Navigating the world of car insurance can feel like driving through a dense fog. Understanding your monthly premiums isn’t just about numbers; it’s about securing your financial future and ensuring peace of mind on the road. This guide demystifies the complexities of car insurance per month, providing you with the knowledge to make informed decisions and potentially save money.

From understanding the factors that influence your monthly costs to discovering strategies for securing better rates, we’ll explore the key aspects of car insurance, empowering you to find the best coverage at a price that suits your budget. We’ll delve into average costs, explore ways to reduce your premiums, and help you choose the right insurer for your needs.

Average Monthly Car Insurance Costs

Understanding the cost of car insurance is crucial for budgeting and financial planning. Several factors significantly influence your monthly premium, including age, driving history, and the type of vehicle you insure. This section provides a breakdown of average monthly costs based on these key variables.

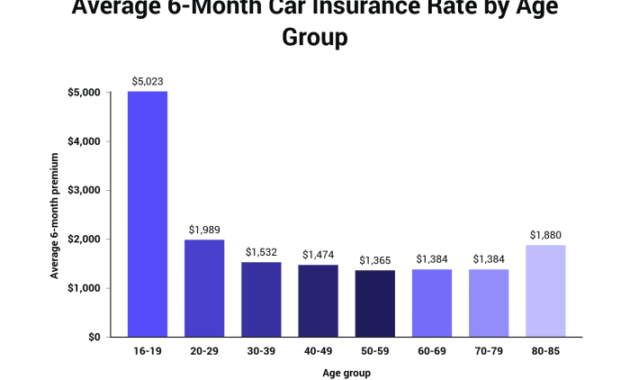

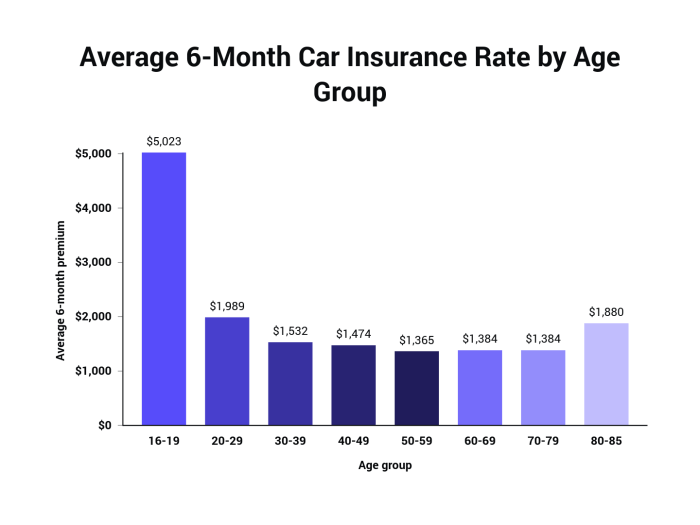

Average Monthly Premiums by Age Group

Insurance companies often categorize drivers into age groups based on perceived risk. Younger drivers, typically those under 25, generally pay higher premiums due to statistically higher accident rates. As drivers age and gain experience, their premiums tend to decrease. The following is a generalized representation of average monthly costs; actual premiums will vary based on other factors. Note that these figures are illustrative and may not reflect precise averages across all insurance providers and locations.

| Age Group | Average Monthly Premium (USD) | Notes |

|---|---|---|

| 16-25 | $150 – $250+ | Higher risk profile, often leading to significantly higher premiums. |

| 26-35 | $100 – $180 | Premiums begin to decrease as drivers accumulate experience. |

| 36-50 | $80 – $150 | Generally a period of lower premiums. |

| 51+ | $70 – $120 | Premiums may increase slightly again in later years, but often remain relatively stable. |

Impact of Driving History on Monthly Premiums

A clean driving record is a significant factor in determining your insurance cost. Accidents and traffic violations increase your perceived risk, leading to higher premiums. Multiple incidents can result in substantially higher costs. For example, a single at-fault accident could increase your premium by 20-40% or more, depending on the severity and the insurer. Similarly, multiple speeding tickets within a short period will likely result in a noticeable premium increase. Conversely, maintaining a clean driving record for several years can lead to significant discounts.

