Car insurance price sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding the factors that influence car insurance premiums is crucial for every driver, as it empowers you to make informed decisions and potentially save money.

From demographics and driving history to vehicle characteristics and location, numerous factors come into play when determining your insurance costs. This guide explores these factors in detail, providing insights into how you can potentially lower your premiums and navigate the complexities of car insurance.

Factors Influencing Car Insurance Prices

Car insurance premiums are calculated based on a variety of factors that assess your risk as a driver. These factors are designed to reflect the likelihood of you being involved in an accident and the potential cost of any resulting claims.

Demographics

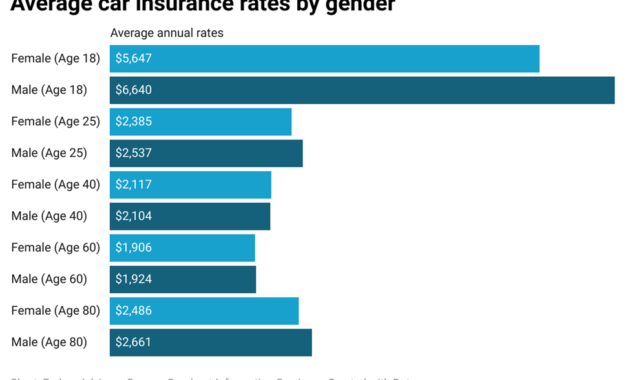

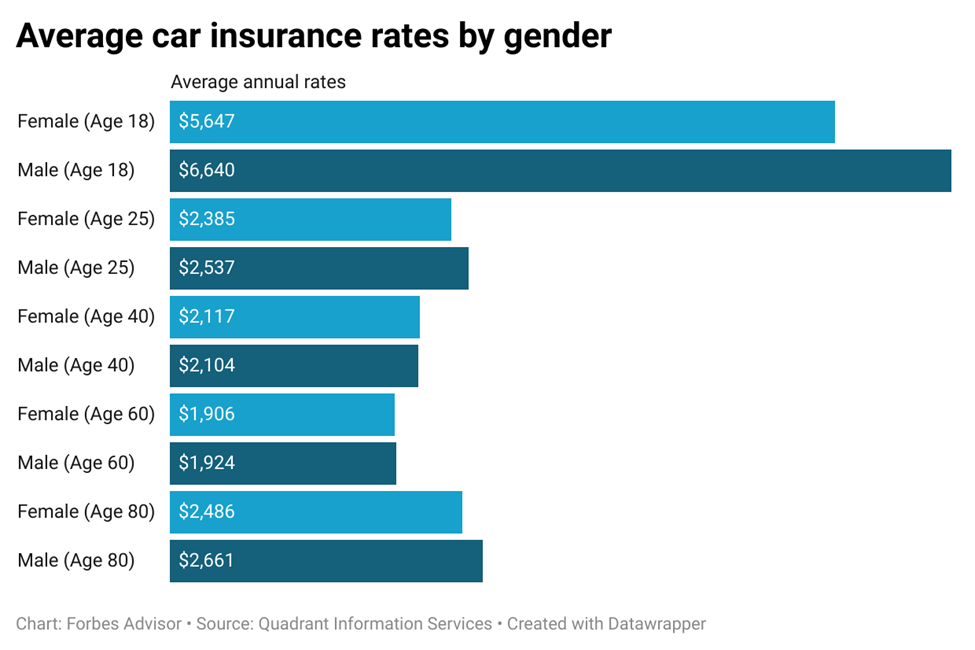

Your age, gender, and driving history are significant factors that influence your car insurance premiums.

- Age: Younger drivers are statistically more likely to be involved in accidents due to lack of experience and higher risk-taking behaviors. As you gain experience and age, your premiums generally decrease.

- Gender: Historically, men have been associated with higher risk driving behaviors, resulting in slightly higher premiums for male drivers. However, this gap has been narrowing in recent years.

- Driving History: Your driving record plays a crucial role in determining your premiums. A clean driving record with no accidents or violations will earn you lower rates. Conversely, accidents, speeding tickets, and DUI convictions will significantly increase your premiums.

