firm, and always have supporting information readily available.

- Highlight Your Good Driving Record: Emphasize your clean driving history, highlighting a lack of accidents or violations. Many insurers offer significant discounts for safe drivers.

- Bundle Your Policies: Inquire about bundling your car insurance with other insurance policies, such as homeowners or renters insurance. Bundling often results in substantial discounts.

- Explore Discounts: Ask about available discounts, such as those for good students, anti-theft devices, or safe driving courses. Some insurers offer discounts for paying premiums annually instead of monthly.

- Compare Quotes Directly: Don’t be afraid to mention quotes you received from other insurers. This can often incentivize the provider to offer a more competitive price.

Common Mistakes When Purchasing Car Insurance and How to Avoid Them

Many people make avoidable mistakes when buying car insurance, leading to higher premiums than necessary. Understanding these common pitfalls and how to avoid them can save you money.

- Failing to Shop Around: Assuming your current insurer offers the best rates without comparing quotes from other providers.

- Choosing the Lowest Premium Without Considering Coverage: Focusing solely on price and neglecting the adequacy of the coverage provided.

- Not Utilizing Available Discounts: Overlooking opportunities for discounts based on driving history, safety features, or other factors.

- Ignoring Policy Details: Failing to thoroughly read and understand the terms and conditions of the policy before signing.

Specific Insurance Needs in Oklahoma City

Oklahoma City’s unique characteristics, from its weather patterns to its traffic congestion, significantly influence the car insurance needs of its residents. Understanding these factors is crucial for securing appropriate and affordable coverage. This section will explore several specific insurance needs prevalent in the Oklahoma City area.

Impact of Oklahoma City’s Weather Patterns on Car Insurance Claims

Oklahoma City experiences a diverse range of weather conditions throughout the year, including severe thunderstorms, hailstorms, and occasional tornadoes. These weather events can lead to a significant increase in car insurance claims. Hail damage, for instance, is a common cause of vehicle damage, resulting in numerous claims for repairs or replacements. Similarly, flooding from heavy rainfall can cause substantial water damage to vehicles, leading to costly repairs and potentially total loss claims. Insurance companies often factor these weather-related risks into their premium calculations, leading to potentially higher premiums for drivers in Oklahoma City compared to areas with milder climates. The frequency and severity of these weather events directly influence the cost of insurance premiums. For example, a year with numerous severe hailstorms will likely result in higher average claim costs for insurers, which will, in turn, be reflected in higher premiums for policyholders.

Insurance Implications of Driving in High-Traffic Areas within OKC

Oklahoma City, like many major cities, has areas with heavy traffic congestion. This increased traffic density elevates the risk of accidents. The higher probability of collisions in high-traffic zones means a greater likelihood of insurance claims. Drivers who frequently navigate congested areas, such as I-44 or I-235 during rush hour, may find their insurance premiums are higher to reflect the increased risk. Insurance companies assess risk based on various factors, and accident frequency within specific zip codes or areas is a key element in determining premiums. A driver consistently commuting through a high-accident area can expect to pay more for insurance than a driver in a less congested area, even if both drivers have clean driving records.

Coverage Options for Drivers with Specialized Vehicles

Oklahoma City, like many other cities, has a community of enthusiasts who own specialized vehicles, including classic cars and motorcycles. Standard car insurance policies may not adequately cover the unique needs of these vehicles. Classic car insurance, for example, often provides agreed-value coverage, which ensures the vehicle is insured for its appraised value, rather than its depreciated market value. Motorcycle insurance policies also differ from standard auto insurance, often requiring separate coverage for specific risks associated with motorcycles. These specialized policies may include additional coverage for parts and repairs specific to the vehicle type. For instance, a classic car policy might cover restoration costs after an accident, while a motorcycle policy might include coverage for specialized gear or rider injury. Drivers with these vehicles should explore specialized insurance options to ensure they have the appropriate coverage for their investment.

Insurance Requirements for Drivers with DUI Convictions or Other Driving Violations

In Oklahoma City, as in all of Oklahoma, drivers with DUI convictions or other serious driving violations face significant consequences, including higher insurance premiums. Insurance companies consider driving history a critical factor in risk assessment. A DUI conviction often results in a substantial increase in premiums, reflecting the increased risk associated with impaired driving. Other violations, such as reckless driving or multiple speeding tickets, can also lead to higher premiums. The severity and frequency of violations directly impact the cost of insurance. For example, a first-time DUI might result in a temporary increase in premiums, while multiple DUI convictions or other serious offenses could lead to significantly higher premiums or even difficulty obtaining insurance coverage. Drivers with such violations should be prepared for increased costs and potentially more stringent requirements to secure car insurance.