Average Monthly Costs for Different Car Types

The type of vehicle you insure also impacts your monthly premium. Generally, sports cars and luxury vehicles are more expensive to insure due to higher repair costs and a greater likelihood of theft. SUVs and trucks tend to have higher premiums than sedans due to their size and potential for more damage in accidents. The table below provides a comparison, acknowledging that specific makes and models within each category will affect the final cost. These figures are averages and should be considered estimates.

| Vehicle Type | Average Monthly Premium (USD) | Factors Affecting Cost |

|---|---|---|

| Sedan | $80 – $150 | Size, safety features, make, and model. |

| SUV | $100 – $200 | Larger size, higher repair costs, and potential for greater damage. |

| Truck | $120 – $250+ | Size, towing capacity, and potential for higher repair costs. |

| Sports Car | $150 – $300+ | Higher repair costs, higher theft risk, and higher performance capabilities. |

Factors Influencing Monthly Premiums

Several key factors interact to determine your monthly car insurance premium. Understanding these influences can help you make informed decisions about your coverage and potentially lower your costs. This section will detail the most significant factors, allowing you to better predict and manage your insurance expenses.

Location’s Impact on Car Insurance Rates

Your geographic location significantly impacts your car insurance premium. Urban areas generally have higher rates due to increased risk of accidents, theft, and higher repair costs. Conversely, rural areas often have lower rates due to fewer vehicles on the road and lower accident frequency. Specific factors within a location, such as the density of traffic, crime rates, and the prevalence of severe weather events, also contribute to the risk assessment and subsequent pricing. For example, someone living in a densely populated city with a high rate of car theft will likely pay more than someone residing in a quiet rural town with low crime rates. Insurance companies use sophisticated algorithms that analyze claims data from specific zip codes to determine risk and set premiums accordingly.

Credit Score’s Influence on Monthly Payments

Surprisingly, your credit score plays a significant role in determining your car insurance premium. Insurers view a poor credit score as an indicator of higher risk. The rationale behind this is that individuals with poor credit may be more likely to file fraudulent claims or be less likely to maintain their vehicles properly. While the exact relationship varies by state and insurer, a higher credit score generally translates to lower premiums. Improving your credit score can lead to significant savings on your car insurance over time. For instance, a consumer with a good credit score (750+) might qualify for a lower rate compared to someone with a fair credit score (650-699), potentially saving hundreds of dollars annually.

Coverage Level Cost Differences

Different levels of car insurance coverage significantly impact your monthly premium. Liability coverage, which is usually legally required, covers damages to other people’s property or injuries sustained by others in an accident you cause. Collision coverage pays for repairs to your vehicle in an accident, regardless of fault. Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Liability-only policies are the cheapest, while a combination of liability, collision, and comprehensive offers the most extensive protection but comes with a higher premium. Choosing the right coverage level depends on your individual risk tolerance and financial situation. For example, a newer, more expensive vehicle may warrant comprehensive coverage, whereas an older vehicle might only require liability coverage.

Saving Money on Monthly Car Insurance

Reducing your monthly car insurance bill is achievable through a combination of smart strategies and responsible driving habits. By understanding the factors that influence your premium and proactively taking steps to mitigate risk, you can significantly lower your costs. This section explores several effective methods to save money on your car insurance.

Discounts on Car Insurance

Many insurance companies offer a variety of discounts to incentivize safe driving and responsible vehicle ownership. These discounts can significantly reduce your overall premium. Taking advantage of these opportunities is a crucial step in lowering your monthly costs.

- Good Driver Discounts: Maintaining a clean driving record, free from accidents and traffic violations, is the most common way to qualify for significant discounts. Insurance companies reward drivers who demonstrate responsible behavior on the road.

- Bundling Discounts: Combining your car insurance with other types of insurance, such as homeowners or renters insurance, often results in substantial savings. Insurers often offer discounts for bundling multiple policies.

- Safety Feature Discounts: Vehicles equipped with advanced safety features, such as anti-theft systems, airbags, and anti-lock brakes, may qualify for discounts. These features demonstrate a commitment to safety and reduce the risk of accidents.

- Payment Discounts: Paying your premium in full annually, rather than monthly, can often result in a discount. This reflects the insurer’s reduced administrative costs.

- Student Discounts: Good grades and enrollment in certain programs can sometimes qualify students for discounts. This reflects the lower risk associated with responsible students.