Vehicle Characteristics

The type of vehicle you drive also influences your insurance costs.

- Make and Model: Certain car makes and models are statistically associated with higher accident rates or higher repair costs, leading to higher insurance premiums.

- Year: Newer vehicles generally have more advanced safety features and are often more expensive to repair, which can impact your insurance costs.

- Safety Features: Vehicles equipped with safety features like anti-lock brakes, airbags, and stability control are considered safer and may result in lower premiums.

Location

Where you live plays a significant role in your insurance rates.

- Population Density: Areas with higher population density often have more traffic and a higher likelihood of accidents, which can lead to higher insurance premiums.

- Crime Rates: Areas with higher crime rates may have a greater risk of vehicle theft or vandalism, which can influence insurance premiums.

- Weather Conditions: Regions with extreme weather conditions, such as heavy snow or frequent hurricanes, may have higher insurance premiums due to increased risk of accidents.

Driving Habits

Your driving habits also play a role in your insurance premiums.

- Mileage: Drivers who commute long distances or frequently use their vehicles for work may have higher premiums due to increased exposure to potential accidents.

- Parking Location: Parking your vehicle in a garage or secured parking lot may result in lower premiums than parking on the street, where it is more vulnerable to theft or damage.

Understanding Coverage Options

Choosing the right car insurance coverage is crucial, as it safeguards you financially in case of accidents or other unforeseen events. Each coverage option offers different protection, and understanding their benefits and limitations is essential for making an informed decision.

Liability Coverage

Liability coverage is a fundamental component of car insurance that protects you financially if you are at fault in an accident. It covers the costs associated with the other driver’s injuries, medical expenses, property damage, and legal fees.

Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Bodily injury liability covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in the accident.

- Property damage liability covers the cost of repairing or replacing the other driver’s vehicle or any other damaged property.

The minimum liability coverage required by law varies by state, but it’s generally recommended to carry higher limits than the minimum. This ensures adequate protection in case of a serious accident involving significant damages.

Collision Coverage

Collision coverage protects your vehicle against damage resulting from a collision with another vehicle or object. This coverage pays for repairs or replacement of your vehicle, minus any deductible you choose.

Collision coverage is optional and not required by law.

It is particularly important for newer vehicles, as the cost of repairs can be substantial.

Comprehensive Coverage

Comprehensive coverage provides protection against damage to your vehicle from events other than collisions, such as theft, vandalism, fire, natural disasters, or animal collisions. This coverage also pays for repairs or replacement of your vehicle, minus your deductible.

Comprehensive coverage is optional and not required by law.

It is recommended for newer vehicles or vehicles with a high market value, as it can help mitigate financial losses in case of unforeseen events.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and other damages, up to the limits of your policy.

UM/UIM coverage is typically optional, but it’s highly recommended, as it can provide crucial financial protection in situations where the other driver lacks sufficient insurance.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident. It is mandatory in some states and optional in others.

PIP coverage can be beneficial for covering your own medical expenses and lost wages, even if you are at fault in an accident.

Table of Coverage Options

| Coverage Option | Description | Typical Cost |

|---|---|---|

| Liability Coverage | Protects you financially if you are at fault in an accident. | Varies based on factors such as driving history, location, and vehicle type. |

| Collision Coverage | Protects your vehicle against damage resulting from a collision. | Varies based on factors such as vehicle age, value, and driving history. |

| Comprehensive Coverage | Protects your vehicle against damage from events other than collisions. | Varies based on factors such as vehicle age, value, and location. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with an uninsured or underinsured driver. | Varies based on factors such as coverage limits and driving history. |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages, regardless of who is at fault. | Varies based on state requirements and coverage limits. |

Strategies for Lowering Insurance Costs

You’ve already learned about the factors that influence car insurance prices and the different coverage options available. Now, let’s explore some strategies to help you keep your premiums manageable. There are a number of ways to lower your car insurance costs, and it’s often a combination of these strategies that can lead to the biggest savings.