Illustrative Examples of Insurance Scenarios

Understanding how car insurance works in Oklahoma City is crucial for navigating potential accidents and financial responsibilities. The following examples illustrate various scenarios and the application of different coverages.

Car Accident Scenario and Insurance Coverage Application

Imagine a scenario where a driver, let’s call her Sarah, runs a red light in downtown OKC and collides with another vehicle driven by John. Sarah is at fault. John’s vehicle sustains $5,000 in damages, and John suffers minor injuries requiring $2,000 in medical bills. Sarah’s liability coverage, if sufficient, would cover John’s vehicle repairs and medical expenses. If Sarah’s liability limits are lower than the total damages, she would be personally responsible for the difference. If Sarah also carries collision coverage, her own vehicle’s damages would be covered, regardless of fault. Uninsured/underinsured motorist coverage would be relevant if John was uninsured or underinsured and Sarah’s liability coverage was insufficient to cover his losses. Comprehensive coverage would not apply in this direct collision scenario but would be relevant if, for instance, a tree fell on Sarah’s car unrelated to the accident.

Driver Actions and Their Impact on Insurance Premiums

A driver’s actions significantly influence their insurance premiums. For example, if David receives three speeding tickets within a year, his insurance company will likely increase his premiums due to the higher risk profile. Conversely, if Maria maintains a clean driving record for five years and completes a defensive driving course, she may qualify for a discount, reflecting her lower risk to the insurer. Similarly, opting for a car with advanced safety features, such as anti-lock brakes or lane departure warning systems, might lead to a lower premium due to a reduced likelihood of accidents. Conversely, choosing a high-performance sports car typically results in higher premiums because of the associated increased risk of accidents and higher repair costs.

Car Insurance Claims Process in OKC

Filing a car insurance claim in OKC typically involves several steps. First, report the accident to the police, especially if there are injuries or significant property damage. Gather all relevant information, including the other driver’s insurance details, police report number, photos of the damage, and witness contact information. Next, contact your insurance company promptly to report the accident. They will guide you through the claims process and request specific documentation, such as the police report, photos, repair estimates, and medical bills. Your insurer will then investigate the claim, assess the damages, and determine liability. Finally, once the claim is approved, the insurer will either directly pay for repairs or reimburse you for expenses, depending on the type of coverage and the specifics of your policy.

Visual Representation of the Car Insurance Claims Process

A flowchart could effectively visualize the claims process. It would begin with “Accident Occurs,” branching into “Report to Police” and “Contact Insurance Company.” The “Contact Insurance Company” branch would lead to “Provide Documentation” (police report, photos, etc.), followed by “Insurance Company Investigation,” and finally “Claim Approved/Denied.” If approved, it branches into “Payment for Repairs/Reimbursement.” If denied, it would branch into “Appeal Process.” Each step could be represented by a box, with arrows indicating the flow of the process. The flowchart clearly depicts a linear progression, highlighting the crucial steps involved in filing a claim.

Final Conclusion

Securing the right car insurance in Oklahoma City requires careful consideration of various factors, from your driving history to the specific coverage options available. By understanding the market, comparing providers, and employing effective negotiation strategies, you can find a policy that balances affordability with comprehensive protection. Remember to regularly review your coverage and adapt it to your changing needs. Driving safely and maintaining a clean driving record are also key factors in keeping your premiums low. With careful planning and informed decision-making, you can confidently navigate the OKC car insurance landscape.

Question Bank

What is the minimum car insurance coverage required in Oklahoma City?

Oklahoma requires minimum liability coverage, typically 25/50/25 (meaning $25,000 for injury per person, $50,000 for total injury per accident, and $25,000 for property damage).

How does my credit score affect my car insurance rates?

In many states, including Oklahoma, your credit score is a factor in determining your insurance rates. A higher credit score generally translates to lower premiums.

Can I bundle my car insurance with other types of insurance?

Yes, many insurance companies offer discounts for bundling car insurance with other policies, such as homeowners or renters insurance. This can lead to significant savings.

What should I do if I’m involved in a car accident in OKC?

Remain calm, prioritize safety, call emergency services if needed, exchange information with other involved parties, and contact your insurance company to report the accident as soon as possible.