- Vehicle Type Discounts: Certain vehicle types are considered less risky to insure than others, leading to lower premiums. For example, smaller, fuel-efficient cars often have lower insurance rates than larger SUVs or sports cars.

Improving Driving Habits to Lower Premiums

Your driving record directly impacts your insurance premiums. Adopting safer driving habits can significantly reduce your risk profile and lead to lower costs over time.

- Defensive Driving: Taking a defensive driving course can not only improve your driving skills but also often earns you a discount on your insurance premium. Many insurers recognize the value of this training.

- Avoiding Accidents: The most significant factor influencing premiums is your accident history. A clean driving record with no accidents or traffic violations is essential for maintaining low insurance rates. Even minor incidents can lead to premium increases.

- Reducing Speeding Tickets: Speeding tickets are a major factor in premium increases. Adhering to speed limits and avoiding reckless driving significantly reduces the risk of incurring penalties.

- Maintaining a Safe Vehicle: Regularly servicing your vehicle and ensuring it is in good working condition minimizes the risk of accidents caused by mechanical failure. Proper maintenance is a key element of safe driving.

Bundling Car Insurance with Other Insurance Types

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, from the same provider can lead to significant cost savings. This is because insurers often reward loyalty and bundled policies with discounts.

- Benefits: The primary benefit is the potential for substantial discounts. This can translate into significant savings over the long term. Furthermore, managing multiple policies with a single provider simplifies administrative tasks.

- Drawbacks: A potential drawback is the lack of flexibility. Switching providers for one type of insurance might require switching all bundled policies. It’s important to compare prices from different providers to ensure that bundling is truly cost-effective in your specific situation.

Comparing Quotes from Different Insurers

Obtaining quotes from multiple insurers is crucial for finding the best possible rates. A systematic approach to comparison shopping ensures you don’t miss out on potential savings.

- Gather Information: Collect necessary information such as your driving history, vehicle details, and desired coverage levels.

- Get Quotes Online: Use online comparison tools to obtain quotes from multiple insurers simultaneously. This saves time and effort.

- Contact Insurers Directly: Follow up with insurers directly to clarify details or ask questions. This allows for a personalized approach.

- Compare Coverage and Prices: Carefully compare the coverage offered by each insurer alongside their respective prices. Don’t solely focus on price; ensure adequate coverage for your needs.

- Read the Fine Print: Thoroughly review the policy documents before making a decision. Pay attention to exclusions and limitations.

Understanding Policy Details

Choosing the right car insurance policy involves more than just finding the lowest monthly premium. A thorough understanding of your policy’s details is crucial to ensure you’re adequately protected and avoid unexpected costs or coverage gaps. This section clarifies key aspects of your policy, empowering you to make informed decisions.

Deductibles and Their Impact on Monthly Payments

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower monthly premiums, as you’re accepting more financial responsibility in the event of a claim. Conversely, lower deductibles lead to higher monthly premiums, but you’ll pay less out-of-pocket if you need to file a claim. For example, a $500 deductible might save you $20 per month compared to a $1000 deductible, but you’ll pay $500 more if you have an accident requiring a claim. The optimal deductible depends on your risk tolerance and financial situation. Consider your emergency fund and ability to cover a significant upfront cost before deciding.

Filing a Claim and Its Effect on Future Premiums

Filing a claim involves reporting an accident or incident to your insurance company. The process typically includes providing details of the event, cooperating with investigations, and potentially providing supporting documentation. While filing a claim is necessary for coverage, it can impact your future premiums. Most insurers increase premiums after a claim, reflecting the increased risk they now assume. The extent of the premium increase depends on factors like the severity of the claim, who was at fault, and your driving history. For example, a minor fender bender might result in a small premium increase, while a serious accident causing significant damage could lead to a more substantial increase. Maintaining a clean driving record and avoiding claims whenever possible is crucial for keeping premiums low.

Common Policy Exclusions and Limitations

Insurance policies don’t cover everything. Understanding common exclusions and limitations is vital to avoid disappointment. Typical exclusions include damage caused by wear and tear, intentional acts, or driving under the influence. Policies often have limitations on coverage amounts, such as maximum payout limits for specific types of damage or liability. For instance, your policy might have a specific limit on the amount it will pay for repairs to your vehicle, or a limit on the amount it will pay to someone injured in an accident you caused. Carefully review your policy documents to understand what is and isn’t covered to avoid surprises.