Maintaining a Good Driving Record

A clean driving record is one of the most significant factors in determining your insurance premiums. Insurance companies view drivers with a history of accidents, speeding tickets, or other violations as higher risk.

Maintaining a clean driving record is crucial to keeping your insurance costs down.

Here’s how a good driving record benefits you:

- Lower Premiums: Insurance companies reward safe drivers with lower premiums.

- Discount Eligibility: Many insurers offer discounts for drivers with no accidents or violations for a certain period.

- Improved Credit Score: A good driving record can indirectly benefit your credit score, as fewer traffic violations may reduce the risk associated with your financial profile.

Bundling Insurance Policies

Combining multiple insurance policies with the same company can often lead to significant savings. This is because insurers recognize the loyalty of customers who bundle their car, home, renters, or other policies with them.

Bundling insurance policies can offer substantial savings.

- Convenience: Managing all your policies under one provider simplifies your insurance needs and can streamline your payment process.

- Discounts: Insurers often offer discounts for bundling multiple policies, as they see you as a more valuable customer.

- Streamlined Claims: In case of an accident, having all your policies with the same company can simplify the claims process.

Taking Advantage of Discounts, Car insurance price

Insurance companies offer a variety of discounts to their customers, and these discounts can add up to significant savings.

Discounts are a great way to reduce your insurance premiums.

- Safe Driver Discount: This is a common discount offered to drivers with a clean driving record for a certain period.

- Good Student Discount: Students with good grades may qualify for this discount, as insurers see them as more responsible.

- Anti-theft Device Discount: Installing anti-theft devices in your car can reduce the risk of theft and qualify you for a discount.

- Multi-Car Discount: Insuring multiple vehicles with the same company can often lead to a discount.

- Loyalty Discount: Some insurers offer discounts to customers who have been with them for a certain period.

Choosing the Right Insurance Provider

Finding the right car insurance provider is crucial, as it directly impacts your financial well-being in case of an accident. While price is a major factor, it’s essential to consider the comprehensive services offered by different companies.

Comparing Pricing and Services

Understanding the pricing and services offered by various insurance companies is key to making an informed decision. You should compare quotes from multiple providers, taking into account the coverage options, deductibles, and discounts offered. It’s important to remember that the cheapest option isn’t always the best. Consider factors like customer service, claims handling, and financial stability before making your choice.

The Importance of Customer Service and Claims Handling

Excellent customer service and efficient claims handling are vital aspects of a good insurance provider. You want a company that responds promptly to your inquiries, resolves issues quickly, and makes the claims process as smooth as possible. A reputable insurance provider will have a dedicated customer service team available to assist you throughout your policy journey.

Key Factors to Consider When Selecting an Insurance Provider

- Financial Stability: Look for companies with strong financial ratings, as this indicates their ability to pay claims in the event of a major incident. You can check financial ratings from organizations like AM Best or Standard & Poor’s.

- Coverage Options: Compare the types of coverage offered by different providers, ensuring they meet your specific needs. Consider options like liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Discounts: Explore available discounts, such as safe driving discounts, good student discounts, and multi-policy discounts. These can significantly reduce your premium.

- Claims Handling Process: Research the company’s claims handling process, including the average time taken to settle claims and customer satisfaction ratings. You can find this information on independent review websites.

- Customer Service: Check online reviews and testimonials to gauge the company’s customer service reputation. Look for providers known for their responsiveness and helpfulness.

- Technology and Innovation: Consider companies that offer digital tools and mobile apps for managing your policy, paying premiums, and filing claims.

Comparing Prominent Insurance Companies

| Company | Strengths | Weaknesses |

|---|---|---|

| Company A | Wide coverage options, competitive pricing, strong financial rating. | Limited customer service availability, slow claims processing. |

| Company B | Excellent customer service, fast claims handling, innovative digital tools. | Higher premiums compared to some competitors, limited coverage options. |

| Company C | Extensive discount program, strong financial stability, user-friendly website. | Limited availability in certain regions, average customer service. |

Understanding Insurance Policies

Your car insurance policy is a legally binding contract between you and your insurance provider. It Artikels the terms and conditions that govern your coverage, including the responsibilities of both parties. Understanding the details of your policy is crucial for navigating any potential claims and ensuring you receive the coverage you need.