Key Components of a Typical Car Insurance Policy

The following is a description of an infographic illustrating the key components of a typical car insurance policy. Imagine a visual representation with clearly labeled sections:

Section 1: Policyholder Information: This section displays the name, address, and contact information of the policyholder. It also shows the policy number and effective dates.

Section 2: Coverage Types: This section details the types of coverage included in the policy, such as liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments. Each coverage type is briefly explained.

Section 3: Premium Information: This section clearly shows the monthly or annual premium, payment due dates, and any applicable discounts. It may also include information about payment methods.

Section 4: Deductibles: This section specifies the deductible amounts for different coverage types, such as collision and comprehensive. It clearly explains the deductible’s role in claim payouts.

Section 5: Exclusions and Limitations: This section highlights common exclusions and limitations of the policy, such as wear and tear, intentional acts, or specific geographical restrictions.

Section 6: Contact Information: This section provides contact information for the insurance company, including phone numbers, email addresses, and website information for claims reporting and policy inquiries.

Finding the Right Insurance Provider

Choosing the right car insurance provider is crucial, as it directly impacts your financial protection and overall driving experience. The market offers a wide range of companies, each with its own strengths and weaknesses. Careful consideration of several factors will help you secure the best policy for your needs.

Comparison of Car Insurance Company Services

Different car insurance companies offer varying levels of service, coverage options, and pricing structures. Some specialize in specific types of coverage, such as classic car insurance or high-value vehicle protection, while others cater to a broader range of drivers. A key differentiator is the level of customization available; some companies offer a wide array of add-ons and flexible policy options, while others provide a more standardized approach. Understanding these differences is critical in selecting a provider that aligns with your individual requirements.

Importance of Customer Service and Claims Processing

Exceptional customer service and efficient claims processing are paramount when choosing a car insurance provider. Prompt and helpful responses to inquiries, clear communication during the claims process, and a straightforward resolution of any issues significantly impact the overall customer experience. Companies with a strong reputation for excellent customer service often have higher customer satisfaction ratings and fewer negative online reviews. Conversely, providers with poor customer service records may leave you frustrated and struggling to resolve problems, especially during stressful situations like accidents. Investigating customer reviews and ratings is vital in assessing a company’s responsiveness and reliability.

Factors to Consider When Choosing a Provider

Several key factors influence the selection of a suitable car insurance provider. These include the cost of premiums, the comprehensiveness of coverage, the financial stability of the company, and the availability of discounts. Analyzing customer reviews and ratings provides valuable insights into the overall customer experience. Furthermore, the ease of online access to policy information and the availability of various communication channels, such as phone, email, and online chat, significantly influence convenience and accessibility. Understanding these factors helps in making an informed decision that aligns with your specific needs and preferences.

Comparison of Car Insurance Providers

The following table compares three hypothetical car insurance providers, highlighting key aspects to consider:

| Provider | Average Monthly Cost (Example) | Customer Rating (Example) | Coverage Options (Example) |

|---|---|---|---|

| Company A | $80 | 4.5 stars | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist |

| Company B | $95 | 4.0 stars | Liability, Collision, Comprehensive, Roadside Assistance, Rental Car Reimbursement |

| Company C | $75 | 4.2 stars | Liability, Collision, Comprehensive, Medical Payments |

Wrap-Up

Ultimately, securing the right car insurance policy comes down to understanding your individual needs and carefully weighing the factors that influence your monthly premiums. By understanding the various components of your policy, actively comparing quotes, and employing smart cost-saving strategies, you can confidently navigate the world of car insurance and find a plan that provides optimal coverage at a manageable monthly cost. Remember, informed decisions lead to better outcomes, and this guide has equipped you with the knowledge to make those decisions.

FAQ Explained

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident.

How does my driving record affect my premiums?

A clean driving record typically leads to lower premiums. Accidents and traffic violations increase your risk profile, resulting in higher costs.

Can I pay my car insurance annually instead of monthly?

Many insurers offer the option of annual payments, which often comes with a small discount compared to monthly payments.

What is uninsured/underinsured motorist coverage?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver.

What is the difference between liability and collision coverage?

Liability covers damages you cause to others, while collision covers damage to your own vehicle, regardless of fault.