Terms and Conditions

Car insurance policies typically include several essential terms and conditions that define the scope of your coverage and your responsibilities as a policyholder.

- Policy Period: This specifies the duration of your insurance coverage, usually a year.

- Covered Vehicles: The specific vehicles covered under the policy, including their make, model, and year.

- Insured Drivers: The individuals authorized to drive the covered vehicles, including their names and driving history.

- Coverage Limits: The maximum amount the insurance provider will pay for covered losses, such as bodily injury liability, property damage liability, collision, and comprehensive coverage.

- Deductibles: The amount you are responsible for paying out-of-pocket for covered losses before your insurance kicks in.

- Exclusions: Specific events or circumstances that are not covered by the policy, such as intentional acts, driving under the influence, or certain types of damage.

- Premium: The regular payment you make to maintain your insurance coverage.

Filing a Claim

If you need to file a claim under your car insurance policy, you will need to contact your insurance provider and follow their specific procedures.

- Report the Incident: Immediately report the incident to your insurance provider, providing details about the date, time, location, and circumstances of the accident or damage.

- File a Claim: Complete the necessary claim forms, providing detailed information about the incident and any injuries or damages sustained.

- Provide Documentation: Gather and submit supporting documentation, such as police reports, medical records, repair estimates, and photographs of the damage.

- Cooperate with Investigation: Be prepared to cooperate with your insurance provider’s investigation of the claim, which may involve providing statements, attending appointments, and providing additional documentation.

- Receive Compensation: If your claim is approved, you will receive compensation for covered losses, subject to your policy’s coverage limits and deductibles.

Common Exclusions and Limitations

Car insurance policies often contain exclusions and limitations that restrict coverage for specific events or circumstances.

- Driving Without a License: Coverage may be denied or limited if you are driving without a valid driver’s license.

- Driving Under the Influence: Coverage may be denied or limited if you are driving under the influence of alcohol or drugs.

- Uninsured or Underinsured Motorists: Coverage may be limited for accidents involving uninsured or underinsured drivers.

- Wear and Tear: Coverage may not apply to damage caused by normal wear and tear, such as tire punctures or worn-out brakes.

- Acts of God: Coverage may be limited or excluded for damage caused by natural disasters, such as earthquakes, floods, or hurricanes.

- Certain Types of Vehicles: Coverage may be limited or excluded for certain types of vehicles, such as motorcycles, recreational vehicles, or commercial vehicles.

Real-World Examples

Here are some real-world examples illustrating how car insurance policies work in different scenarios:

- Scenario 1: Collision with an Uninsured Driver

If you are involved in an accident with an uninsured driver, your uninsured motorist coverage will help cover your medical expenses and vehicle damage, up to your policy limits. - Scenario 2: Theft of Your Vehicle

If your car is stolen, your comprehensive coverage will help replace your vehicle or reimburse you for its value, minus your deductible. - Scenario 3: Damage Caused by a Hailstorm

If your car is damaged by a hailstorm, your comprehensive coverage will help cover the repairs, minus your deductible.

Closing Notes: Car Insurance Price

Armed with knowledge about car insurance price, coverage options, and strategies for cost reduction, you are equipped to confidently navigate the world of auto insurance. By understanding the intricacies of this complex system, you can make informed choices, secure adequate coverage, and potentially save money on your premiums. Remember, proactive research and comparison shopping are key to finding the best car insurance solution for your individual needs and circumstances.

Quick FAQs

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever you experience a significant life change, such as a change in driving habits, vehicle ownership, or address.

What is a deductible, and how does it affect my insurance premiums?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically lead to lower premiums, while lower deductibles result in higher premiums.

Can I get car insurance if I have a poor driving record?

Yes, you can still get car insurance even with a poor driving record. However, your premiums will likely be higher due to the increased risk you pose to insurance companies. Consider exploring options like defensive driving courses to potentially lower your rates.